Pharmaceutical Packaging Equipment Market Research, 2032

The global pharmaceutical packaging equipment market size was valued at $7.6 billion in 2022, and is projected to reach $15.2 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032. The growing global demand for pharmaceutical products has led to an increase in production volumes. There is a corresponding need for efficient and high-capacity pharmaceutical packaging equipment to meet demand for high pharmaceutical production volumes as pharmaceutical companies expand their manufacturing capacities. Thus, increasing demand for pharmaceutical packaging equipment in the pharmaceutical industry drives the growth of the market.

An increase in the adoption of strategies by key players such as product launches, partnerships, and acquisitions to expand their product portfolio further drives the pharmaceutical packaging equipment market growth. For instance, in July 2023, IMA completed the closing for the acquisition of 60% of Phoenix Italia S.r.l. and 100% of its subsidiary Phoenix Tech S.r.l. Phoenix Italia specializes in the production of print & apply label applicators and modular labelers for self-adhesive labels for secondary and end-of-line packaging. In addition, in November 2021, Syntegon entered a strategic partnership with Bayer for the development of new continuous manufacturing processes for oral solid dosage (OSD) forms. Moreover, in March 2021, Syntegon expanded its portfolio to produce parenteral pharmaceuticals.

Key Takeaways

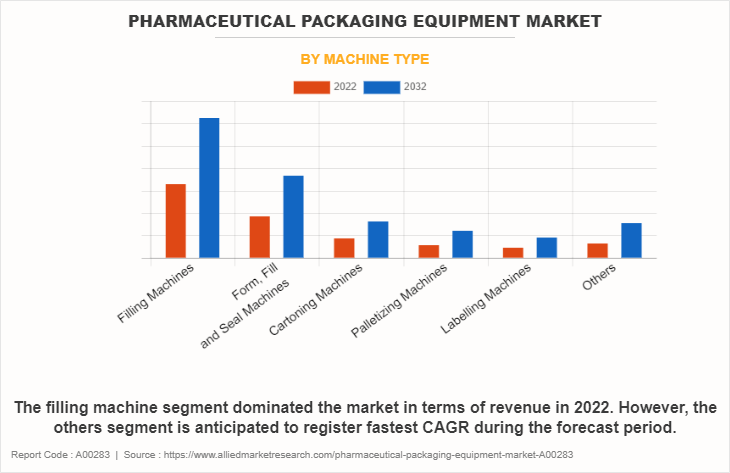

- By machine type, the filling machine segment dominated the pharmaceutical packaging equipment industry in terms of revenue in 2022. However, the others segment is anticipated to register fastest CAGR during the forecast period.

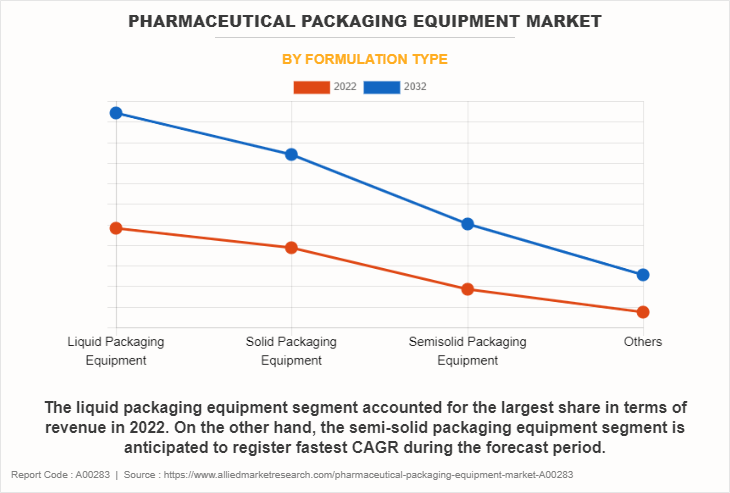

- By formulation type, the liquid packaging equipment segment accounted for the largest share in terms of revenue in 2022. On the other hand, the semi-solid packaging equipment segment is anticipated to register fastest CAGR during the forecast period.

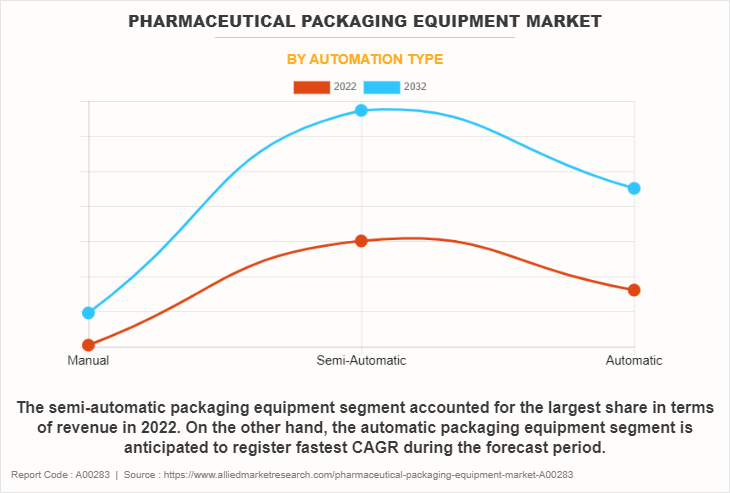

- By automation type, the semi-automatic packaging equipment segment accounted for the largest share in terms of revenue in 2022. On the other hand, the automatic packaging equipment segment is anticipated to register fastest CAGR during the forecast period.

