Pet Insurance Market Research, 2033

The global pet insurance market was valued at $10.1 billion in 2023, and is projected to reach $38.3 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

Pet insurance helps mitigate these expenses of veterinary care for an insured person's sick or injured animal. Some plans provide benefits in the event of a pet's death, loss, or theft. The pet insurance market, also referred to as veterinary insurance. The pet insurance market is increasing as veterinary treatment uses more expensive procedures and medications, and as pet owners have greater standards for the health and well-being of their animals than in the past.

Key Takeaways of Pet Insurance Market Report

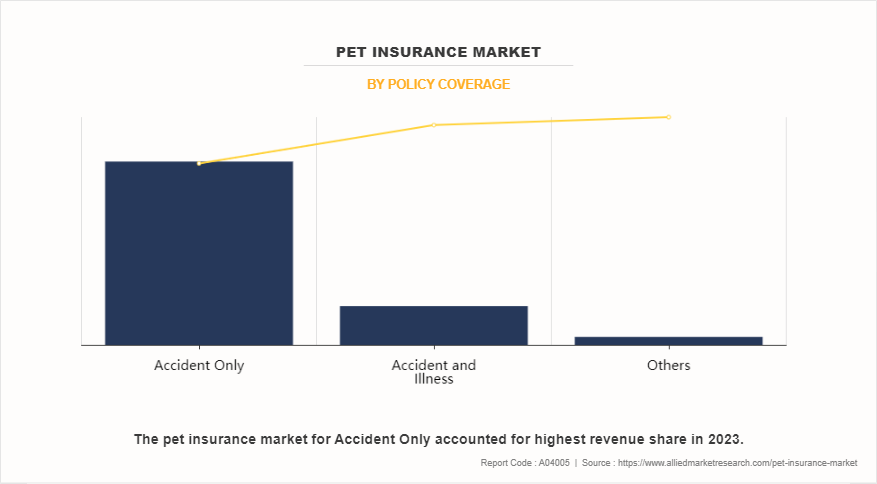

- By policy coverage, the accident only segment held the largest share in the pet insurance market in 2023.

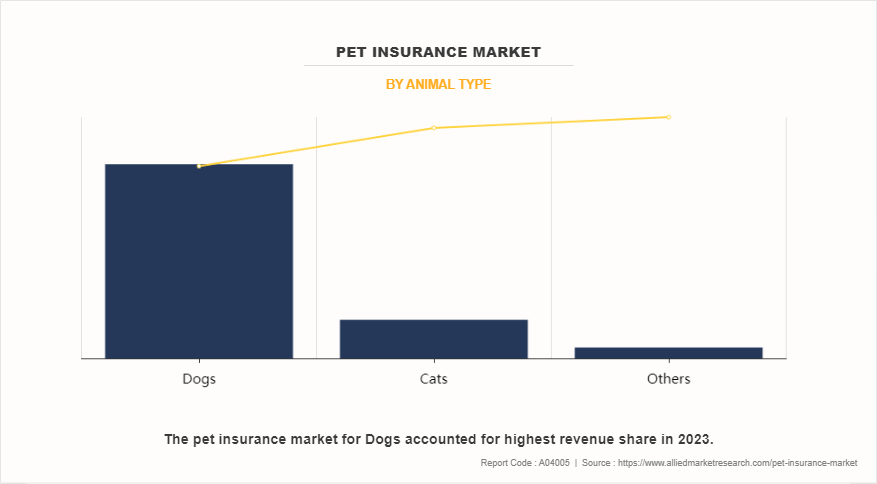

- By animal type, the others segment is anticipated to grow at the fastest CAGR during the pet insurance market forecast period.

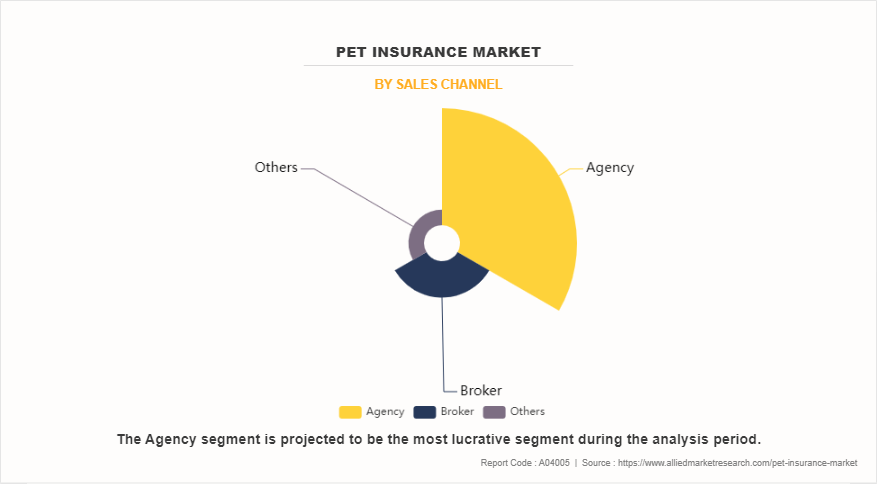

- By sales channel, the agency segment held the largest share in the pet insurance market in 2023.

