Pet Toys Market Research, 2032

The global pet toys market was valued at $8.3 billion in 2022, and is projected to reach $18.4 billion by 2032, growing at a CAGR of 8% from 2023 to 2032. The increasing trend of humanizing pets is a major factor contributing to the growth of the pet toy market. The trend emphasizes treating pets as a part of a family. As an increasing number of pet owners humanize their pets, they are consistently increasing the amount of money spent on improving their pet’s living conditions. This has further led to a soaring demand for a wide range of products & services and huge opportunities for businesses in premium pet food, veterinary services, and toys.

Market Dynamics

Pet toys is an object that allows a pet or companion animal such as dogs, cats, or birds to engage in playful activities. These toys are manufactured using different materials to meet a particular animal's specific needs. Materials such as rubber, plastic, silicone, and jute are used together with impressive and functional designs. Besides entertaining pets, toys play a pivotal role in improving their mental and physical health by increasing their participation in exercise and problem-solving tasks results in pet toys market growth.

In the United States, dogs are the most popular pets, with 44.6% of households owning a total of 62 million dogs. Cats follow with 26% of households having a total cat population of 37 million. Birds are owned by 2.5% of households, totaling 3.5 million households with a bird population of 7.5 million. Horses, owned by 0.2% of households, amount to 893,152 households and a total horse population of 1.9 million. On average, households own 1.46 dogs, 1.78 cats, 2.1 birds, and 2.1 horses. Veterinary expenditure per household per year varies, with dogs at $367, cats at $253, birds at $40, and horses at $614.

The growing pet population globally is progressively contributing to the increasing economic value for pet toy market. This rise is attributed to several advantages that pets provide such as companionship, relaxation, and physical & mental health benefits such as boosting mood as well as relief in depression & anxiety. In addition, pets such as dogs & cats are often kept as security and support animals for children and older adults such facotrs surge the pet toys market share. According to the 2023 State of the Industry Report by NAPHIA, pet insurance in the U.S. reached a total premium volume of almost $3.2 billion. By the end of 2022, 4.8 million pets were insured, marking a 22% increase from 2021. On average, dog owners paid a yearly premium of $640 or $53 per month for accident and illness coverage, while cat owners paid $387 yearly or $32 per month. The majority of insured pets were in California, New York, and Florida. Dogs made up 80% of insured pets, surpassing cats, which constituted 20%.

Developed countries in Europe, North America, and Asia-Pacific such as Germany, the U.S., and Australia are leading in terms of expenditure on pets. Trends such as humanization and premiumization rapidly become popular in such nations due to high disposable income, thus boosting the demand for premium products and services for pets. Furthermore, pet supplies such as food and veterinary services are a high priority for owners, and they are making significant efforts to enhance mental and physical health of their pet by learning about their natural behavior and care needs. Increase in awareness about treating pets better has simultaneously propelled the demand for toys, as they have witnessed high demand due to the important role they play to support pets’ growing need surge the pet toys market demand.

However, the increasing cost of pet ownership is hindering the pet toy market growth. Increased costs lead to financial concerns that are difficult to manage. Unlike pet food, toys are not often a priority for most pet owners, thus, increase in financial stress forces people to cut or reduce their spending and are prioritizing essential products. Household income heavily affects people’s decision for pet adoption. According to a report published by Animal Medicines Australia (AMA) in 2022, price was the leading decisive factor for pet acquisition, followed by responsibility and progressive costs. These factors collectively reduce the frequency of toys bought for a pet and has more significant impact on certain households that look after a disabled person and have overall low household income.

With increasing awareness for pet care, brands are taking advantage to capture this opportunity. As a greater number of pet owners become more conscious about types of toys, the material used, and the appeal to their companion animal, companies are making a variety of innovative pet toys. Toys that are made using more durable material such as ultra-durable thermoplastic rubber used by Guru Pet Company are gaining high traction, results in increasing pet toys market size. This is attributed to the fact that these materials increase safety for the pet while playing by preventing plastic from breaking into smaller fragments which potentially go inside the digestive tract. In addition to using durable material, companies are focusing on meeting demand for eco-friendly toys as pet owners look to reduce their carbon footprint.

In addition, the developing nations such as India, China, Brazil, and the Philippines have high potential for growth due to rapidly developing online channels and availability of veterinary services. The availability of veterinary services allows pet owners to take care of their pets timely, thus increasing pet acquisition rate. These factors play a pivotal role in strengthening the pet toy market industry in these countries. With increasing penetration of online channels, they allow consumers to purchase pet supplies with no time constraints, convenience, and many specialties online pet stores such as Chewy, feature a vast variety of brands and broad portfolio of products, which pet owners can purchase in one place.

Segmental Overview

The global pet toys market is segmented into type, distribution channel, pet, and region. By type, the market is classified into interactive & self-play toys, stuffed toys, chew toys, chase & fetch toys, and others. On the basis of distribution channel, it is bifurcated into online and offline. Depending on pet, it is fragmented into dogs, cats, birds, and others. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, Italy, France, Russia, and rest of Europe), Asia-Pacific (China, India, Australia, Singapore, South Korea, and rest of Asia-Pacific), and LAMEA (Saudi Arabia, Brazil, UAE, Argentina, South Africa, and rest of LAMEA).

