Perfluorosulfonic Acid Membrane Market Research, 2030

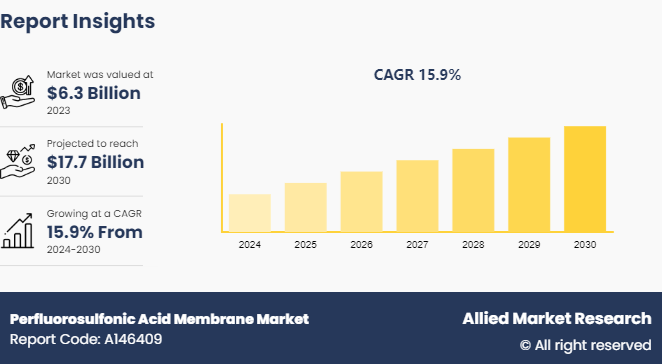

The global perfluorosulfonic acid membrane market was valued at $6.3 billion in 2023, and is projected to reach $17.7 Billion by 2030, growing at a CAGR of 15.9% from 2024 to 2030.

Market Introduction and Definition

Perfluorosulfonic acid (PFSA) membranes are specialized polymeric materials primarily used in electrochemical applications due to their ionic conductivity and chemical stability. These membranes consist of a perfluorinated backbone, similar to polytetrafluoroethylene (PTFE) , with sulfonic acid functional groups attached to it. This combination provides the membrane with a unique set of properties that makes it highly suitable for demanding environments where both mechanical robustness and chemical resistance are critical. In addition to their electrochemical applications, PFSA membranes are also used in various industrial processes such as chlor-alkali production and gas separation. Their robustness and selective ion transport capabilities make them ideal for these processes, where long-term stability and efficiency are paramount.

Key Takeaways

The perfluorosulfonic acid membrane market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major perfluorosulfonic acid membrane industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in the adoption of fuel cell vehicles drives the demand for perfluorosulfonic acid (PFSA) membranes, which are critical components in these vehicles. According to the International Council on Clean Transportation, in 2022 sales of fuel cell electric vehicles (FCEV) surged by 144% relative to 2021. A total of 113, 000 ZE-HDVs sold in 2022 of that 4, 572 were FCEVs. PFSA membranes play a crucial role in the operation of fuel cells by acting as the electrolyte that facilitates the movement of protons while preventing the crossover of gases. These membranes are valued for their high proton conductivity, chemical stability, and durability, which are essential for the efficient and long-lasting operation of fuel cells?. All these factors are expected to drive the demand for the perfluorosulfonic acid membrane market during the forecast period.

However, the materials used in the production of perfluorosulfonic acid membranes are expensive to manufacture. This cost is exacerbated by the intricate synthesis processes required to achieve the desired properties, such as high proton conductivity and chemical stability. As a result, the high upfront expenses often deter potential users from investing in PFSA membranes, particularly in large-scale applications where cost-effectiveness is paramount. Moreover, the manufacturing complexity adds another layer of difficulty to the scalability of PFSA membranes. The intricate fabrication processes involve precise control over factors such as polymer morphology, ion exchange capacity, and membrane thickness. All these factors hamper the growth of the perfluorosulfonic acid membrane market.

Market Segmentation

The perfluorosulfonic acid membrane market is segmented into thickness, application, end-use industry, and region. By thickness, the market is classified into below 20 microns, 20 to 50 microns, 50 to 150 microns, and above 150 microns. By application, the market is divided into fuel cells, chlor-alkali process, hydrogen production, and others. By end-use industry, the market is classified into automotive, energy and power, chemical processing, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Surge in emphasis on clean energy solutions, particularly in countries such as China, Japan, and South Korea drive the demand for the perfluorosulfonic acid membranes. PFSA membranes play a crucial role in proton exchange membrane fuel cells (PEMFCs) , which are increasingly being recognized as a promising alternative to traditional fossil fuel-based energy sources. The demand for PFSA membranes is expected to rise substantially to support the proliferation of PEMFCs in transportation, stationary power generation, and portable electronics as governments in the Asia-Pacific region implement policies to reduce carbon emissions and transition towards renewable energy. Moreover, the robust growth of the electronics and semiconductor industries in countries such as China, South Korea, and Taiwan is fueling demand for PFSA membranes in niche applications such as electrochemical devices and membrane capacitors.

China aims to have 50,000 fuel cell vehicles on its roads by 2025, under a long-term plan for developing the country's hydrogen industry. The plan which runs through 2035, positions hydrogen as an important element in the national energy system to help reach President Xi Jinping's goals of having China's carbon dioxide emissions peak before 2030 and achieving net-zero emissions by 2060.

The Asia-Pacific region faces significant challenges related to water scarcity and pollution. PFSA membranes are increasingly being utilized in advanced water treatment processes such as desalination, wastewater treatment, and ion exchange. The demand for PFSA membranes in water treatment applications is expected to grow during the forecast period as governments and industries seek innovative solutions to address these challenges.

Japan is at the forefront in terms of the adoption of alternative fuel technologies. The Japanese government and the local original equipment manufacturers (OEMs) focus on standardizing electrified powertrains globally. Meanwhile, the Japanese government also encouraged hydrogen fuel technology for large-scale deployments and transport applications.

