Pet Diabetes Care Devices Market Research, 2031

The global pet diabetes care devices market was valued at $1.9 billion in 2021, and is projected to reach $3.5 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031. Diabetes is more common in older pets. The disease is more manageable if it is detected early and controlled with the help of a veterinarian. Diabetes is suspected on the basis of signs a pet is showing, but the diagnosis is confirmed only by the veterinarian by finding consistent hyperglycemia and glucosuria. Dogs and cats with diabetes usually require lifelong treatment with special diets, a good fitness regimen and daily insulin injections. The key to managing diabetic pets is to keep the pet’s blood sugar near normal levels and avoid too-high or too-low levels that can be life-threatening.

Historical Overview

The market has been analyzed qualitatively and quantitatively from 2021 to 2031. The pet diabetes care devices market witnessed growth at a CAGR of around 6.3% during 2022-2031. Most of the growth during this period was from North America owing to the improvement in veterinary health awareness, rise in incidences of diabetes in pets, as well as well-established presence of Pet Diabetes Care Devices Industry in the region.

Market Dynamics

Growth & innovations in the medical device industry for the manufacturing of pet diabetes care devices owing to massive pool of diabetes conditions incidences creates an Pet Diabetes Care Devices Market Opportunity. Rise in launch of new products made up of advanced technology by various key players across the globe is set to affect the market growth positively. For instance, in September 2020, Trividia Health, Inc. announced that it has expanded its portfolio to include products specifically designed for better pet health. In addition to the Test Buddy Pet-Monitoring Blood Glucose System, the launch of the Healthy Tracks for Pets Insulin Syringes includes U-40 and U-100 syringes in a variety of gauges and sizes. The growth of the pet diabetes care devices market is expected to be driven by high potential in developing countries due to increase in the availability of improved healthcare infrastructure, increase in practice to meet unmet veterinary healthcare needs, and surge in demand for pet diabetes care devices.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced veterinary care, significant investments by government to improve veterinary healthcare services, and development of the medical devices industry in emerging countries. E-commerce (electronic commerce) has become a vital tool for small and large businesses globally, due to rise in preference of consumers for online shopping over traditional purchasing methods. This is attributed to further support the market growth. The demand for pet diabetes care devices is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of glucose monitoring devices and increase in awareness toward pet diabetes further drive the growth of the market. Furthermore, rise in consumer awareness related to preventive healthcare of pets boosts the adoption of pet diabetes care devices. Moreover, an increase in promotional activities by manufacturers and growth in awareness for glucose monitoring devices among the pet owner population are expected to fuel their adoption in the near future.

Stringent regulations for the approval of pet diabetes care devices and lack of awareness in developing economies are hampering the Pet Diabetes Care Devices Market Growth. Moreover, the unfavorable regulatory scenarios of the products used for drug delivery are anticipated to hamper the growth of the market.

The COVID-19 pandemic affected the pet diabetes care devices industry in a negative way, like various other veterinary medical devices industries were affected. The COVID-19 has helped to increase the demand for pet diabetes care devices, healthcare facilities, and personnel, the healthcare systems are likely to meet the increased demand during a pandemic event. However, COVID-19 has disrupted the supply chain, resulting in a global scarcity of animal health items such as glucose meters for dogs, nutritious feed, and vaccinations. Despite this, there is no indication that animals can transmit the virus to humans.

The infrastructural projects, manufacturing units, industries, and various operations had to be put on hold owing to the pandemic situation. The volatile costs of raw materials and the challenges brought on by the COVID-19 pandemic have restricted the growth rate of the market. Moreover, some of the pet care businesses had to close permanently, and some managed to keep afloat despite an entirely unparalleled dent in earnings. Following the initial lockdown, there have been various restrictions and rebounds into lockdowns on both a regional and national level. The animal company operating across the country, have supported their franchisees to try and adapt and leverage income by focusing on dog walking, dog daycare, and gardening services. As per the article published in 2021 under the title “Diabetes among dogs increased by 10-20% during pandemic: Vets”, cases of diabetes in dogs have increased 10-20% during COVID-19. Due to the increased lockdown and restrictions, there was a lack of routine checkups which lead to more cases of diabetes in dogs. Hence COVID-19 had a notable impact in the pet diabetic care market.

