Permanent Magnet Market Research, 2032

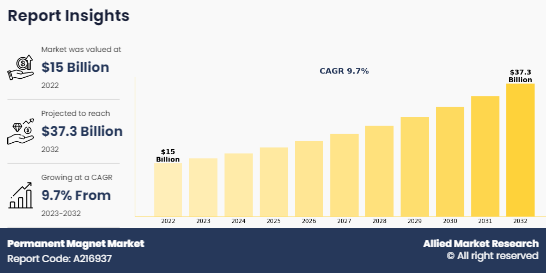

The global permanent magnet market size was valued at $15.0 billion in 2022, and is projected to reach $37.3 billion by 2032, growing at a CAGR of 9.7% from 2023 to 2032. An increase in demand for the automotive industry is expected to drive the growth of the permanent magnet industry during the forecast period. As electric vehicles (EVs) and hybrid vehicles gain popularity in the automotive industry, there is a growing need for electric motors, which heavily rely on permanent magnets for their operation. This surge in demand stimulates the production of permanent magnets used in electric motors. However, the price volatility of raw materials is expected to restrain the permanent magnet market growth from 2023-2032. The surge in demand for magnetic field and imaging systems in permanent magnet is expected to provide lucrative opportunities to the permanent magnet market.

Introduction

Permanent magnets are typically made from materials such as iron, cobalt, nickel, or rare earth elements. These materials exhibit ferromagnetic properties, meaning they have a high magnetic permeability and can be magnetized. The strength of a permanent magnet is characterized by its magnetic flux density, measured in Tesla (T), and its coercivity, which denotes the magnet's resistance to demagnetization. The most common types of permanent magnets include neodymium (NdFeB), samarium-cobalt (SmCo), alnico, and ceramic (ferrite) magnets, each with unique properties suited to different applications.

In the renewable energy sector, permanent magnets are pivotal in wind and hydroelectric power generation. In wind turbines, permanent magnet generators (PMGs) are used to convert wind energy into electrical power efficiently. These generators eliminate the need for external excitation systems, thus reducing maintenance and improving reliability. Similarly, in hydroelectric power plants, permanent magnets are used in generators to enhance the efficiency and reliability of power generation.

In the automotive industry, permanent magnets play a crucial role in the development of electric and hybrid vehicles. They are used in electric motor systems to drive vehicle propulsion and enhance efficiency. Permanent magnet synchronous motors (PMSMs) are particularly valued for their high torque density, efficiency, and compact size. These motors are employed in various components, including traction motors, actuators, and power steering systems. The use of permanent magnets helps in reducing the overall weight and thus, improves the performance of electric vehicles (EVs).

Key Takeaways:

- The permanent magnet market covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2023-2032).

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global permanent magnet and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The permanent magnet market share is highly fragmented, with several players including Arnold Magnetic Technologies, Adams Magnetic Products, LLC, Dexter Magnetic Technologies, Electron Energy Corporation, Lynas Rare Earths Ltd, Bunting, Stanford Magnets, TDK Corporation, VACUUMSCHMELZE GmbH & Co. KG, and Magnequench International, LLC. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the permanent magnet market growth.

Market Dynamics

Increase in adoption of electric vehicles (EVs) and hybrid vehicles is expected to drive the growth of the permanent magnet market during the forecast period. The automotive sector is undergoing a significant transformation with the increasing adoption of electric vehicles (EVs) and hybrid vehicles. This shift towards electrification is driven by various factors, including environmental concerns, government regulations promoting clean energy, and advancements in battery technology. As automakers strive to meet emissions targets and improve fuel efficiency, they are increasingly turning to electric propulsion systems, which rely heavily on permanent magnets for their electric motors.

As per the International Energy Agency, in 2022, global spending on electric cars increased by 50% compared to 2021, reaching around $425 billion. Electric vehicles are the key technology to decarbonize road transport, a sector that accounts for over 15% of global energy-related emissions. In February 2023, electronic component maker Flash announced a technical collaboration with Slovenia-based GEM motors to develop electric motors. Under the partnership, both brands will manufacture hub motors for various electric vehicle segments in the range of 1 kW to 15 kW.