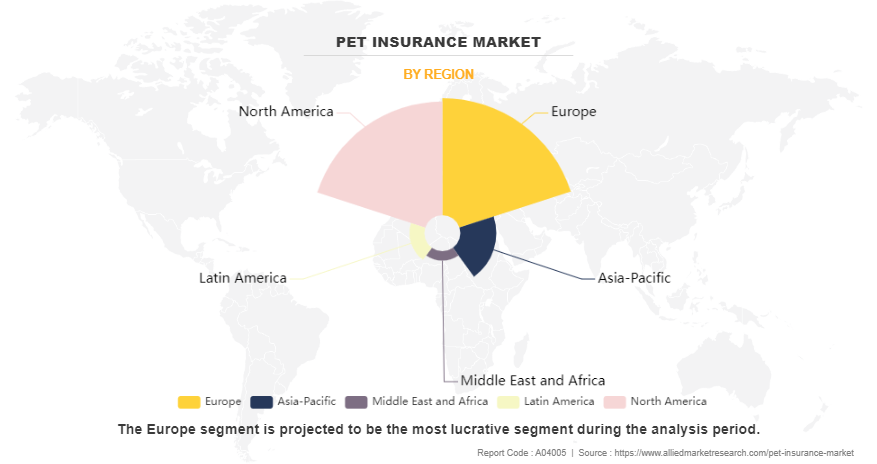

- Region-wise, Europe held the largest share in pet insurance market in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Rise in the number of pet owners and their willingness to spend on pet healthcare is driving the demand for pet insurance market. Pet humanization and the emotional bond between pet owners and their pets are also contributing to this trend. Furthermore, high costs of veterinary care, including treatments for chronic and acute illnesses, is making pet insurance more attractive to pet owners. This is particularly true for accident and illness policies, which cover a wide range of conditions. However, with the growing demand for pet insurance, many pet owners are still unaware of its benefits or are unsure of how it works. This lack of pet insurance awareness of pet insurance policy is expected to limit the pet insurance market growth. Moreover, the high cost of pet insurance premiums is expected to be a barrier for some pet owners, particularly those with multiple pets or limited resources. According to the North American Pet Health Insurance Association (NAPHIA), the average annual premium for pet insurance in the U.S. was $594 in 2021, which may be too expensive for some pet owners. On the contrary, advancements in pet healthcare technology, such as telemedicine and wearable devices, are creating new pet insurance market opportunity for pet insurance providers in the upcoming years. Pet insurance products that integrate with these technologies can provide pet owners with more comprehensive and convenient coverage options, such as remote consultations, behavioral training, and preventative care.

Pet Insurance Market Dynamics

Increase in pet ownership

Increase in pet ownership trends is driving the growth of the pet insurance market size due to the growing trend of pet humanization and viewing pets as family members has led to increase in pet care expenditure, including insurance coverage. Furthermore, rise in veterinary expenses due to advancements in medical technology and treatments has made pet insurance a desirable option for pet owners to manage unexpected and expensive veterinary bills. Moreover, rise in awareness of pet healthcare needs and the benefits of pet insurance has led to increase in demand for insurance coverage, as pet owners become more conscious of their pets' health requirements.

Lack of awareness and understanding of pet insurance market

Lack of awareness and understanding of pet insurance is limiting the growth of the pet insurance market by hindering potential customers from recognizing the benefits and value of pet insurance. Moreover, pet owners may not fully understand the benefits of pet insurance, such as financial protection against unexpected veterinary costs and coverage for preventive care. To overcome these restraints, pet insurance companies can focus on educating pet owners about the benefits and value of pet insurance, offering affordable premiums and flexible coverage options, and providing clear and transparent policy information.

Innovations in pet healthcare technology

Advancements in pet healthcare technology, such as telemedicine and wearable devices, are creating new opportunities for pet insurance providers. Pet insurance products that integrate with these technologies can provide pet owners with more comprehensive and convenient coverage options, such as remote consultations, behavioral training, and preventative care. In addition, the pet insurance market is still relatively underdeveloped in many regions, particularly in emerging markets such as Asia-Pacific, Latin America, and Eastern Europe. Pet insurance providers are expected to capitalize on this opportunity by expanding their presence in these markets and tailoring their products to meet the unique needs of pet owners in these regions.