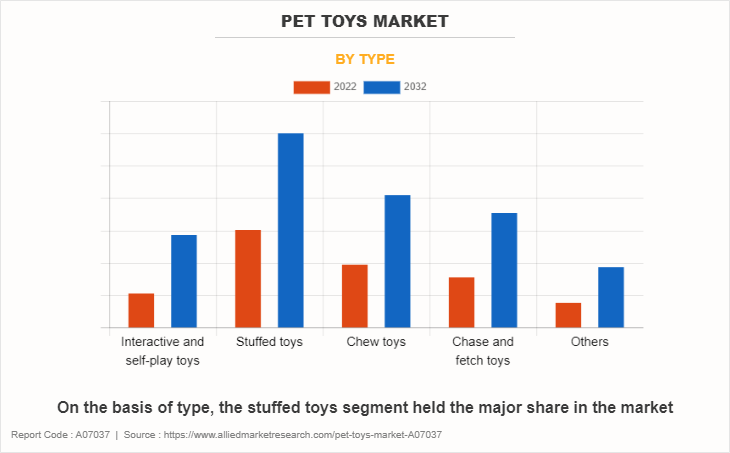

By Type

On the basis of type, the stuffed toys segment dominated the pet toys market in 2022 and is expected to maintain its trend during the pet toys market forecast period. Stuffed toys fulfill various requirements of pets, especially cats and dogs. These toys allow pets to chew, shake, and tear apart, which pets enjoy doing. Many pets often develop personal bonds with stuffed toys due to certain appearance, scent, and shape. Cats and dogs globally have the highest population; therefore, manufacturers develop these toys to capture high market share. In addition, pets such as cats and dogs have a high tendency to hunt, chew, and scratch. Besides tearing toys apart while playing, stuffed toys provide dogs with comfort in the absence of their owner.

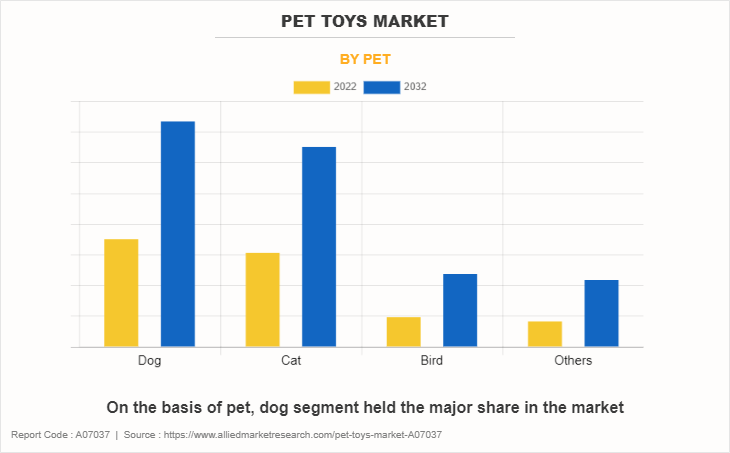

By Pet

On the basis of pet, the dog segment dominated the pet toys market in 2022 and is expected to maintain its dominance during the forecast period. The growth in pet adoption is highly attributed to rise in disposable income in the developing nations such as India, China, and Brazil, rapid expansion of the veterinary sector and increase in online pet stores surge the market demand for dog toys These factors contribute to increasing dog pet acquisition. In addition, the developed countries such as the U.S. and Australia have high number of pet dogs. According to Animal Medicines Australia organization, survey in 2022, the number of pet dogs in Australia stood at 6.4 million, owing to companionship and mental health benefits.

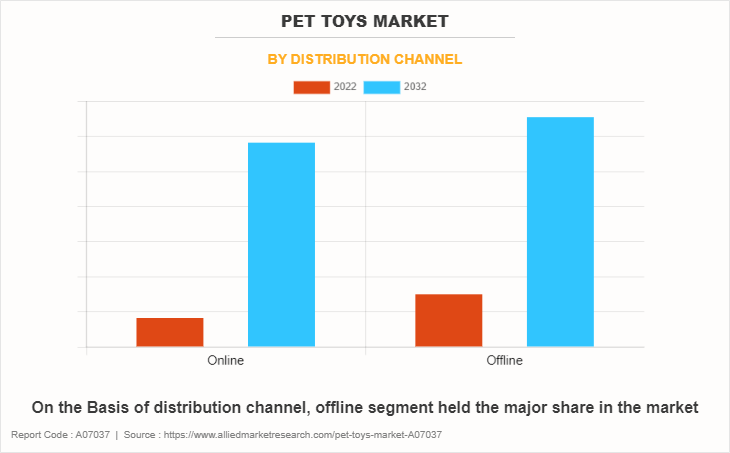

By Distribution Channel

On the basis of distribution channel, the offline segment dominated the pet toys market in 2022. This is attributed to the fact that specialty pet stores such as Chewy and Petz are largely investing money to improve consumer shopping experience through integration of different technologies such as artificial intelligence. Moreover, these stores feature vast number of brands and have a broad portfolio, which provides pet owners convenience of acquiring different pet products in one place. However, the online segment is expected to grow at the fastest rate during the forecast period. This is attributed to the fact that online distribution channels allow brands to reach a wider audience. In addition, many e-commerce sites focus on personalized production recommendations through the utilization of shopping history, search optimization, and video reviews.

