Payroll Outsourcing Market Research, 2031

The global payroll outsourcing market was valued at $9.9 billion in 2021, and is projected to reach $19.5 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

Payroll outsourcing is when an organization uses a third-party service provider to handle the administrative and compliance tasks associated with employee pay. Depending on the payroll outsourcing firm, this may include filing payroll taxes and payments on the organization’s behalf. Many companies choose outsourced payroll services due to the manual and time-consuming nature of these tasks. This automation of payroll processing allows HR and payroll managers to focus on more strategic tasks in their organizations.

Payroll outsourcing frees up time for the organization to focus on their core business by undertaking all the payroll related activities under themselves. In addition, payroll outsourcing cost reduces the need for training in-house payroll staff. Moreover, it removes the expense of buying and maintaining a costly payroll system. Therefore, these are some of the factors that propel the growth of payroll outsourcing market. However, handing over confidential and sensitive staff information to third parties and high cost of outsourcing payroll is a major factor limiting the growth of payroll outsourcing market outlook. On the contrary, up gradation in the payroll outsourcing services by organization in order to become more efficient is expected to provide lucrative growth opportunities for the payroll outsourcing market forecast period.

The report focuses on growth prospects, restraints, and trends of the payroll outsourcing industry. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the payroll outsourcing industry.

The payroll outsourcing market is segmented into Type, Business Size and Industry Vertical.

Segment Review

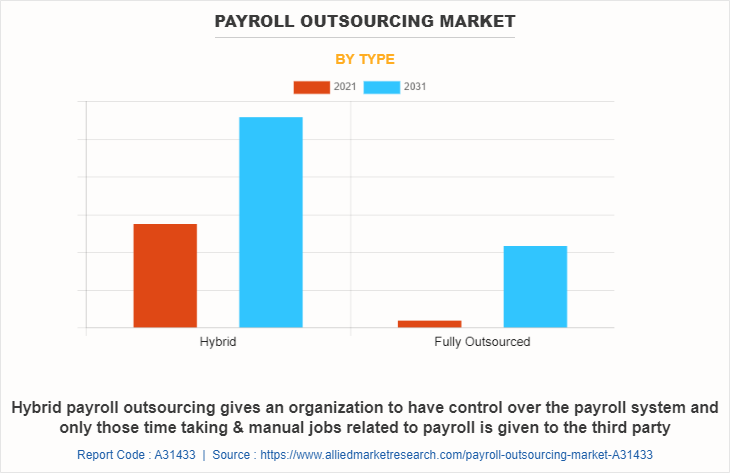

The payroll outsourcing market is segmented on the basis of type, business size, industry verticals, and region. By type, it is bifurcated into hybrid and fully outsourced. The fully outsourced segment is divided on the basis of application into payroll processing, tax filing, & tax preparation, bookkeeping & accounting, and others. The payroll processing is fragmented on the basis of component into software and services. By business size, it is segregated into small business, medium business, and large business. By industry vertical, the payroll outsourcing market is bifurcated into BFSI, consumer and industrial products, IT and telecommunication, public sector, healthcare, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the hybrid segment attained the highest growth in 2021 in the payroll outsourcing market. This is attributed to the fact that hybrid payroll outsourcing gives an organization to have control over the payroll system and only those time taking & manual jobs related to payroll is given to the third party. Moreover, having a hybrid system ensures that the HR team knows how to handle the payroll without being dependent on others for doing their job. Furthermore, hybrid systems cut down the cost to almost half as the job is divided between the organization and the third party.

By region, Europe attained the highest growth in 2021 in the payroll outsourcing market. This is attributed to the rise in need for real-time data access and the growth in usage of mobile & cloud-based applications in the area. Moreover, businesses are investing in cloud computing due to aligned government regulations, which provides lucrative growth opportunities for the European region market in the future. In addition, key market players are constantly working to improve the functionality of systems and standardize administrative tasks in order to ensure efficiency and productivity, which is driving them to choose payroll outsourcing.

The report analyzes the profiles of key players operating in the payroll outsourcing companies such as ADP, Inc., CloudPay, Deloitte Touche Tohmatsu Limited, Gusto, HCL Technologies Limited, HRMantra Software Pvt. Ltd., Infosys Limited, International Business Machines Corporation, Intuit Inc., KPMG, Paychex Inc., Sage Group plc, Vision H.R., Workday Inc., Zalaris ASA, Keka Inc., and Papaya Global. These players have adopted various strategies to increase their market penetration and strengthen their position in the payroll outsourcing market share.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the payroll outsourcing as most of the organizations were working remotely, therefore it was difficult for HR and payroll managers to work on the compliance tasks related to payroll. Therefore, most of the organizations shifted their focus to payroll outsourcing provider for handling their payroll related activities. Moreover, as there were high chances of spread of virus, the payroll outsourcing effectively reduced the face to face interactions among employees and employers related to payroll. Therefore, the pandemic had a positive impact on the payroll outsourcing market growth.

Top Impacting Factors

Payroll Outsourcing Frees up for the Organization’s time to Focus on their Core Business

Payroll outsourcing saves a lot of time which can be consumed in calculating the payroll of each and every employee as per their designation and attendance. Moreover, According to Technology Advice, 26% of small businesses spend three to five hours per month processing payroll manually. Many payroll outsourcing solutions provide a centralized database for payroll and attendance information. This unified approach automates the process from time capture to paycheck into a closed-loop workflow. In addition, outsourcing payroll to a third party provider allows organizations to save valuable time in their workday. They are more productive and have time to focus on more strategic initiatives for their organization. Therefore, this is a major driving factor for the payroll outsourcing market.

