Peanut Oil Market Summary

The global peanut oil market size was valued at $10.1 billion in 2022, and is projected to reach $15.7 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2022.

The global peanut oil market share was dominated by the food segment in 2022 and is expected to maintain its dominance in the upcoming years

The business-to-business segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2022 Market Size: USD 10.1 Billion

- 2032 Projected Market Size: USD 15.7 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 4.6%

- Asia-Pacific: Generated the highest revenue in 2022

Market Dynamics

Peanut oil, also known as groundnut oil or arachis oil, is an edible vegetable oil derived by pressing or extracting the oil from peanuts. It is commonly used in cooking and is known for its mild flavor, high smoke point, and versatility in various culinary applications. The oil has a pale-yellow color, a neutral taste, and is often used in frying, sauteing, and baking due to its ability to withstand high temperatures. There are different varieties of peanut oil, including refined, unrefined, and roasted versions, each with distinct characteristics and uses. In addition to its culinary uses, peanut oil is also utilized in certain non-food applications, such as in the production of cosmetics and pharmaceuticals.

Peanut oil is recognized for its gentle flavor and high smoke point, and has graced kitchens worldwide for centuries, imparting a delightful nutty essence to a variety of dishes, both savory and sweet. Its exceptional versatility as a cooking medium preserves its integrity during deep frying and stir-frying, positions it as a kitchen essential. Whether aiming for the perfect crunch in frying, the fine enhancement of flavors in sauteing, the moist tenderness in baking, or fast frying, peanut oil is the secret ingredient for achieving delectable and crispy results. As culinary enthusiasts increasingly hold a rich taste of global flavors, peanut oil's neutral character proves invaluable, effortlessly blending into dishes from diverse cultural backgrounds. Beyond its roles in frying and sauteing, peanut oil extends its influence into baking, roasting, and crafting flavorful salad dressings, expanding its culinary footprint with each use. Its application in marinades and dipping sauces further highlights its ability to elevate the overall flavor profile of a vast range of dishes, making it a trusted source in the kitchen. Notably, peanut oil perfectly fit in Asian cuisines, playing a prominent role in dishes from Chinese, Thai, and Indian culinary traditions. As a result, the journey of peanut oil through the centuries continues, adding its distinct touch to kitchens around the globe, creating culinary masterpieces that stand the test of time.

Moreover, in the current health-conscious era, individuals are aware of their dietary choices, facing competition among various cooking oils. Olive oil, canola oil, avocado oil, and sunflower oil are gaining consumer attention, promoting their health benefits, distinct tastes, and versatility in cooking. These oils have gained popularity by positioning themselves as heart-healthy options, rich in beneficial fats, and offering appealing flavors. Consequently, consumers are now seeking a wide range of choices when selecting cooking oil. Beyond taste, the challenge lies in assuring consumers that peanut oil is a healthy and adaptable option for their culinary needs. As the market becomes saturated with alternatives, peanut oil faces the risk of maintaining its position between the diverse preferences and health considerations of consumers, which may impact the peanut oil market size along with peanut oil market demand.

However, peanut oil gets the attention in the kitchen owing to its perfect frying quality. It can handle high temperatures, ensuring that French fries, crispy chicken, and tempura come out irresistibly golden and delicious. Also, it adds a delightful nutty flavor to veggies, meats, and noodles, striking the right balance without being too overpowering. Further, in the culinary scenes of Chinese, Thai, and Vietnamese traditions, peanut oil is the essential ingredient, nailing wok cooking, stir-frying, and crafting beloved traditional dishes. It adapts to various cooking methods, seamlessly blending with a wide range of flavors. This adaptability is the magic behind its popularity, securing a special place in kitchens worldwide, preferred by both professional chefs and home cooks alike. Whether whipping up the perfect stir-fry or adding that extra crunch to a favorite snack, peanut oil stands as a reliable and beloved companion in kitchens across the globe.

Additionally, peanut oil has an opportunity to become the go-to option for cooking oils because of the rise in consumer preference for natural and clean-label goods. Consumers that value purity and transparency in their food choices may find a connection with peanut oil, which promotes being minimally processed, non-GMO, and 100% natural. Through highlighting these essential characteristics, peanut oil can present itself as a pure and healthy cooking oil that comes straight from peanuts and isn't genetically modified. This strategic positioning supports trust and satisfies the rising demand for natural and clean ingredients in the culinary scene while also catering to the expectations of contemporary consumers who seek clear, simple information about the meals they eat during peanut oil market forecast.

Segmental Overview:

The peanut oil market is segmented on the basis of type, application, distribution channel, and region. By type, the market is divided into refined and unrefined. By application, the market is divided into cosmetics, food, pharmaceuticals and others. By distribution channel, the market is divided into hypermarkets/supermarkets, independent retail, business-to-business and online stores. Region-wise, the market share is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, South Korea, Indonesia, and the rest of Asia-Pacific), Latin America (Brazil, Colombia, Argentina and rest of Latin America), and MEA (GCC, South Africa and the rest of MEA).

