Pest Control Market Research, 2034

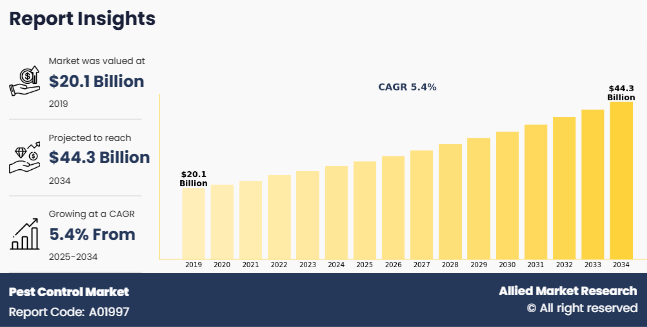

The global pest control market was valued at $20.1 billion in 2019, and is projected to reach $44.3 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034. The global pest control market is driven by increasing urbanization, climate change, and growing awareness of hygiene and health concerns. Advancements in biological and smart pest control solutions, along with stringent regulations on chemical pesticides, are shaping the pest control industry. The market is expanding across residential, commercial, and agricultural sectors worldwide.

Introduction

Pest control is the management of specific species of insects, such as mosquitoes, cockroaches, bed bugs, fleas, and houseflies, which are recognized as detrimental to human health. These pests transmit diseases such as malaria, dengue, Lyme disease, salmonellosis, and allergic reactions, posing serious health risks to humans. House flies are well-adapted to a wide variety of human habitations, including housing, garbage dumps, and food storage.

Moreover, homeowners have encountered serious issues with bed bugs, mosquitoes, and cockroaches, as these pests destroy property and carry diseases. Thus, pest management has gained significant importance in recent years to repel pests. Chemical control methods are commonly used for controlling insects and are applied as sprays, baits, dusts, or fumigants. It is important to use chemicals responsibly and follow safety guidelines to minimize risks to humans, pets, and the environment.

Key Takeaways:

- Quantitative information mentioned in the global pest control market includes the market numbers in terms of value ($Billion) concerning different segments, annual growth rate, CAGR (2025-34), and growth analysis.

- The analysis in the report is provided based on type, and end-use industry. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Anticimex, BASF SE, Bayer AG, Clean kill Environmental Services Ltd., Dodson Pest Control, Inc., Rentokil Initial, FMC Corporation, JG Pest Control, Rollins, Inc., and Syngenta AG. hold a large proportion of the global pest control market.

- This report makes it easier for existing market players and new entrants to the pest control industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics

The biological control method involves introducing natural predators, parasites, or pathogens that prey on pests. For instance, ladybugs are often used to control aphids in gardens. Furthermore, cultural control practices involve modifying the environment to discourage pests. For instance, practicing good sanitation & proper waste management, removing food sources or breeding grounds, and maintaining clean & clutter-free spaces help prevent pest infestations. The growth of the global pest control market is attributed to the factors such as increase in urban population all around the world, which has resulted in significant increase in food sources, and conducive living habitats for various pests such as rodents, cockroaches, and mosquitoes.

In addition, rapid migration has been witnessed from rural areas to urban centers, which is more prevalent in the developing countries such as India. This has further increased the population density of urban areas, which, in turn, is anticipated to fuel the demand for pest control products and services. Furthermore, the rise in concern of consumers from residential and commercial sectors toward maintaining health and hygiene has escalated the adoption of pest control products and services. Moreover, a considerable rise has been witnessed in the prevalence of diseases caused by pests; hence, making it essential to control them. However, health and environmental hazards caused by pesticides due to their chemical content are significant factors anticipated to hamper growth of pest control market forecast during this period.

