Paperboard Container Market Research, 2031

The global paperboard container market size was valued at $135.48 billion in 2021, and is projected to reach $207.40 billion by 2031, growing at a CAGR of 4.3% from 2022 to 2031. Paperboard is a substantial paper-based product, which is typically thicker than paper (typically above 0.30 mm, 0.012 in, or 12 points) and has certain advantages over paper, including foldability and stiffness. The sheets are either made from recycled waste paper or the fibrous material in wood. It can be manipulated, cut, and folded into various designs and shapes. Paperboard is quite commonly used for packaging food and beverage products including juices, milk, and cereal products. Paperboard packaging comes in several grades.

The paperboard container market is witnessing the growth due to the increase in demand from packaging, foods & beverages, and pharmaceutical sectors. Consumers that care about the environment, nowadays favor paper or paperboard container over other forms of packaging. Increase in demand for paperboard packaging containers from foods and beverages and healthcare sectors is driving the paperboard container market. In addition, with the increasing environmental issues and stringent government policies, companies are focusing on providing paper and paperboard packaging solutions. A lot of effort has been put into innovation to provide cost-effective products that have similar utility and provide satisfaction to consumers. For instance, in September 2019, Nippon Paper Industries Co., Ltd. decided on capital investment for mass production of Shieldplus, which adds barrier properties to paper.

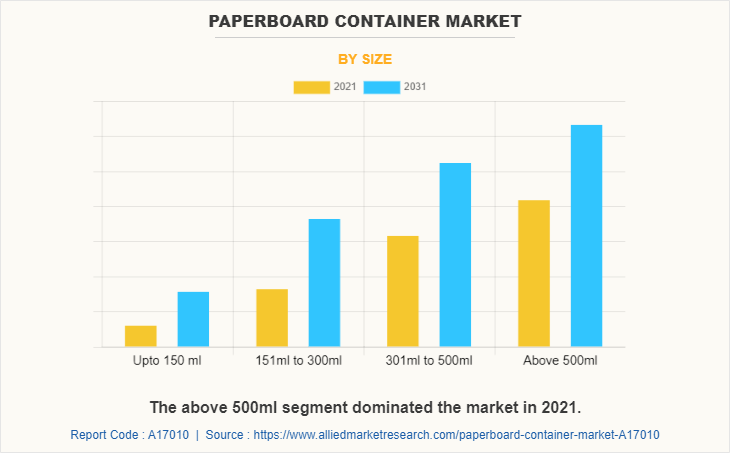

Based on size, the 500ml segment is the largest segment owing to its increase demand in food and beverage industry. In addition, the different delevelopment strategies adopted by manufacturer will boost the market growth. For instance, in December 2019, Oji Holdings Corporation announced that Oji HD and Ishizuka Glass Co., have concluded a basic joint venture agreement on paper container-related business intending further to develop the business through cooperation between the two companies.

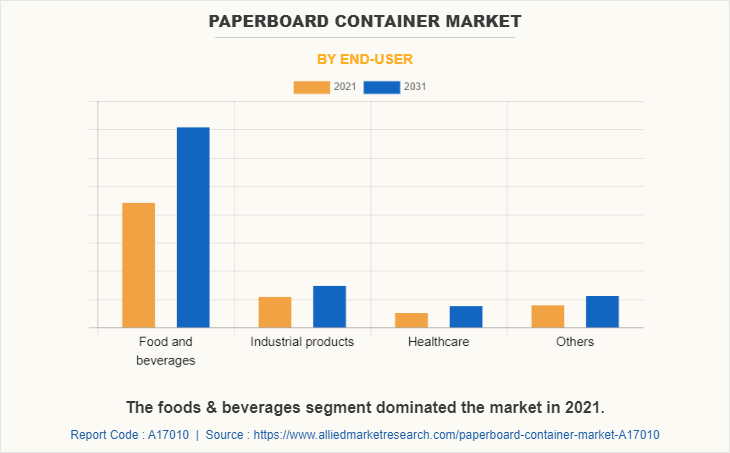

On the basis of end-user, the food & beverage segments accounted for the largest paperboard container market share in 2021, owing to the wide adoption of paper-based packaging products by the food manufacturers. Furthermore, introduction of various packaged food products coupled with growing consumer preference for packed foods is driving the paperboard container market growth.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the paperboard container market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 in the market. This has led to the reopening of paperboard container companies at their full-scale capacities. This is expected to help the market recover by the mid of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

