Pet Beverage Packaging Market Research, 2032

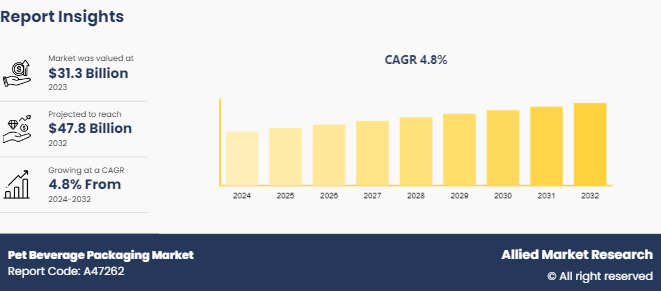

The global pet beverage packaging market size was valued at $31.3 billion in 2023, and is projected to reach $47.8 billion by 2032, growing at a CAGR of 4.8% from 2024 to 2032.

PET beverage packaging is the use of PET, a specially designed thermoplastic polymer resin, to form containers such as bottles that are used for beverages. PET is the preferred choice in the industry because of its lightweight and shatterproof nature. Its physical characteristics provide effective gas and moisture barrier for maintaining the freshness and carbonation of beverages. PET is an additive-free product that can be viewed from within and it is completely recyclable. PET feature of being easily molded into diverse shapes and sizes enhances its usability in providing various requirements for beverage packaging.

Pet Beverage Packaging Market Introduction and Definition

The manufacturing of PET bottles involves synthesis of PET resin pellets through the polymerization of ethylene glycol and terephthalic acid. These pellets are then turned into preforms through the process of melting and injection of the pellets into molds. In blow molding machines the preforms are stretched, as well as blown into bottle forms with the help of high pressure air. The bottles formed are then allowed to cool and solidify before being inspected for quality, labeled and packed for supply. Some of the advantages that favor PET are; it has high strength, it is resistant to moisture and gases, and is recyclable – making it suitable for producing durable and light beverage containers. Moreover, by switching to PET, manufacturers can achieve up to a 40% cost reduction when moving from polystyrene to PET and a 20% reduction from HDPE.

Key Takeaways

- The PET Beverage Packaging market studies more than 23 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2023 to 2033.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global PET Beverage Packagingmarket, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3, 700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the PET Beverage Packaging market.

- The PET Beverage Packaging market share is marginally fragmented, with players such as Amcor plc, Berry Global Group, Inc., Graham Packaging Company, Plastipak Holdings, Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, RETAL Industries Ltd., Resilux NV, CKS Packaging, Inc., Zhuhai Zhongfu Enterprise Co. Ltd., and Sidel Group. Major strategies such as product launch, partnerships, expansion, and other strategies of players operating in the PET Beverage Packaging market are tracked and monitored.

Industry Trends:

- Weight Reduction: Industry players are keen to reduce the weight of their bottles and jars. With continued innovation, manufactures of PET bottles have been able to reach less than 8 grams for a 500ml PET water bottle. This is primarily a result of increased demand for cost-optimization to gain an edge over the competition.

- Sustainability: Sustainability remains a significant challenge for the plastic sector. Recycling rates are gradually improving in Europe, but consumer behavior impedes achieving full sustainability. While 100% recycling rates may be unattainable, enhanced recycling efforts can mitigate sustainability issues. Some regions incentivize recycling through programs like bottle banks, yet widespread adoption faces challenges, especially in less developed markets where recycling education lags behind more developed regions like North America and Western Europe.

Key Market Dynamics

The Pet Beverage Packaging Market Growth can be witnessed due to various factors such as the global increase in consciousness towards environmental conservation. This dictate packaging demands at about 30%. This trend benefits PET packaging since it is lightweight and can be recycled and reused. However, the growth of consumption of products in the beverage sector as well as increased popularity of PET in the Asia-Pacific and Latin America contributes to the demand. This shows that due to the growth in the consumption of drinks, PET packaging industry is faced with growing demand for its products. Further, the technological enhancement in the PET production has resulted in the increased efficiency and reduction in cost which in turn has added value to the PET packaging in the global market.