Segment Overview

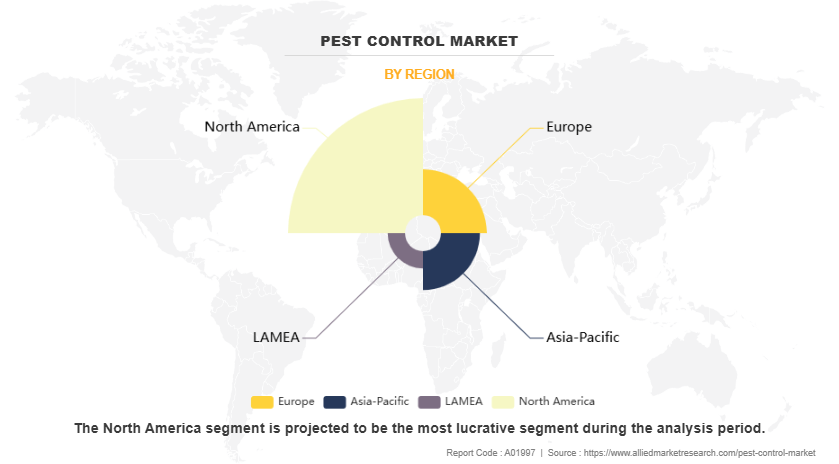

The pest control market is segmented into type, pest type, application, and region. Depending on type, the market is categorized into chemical, mechanical, biological, and others. On the basis of pest type, it is classified into insects, termites, rodents, and others. The insect segment is further segregated into bedbugs, cockroaches, mosquitoes, ants, flies, and others. By application, the market is fragmented into commercial, residential, agriculture, industrial, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

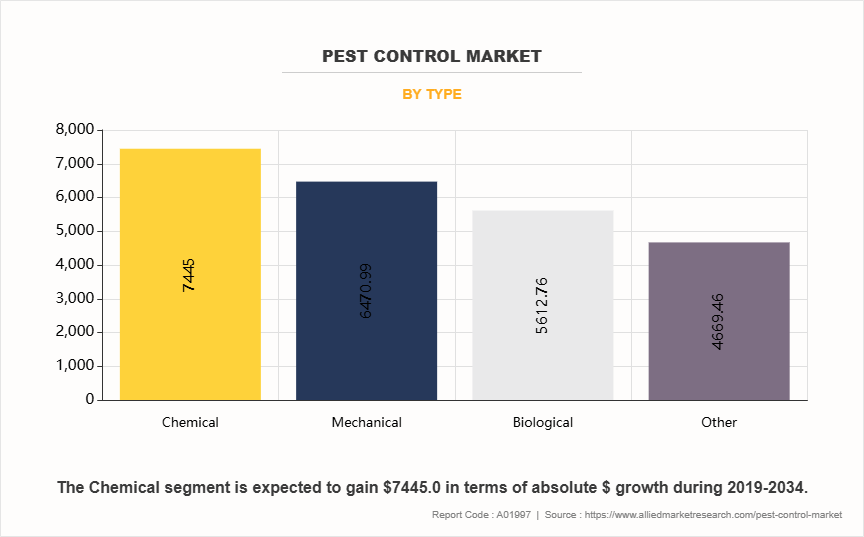

In terms of pest control type, the chemical segment held the largest pest control market share in 2024, accounting for approximately 60% of the total market revenue, due to its widespread use in residential, commercial, and agricultural applications. Chemical pest control methods, including insecticides, rodenticides, and fumigation, have been widely adopted due to their high efficacy in eliminating pests quickly. These solutions are particularly effective against a broad spectrum of pests, making them a preferred choice for large-scale pest management programs. However, concerns regarding the environmental impact of chemical pesticides and their potential health hazards have led to growing interest in alternative pest control methods. As a result, the other type of pest control segment, which includes biological and mechanical control methods, is expected to grow at the highest CAGR of 5.7%, reaching a market value of approximately $6.5 billion by 2030. This growth is driven by increasing consumer preference for eco-friendly and sustainable pest management solutions. Advancements in biotechnology and integrated pest management (IPM) strategies, which accounted for 20% of the total market share in 2023, are also expected to support the adoption of alternative pest control methods in the coming years.