By Region

Region wise, North America dominated the pet toys market in 2022, as the region has the highest pet expenditure. According to a survey in 2021 by the American Pet Products Association (APPA), annual pet toy expenditure in the U.S. stood at $136.8 billion. In addition, annual pet toy expenditure stood at $56 for dogs and $41 for cats. Moreover, trends such as pet humanization and premiumization are highly popular in this region, as people have high disposable income, they are in much better condition to afford premium quality food & treats, as well as supplies such as personal beds and toys.

Competition Analysis

Players operating in the pet toys industry have adopted various developmental strategies to expand their pet toy market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Spectrum Brands Holdings, Inc, Unicharm Corporation, Petz Group, Fressnapf Tierfutter GmbH, Tractor Supply Company, Outward Hound, Doskocil Manufacturing Company, Inc., Pets at Home Group Plc, KONG Company, and Chewy, Inc.

Recent Developments in the Pet Toys Market

- In 2023, Fressnapf Tierfutter GmbH acquired Jumper Groep, which is a specialty pet products retailer in Netherlands. This acquisition will strengthen its business position.

- In 2023, Chewy, Inc. announced plans to expand its business in Canada to strengthen its business in position.

- In 2023, Fressnapf Tierfutter GmbH announced opening of new concept store in Ratingen, Germany. With this, it will provide its customer improved shopping experience.

- In 2021, Petz Group acquired Cansei de Ser Gato (CDSG), largest digital content platform dedicated exclusively to cat products in Brazil. With this acquisition, it will strengthen its business position in the country.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet toys market analysis from 2022 to 2032 to identify the prevailing pet toys market opportunities.

- The market research is offered along with information related to key drivers, restraints, opportunities, and pet Toys market statistics.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet toys market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet toys market trends, key players, market segments, application areas, and market growth strategies.

Pet Toys Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Pet |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | KONG Company, Unicharm Corporation, Petz Group, Chewy, Inc., Doskocil Manufacturing Company, Inc., Outward Hound, Fressnapf Tierfutter GmbH, Spectrum Brands Holdings, Inc., Pets at Home Group Plc, Tractor Supply Company |

Analyst Review

According to CXOs, consumers are making substantial efforts to meet their pet’s behavioral requirements. This is attributed to the growing trend toward pet humanization and awareness about pivotal role played by toys in enhancing mental & physical well-being of pets. Pets often struggle with stress, anxiety, and boredom. As a result, in many cases, pets show various behaviors such as destructive chewing and scratching, which are prominent in the case of cats and dogs. Pet toys assist in managing these behaviors and help them with training as well. Changes in perception of owners toward their pets lead them to buy premium food, human-like treatment, providing personal beds & toys, as owners want to show their gratitude toward pets.

Moreover, developed nations in Europe, North America, and Asia-Pacific have high disposable income. High income consumers are more capable of affording pet expenditure, thus contributing to the growth of the pet toy market. In addition, people in Australia, the U.S., and Germany have higher pet acquisition rate. These nations adapt and create trends such as premiumization and humanization. Furthermore, owners are increasingly demanding high-quality pet toys that are durable. There is emerging demand for eco-friendly toys, as consumers look to reduce their individual carbon footprint. In response, brands are utilizing advanced technologies to recycle and reuse materials to manufacture pet toys. This further reduces the cost of production and makes toys affordable. Moreover, brands are developing toys to increase participation of owners & pets, through functional designs and shapes. In addition, demand is increasing for toys manufactured for less known pets such as small mammals, including hamsters, and rabbits. This further presents manufacturers with an opportunity to capture market share by innovating toys for small animals.

The online channel is growing rapidly allowing brands to reach remote areas and expand their serving capabilities. Popularity is rising for specialty online stores such as Chewy, as these stores offer extensive collection of brands, pet supplies, and other essential pet products. This enhances the shopping experience for consumers as consumers can shop for different products in one place and therefore online stores offer more convenience.

Innovation in pet toys are the upcoming trends of Pet Toys Market in the world

Stuffed toys is the leading type of Pet Toys Market

North America is the largest regional market for Pet Toys

Global Pet Toy Market Expected to Reach $18,372.8 million by 2032

The key players profiled in this report include Spectrum Brands Holdings, Inc, Unicharm Corporation, Petz Group, Fressnapf Tierfutter GmbH, Tractor Supply Company, Outward Hound, Doskocil Manufacturing Company, Inc., Pets at Home Group Plc, KONG Company, and Chewy, Inc.

Loading Table Of Content...

Loading Research Methodology...