Pet Insurance Market Segment Review

The pet insurance market is segmented into policy coverage, animal type, sales channel, and region. By policy coverage, the pet insurance market is divided into accident only, accident and illness, and others. By animal type, it is categorized into dogs, cats, and others. By sales channel, the pet insurance market is differentiated into agency, broker, and others. Region-wise, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By policy coverage, the accident only segment acquired a major pet insurance market share in 2023. This is attributed to surge in acceptance of pet insurance and increase in the cost of treatments and medication fees. In addition, accident only coverage in pet insurance policy proves to be a cost-effective way of avoiding any large and unexpected bills. However, the others segment is expected to be the fastest-growing segment during the forecast period, owing to the expansion of the pet industry and the advancement of pet laws, which permit the ownership of new breeds of animals such as turtles and others.

By animal type, the dogs segment dominated the pet insurance market in 2023 as dogs are the most preferred animals in most countries across the globe and the huge pet insurance adoption of dogs as a pet due to the contribution of dogs toward safety factors, and their higher cost of maintenance is increasing the demand for pet insurance. However, the others segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the cost of veterinary care, which is increasing, making it more difficult for pet owners to afford necessary treatments for their pets. Pet insurance can help offset these costs, making it a more attractive option for pet owners.

By sales channel, the agency segment acquired a major share in the pet insurance market in 2023. This is attributed to the growing number of pet owners, particularly in regions such as North America and Europe, contributing to rise in demand for pet insurance. This trend is driven by factors such as pet humanization, where pets are treated as family members, and rise in awareness of pet health and well-being. However, the others segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the advancements in pet healthcare technology, such as telemedicine and wearable devices, which are creating new opportunities for pet insurance providers. Sales channel insights reveal that financing institutions and credit unions are expected to capitalize on these trends by offering pet insurance products that integrate with these technologies, providing pet owners with more comprehensive and convenient coverage options.

Region-wise, Europe dominated the pet insurance market in 2023 owing to increase in the adoption of pets in the UK, Italy, France, Russia, and Germany. In addition, many insurance companies across Europe are coming up with various policy coverage to encourage pet owners to adopt dogs. These companies render services with plans for illnesses, injuries, and various diseases these factors drive the Europe pet insurance market trends. However, Asia-Pacific is expected to be the fastest-growing region during the forecast period owing to rise in awareness of pet care and pet insurance during the lockdown such factors drive the Asia Pacific pet insurance market trends. India has an estimated pet population of 32 million pets growing at 12% yearly, with dogs making up almost 85% of the total population. Furthermore, in August 2022, InsuranceDekho partnered with Future Generali India Insurance Company to offer unique Dog Health coverage. Thus, these factors are anticipated to drive the growth of the pet insurance market in the Asia-Pacific region.

Competition Analysis

Competitive analysis and profiles of the major players in the pet insurance market include Trupanion, Lemonade Insurance Agency, LLC, Spot Pet Insurance Services, LLC, Nationwide, Embrace Pet Insurance Agency, LLC, Healthy Paws Pet Insurance, LLC, GEICO, Progressive Casualty Insurance Company, Figo Pet Insurance LLC, and Pumpkin Insurance Services Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Developments in the Pet Insurance Industry

- In April 2024, MetLife Pet Insurance collaborated with the Association of Animal Welfare Advancement (AAWA) to help pet parents confidently care for their pets throughout their furry family member's life. Through the collaboration, MetLife Pet Insurance and AAWA are expected to work together to develop and produce content highlighting issues pet parents may face surrounding access to veterinary care while also recognizing innovative animal welfare organizations with the Golden Beagle Award.

- In April 2024, Chubb, a global insurance leader, announced a definitive agreement to acquire Healthy Paws, a U.S.-based managing general agent (MGA) specializing in pet insurance, from Aon. The acquisition aims to position Chubb for expansion in a niche market with substantial growth potential, such growing potentials drives the U.S. pet insurance market trends.

- In January 2024, a leading pet insurance market, Nationwide and Petco Health and Wellness Company, Inc., delivered on their shared commitment to providing affordable and integrated pet health, wellness, and protection solutions with the introduction of a new customizable pet health insurance offering available on petco.com.