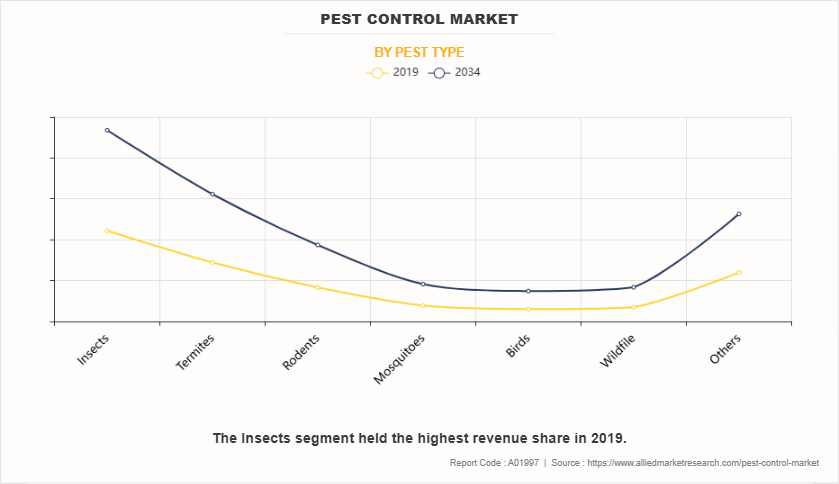

On the basis of pest type, the birds segment is anticipated to witness the highest CAGR of 6.3% in terms of revenue during the forecast period. Bird-related pest control solutions have gained significant traction due to the increasing challenges posed by bird infestations in urban and industrial settings. Birds can cause extensive damage to buildings, vehicles, and machinery while also posing health risks through the transmission of diseases such as avian flu, histoplasmosis, and cryptococcosis. In 2023, damages caused by birds to industrial and commercial properties were estimated at $3 billion annually, highlighting the need for effective bird management strategies. The rising need for bird control solutions in airports, food production facilities, warehouses, and commercial establishments has led to increased demand for humane and effective bird deterrents. The use of solutions such as bird spikes, netting, sonic repellents, and falconry is gaining popularity as businesses and municipalities seek to mitigate bird-related nuisances while complying with wildlife protection laws. The implementation of advanced bird deterrent technologies, such as AI-powered monitoring systems, is expected to drive the growth of this segment further.

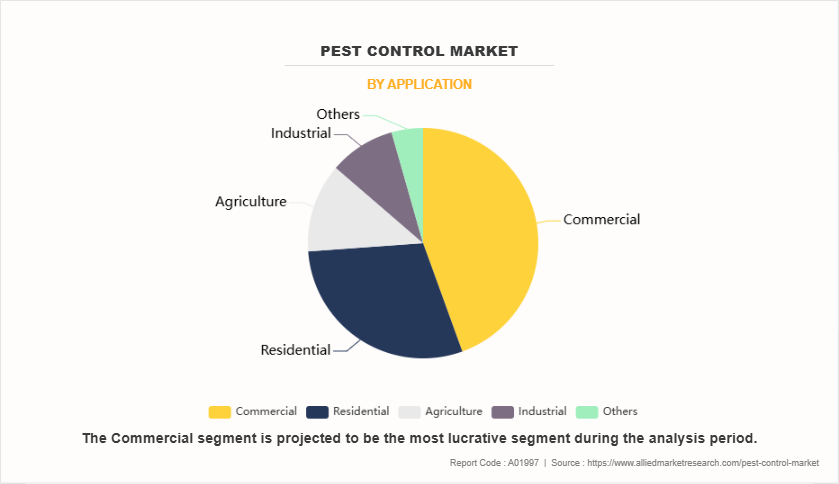

Based on application, the commercial segment was the major shareholder in 2024, accounting for over 40% of the pest control market size, as commercial establishments such as hotels, restaurants, office buildings, and healthcare facilities require consistent and effective pest control solutions to maintain hygiene and regulatory compliance. The hospitality and food service industries, in particular, have stringent pest control requirements due to health and safety regulations, leading to a strong demand for professional pest management services. In 2023, the global food service industry spent approximately $5 billion on pest control services to ensure compliance with hygiene standards. Meanwhile, the industrial segment is anticipated to register a CAGR of 5.8% in terms of revenue during the forecast period. The increasing need for pest control in manufacturing plants, warehouses, and logistics facilities is a key driver for this segment. Industries dealing with food processing, pharmaceuticals, and packaging are particularly vulnerable to pest infestations, necessitating comprehensive pest control measures. The rising adoption of integrated pest management (IPM) solutions, which are expected to account for 25% of industrial pest control services by 2030, is anticipated to support the growth of the industrial segment, ensuring compliance with safety standards while minimizing environmental impact.