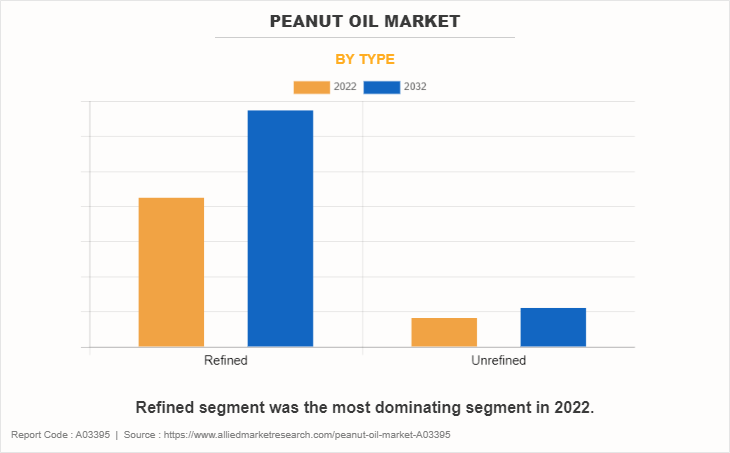

By Type

By type, the market is segmented into refined and unrefined. The refined segment accounted for a major share in the peanut oil market in 2022 and is expected to grow at a significant CAGR during the forecast period. Demand for peanut oil is rising due to growing consumer awareness and health concerns. Consumers are increasingly aware of the health benefits of peanut oil, which is driving the demand for these oil and oil products. Hence, these factors are fueling the refined segment in the market. While unrefined peanut oil still maintained their market share, the momentum leaned toward organic options as consumers increasingly sought transparency in sourcing and a commitment to cleaner, more environment-friendly products.

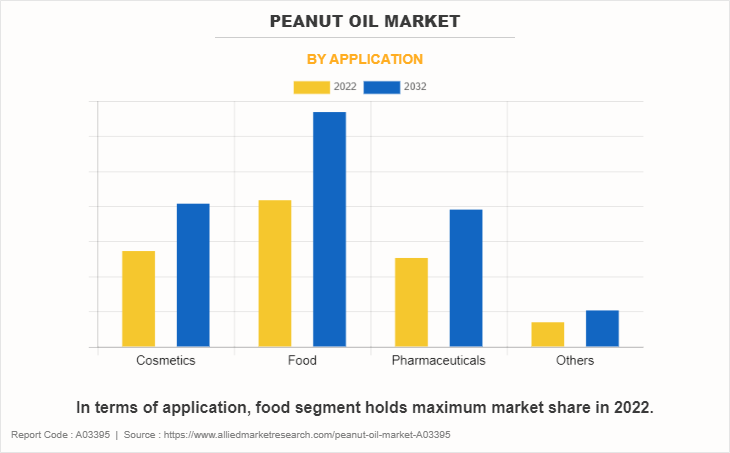

By Application

By application, the market is segmented into cosmetics, food, pharmaceuticals and others. The peanut oil market had been witnessing a notable surge in demand for food segment. The food segment was experiencing prominent growth, driven by a rise in consumer preferences for healthier, more nutritious and functional food. Consumers are seeking food products with added health benefits, such as fortified food, functional beverages, and those containing natural ingredients. Moreover, the snacking culture has gained momentum, contributing to the growth of food segment.

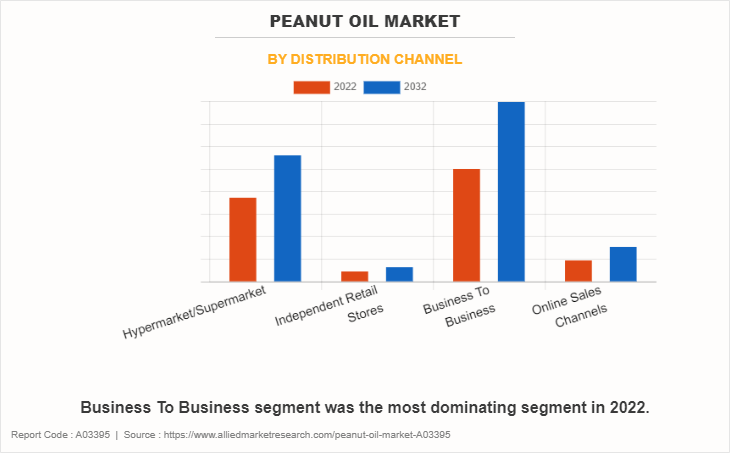

By Distribution channel

By distribution channel, the market is segmented into hypermarkets/supermarkets, independent retail, business-to-business, and online stores. The business-to-business segment is projected to witness the fastest growth in the global peanut oil market during the forecast period. The peanut oil industry has seen an increase in the influence of the business-to-business segment. The business-to-business segment caters to hospitality and food service sectors, including restaurants, hotels, and catering services, relies on bulk quantities of cooking oils like peanut oil. Thus, the business-to-business segment is expected to be the fastest growing segment throughout the anticipated period.

