Pet Smart Tracker Market Research, 2031

The global pet smart tracker market size was valued at $938.9 million in 2021, and is projected to reach $2.6 billion by 2031, growing at a CAGR of 10.3% from 2022 to 2031.

Some of the primary drivers driving market expansion are an increase in per capita disposable income, growing trend of nuclear families, and a quick rise in humanization of pets. Pet parents use GPS-enabled smart trackers to efficiently and effectively track and monitor their pets. Dogs are more popular as pets than other animals like cats. This opens up a lucrative opportunity for pet smart tracker producers to develop a diverse range of dog supplies and products. In many areas, people live in small apartments, where smaller pets are better adapted to their lifestyle. As the majority of couples abstain from conceiving, increasing adoption of dogs as substitute companions is resulting in a pampered pet business.

![]()

The growth in the number of aging couples and no child or dual income families, as well as increased disposable income, are assertive to global pet adoption. There has been a considerable increase in the number of people who are separated from their pets, which is also a major reason driving global demand for pet smart trackers. Various governments have taken steps to promote the usage of pet smart trackers in order to track location of pets efficiently and effectively. Such activities would help to drive the pet smart tracker market forward.

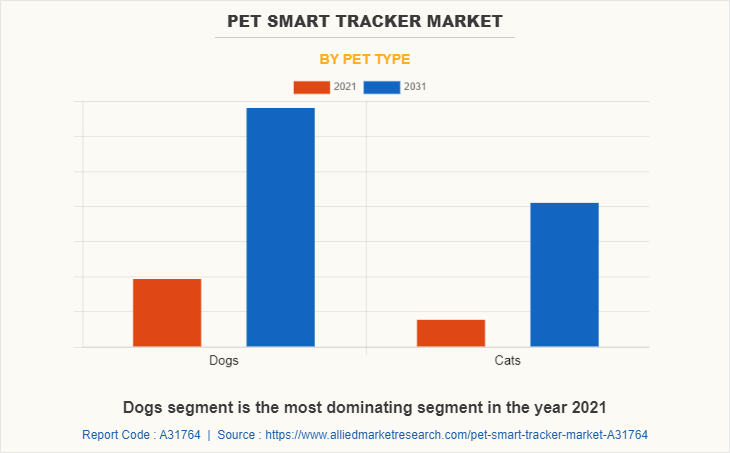

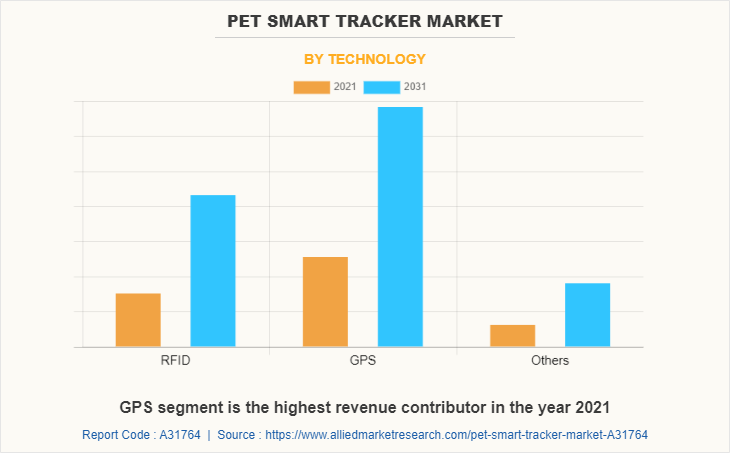

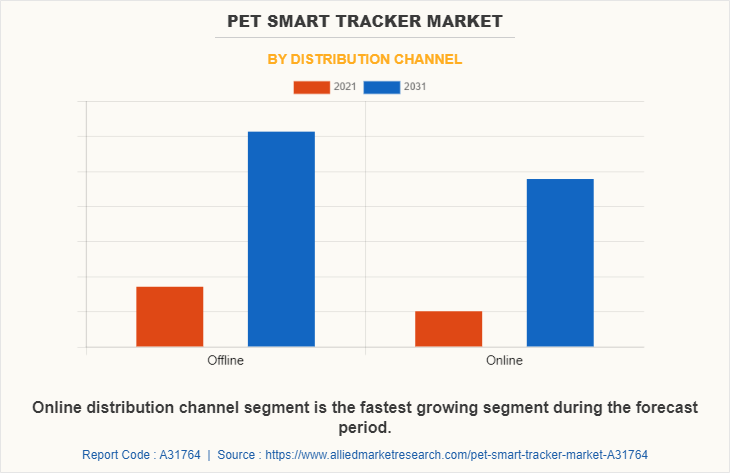

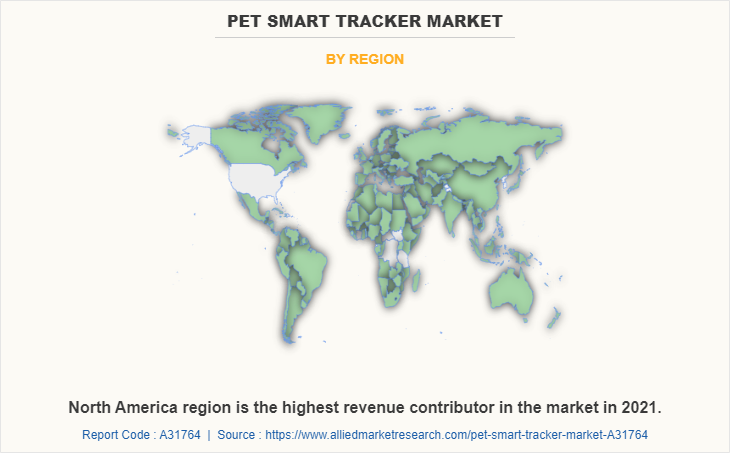

According to pet smart tracker market analysis, the global pet smart tracker market is segmented into pet type, technology, distribution channel, and region. On the basis of pet type, the pet smart tracker market is classified into dogs and cats. By technology, it is categorized into RFID, GPS, and others. As per distribution channel, it is segregated into offline and online. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Due to the rising trend of nuclear families and customers' growing propensity for dogs for companionship and security, the dog category accounted for the highest share of the global market in 2021. Dogs were the most popular form of pet in 2018, with over 470 million being kept as pets globally. 38.4% of American households have dogs, according to the American Veterinary Medical Association, the Humane Society, and PetFoodIndustry.com. In 2018, 76,811,305 dogs were owned by Americans. Nearly 40% of American households have at least one pet dog. In addition, the growing dog population is propelling the category upward. Thus, dog owners have concentrated on buying pet smart trackers with enhanced features and latest technologies. As a result of this, the demand for dog smart trackers is expected to increase in the coming years.