However, one of the major issues the Pet Beverage Packaging Marketis experiencing is the volatility of the prices of raw materials. Variations in crude oil and natural gas prices that are used in the production of PET resin cause variations in cost of manufacturing PET. For instance, a 10% increase in the costs of crude oil leads to an increase in PET resin costs of 5-7%. This type of fluctuation makes it difficult for manufacturers to predict prices and maintain their profit margins hence becomes a major factor in destabilizing the Pet Beverage Packaging Market.

On the other hand, growth of ready-to-drink (RTD) products is expected to offer opportunities for growth for the key market players. Ready to drink beverage which includes bottled water, carbonated soft drinks, and functional beverages are flourishing market due to their easy carrying ability. In catering to the trend of convenience, single-serve PET bottles are becoming popular as consumers shift towards portability. This establishes a challenge to PET packaging manufacturers in that they have to seize this likelihood and increase their market share in the bottle packaging sector. Such factors positively affect the the Pet Beverage Packaging Market Overview.

Pet Beverage Packaging Market Segmentation

The PET Beverage Packaging market is segmented into packaging type, and end user industry. By packaging type, it is categorized into bottles, jars, and others. By beverage type, the market is categorized into alcoholic beverages, and non-alcoholic beverages. Region wise, the PET Beverage Packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Pet Beverage Packaging Industry is rather diverse geographically and may exhibit different demand and growth trends among various regions. In the North American region, the PET Beverage Packaging market has a large share due to the high demand in the population for bottled water and soft drinks. For instance, the United States of America continues to have a relatively large demand for these easy-to-handle beverages and on-packaging sustainability. Furthermore, the Pet Beverage Packaging Market share in Europe is also substantial, thus is the focus on sustainability and recycling programs. Players from Europe namely Germany and the UK have an edge in recycling and hence the recycling rate of PET is quite high and the demand for recycled PET bottles is relatively constant. The Asia-Pacific is expected to dominate the Pet Beverage Packaging Market Forecast. It also has a large market share worldwide. Beverage industry growth, urbanization, and increase in per capital income particularly in the emerging markets such as China and India have fueled this growth. Expected growth in consumption of bottled water, soft drinks and ready to drink beverages is also expected to fuel the PET packaging demand in this region. The Latin American market has a significant hold in the market due to the thriving beverage industry and more significantly the usage of PET bottles particularly in alcoholic and non-alcoholic products. Among the Latin American countries, Brazil and Colombia are most promising in terms of beverage market growth because of the growing demand on the population. However, the Middle East & Africa region is anticipated to occupy a considerable share of the total Pet Beverage Packaging Market. Bottled water and soft drinks have further fueled the growth of this sector due to higher temperatures in Arabian and African countries such as Saudi Arabia and South Africa.

Industry Developments

- In May 2024, ALPLA, a specialist in plastic packaging, introduced a new recyclable wine bottle made from polyethylene terephthalate (PET) . This innovative packaging solution reduces carbon footprints by up to 50% and offers potential cost savings of up to 30%.

- In November 2023, Sidel introduced a new PET bottle aimed at providing a competitive edge for liquid dairy manufacturers. The mini-size bottle, designed for products like drinking and probiotic yoghurts with capacities ranging from 65ml to 150ml, is ideal for both ambient and cold chain processes. Additionally, Sidel states that the bottle is well-suited for applications in the juice, nectar, soft drinks, isotonic, and tea sectors.

- In October 2023, Coca-Cola launched in rPET in pack sizes of 250 ml and 750 ml across several markets in India. These offerings come with a call-to-action label ‘Recycle ME Again’, indicating a strong shift to more sustainable plastic bottle offerings.