Segmental Overview

The global pet diabetes care devices market is segmented based on the basis of device type, animal, end user, and region. On the basis of device type, the market is bifurcated into glucose monitoring devices and insulin delivery devices. On the basis of animal, the market is classified into dogs and cats. On the basis of end user, the market is classified into homecare, veterinary hospitals and others. Region wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

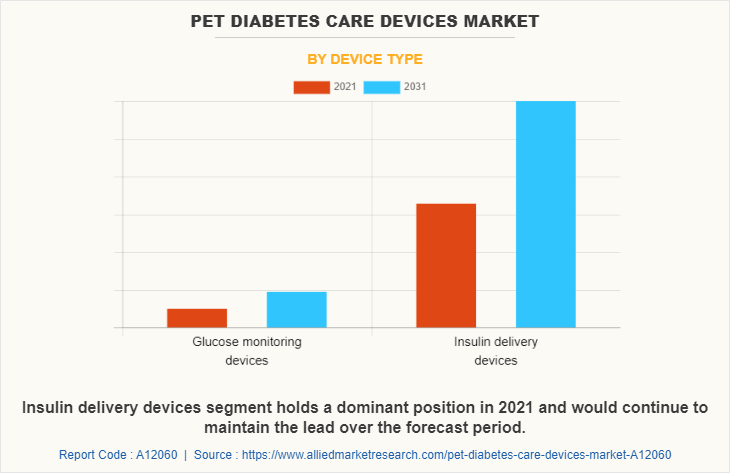

By Device Type

On the base of device type, the market is classified into glucose monitoring devices and insulin delivery devices. The insulin delivery devices segment dominated the global Pet Diabetes Care Devices Market Size in 2021 and is expected to remain dominant throughout the forecast period, owing to the increase in the adoption of insulin delivery devices for diabetes management of ill pet animals and the availability of several types of pet diabetes care devices in the market by various key players.

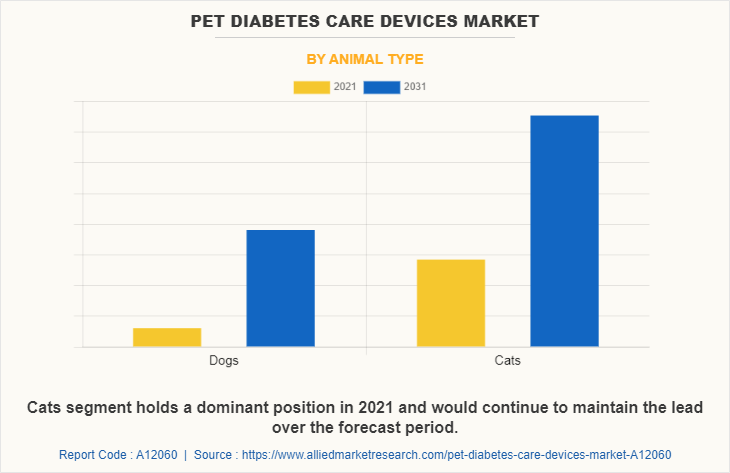

By Animal

The pet diabetes care devices market is segregated into dogs and cats. The cats segment dominated the global Pet Diabetes Care Devices Market Size in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to the increase in the prevalence of diabetes among cats. In addition, growth in the population of cats drives the growth of the market.

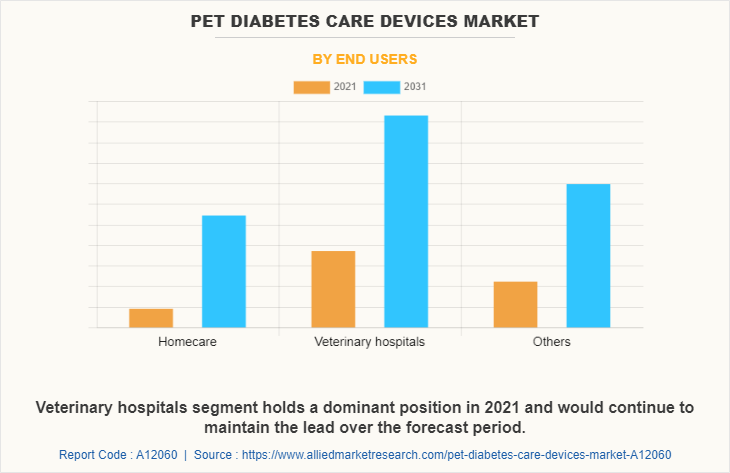

By End User

The Pet Diabetes Care Devices Market Share is classified into homecare, veterinary hospitals, and others. The veterinary hospitals segment held the largest Pet Diabetes Care Devices Market Share in 2021 and is expected to remain dominant throughout the Pet Diabetes Care Devices Market Forecast period, owing to the preference of pet owners for the pets to be treated in veterinary hospitals along with the surge in the usage of pet diabetes care devices to manage the pet animals, and ease of the accessibility of the veterinary hospitals.