North America dominated the pest control market in 2024, accounting for approximately 35% of the global market share, primarily due to the presence of stringent regulatory bodies in the U.S., such as the Environmental Protection Agency (EPA), the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), and the Federal Food, Drug, and Cosmetic Act (FFDCA). These organizations ensure that pesticides are used safely and effectively, minimizing harm to both public health and the environment. The well-established regulatory framework in the region has encouraged the development and adoption of advanced pest control solutions, supporting pest control market growth. Additionally, the increasing prevalence of pest-related issues in residential, commercial, and agricultural sectors has driven demand for pest control services. In 2023, pest-related damages in the U.S. agricultural sector were estimated at $20 billion, highlighting the urgent need for effective pest management solutions. The rising awareness about hygiene and the adverse effects of pests on health, coupled with climate changes that contribute to increased pest infestations, has further strengthened market expansion in North America. The presence of key market players, including Rentokil, Terminix, and Ecolab, with a combined market revenue of over $7 billion, further contributes to the region’s dominant position.

Competetive Analysis

Some of the major players analyzed in this report are Anticimex, BASF SE, Bayer AG, Clean kill Environmental Services Ltd., Dodson Pest Control, Inc., Rentokil Initial, FMC Corporation, JG Pest Control, Rollins, Inc., and Syngenta AG.

Recent Key Developments

- In May 2023, Rollins, Inc announced that it acquired FPC Holdings, LLC ("Fox Pest Control" or the “Company” Fox Pest Control employs more than 1,300 associates and is headquartered in Logan, Utah. It ranks as the 13th largest pest management company according to PCT 100 rankings.

- In August 2024, JG Pest Control was acquired by Vergo Pest Management Ltd, a leading independent national pest control service provider in the UK.

- In September 2024, Syngenta Biologicals and Provivi collaborated to develop pheromone-based biological pest control solutions for corn and rice, while in May 2023, Syngenta AG acquired Macspred Australia, expanding into the forestry and vegetation management sector through its professional solutions division.

- In April 2024, Bayer AG announced it has signed an agreement with UK-based company AlphaBio Control to secure an exclusive license for a new biological insecticide. The new product will be the first available for arable crops, including oilseed rape and cereals. Targeted for initial launch in 2028 pending further development and registration, this new insecticide was discovered by AlphaBio, with whom Bayer distributes FLiPPERR. an award-winning bioinsecticide-acaricide.

- In June 2024, Rentokil Initial plc, a global leader in Pest Control and Hygiene & Wellbeing services, is delighted to announce the official opening of its first pest control innovation Centre in North America (NA). Rentokil Terminix, as our NA operations are known, is the largest pest control company in North America.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pest control market analysis from 2019 to 2034 to identify the prevailing pest control market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pest control market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pest control market trends, key players, market segments, application areas, and market growth strategies.

Pest Control Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 44.3 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2019 - 2034 |

| Report Pages | 578 |

| By Application |

|

| By Type |

|

| By Pest Type |

|

| By Region |

|

| Key Market Players | Anticimex, Dodson Pest Control, Inc., BASF SE, Rentokil Initial plc, Rollins, Inc., JG Pest Control, FMC Corporation, Bayer AG, Syngenta AG, Cleankill Environmental Services Ltd |

Analyst Review

According to the CXOs, pest management products and services are gaining significant traction in recent years due to exponential population growth, rapid urbanization, and changes in climatic conditions. In addition, implementation of stringent food safety regulations and increase in business & consumer intolerance toward pest issues propel the growth of the market.

The CXOs further added that North America is expected to dominate the global pest control market during the forecast period due to increase in awareness about health issues related to insects and pests. Implementation of stringent regulations toward hygiene & sanitation and increase in health initiatives is further expected to boost the growth of the market.

As per the CXOs, the industry is characterized by a high number of new market entrants that seek to tap lucrative opportunities in the global market while existing players enter strategic collaborations to increase capacities & expand their reach into emerging markets. Joint venture, merger, and acquisition activities in the industry have increased significantly over the past decade. Companies constantly seek to establish long-term contract agreements with trusted partners for sustainable business operations globally.

The global pest control market was valued at approximately $27.6 billion in 2025.

Adoption of Integrated Pest Management (IPM) Growth of Biological Pest Control Smart Pest Control Solutions Rising Demand in Commercial and Industrial Sectors Expansion in Developing Markets Drones and Automation in Pest Control

The commercial sector holds the largest share in the pest control market, accounting for over 40% of the total market revenue.

North America is the largest regional market for pest control, accounting for approximately 35% of the global market share in 2024.

Anticimex, BASF SE, Bayer AG, Clean kill Environmental Services Ltd., Dodson Pest Control, Inc., Rentokil Initial, FMC Corporation, JG Pest Control, Rollins, Inc., and Syngenta AG

Loading Table Of Content...

Loading Research Methodology...