The GPS segment exhibits the fastest growth in the global pet smart tracker market. GPS-based pet smart trackers are becoming more popular as the demand to monitor pet activities while maintaining security grows. The demand is expected to be fueled by advances in real-time positioning, smartphone penetration, and the expansion of mapping portals globally. Furthermore, to increase GPS usage in new applications, GPS providers have formed strategic agreements with retailers, phone manufacturers, and app developers. For instance, in January 2022, Smart Track Technologies, LLC announced a partnership with Petriage, a pet health technology company that offers fully integrated telehealth services.

Consumers purchase pet smart trackers by various distribution channels including offline and online. The online segment is growing at the highest rate owing to the benefits provided such as discounts and free home delivery. In addition, online distribution channel provides wide range of products. The easy availability of pet smart trackers over a variety of marketplaces, from modern trade to internet, has resulted in a global pet smart tracker market expansion. Over the years, online sales have been steadily increasing. Because of the rapid development in pet humanization, the availability of creative and modern solutions that meet consumer pet smart tracker market demand has grown even more popular than before.

Region wise, Asia-Pacific dominated the market with largest pet smart tracker market share during the pet smart tracker market forecast period. The Asia-Pacific region's fast emerging markets are China, Japan, and South Korea's high-pitched economies. The pet smart tracker industry is fueled by these countries' high educational levels and contemporary infrastructure, as well as the affluent status and companionship provided by owning a pet. Pet smart tracker sales on e-commerce sites are increasing as a result of the strong internet connectivity accessible in these countries. Some of the factors boosting the adoption rate of pets in China are the aging population, the expanding trend, and the declining birthrate. These will cause the market for pet smart trackers in the Asia-Pacific region to expand.

Pets have been rapidly humanized in both developed and developing countries, according to the pet business. More people are treating their pets like family members, including cats, dogs, birds, and other animals. Therefore, the urge to humanize pets is to blame for the rise in sales of pet care products worldwide. People spend excessively on their pets, but as a result, they purposefully look for high-quality expensive goods. The Household and Pet Care CPG research forecasts that internet sales in the household and pet care sector will grow significantly during the next five years. They are anticipated to increase by 15% from 2018 to 2023. As a result, the worldwide pet smart tracker market is expanding due to the pets' quick humanization.