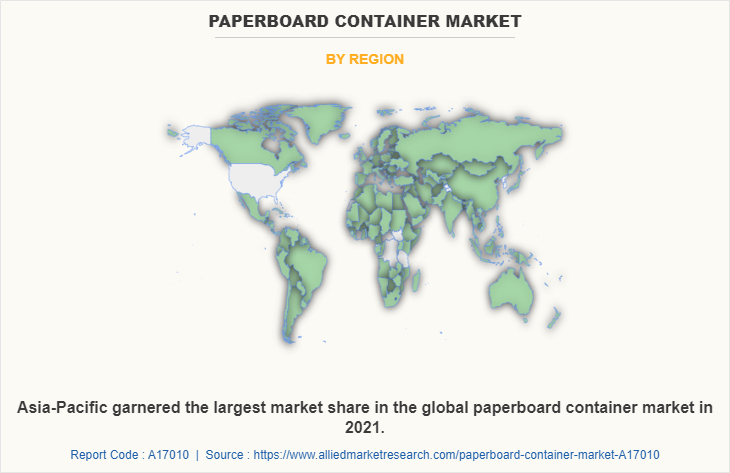

On the basis of region, Asia-Pacific registered the highest revenue in 2021 and is expected to register the highest CAGR in the paperboard container market forecast period. Owing to growth of the foods and beverages and healthcare sectors. Moreover, rising e-commerce and cosmetic & personal care industries in countries such as India, China, and Japan is likely to propel the demand for paperboard container packaging in Asia-Pacific region.

The paperboard container market is segmented into Size, End-user and Board Type. On the basis of board type, the market is divided into paperboard and containerboard. On the basis of size, the market is divided into up to 150 ml, 151 ml to 300 ml, 301 ml to 500 ml, and above 500 ml. On the basis of end users, the market is divided into food and beverages, industrial product, healthcare, and others. Region-wise, the global market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

The key players that operating in the paperboard container industry are Amcor Plc, Cascades, DS Smith Plc, Evergreen Packaging LLC, International Paper, Keystone Folding Box, Metsä Board, Mondi Plc, Nampak Products Ltd., Nippon Paper Industries Co. Ltd., Nine Dragons Paper (Holdings), Oji Fibre Solutions (NZ) Ltd., Sappi, Stora Enso, Smurfit Kappa Group Plc., Svenska Cellulosa Aktiebolaget (SCA), and Westrock

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the paperboard container market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the paperboard container market segmentation assists to determine the prevailing paperboard container market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global paperboard container market trends, key players, market segments, application areas, and market growth strategies.

Paperboard Container Market Report Highlights

| Aspects | Details |

| By Size |

|

| By End-user |

|

| By Board Type |

|

| By Region |

|

| Key Market Players | International Paper, Smurfit Kappa Group Plc, Mondi Plc, Keystone Folding Box, DS Smith Plc, Cascades, Sappi, Westrock, Nine Dragons Paper, Nampak Products Ltd, Amcor Plc, Nippon Paper Industries Co. Ltd, Evergreen Packaging LLC, Meta Board, Svenska Cellulosa Aktiebolaget, Oji Fibre Solutions, Stora Enso |

Analyst Review

The paperboard container market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to remain the major revenue generating region of the market in the near future. The expanding population, rise in food and beverages industries, and increase in manufacturing of industrial and healthcare products, fueling the demand for paperboard packaging in the region.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand its business and strengthen its market position. For instance, in March 2021, the International Paper completed its collaboration with Ortloff Engineers Limited. This strategic move is expected to increase the production of paperboard container packaging products. It enhances the manufacture of high-quality paper packaging, which can be used in industries, such as packaging of vegetables and fresh fruits. ?As a result, such strategic moves are expected to provide lucrative growth in the global paperboard container market.

The Paperboard Container market size was valued at $135,481.0 million in 2021.

The Paperboard Container market is projected to reach $207,396.1 million by 2031.

Asia-Pacific is the largest regional market for Paperboard Container.

The foods & beverages segment is the leading end user of the Paperboard Container Market.

An increase in consumer awareness of eco-friendly packaging options and a rise in consumption of paperboards globally are the upcoming trends in the Paperboard Container Market in the world.

The product launch is a key growth strategy of the Paperboard Container industry players.

Preference for plastic packaging and strict deforestation regulations are the Paperboard Container market affecting factors

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...