Pea Protein Market Research, 2032

The global pea protein market size was valued at $94.6 million in 2022, and is projected to reach $227.1 million by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

Pea protein is a lactose- plant protein produced from yellow field peas. Pea protein isolate, pea protein concentrate, and textured pea protein are the types of protein available in the market. Pea protein is a crucial alternative protein source for both vegetarians and lactose intolerant people.. Pea protein products are used in place of alternative sources of protein such as soy, almonds, and peanuts, that are prone to cause allergic reactions in a selected group of audience. Pea protein offers a high protein concentration and necessary amino acids, resulting in a number of favourable health benefits, including enhanced circulation and absorption of calcium, muscle conservation, increased metabolism, and managing blood sugar levels.

Market Overview

People's eating habits have shifted as their health knowledge has increased. Consumers are looking for products that are safe for digestion, eco-friendly, and healthy and help to reduce ailments such as sickness, water loss, gas, cramps, a lack of appetite, exhaustion, and headache, and pea protein suits their requirements as it is the suitable source of protein without any side effects. People who are intolerant or too allergic to gluten or dairy finds pea protein as a suitable source of nutrition. Furthermore, unlike other protein powders such as soy, eggs, whey, or casein, it is easily absorbed and does not cause bloating. Pea protein's strong nutritional composition makes it ideal for senior, vegetarian, and without lactose diets, and child nutrition, driving up demand. As a consequence, all of these factors contribute to market growth.

Consumers frequently turn to animal-derived sources of protein such as meat, cheese, milk, and eggs to fulfil their daily requirement for protein. Animal-derived protein have a higher protein content than plant-based proteins and increase severe health issues such as cardiovascular disease, obesity, diabetes, and others. The pea protein market has grown in recent years due to the growing health consciousness in consumers, health benefits associated with pea protein consumption, and a growing need for plant-based protein options. According to a study/survey by the International Food Information Council (IFIC), in 2022, 28% of the US population recognized the nutritive significance of plant proteins, and 69% considered that plant proteins helped their nutritional gains. Furthermore, the surge in the requirement for vegan and meat alternatives owing to ethical and environmental concerns about food industry practices, influenced the population to be more conscious in their selections, especially when it comes to supplementation and additives to a well-balanced diet.

Furthermore, the affordable nature of proteins made from plants in compared to other types of protein, as well as their various health benefits, have increased the demand from customers in recent years, boosting market growth. Future trends towards a high-protein diet, increased health awareness, growth in the economy, urbanisation, and a sizeable vegan population all indicate to an increase in the utilisation of plant-based proteins in food products. To accommodate changing customer tastes, the food industry is continuously exploring for less costly and healthier protein components to replace those derived from animals, such as whey protein, casein, gelatin, which is and ovalbumin- and gluten-based proteins. Pea protein is a feasible food industry choice due to its neutral flavour and usual amino acid makeup Furthermore, the remarkable emulsification qualities of pea protein, which combine both water and fat for a stable emulsion, it is used as a texturizing component in meat products. In recent years, food manufacturers are using pea protein in food items to increase its nutritional content, breakfast cereals, nutritional supplements, baked savories, protein powder, ready-to-drink meal replacement beverages, and plant-based meat are the types of food products where pea protein isolates are used. The growing expansion of the F&B industry, and introduction of innovations in protein-based solutions in developed marketplaces, have propelled demand of the market globally.

On the contrary, pea protein is a good source of vitamins, minerals, and amino acids, but it lacks essential nutrients therefore the need for alternative sources of protein such as whey, soy, casein, and others are still on the rise. Additionally, the positive advantage of animal-based proteins in the protein-based ingredients industry limits the market for pea protein. Animal-based proteins are a superior source of protein than plant-based proteins because they include all of the necessary amino acids required for the body's health to operate. Consumer preference for other plant-based proteins such as soy and rice after animal-based proteins means that consumer predisposition toward pea protein is low, which has an adverse effect on pea protein market growth. Since the pea protein business is still in its infancy, it will likely take longer for it to maintain its position among the diverse range of other proteins. In addition, it is projected that the effective marketing and positioning techniques used by top corporations will make it difficult for producers of pea protein to maintain the competition, hence limiting market expansion.

Even though the use of pea protein as a replacement for animal-based proteins in food is growing, many people are still unaware of its existence. They prefer to consume milk, eggs, soy, wheat, rice, and other traditional protein sources to meet their daily protein requirements. The market's expansion is being constrained by low consumer awareness of the advantages of pea protein. Moreover, it is challenging for pea protein manufacturers to launch pea protein-based products in the market as R&D activities for pea protein are not as robust as those for whey and soy. To maintain a strong position in the market for protein components, leading companies must use effective marketing and positioning strategies. Therefore, each of these issues inhibits the market's expansion.

The multiuse of pea protein, such as protein supplement and functional food ingredient, has propelled its use across the globe. The ever-changing and rise in demand for nutritious, healthy, & tasty food has led to the formulation of pea protein, which is widely adopted as a prominent protein alternative in developed regions, such as North America and Europe. Furthermore, factors, such as increase in disposable income, consistent growth of food & beverages industry, rise in demand for organic-based foods, and innovations in protein-based products drive the market growth of pea protein in the Asia-Pacific and LAMEA regions.