According to the China Association of Automobile Manufacturers (CAAM), In December 2022, automotive sales in China experienced a year-over-year decline of 8.4%, totaling 2.56 million units. However, for the entire year of 2022, sales surged to 26.86 million units, marking significant growth. As advancements in battery technology continue to improve the range and performance of electric vehicles, consumer interest in EVs is on the rise. Electric propulsion systems, which rely on permanent magnet motors for efficient power conversion, are becoming increasingly prevalent in the automotive market.

Price volatility of raw materials is expected to restrain the growth of the permanent magnet market during the forecast period. The price volatility of raw materials, particularly rare earth elements such as neodymium and dysprosium, presents a significant restraint for the permanent magnet industry. One of the primary challenges stemming from price volatility is the unpredictability it introduces into cost projections and financial planning for manufacturers. Sharp increase in raw material prices can erode profit margins and disrupt supply chains, while sudden decrease may result in excess inventory and reduced competitiveness.

Segments Overview

The permanent magnet market is segmented into type end-use, and region. On the basis of type, the market is classified into neodymium iron boron magnet, ferrite magnet, samarium cobalt magnet, and others. On the basis of the end-use, the market is divided into consumer electronics, automotive, medical technology, energy, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the Neodymium-Iron-Boron (NdFeB) magnet segment dominated the permanent magnet market accounting for almost half of the market share. NdFeB magnets are extensively used in electric motors and generators, ranging from small motors in household appliances to large industrial motors. The high magnetic strength of NdFeB magnets enables efficient energy conversion and compact designs. NdFeB magnets are used in speakers and headphones to produce high-quality sound reproduction. Their strong magnetic field allows for greater efficiency in converting electrical energy into sound waves.

On the basis of end-use, consumer electronics is the most lucrative segment in the permanent magnet market accounting for one-third of the market share. Permanent magnets are an essential component of speakers, where they interact with electric currents to produce sound. The permanent magnet interacts with an electromagnet (voice coil) attached to the speaker cone, causing it to move and produce sound waves. Permanent magnets are used in the actuator motors of Hard Disk Drives (HDDs) to position the read/write head accurately. In Solid State Drives (SSDs), magnets might not be used directly, but they can be employed in manufacturing processes for assembly or calibration.

Region-wise, Asia-Pacific dominated the permanent magnet market, growing with a CAGR of 10.0% during the forecast period. Permanent magnets, particularly those made from neodymium-iron-boron (NdFeB), are crucial for electric vehicle (EV) motors and other automotive applications, contributing to the growth of the EV market in countries such as China, Japan, and South Korea. Permanent magnets are utilized in wind turbines and hydroelectric generators for producing renewable energy. China is one of the largest manufacturers and consumers of wind turbines, driving demand for permanent magnets in this sector.

Competitive Analysis

The major players operating in the permanent magnet market report include Arnold Magnetic Technologies, Adams Magnetic Products, LLC, Dexter Magnetic Technologies, Electron Energy Corporation, Lynas Rare Earths Ltd, Bunting, Stanford Magnets, TDK Corporation, VACUUMSCHMELZE GmbH & Co. KG, and Magnequench International, LLC

Recent Key Developments in the Permanent Magnet Market

- In October 2023, Ara Partners, a private equity firm acquired Vacuumschmelze (VAC), a German permanent magnets producer, from its equity investor Apollo. This will strengthen the duo’s rare earths value chain and help the former to pursue its strategic growth opportunity of supplying permanent magnets to key industries such as electric vehicles (EV).

- In January 2023, VAC inked a deal with American automotive giant General Motors to establish a permanent magnets production facility in North America. This plant would locally source raw materials for manufacturing, with the product destined for electric motors utilized in GM vehicles.

- In September 2022, Solvay announced plans to expand its rare earths operations in La Rochelle, France to enter the value chain for rare earth permanent magnets in Europe and serve customers in the wind power, electric vehicles, and electronics markets.

- In July 2022, GKN Powder Metallurgy, a provider of powder metal solutions, entered the permanent magnets for the electric vehicle (EV) market. An investment is being planned to establish a capacity to produce up to 4,000 tons of permanent magnets per year for the EV market by 2024.