By Region

Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America and MEA. The Asia-Pacific peanut oil market is accounted for a major share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for peanut oil in Asia-Pacific is rising with the increase in the preference for healthy lifestyle along with the growth in health concerns, production, e-commerce and online grocery shopping, which has made it easier for consumers to access a wider range of peanut oil.

Competitive Landscape:

The major players operating in the market focus on key strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their reputation in the ever-competitive market. Some of the key players in the peanut oil market share include Olam International, CHS Inc., Cargill, Inc., Wilmar International Limited, Archer Daniels Midland, Patanjali Ayurvedic Limited Incorporated, Mother Dairy, Hain Celestial, Bettcher Industries, Inc., and COFCO Corporation.

Several well-known and upcoming brands are vying for market dominance in the fiercely competitive peanut oil industry. Smaller, niche firms have become more well-known for catering to particular consumer demands. Large companies, however, still control the majority of the market and frequently acquire creative startups to broaden their product lines and peanut oil market growth.

Large multinational corporations with broad brand portfolios, global reach, and sizable marketing budgets, such as Cargill, Inc., Olam International, CHS Inc., Archer Daniels Midland, and Wilmar International Limited dominate the peanut oil market. They have the means to conduct considerable R&D and continual product development. With a focus on clean and sustainable products, niche brands such as Amazon brand like Vedika and Mr. Gold are gaining market dominance through targeted offers that address certain customer demands. For quick development, these brands work with influencers, social media, and digital marketing.

The direct-to-consumer (DTC) approach made popular by companies such as Peanut Oil Direct, and Kadoya Sesame Mills among others, alters the market by avoiding conventional retail channels and enabling a direct relationship with customers. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Brands that can change the tastes of their target market and align with their ethical and environmental values have an advantage over rivals operating in the peanut oil market.

Recent Developments in Peanut Oil Market

- In November 2021, Cargill has acquired an edible oil refinery located in Nellore, State of Andhra Pradesh, India. Cargill $35 million investment to acquire and upgrade the facility will significantly expand its edible oil production capacity and footprint in southern India and strengthen its existing supply chain to meet growing customer demand.

- In October 2023, Bunge, a global leader in agribusiness, food and ingredients, through its Bunge Loders Croklaan JV with IOI Corporation Berhad, entered into a definitive asset purchase agreement with Fuji Oil New Orleans, LLC (Fuji Oil) to acquire its newly constructed, port-based refinery located in IMTT (International-Matex Tank Terminals) Avondale Terminal, Louisiana. The state-of-the-art facility has multi-oil refining capabilities and will enable Bunge to expand its existing customer base.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the peanut oil market analysis from 2022 to 2032 to identify the prevailing peanut oil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peanut oil market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global peanut oil market trends, key players, market segments, application areas, and market growth strategies.

Peanut Oil Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 190 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Archer Daniels Midland Company, Wilmar International Limited., Patanjali Ayurvedic Limited Incorporated, Bettcher Industries, Inc., Mother Dairy, COFCO Corporation, Cargill, Incorporated, CHS Inc., Olam International, Hain Celestial Group, Inc. |

Analyst Review

According to insights of CXOs, the global peanut oil market is considered during the forecast period. This is attributed to the convergence of health-conscious consumer preferences, the versatile culinary applications of peanut oil, and its alignment with prevalent snacking trends across the region. The increasing importance of health by consumers aligns with the perceived nutritional benefits of peanut oil, characterized by its high content of monounsaturated and polyunsaturated fats. The adaptability of peanut oil in various cooking methods, including frying and sautéing, coupled with its mild flavor that complements diverse cuisines, positions it as a preferred choice for both home and professional chefs. Additionally, the global trend toward increased snacking and the popularity of snack-focused products contribute to the growing demand for peanut oil in the regions.

Furthermore, the expanding presence of business-to-business operations and retail stores, coupled with the rise of e-commerce, provides peanut oil manufacturers with enhanced avenues to engage a diverse consumer base. Online platforms offer convenient access for individuals to purchase a variety of oil selections and niche products, catering to changing consumer preferences. The ease of online exploration and purchase contributes to increased market penetration for peanut oil across the globe, presenting the potential to capture a wider audience.

The global peanut oil market size was valued at $10.1 billion in 2022, and is projected to reach $15.7 billion by 2032

The global Peanut Oil market is projected to grow at a compound annual growth rate of 4.6% from 2023 to 2032 $15.7 billion by 2032

Some of the key players in the peanut oil market share include Olam International, CHS Inc., Cargill, Inc., Wilmar International Limited, Archer Daniels Midland, Patanjali Ayurvedic Limited Incorporated, Mother Dairy, Hain Celestial, Bettcher Industries, Inc., and COFCO Corporation.

The Asia-Pacific peanut oil market is accounted for a major share in 2022 and is expected to grow at a significant CAGR during the forecast period.

Global Influence in Asian Cuisines, Neutral Flavor Profile, Crisp Results in Frying

Loading Table Of Content...

Loading Research Methodology...