Competitive Landscape

The major players operating in the perfluorosulfonic acid membrane market include Vritra Technologies, Shandong Hengyi New Material Technology Co., Ltd, Fuzhou Topda New Material Co., Ltd., The Chemours Company, ULTRANANOTECH PRIVATE LIMITED, Solvay, Ningbo Miami Advanced Material Technology Co., Ltd, Mianyang Prochema Commercial Co., Ltd., Shandong AME Energy Co., Ltd., and Weifang Senya Chemical Co., Ltd.

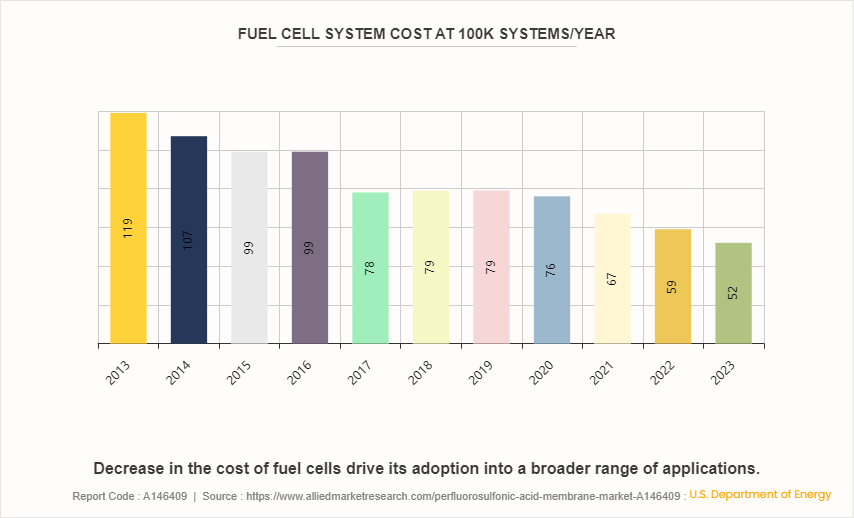

Pricing Analysis of Fuel Cell System

Advancements in fuel cell technology present compelling opportunities for the utilization and further development of perfluorosulfonic acid membranes (PFSAs) . The ongoing refinement of PEMFC designs, coupled with advancements in materials science, has led to the development of next-generation PFSA membranes with enhanced proton conductivity, chemical stability, and mechanical robustness. These advancements contribute to higher power output and energy efficiency and extend the lifespan of fuel cell systems that makes them more economically viable for a broader range of applications.

There is a decrease in the cost of fuel cells which increases its adoption into a broader range of applications such as transportation, stationary power generation, and portable electronics. This increased deployment of proton exchange membrane fuel cell (PEMFCs) is expected to drive the demand for PFSA membranes, as they are essential for enabling efficient proton transport within the fuel cell stack. In addition, decrease in the cost of fuel cells results in increased production volumes, leading to economies of scale in manufacturing. This helps drive down the overall cost of PEMFC systems, including the cost of PFSA membranes. Moreover, manufacturers benefit from efficiencies in production processes, bulk purchasing of materials, and optimized supply chains, ultimately contributing to cost reductions for PFSA membranes.

Industry Trends

According to the International Council on Clean Transportation, fuel cell electric trucks grew considerably in 2022, with a 144% increase in total sales compared to 2021; however, fuel cell technology is still in a nascent stage of development. Furthermore, a continued decline in the cost of hydrogen could provide momentum for expansion of the market.

Rise in concerns over environmental impact and climate change increased the emphasis on sustainable energy solutions. PFSA membranes are integral components in proton exchange membrane fuel cells (PEMFCs) that gain traction as clean energy alternatives in transportation, stationary power generation, and portable electronics. As a result, there is an increase in demand for PFSA membranes driven by the global shift toward cleaner and more sustainable energy sources.

Government regulations for reducing environmental pollution encourage the adoption of fuel cells in the automotive sector. The countries are focusing on R&D and investing in fuel cell technology to improve their public transportation while reducing harmful emissions. According to SEOUL METROPOLITAN GOVERNMENT (SMG) the South Korean government plans to replace around 26, 000 CNG buses with fuel-cell buses by 2030.

Key Sources Referred

International Council on Clean Transportation

The Electrochemical Society

California Hydrogen Business Council

U.S. Department of Energy

Clean Energy States Alliance (CESA)

Fuel Cell & Hydrogen Energy Association

International Renewable Energy Agency (IRENA)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the perfluorosulfonic acid membrane market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the perfluorosulfonic acid membrane market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global perfluorosulfonic acid membrane market trends, key players, market segments, application areas, and market growth strategies.

Perfluorosulfonic Acid Membrane Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 17.7 Billion |

| Growth Rate | CAGR of 15.9% |

| Forecast period | 2024 - 2030 |

| Report Pages | 340 |

| By Thickness |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | The Chemours Company, ULTRANANOTECH PRIVATE LIMITED, Vritra Technologies, Mianyang Prochema Commercial Co., Ltd., Ningbo Miami Advanced Material Technology Co., Ltd, Fuzhou Topda New Material Co., Ltd., Shandong AME Energy Co., Ltd., Weifang Senya Chemical Co., Ltd., Solvay, Shandong Hengyi New Material Technology Co.,Ltd |

Loading Table Of Content...