Passive Temperature Controlled Packaging Market Research, 2031

The global passive temperature controlled packaging market size was valued at $10.3 billion in 2021, and is projected to reach $24.5 billion by 2031, growing at a CAGR of 9.1% from 2022 to 2031. Passive temperature controlled packaging includes all types of the thermally insulated packaging. Instead of using electricity and active refrigeration systems, passive temperature controlled packaging uses frozen water-packs, gel packs, dry ice, and various other phase-change materials (PCM), including advanced insulation technologies to keep the contained items cool or hot.

Growth in the global population, especially the geriatric population, and increasing number of communicable and non-communicable diseases are playing a crucial role in propelling the pharmaceutical industry. This is increasing the demand for prescription and non-prescription drugs which are labeled as temperature-sensitive owing to their critical nature. Various countries such as South Africa, South Korea, India, and others are investing heavily in life sciences R&D; thereby, increasing the demand for clinical trial supplies, lab samples, APIs, vaccines, and others. Witnessing such growth, various companies are expanding their businesses in this sector. For instance, in December 2021, CSafe Global, the leader in temperature-controlled container solutions for the pharmaceutical industry acquired Softbox Systems, a provider of passive temperature-controlled packaging solutions for the pharmaceutical, life science and cold chain logistics industries.

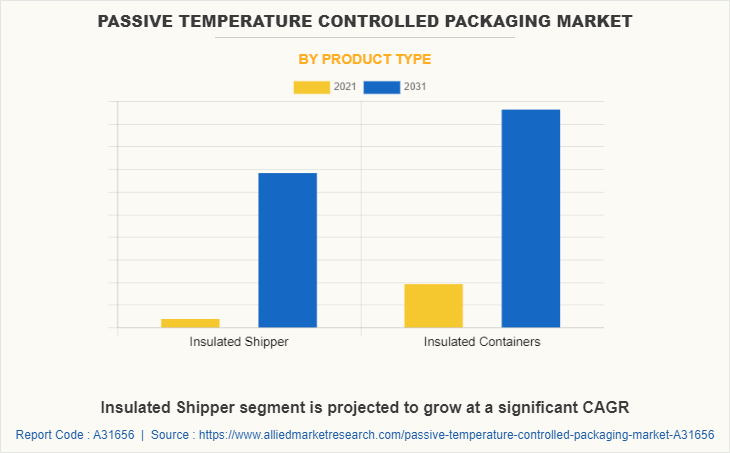

On the basis of product type, the insulated containers segment accounted for the highest market share in 2021, owing to its large-scale usage, which is fueled by increasing international trade.

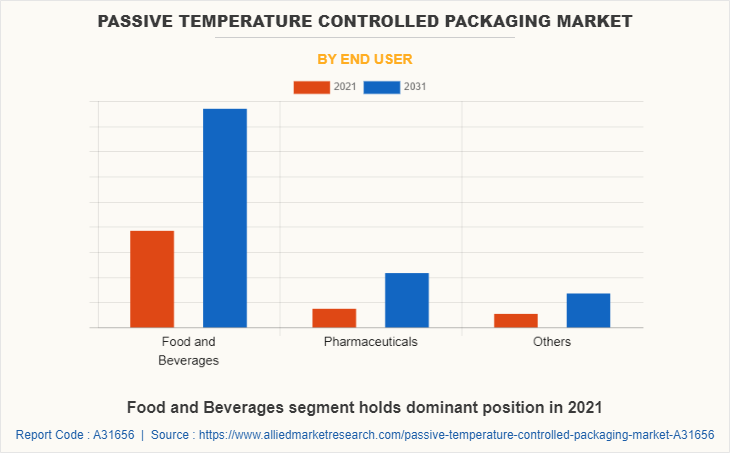

Furthermore, with the increasing working population across the world, maintaining a balance of work, family, and social life is becoming difficult. These factors play a pivotal role in propelling the growth of the food & beverages industry. For instance, popular food service brands such as McDonalds, Starbucks, KFC, Subway, Pizza Hut, and others are witnessing growth. In addition, the growing trade of vegetables, fruits, seafood, and others is also positively affecting the food and beverages industry.