- In December 2023, Spot Pet Insurance market, a leading pet insurance provider announced an exclusive partnership with AAA, one of North America's largest and most trusted membership organizations. This strategic collaboration aims to offer AAA members unparalleled access to comprehensive and affordable pet insurance coverage for their furry companions.

- In May 2023, JAB Holding Company (JAB) announced that its pet insurance platform acquired a majority interest in Pumpkin Insurance Services Inc. (Pumpkin), a best-in-class preventive care and pet insurance provider, expanding its global leadership in the under-penetrated, fast-growing pet insurance market.

Concentration & Characteristics:

The pet insurance market is characterized by a high degree of innovation owing to advancements in veterinary medicine and the availability of a wide range of pet protection plans for different animal species. In addition, rising number of pet adoptions and growing trend of treating pets as family members have significantly increased the demand for pet insurance. The expansion of available treatments for pets has led to increased healthcare costs. Pet insurance helps mitigate these expenses, encouraging pet owners to seek necessary medical care for their pets.

Coverage Type Insights:

By coverage type, the accident & illness segment dominated market with a share in 2023. It is also estimated to witness the fastest CAGR in the coming years. This growth can be attributed to several key factors, including the high costs associated with veterinary treatments and diagnostics, increasing population of companion animals, and a growing awareness of the importance of pet health coverage.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet insurance market analysis from 2024 to 2033 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the pet insurance market outlook.

- In-depth analysis of the pet insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as pet insurance market trends, key players, market segments, application areas, and market growth strategies.

Pet Insurance Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 342 |

| By Policy Coverage |

|

| By Animal Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Figo Pet Insurance LLC, Progressive Casualty Insurance Company, Pumpkin Insurance Services Inc., GEICO, Spot Pet Insurance Services, LLC, Lemonade Insurance Agency, LLC, Embrace Pet Insurance Agency, LLC, Nationwide, Healthy Paws Pet Insurance, LLC, Trupanion |

Analyst Review

According to the North American Pet Health Insurance Association (NAPHIA), the number of pets insured in the U.S. grew to 5.36 million in 2022, up from 4.4 million in 2021. Of those insured pets, 80.1% were dogs and 19.9% were cats. Most owners chose comprehensive insurance plans, with 92.8% of pets being covered by accident and illness plans or embedded wellness plans.

Key players in the pet insurance market adopt partnership, acquisition, and product launch as their key development strategies to sustain their growth in the market. For instance, in January 2024, Leading pet insurer Nationwide and Petco Health and Wellness Company, Inc. delivered on their shared commitment to providing affordable and integrated pet health, wellness, and protection solutions with the introduction of a new customizable pet health insurance offering available on petco.com. Petco|Nationwide pet insurance leverages Nationwide's customizable pet health insurance product within Petco's unique and fully integrated pet care ecosystem. Therefore, such strategies adopted by key players propel the growth of the pet insurance market.

The key players in the pet insurance market include Trupanion, Lemonade Insurance Agency, LLC, Spot Pet Insurance Services, LLC, Nationwide, Embrace Pet Insurance Agency, LLC, Healthy Paws Pet Insurance, LLC, GEICO, Progressive Casualty Insurance Company, Figo Pet Insurance LLC, and Pumpkin Insurance Services Inc. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the pet insurance market.

The global pet insurance market was valued at $10.1 billion in 2023 and is projected to reach $38.3 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

The pet insurance market refers to the industry providing coverage for veterinary expenses, including treatments for sick or injured animals. It also includes plans that provide benefits in case of a pet’s death, loss, or theft. The market is growing due to increasing veterinary treatment costs and rising standards for pet healthcare.

Major players in the pet insurance market include Nationwide, Healthy Paws Pet Insurance, Embrace Pet Insurance, Progressive Casualty Insurance, Lemonade Insurance Agency, GEICO, Trupanion, Spot Pet Insurance, Figo Pet Insurance, and Pumpkin Insurance Services.

In 2023, Europe held the largest share of the global pet insurance market, driven by high pet adoption rates in countries like the UK, France, Germany, and Italy. However, Asia-Pacific is expected to experience the highest growth during the forecast period due to increasing awareness and adoption of pet insurance.

Key drivers include an increase in pet ownership, a growing emotional bond between pets and owners, rising veterinary costs, and increasing awareness about the healthcare needs of pets. These factors make pet insurance more attractive to pet owners as a way to manage unexpected veterinary expenses.

The pet insurance market faces challenges such as a lack of awareness about the benefits of pet insurance, high premiums, and the need for better education around pet insurance policies. Additionally, the high costs of premiums can be a barrier for some pet owners, especially those with multiple pets.

Loading Table Of Content...

Loading Research Methodology...