Segmental Overview

The pea protein market is segmented on the basis of type, form, application, and region. By type, it is classified into pea protein isolate, pea protein concentrate, and textured pea protein. Depending on form, it is categorized as dry and liquid. By application, it is segmented into dietary supplement, bakery & confectionery goods, meat products & alternative, beverages, and others. By region, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

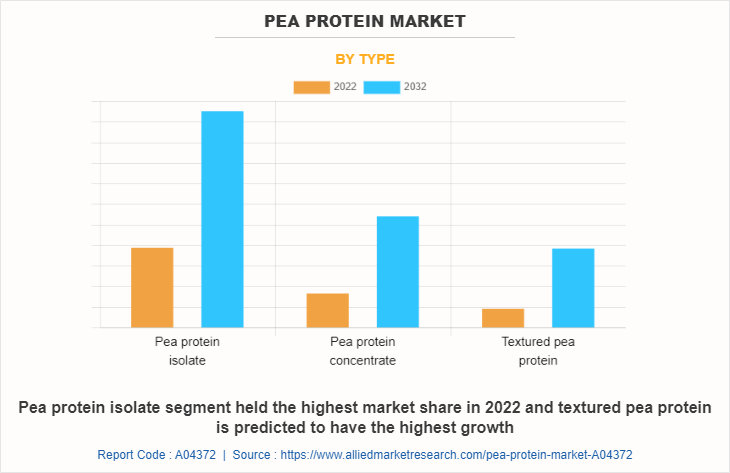

By Type

According to pea protein market demand, depending on type, the pea protein isolate segment dominated the market in 2022, garnering around half of the market share. Moreover, the textured pea protein segment is expected to grow at the highest CAGR of 9.7% from 2023 to 2032. In addition, pea protein isolates are more suited for dietary supplements in the sports nutrition sector since they have a protein concentration of 80–95%. These products are also used as texturizing ingredients in meat products due to their substantial amino acid content, increased emulsification, good water-binding characteristics, and high solubility. Furthermore, they are free of common allergen such as lactose and soy, making them an ideal source of animal protein for persons with dietary intolerances. Therefore, the market is anticipated to grow throughout the pea protein market forecast period as a result of these pea protein isolate qualities.

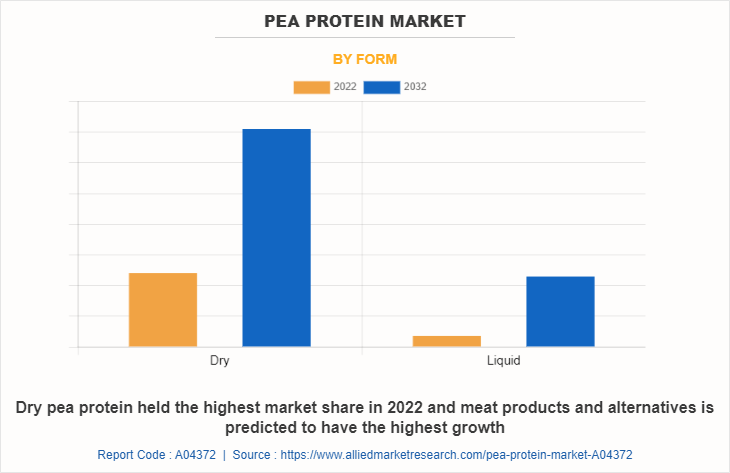

By Form

By form, dry segment dominated the market in 2022, garnering around three-fourths of the pea protein market share. Moreover, liquid segment is expected to grow at the highest CAGR of 9.4% from 2023 to 2032. In addition, applications for dry pea protein range from enhancing the texture of meat substitute goods to adding it to protein drinks and dietary supplements. Dry-based pea protein maintains its market leadership over the projection period due to its significant use in the manufacturing of meat, loaf, and nutritional health supplements. Its ease of blending with other food components is one of the important properties that allows it to be utilised in dietary supplements, energy drinks, and other beverages. The demand for pea protein has lately increased due to reasons such as ease of availability, cheap cost in contrast to other kinds of protein, multiple health advantages, and increased desire for meat replacements.