The food & beverage and pharmaceuticals industry produce many perishable products that are sensitive to high temperatures, such as ice creams, beverages, fruits, medicines, vaccines, and others. Transporting such items require passive temperature-controlled packaging to prevent the spoilage of the goods. Thus, the rise of the above-mentioned industries that extensively use passive temperature controlled packaging is anticipated to drive the passive temperature controlled packaging market growth during the forecast period.

On the basis of end user, the food and beverages segment registered higher revenue in 2021, owing to increasing demand for food and beverages.

Major players in the industry adopted product launches and other strategies as their key developmental strategies to sustain the competition and improve their product portfolio to remain competitive in the passive temperature controlled packaging market. For instance, in May 2020, Softbox, a subsidiary of Csafe, a provider of passive temperature controlled packaging and other solutions for cold chain logistics, introduced a new plastic-free 100% curbside-recyclable cardboard insulated shipper to deliver chilled food. Other companies such as Cold Chain Technologies, LLC, Intelsius, and Sonoco Products Company, including others offer a wide range of passive temperature controlled packaging.

COVID-19 had rapidly spread across various countries and regions and caused havoc in the lives of individuals and communities as a whole. In the beginning, it was just considered a health issue, and lockdowns were the best preventive measures to stop the virus from spreading. However, the lockdowns led to a halt in global trade, economy, and finance, by imposing restrictions on the global supply chain including the cold supply chain. The manufacturing activities of passive temperature controlled packaging across the world also witnessed a reduction. Since, cold-chain logistics industry is a major user of the passive temperature controlled packaging solution, its halt negatively impacted the market. Contrarily, demand for passive temperature controlled packaging solutions from pharmaceutical distributors for the distribution of medicines and vaccines for COVID-19 positively affected the market. Finally, with the introduction of various vaccines, the severity of the COVID-19 pandemic reduced significantly. As of 2022, the number of COVID-19 cases has diminished significantly. This has led to the reopening of businesses involved in producing and using passive temperature controlled packaging at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Moreover, developments in the cold-chain logistics industry are positively influencing the passive temperature controlled packaging market; thus, are expected to provide lucrative growth opportunities.

The passive temperature controlled packaging market is segmented on the basis of product type, business, application, and region. By product type, the market is bifurcated into insulated shippers, and insulated containers. By business, the market is categorized into warehousing, and transportation. On the basis of application, it is categorized into food and beverage, pharmaceuticals, and others.

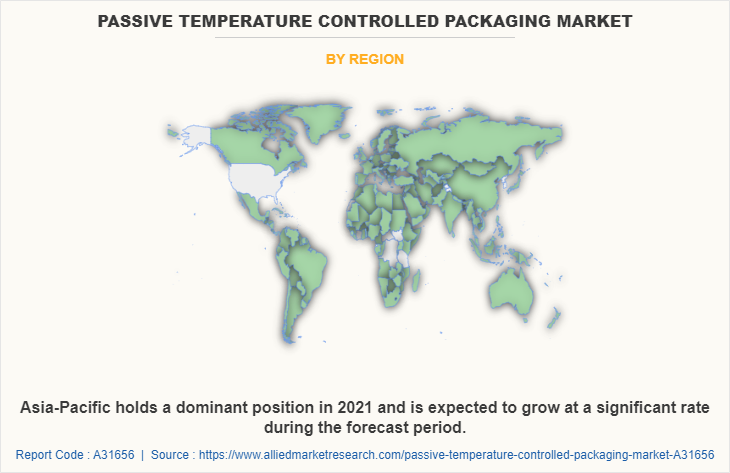

Region wise, the passive temperature controlled packaging market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2021, accounting for the highest share, and the same is anticipated to grow with the highest CAGR throughout the forecast period. This is attributed to the increasing population and improving economic condition in the region which is driving demand for food and beverages, and pharmaceuticals.