By Region

The pet diabetes care devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America was the dominant region and is expected to remain dominant throughout the forecast period, owing to high prevalence rate of diabetes, increase in the number of market players and surge in the number of products available in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the presence of high populace countries such as India and China, which in turn increases the number of pet owners, and the increasing number of strategies and trends adopted by the market players.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the pet diabetes care devices, such as AccuBioTech Co., Ltd., Allison Medical Inc., ALR Technologies Inc., Becton, Dickinson and Company, MED Trust, Merck Animal Health, TaiDoc, UltiMed, Inc., Zoetis, i-SENS, Inc. are provided in this report. There are some important players in the market such as AccuBioTech Co., Ltd., Allison Medical Inc., ALR Technologies Inc., Becton, Dickinson and Company. Various players have adopted strategies like partnership, and acquisition as key developmental strategies to improve the product portfolio of the pet diabetes care devices market.

Partnership in the market

In June 2022, ALRT, the diabetes management company, announced the completion of a definitive manufacturing agreement with Infinovo Medical Co. Ltd. to manufacture and supply the Continuous Glucose Monitor (“CGM”) hardware that is utilized as a part of the ALRT GluCurve Pet CGM. This agreement gives ALRT the exclusive global rights to distribute the Infinovo CGM hardware for the animal health market, providing long-term production and supply.

In December 2022, ALRT, the diabetes management company, announced its co-branded distribution agreement with Covetrus, Inc., a global leader in animal-health technology and services, for ALRT's GluCurve Pet CGM, a continuous glucose monitoring (“CGM”) system for diabetic cats and dogs.

Acquisitions in the market

In October 2019, Zoetis, a leading animal health company, announced acquisition of Ethos Diagnostic Science, a veterinary reference lab business, to further expand its comprehensive diagnostics products and services as an enhanced value to veterinarians in the U.S.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet diabetes care devices market analysis from 2021 to 2031 to identify the prevailing pet diabetes care devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet diabetes care devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet diabetes care devices market trends, key players, market segments, application areas, and market growth strategies.

Pet Diabetes Care Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.5 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Animal Type |

|

| By End Users |

|

| By Device Type |

|

| By Region |

|

| Key Market Players | Med Trust LLC, Becton, Dickinson and Company, I-SENS. Inc., Merck & Co. Inc., Allison Medical Inc., Zoetis, Taidoc Technology Corp., AccuBioTech Co., Ltd., UltiMed, Inc, ALR Technologies Inc. |

Analyst Review

The diabetes is a chronic disease that can also affect dogs and cats. Diabetes is more common in older pets, but it can also occur in younger or pregnant pets. Pet Diabetes Care includes devices used to track or monitor blood glucose and administer insulin in animals. The demand for pet diabetes care devices can be seen to be increased due to the rise in the number of market players, research and development in the field of diabetes. These are further supported with the incidences like raised blood pressure, blood glucose, blood lipids and obesity. The growth in the demand from hospitals and other healthcare facilities for the pet diabetes care devices are gaining significant rise worldwide owing to the benefits offered by the devices in monitoring and delivering the diabetes care in the veterinary patients in the healthcare organization.

North America is expected to witness the largest share during the analysis period, owing to increase in the number of pet adoption and rise in number of pet insurance. For instance, according to the 2021-2022 National Pet Owners Survey (NPOS) conducted by the American Pet Products Association (APPA), the total pet industry expenditures in the United totaled $123.6 billion that is up 19% from $103.6 billion in 2020. Moreover, the increase in government expenditure on healthcare and other related trends adopted by the market players.

The total market value of the Pet Diabetes Care Devices market is $1885.07 million in 2021.

The forecast period in the report is from 2022 to 2031.

North America is the largest regional market for Pet Diabetes Care Devices.

The market value of the Pet Diabetes Care Devices market in 2022 was $1994.4 million.

The top companies that hold the market share in the Pet Diabetes Care Devices market are AccuBioTech Co., Ltd., Allison Medical Inc., ALR Technologies Inc., Becton, Dickinson and Company, MED Trust, Merck Animal Health, TaiDoc, UltiMed, Inc., Zoetis, and i-SENS, Inc..

Yes, Pet Diabetes Care Devices companies are profiled in the report.

The base year for the report is 2021.

The key trends in the Pet Diabetes Care Devices market are an increase in pet adoption, the prevalence of diabetes in pets, and a surge in technological advancement in Pet Diabetes Care Devices.

Loading Table Of Content...