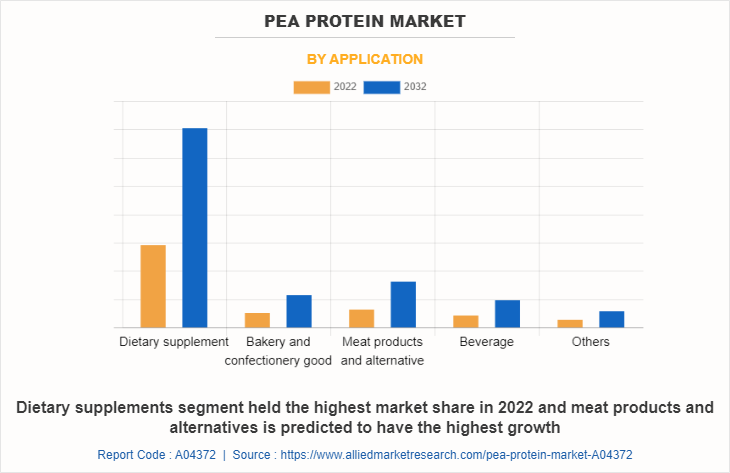

By Application

As per application, the dietary supplement segment dominated the market in 2022, garnering majority of the market share. Moreover, meat products & alternative segment is expected to grow at the highest CAGR of 9.9% from 2023 to 2032. In addition, consumer preferences for a nutritious diet have changed as a result of growth in health consciousness and objective to live a healthy lifestyle. They've been looking for complete protein-rich, sustainable, and healthful food alternatives. Pea protein, which is completely vegan and includes every one of the nine essential amino acids, has an array of health benefits, including weight management, enhanced circulation and calcium absorption, muscle maintenance, speeding up metabolism, and blood sugar control. As a result, manufacturers of food supplements and nutritious items have been working hard to include pea protein into their products.

By Region

Region wise, North America dominated the market in 2022, garnering a market share of 35.2%. The well-established food & beverages sector and growth in concerns about animal products & protein are mostly to blame for the North American region's dominant position. Pea protein has improved nutritional value and food flavor thanks to technological advances, which has a big impact on how many people utilize it. The pea protein market in this region is expanding as a result of the food industries' demand for pea proteins with a certain texture.

Competitive Analysis

Some of the major players analyzed in this report are A&B Ingredients, Roquette Freres Le Romarin, Burcon Nutrascience Corporation, Cosucra Groupe Warcoing SA, Glanbia, Plc., Green Labs, LLC, GEMEF Industries, Axiom Foods, Inc., Puris, and Yantai Shuangta Food Co., Ltd.

Some Examples of Business Expansion in the Global Pea protein Market

- In March 2023, Glanbia, Plc. expanded its business by introducing new manufacturing center in Singapore and new facilities in China to increase its presence in the region.

- In June 2022, A&B Ingredients announced that it expanded its line of plant-based, functional ingredients with Texta Feve, textured Faba bean proteins. This development tends to add a comprehensive portfolio of plant protein ingredients and offers its customers a solution for texturizing plant-based meats.

- In March 2022, A&B Ingredients is expanding its line of plant-based solutions with Texta Feve textured fava bean proteins to offer a variety of pea protein products to its customers.

Some Examples of Product Launch in the Global Pea Protein Market

- In October 2022, Roquette Freres Le Romarin announced the launch of a new line of organic pea ingredients such as organic pea starch and organic pea protein. In addition, it enables its customers to select food with quality, full traceability and reliability.

Key Benefits For Stakeholders

- This report on Pea Protein Industry Analysis provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pea protein market analysis from 2022 to 2032 to identify the prevailing pea protein market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pea protein market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pea protein market trends, key players, market segments, application areas, and market growth strategies.

Pea Protein Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 227.1 million |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Application |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | Burcon Nutrascience Corporation., GEMEF Industries, A&B Ingredients, Inc., Cosucra, Puris, The Green Labs, LLC., Yantai Shuangta Food Co., Ltd., Roquette Freres S.A., Axiom Foods, Inc., Glanbia PLC |

Analyst Review

According to the top CXOs, surge in demand for plant-based proteins is the major driving factor of the global pea protein market. Proteins are the essential nutrients needed by the human body for growth and maintenance. To meet the daily protein requirements of body, consumers seek for healthy as well as sustainable protein sources. Although animal protein is the most significant & preferable source of protein, health issues related to them such as obesity, diabetes, and cardiovascular diseases have fueled the growth of vegan population demanding for plant-based proteins. Inclusion of pea protein in dietary & nutritional supplements, meat alternatives & extenders, snacks, beverages, and other bakery & confectionery goods is one of the major factors driving the growth of the pea protein market. In addition, factors such as rise in living standards, increase in demand for healthy & nutritional products, growth in economy, and rapid urbanization are indirectly influencing the growth of the global market.

Pea protein’s nutritional characteristics aid in relieving depression & anxiety as well as promote brain health. Further, owing to increase in disposable income, consumer expenditure on health supplement products has simultaneously increased. This resulted in increase in demand for pea protein which is anticipated to augment the market growth during the forecast period. Moreover, one of the primary drivers for the increase in demand for pea protein is the increased demand for healthy across the globe. Many new market players are expected to enter the Pea protein market over the forecast period, attracted by profitable growth and high-profit margins.

The global pea protein market size was valued at $94.6 million in 2022, and is projected to reach $227.1 million by 2032

The global Pea Protein market is projected to grow at a compound annual growth rate of 9.2% from 2023 to 2032 $227.1 million by 2032

Some of the major players analyzed in this report are A&B Ingredients, Roquette Freres Le Romarin, Burcon Nutrascience Corporation, Cosucra Groupe Warcoing SA, Glanbia, Plc., Green Labs, LLC, GEMEF Industries, Axiom Foods, Inc., Puris, and Yantai Shuangta Food Co., Ltd.

Region wise, North America dominated the market in 2022

Loading Table Of Content...

Loading Research Methodology...