Handing Over Confidential and Sensitive Staff Information to Third Parties

Handing over payroll operations to a third party limits the organization’s control over processes and information accessibility. In addition, it is extremely important to ensure that all company and employee information is protected and to establish confidentiality and data protection policies and agreements. Since payroll outsourcing involves giving away all the sensitive data of employees to third party, many organizations hesitate to outsource their payroll and they stick to their in-house staff for managing payroll. Therefore, this is a major factor limiting the growth of payroll outsourcing market.

Upgrade in the Payroll System

Organizations are rapidly updating their work systems and making sure that work is automated with the growing technological advancement. Furthermore, the traditional system of keeping record of employees for payroll system is updated and nowadays most enterprises are hiring third parties to handle their payroll, so that they can focus more on their core businesses. In addition, outsourcing payroll is considered as a basic amenities by organizations for handling their payroll systems and the traditional system of manually recording each and every detail of the employees is rapidly decreasing as organizations are outsourcing payroll from third parties. Therefore, this factor will provide major lucrative opportunities for the growth of the market in the upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the payroll outsourcing market analysis from 2021 to 2031 to identify the prevailing payroll outsourcing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the payroll outsourcing market size segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global payroll outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Payroll Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 19.5 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 375 |

| By Type |

|

| By Business Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Deloitte Touche Tohmatsu Limited, HRMantra Software Pvt. Ltd., Vision H.R., Keka Inc., HCL Technologies Limited, International Business Machines Corporation, Gusto, CloudPay, Intuit Inc., ADP, Inc., Paychex Inc., Infosys Limited, Papaya Global, KPMG, Sage Group plc, Workday Inc., Zalaris ASA |

Analyst Review

Many organizations who do not have a dedicated person for payroll go for payroll outsourcing. Based on their pay cycle, every month they provide employee salary information and other data such as attendance, leaves, reimbursement details, and others to the payroll service provider. The service provider then computes payroll and also takes care of statutory compliance. Since payroll is a crucial function and businesses want to have full transparency and control over it, they often hesitate in outsourcing payroll. Furthermore, for running successful payroll, organizations need to ensure that payroll inputs are coming from every source in a timely and seamless manner. The intent of outsourcing payroll is to reduce the friction in getting the inputs from the employees. Advanced payroll management software are available with the third parties that not only automates payroll computation but also serve as a holistic leave and attendance management, HR management and employee self-service portal. Depending on the size of the business and use cases, organizations can opt for an appropriate payroll software for their business.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on January 2022, Bambee, the HR solution known for automating HR workflows for small businesses, and pairing each of its customers with a real, dedicated HR manager, announced the launch of Guided Payroll, the first-ever payroll product with built-in HR guidance. Bambee’s Guided Payroll product is free for companies and start-ups with less than 20 employees–meaning 4+ million American businesses who employ 30+ million American workers have access to guided payroll for no additional cost. For more mature small companies, Bambee’s payroll product is assertively discounted for maximum affordability, priced 70% under the market average rate at a flat $4 per employee, with no monthly company fee. Therefore, these strategies will offer lucrative opportunities for the market in the upcoming years.

Some of the key players profiled in the report include ADP, Inc., CloudPay, Deloitte Touche Tohmatsu Limited, Gusto, HCL Technologies Limited, HRMantra Software Pvt. Ltd., Infosys Limited, International Business Machines Corporation, Intuit Inc., KPMG, Paychex Inc., Sage Group plc, Vision H.R., Workday Inc., Zalaris ASA, Keka Inc., and Papaya Global. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The Payroll Outsourcing Market is estimated to grow at a CAGR of 7.2% from 2022 to 2031.

The market value of the Payroll Outsourcing Market by the end of 2031 will be $19,450.87 million

Payroll outsourcing frees up time for the organization to focus on their core business by undertaking all the payroll related activities under themselves. In addition, payroll outsourcing cost reduces the need for training in-house payroll staff. Moreover, it removes the expense of buying and maintaining a costly payroll system. Therefore, these are some of the factors that propel the growth of payroll outsourcing market. However, handing over confidential and sensitive staff information to third parties and high cost of outsourcing payroll is a major factor limiting the growth of payroll outsourcing market outlook. On the contrary, up gradation in the payroll outsourcing services by organization in order to become more efficient is expected to provide lucrative growth opportunities for the payroll outsourcing market forecast period.

The report analyzes the profiles of key players operating in the payroll outsourcing market such as ADP, Inc., CloudPay, Deloitte Touche Tohmatsu Limited, Gusto, HCL Technologies Limited, HRMantra Software Pvt. Ltd., Infosys Limited, International Business Machines Corporation, Intuit Inc., KPMG, Paychex Inc., Sage Group plc, Vision H.R., Workday Inc., Zalaris ASA, Keka Inc., and Papaya Global

The payroll outsourcing market is segmented on the basis of type, business size, industry verticals, and region. By type, it is bifurcated into hybrid and fully outsourced. The fully outsourced segment is divided on the basis of application into payroll processing, tax filing, & tax preparation, bookkeeping & accounting, and others. The payroll processing is fragmented on the basis of component into software and services. By business size, it is segregated into small business, medium business, and large business. By industry vertical, the payroll outsourcing market is bifurcated into BFSI, consumer and industrial products, IT and telecommunication, public sector, healthcare, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA

Loading Table Of Content...

Loading Research Methodology...