Competitive Landscape

The major players operating in the PET Beverage Packaging analysis include Amcor plc, Berry Global Group, Inc., Graham Packaging Company, Plastipak Holdings, Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, RETAL Industries Ltd., Resilux NV, CKS Packaging, Inc., Zhuhai Zhongfu Enterprise Co. Ltd., and Sidel Group.

Other players in PET Beverage Packaging market include Silgan Holdings Inc., Consolidated Container Company LLC, Rex Plastics, Inc., Alpha Packaging, and Indorama Ventures Public Company Limited.

Key Sources Referred

- Plastics Industry Association (PLASTICS) - Represents the entire plastics supply chain and provides industry data.

- Association of Plastic Recyclers (APR) - Focuses on the recycling of plastics, including packaging.

- American Chemistry Council (ACC) - Provides information on the plastics industry, including packaging materials.

- European Plastics Converters (EuPC) - Represents the European plastics converting industry, including packaging.

- The Packaging Federation - Represents the UK packaging manufacturing industry and provides data on packaging trends.

- Flexible Packaging Association (FPA) - Represents the flexible packaging industry and provides relevant market data.

- The British Plastics Federation (BPF) - Represents the UK plastics industry, including packaging, and offers industry insights.

- Sustainable Packaging Coalition (SPC) - Promotes sustainable packaging solutions and provides data on packaging sustainability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the PET Beverage Packaging Market segments, current trends, estimations, and dynamics of the PET Beverage Packaging market analysis from 2023 to 2032 to identify the prevailing PET Beverage Packaging market opportunities.

- The PET Beverage Packaging market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the PET beverage packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global PET Beverage Packaging Market Statistics.

- PET Beverage Packaging Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global PET Beverage Packaging market trends, key players, market segments, application areas, and market growth strategies.

Pet Beverage Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 47.8 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 213 |

| By Packaging Type |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Sidel Group., PLASTIPAK HOLDINGS, INC., Berry Global Group, Inc., Retal Industries LTD., Zhuhai Zhongfu Enterprise Co. Ltd., ALPLA Werke Alwin Lehner GmbH & Co KG, RESILUX NV, CKS Packaging, Inc., Graham Packaging Company, L.P., Amcor PLC |

Analyst Review

The PET beverage packaging market is experiencing growth driven by several factors, including the global increase in environmental consciousness. This environmental awareness dictates about 30% of packaging demands. PET packaging benefits from this trend due to its lightweight nature and recyclability. Additionally, the growing consumption of beverages and the rising popularity of PET packaging in the Asia-Pacific and Latin America regions contribute to the increasing demand. The surge in beverage consumption has led to a growing demand for PET packaging products. Moreover, technological advancements in PET production have enhanced efficiency and reduced costs, adding value to PET packaging in the global market.

However, the market faces challenges such as the volatility of raw material prices. Fluctuations in crude oil and natural gas prices, which are used in PET resin production, cause variations in manufacturing costs. For instance, a 10% increase in crude oil prices can lead to a 5-7% increase in PET resin costs. Such fluctuations make it difficult for manufacturers to predict prices and maintain profit margins, destabilizing the market.

Inclusion of industry 4.0 is the upcoming trends of Pet Beverage Packaging Market in the globe.

The rising awareness related to environment pollution, stringent government regulations associated with plastic, and rapid boost in the beverages industry especially in the developing countries drives the market growth.

Asia-Pacific is the largest regional market for Pet Beverage Packaging.

The PET beverage packaging market was valued at $31.32 billion in 2023.

The PET Beverage Packaging market share is marginally fragmented, with players such as Amcor plc, Berry Global Group, Inc., Graham Packaging Company, Plastipak Holdings, Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, RETAL Industries Ltd., Resilux NV, CKS Packaging, Inc., Zhuhai Zhongfu Enterprise Co. Ltd., and Sidel Group

Loading Table Of Content...