Competition Analysis

Key companies profiled in the passive temperature controlled packaging market report include AmerisourceBergen Corporation, Atlas Roofing Corporation (Atlas Molded Products), Cold Chain Technologies, LLC, CSafe (Softbox Systems), Deutsche Post AG, FedEx Corporation, Intelsius, Pelican Products, Inc. (Peli BioThermal Limited), Sofrigam, and Sonoco Products Company.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging passive temperature controlled packaging market trends and dynamics.

- In-depth passive temperature controlled packaging market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

- Extensive analysis of the passive temperature controlled packaging market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global passive temperature controlled packaging market forecast analysis from 2022 to 2031 is included in the report.

- The key players within the passive temperature controlled packaging market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the passive temperature controlled packaging industry.

- A comprehensive analysis of all the regions is provided to determine the prevailing passive temperature controlled packaging market opportunity.

Passive Temperature Controlled Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 24.5 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 263 |

| By Product type |

|

| By Business |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sofrigam, CSafe (Softbox Systems), Deutsche Post AG, Cold Chain Technologies, LLC, Sonoco Products Company, FedEx Corporation, Atlas Roofing Corporation (Atlas Molded Products), Intelsius, AmerisourceBergen Corporation, Pelican Products, Inc. (Peli BioThermal Limited) |

Analyst Review

Rise in industrialization, global trade has witnessed a rapid surge; thereby driving demand for global supply-chain services. Since, packaging media are largely used for the safe transportation and storage of products, the rise in supply-chain industry is positively influencing the packaging industry including passive temperature controlled packaging.

The products from food & beverages and pharmaceutical industries are consumed across the globe and any deviation from the desired quality can be a serious health hazard. Thus, governments closely monitor these industries and establish guidelines for production and handling of the end products. For instance, ‘Guidelines on Good Distribution Practices for Pharmaceutical Products’ set up by the Central Drugs Standard Control Organization of India, the pharmaceutical products shall be stored and transported in packaging that can maintain temperature as specified by the manufacturer. This drives demand for passive temperature controlled packaging. Furthermore, various companies launched their passive temperature controlled packaging for the distribution of COVID-19 vaccines across the globe. Thus, it can be stated that COVID-19 positively influenced the market majorly in 2021. Since Asia-Pacific is a major producer of pharmaceuticals, such factors are expected to positively affect the passive temperature controlled packaging in the region. In addition, owing to the high disposable income and high living standards the demand for exotic fruits & vegetables in Europe is high. since, these fruits & vegetables are exported from around the globe, the demand for food-grade passive temperature controlled packaging is increasing.

Furthermore, the personal care products, such as cosmetics being a non-essential product, witness a high demand where the masses have higher disposable income. This includes countries such as U.S., Canada, and countries in Europe. Thus, rising consumption of cosmetic products is driving demand for passive temperature controlled packaging that ships temperature-sensitive cosmetics in these countries.

In addition to that, various companies have introduced 100% recyclable passive temperature controlled packaging, which is expected to aid companies in reaching their sustainability goals: thereby, providing growth opportunities.

Rapid industrialization in developing countries and increasing packaging industry are the upcoming trends of Passive Temperature Controlled Packaging Market in the world

The food and beverage segment is the leading end user of Passive Temperature Controlled Packaging Market

Asia-Pacific is the largest regional market for Passive Temperature Controlled Packaging

The global passive temperature controlled packaging market size was valued at $10,286.1 million in 2021

AmerisourceBergen Corporation, Atlas Roofing Corporation (Atlas Molded Products), Cold Chain Technologies, LLC, CSafe (Softbox Systems), Deutsche Post AG, FedEx Corporation, Intelsius, Pelican Products, Inc. (Peli BioThermal Limited), Sofrigam, and Sonoco Products Company.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The global passive temperature controlled packaging market is projected to reach $24,462.0 million by 2031

By business, transportation segment tholds the maximum market share of the Passive Temperature Controlled Packaging market in 2021

Loading Table Of Content...