Pet health has been a major concern in recent years because of the government's rigorous regulations and owners' love for their animals. The Queensland Government, for instance, mandates that owners of pets register their animals in specific local districts and provide them with enough food, shelter, and care. The government also assures the best possible treatment, love, and quality of life for all animals. Pet owners may now afford to invest in cutting-edge tools that help track and monitor their animals' health and well-being due to an increase in disposable income. Owner-initiated initiatives for adequate vaccination, diet, and shelter for their pets are what drive the overall pet health sector.

Due to its capacity to deliver real-time information on a pet's health status, pet smart trackers are becoming more and more popular; yet, privacy concerns are restricting pet smart tracker market growth. For instance, authorities or organizations who might misuse the personal information of pet owners without their knowledge or consent are keeping an eye on pet smart trackers for possible access control. Tech businesses are investing money in R&D to enhance pet wearable privacy as a result. As a result, the global market for smart trackers isn't expanding as quickly as it could because of growing worries about data security and privacy.

Online sales among pet owners have significantly increased when compared to nearby hypermarkets or other grocery stores. Some benefits that e-commerce platforms provide pet owners include the convenience of buying a variety of pet products, a wider selection, and the potential for home delivery. Online sales of pet smart trackers grew globally in 2021 as a result. Despite having small market shares, e-commerce sites like Walmart.com, Petfooddirect.com, and Petco.com experienced tremendous growth.

Aside from industrialized nations like the U.S., the UK, and Australia, pet ownership is rising in emerging nations like India, Iran, and Bangladesh. Due to the significant rise in personal disposable income, people in these nations can afford to acquire pets and give them the best quality of life. The market for pet smart trackers is also booming as a result of a rise in the number of pets in Southeast Asia. Additionally, from 10 million in 2010 to over 17 million in 2018, India's pet population has grown. As a result, rising pet ownership in developing countries is promoting market expansion.

The major players analyzed for the pet smart tracker industry are High Tech Pet Products Inc., Life360 Inc., Kippy SRL, Smart Track Technologies Co., Num’axes-eyenimal, Pawscout Inc., Petpace LLC, Pitpatpet Ltd., Shenzhen Motto Electronics Co. Ltd, and Tractive. Market players' primary growth strategy is product launch to broaden their market reach and serve international clients, which is followed by partnership and agreement, expansion, and acquisition.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the pet smart tracker market size, market segments, current trends, estimations, and dynamics of the pet smart tracker market from 2021 to 2031 to identify the prevailing pet smart tracker market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet smart tracker market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet smart tracker market trends, key players, market segments, application areas, and market growth strategies.

Pet smart tracker Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.6 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Pet Type |

|

| By Technology |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Num’Axes /EYENIMAL, Felcana, High Tech Pet Products, Loc8tor Ltd., Jiobits, Otto Petcare, Whistle Labs, Inc., Dynotag, Avid Identification Systems, Inc., Datamars |

Analyst Review

According to the insights of CXOs of leading companies, the desire for higher-quality pet products has resulted in an upsurge in pet smart tracker production around the globe. The rise in premiumization has led in the introduction of cutting-edge technologies and solutions related to pet tracking. Furthermore, manufacturers aim at providing premium & advanced feature in pet smart trackers with innovative functionality. This would expand the market by allowing manufacturers or market players to create smart tracking devices for cats in addition to what is currently available for dogs.

The pet smart tracker industry is still driven by premiumization and product differentiation. As more advanced pet technological items become available, there will be more segmentation based on criteria like age, breed, and health. The growing tendency of treating pets like children has resulted in a surge in the use of pet products. To keep their pets healthy, pet owners are choosing high-quality items.

Demand for high-quality luxury pet goods has risen as pet ownership has expanded. As a result, dog smart tracker is expected to grow in popularity during the forecast period. Furthermore, over the last several years, the pet smart tracker market has garnered significant funding for a variety of technology-enhanced pet products, such as trackers and cameras.

The global pet smart tracker market size was valued at $938.9 million in 2021, and is projected to reach $2,584.4 million by 2031, registering a CAGR of 10.3% from 2022 to 2031.

The forecast period in the pet smart tracker market report is 2022 to 2031.

The base year calculated in the pet smart tracker market report is 2021.

The top companies analyzed for global pet smart tracker market report are High Tech Pet Products Inc., Life360 Inc., Kippy SRL, Smart Track Technologies Co., Num’axes-eyenimal, Pawscout Inc., Petpace LLC, Pitpatpet Ltd., Shenzhen Motto Electronics Co. Ltd, and Tractive.

The dogs segment is the most influential segment in the pet smart tracker market report.

Asia-Pacific holds the maximum market share of the pet smart tracker market.

The company profile has been selected on the basis of key developments such as partnership, product launch, merger and acquisition.

The market value of the pet smart tracker market in 2021 was $938.9 million.

Loading Table Of Content...