Historic Trends of the Permanent Magnet Market

- In 1880, Alnico, an alloy composed primarily of aluminum, nickel, and cobalt, was developed by T. Mishima in Japan. This material became one of the first widely used permanent magnet materials due to its high magnetic strength and resistance to demagnetization.

- The development of ceramic (ferrite) magnets marked a significant advancement in permanent magnet technology. These magnets were made from a mixture of ceramic materials and iron oxide, providing high coercivity and relatively low cost.

- In the 1960s, the discovery of rare-earth magnets, specifically samarium-cobalt (SmCo) and neodymium-iron-boron (NdFeB) magnets, revolutionized the field of permanent magnets. These magnets offered much higher magnetic strength than previous materials, opening new possibilities in various industries.

- In the 1970s, neodymium-iron-boron (NdFeB) magnets were developed. These magnets surpassed the magnetic strength of SmCo magnets and became the strongest type of permanent magnet available. NdFeB magnets revolutionized numerous industries, including consumer electronics, renewable energy, and medical devices.

- In the 1990s, the increasing demand for smaller and more efficient electronic devices drove the miniaturization of permanent magnets. Manufacturers developed techniques to produce smaller magnets with high magnetic strength, enabling the creation of compact and lightweight products such as smartphones, laptops, and hard disk drives.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the permanent magnet market analysis from 2022 to 2032 to identify the prevailing permanent magnet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the permanent magnet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global permanent magnet market trends, key players, market segments, application areas, and market growth strategies.

Permanent Magnet Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 37.3 billion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By End-Use |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Arnold Magnetic Technologies, Dexter Magnetic Technologies, Magnequench International, LLC, Adams Magnetic Products, LLC, Bunting, TDK Corporation, Stanford Magnets, vacuumschmelze gmbh & co. kg, Electron Energy Corporation, Lynas Rare Earths Ltd |

Analyst Review

According to the opinions of various CXOs of leading companies, the global permanent magnet market was dominated by the Neodymium-Iron-Boron (NdFeB) magnet segment. NdFeB magnets are commonly used in various industrial applications where strong magnetic fields are required, such as electric motors, generators, magnetic resonance imaging (MRI) machines, magnetic separators, and magnetic bearings.

An increase in demand for the automotive sector is expected to drive the growth of the permanent magnet market. Permanent magnet motors offer several advantages over traditional induction motors, including higher efficiency, compact size, and lighter weight. These characteristics are particularly desirable in EVs and hybrid vehicles, where optimizing energy efficiency and maximizing driving range are paramount. Furthermore, permanent magnets are integral components of powertrains in electric and hybrid vehicles. They are used in systems such as traction motors, generators, and inverters, contributing to the overall propulsion and energy management of the vehicle. The efficiency and power density of these powertrain components are crucial for enhancing the driving experience and extending the range of electric vehicles.

The fluctuation in prices of raw materials is expected to restrain the growth of the permanent magnet market. Raw materials such as rare earth elements, particularly neodymium, praseodymium, and dysprosium, are essential components in the production of high-performance permanent magnets, including neodymium-iron-boron (NdFeB) magnets. These rare earth elements are mined primarily in a limited number of countries, which can lead to supply chain vulnerabilities and price volatility in response to factors such as geopolitical tensions, trade policies, and changes in demand-supply dynamics.

The global permanent magnet market was valued at $15.0 billion in 2022, and is projected to reach $37.3 billion by 2032, growing at a CAGR of 9.7% from 2023 to 2032.

Asia-Pacific is the largest region in the permanent magnet market

Consumer electronics is the leading end-use of permanent magnet market.

Advancements in medical devices and electric vehicles are the upcoming trends of permanent magnet Market in the world.

The surge in demand for magnetic field and imaging systems are the main opportunities of the permanent magnet market.

The price volatility of raw materials is the restraint of the permanent magnet market.

The major players operating in the permanent magnet market include Arnold Magnetic Technologies, Adams Magnetic Products, LLC, Dexter Magnetic Technologies, Electron Energy Corporation, Lynas Rare Earths Ltd, Bunting, Stanford Magnets, TDK Corporation, VACUUMSCHMELZE GmbH & Co. KG, and Magnequench International, LLC

Loading Table Of Content...

Loading Research Methodology...