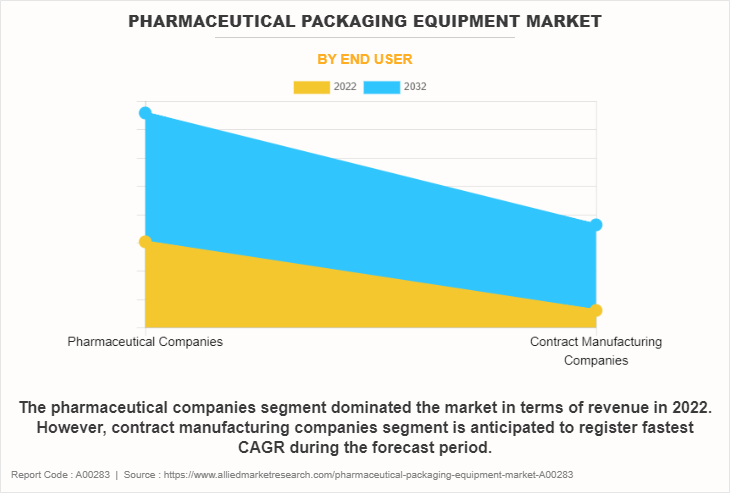

- By end user, the pharmaceutical companies segment dominated the pharmaceutical packaging equipment industry in terms of revenue in 2022. However, the contract manufacturing companies segment is anticipated to register the fastest CAGR during the forecast period.

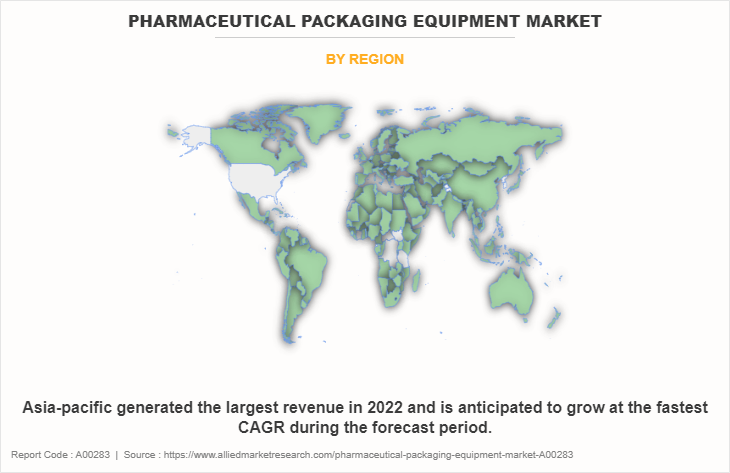

- Region-wise, Europe generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Pharmaceutical packaging equipment, referred to as machinery, is used in the pharmaceutical business to pack pharmaceutical items, including pharmaceutical products such as blister packaging, tablet packaging, liquid packaging, and others. Packaging is an essential stage in the production of pharmaceuticals as it guarantees the safety, preservation, and appropriate dosage of drugs. To accomplish these aims, a variety of pharmaceutical packaging equipment is utilized, including gas, liquid, semi-solid, and solid packaging equipment.

Market Dynamics

The surge in the need for effective, secure, and compliant packaging solutions is one of the main reasons propelling the growth of the pharmaceutical packaging equipment market size. Furthermore, the packaging process is now more automated, flexible, and efficient due to technical developments in pharmaceutical packaging equipment. Pharmaceutical businesses benefit from innovations such as‐¯robotics, automation, and smart packaging, which increase production while reducing costs. As a result, the market is experiencing rapid growth due to advancements in technology in pharmaceutical packaging equipment.

Moreover, the pharmaceutical packaging equipment market has expanded significantly in emerging markets owing to the development of healthcare infrastructure and increased research and development activities. Rapid urbanization and economic growth in countries such as China and India have created substantial opportunities for pharmaceutical packaging equipment manufacturers to cater to the requirements of these growing markets.

However, challenges such as high costs associated with pharmaceutical packaging equipment pose hindrances to the widespread adoption of pharmaceutical packaging equipment, thereby restraining the market growth.

Segmental Overview

The pharmaceutical packaging equipment market is segmented into machine type, formulation type, automation type and end user and region. By machine type, the market is categorized into filling machines, form, fill and seal machines, cartoning machines, palletizing machines, labeling machines, and others.

By formulation, the market is classified into liquid packaging equipment, solid packaging equipment, semi-solid packaging equipment, and others. By automation type, the market is divided into manual packaging equipment, semi-automatic packaging equipment and automatic packaging equipment. By end user, the market is segregated into pharmaceutical companies, and contract manufacturing companies. Region-wise, market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Machine type

The filling machines segment accounted for largest share in terms of revenue in 2022, owing to technological advancements in filling equipment that contribute to improved efficiency, flexibility, and adaptability. Innovations such as smart sensors, data analytics, and real-time monitoring enhance the overall performance of filling machines.

On the other hand, the other segment is expected to register the fastest CAGR during the forecast period. This is attributed to a rise in concern about counterfeit drugs in the pharmaceutical supply chain, which is a significant driver for the surge in demand for serialization equipment. Serialization helps in authenticating products, reducing the risk of counterfeit medicines, and protecting patients from substandard or falsified drugs.

By Formulation Type

The liquid packaging equipment segment accounted for the largest pharmaceutical packaging equipment market share in terms of revenue in 2022. This is attributed to the fact that liquid medications are frequently sensitive to environmental variables like light, oxygen, and temperature.

However, the semi-solid packaging equipment applications segment is expected to register the fastest CAGR during the forecast period, owing to the surge in demand for topical products, such as topical creams and ointments. Dermatological medications often require precise dosing and specialized packaging features.

By Automation Type

The semi-automatic packaging equipment and automatic packaging equipment. The semi-automatic packaging equipment segment accounted for the largest share in terms of revenue in 2022 owing to the cost-effectiveness of the semi-automatic machines that offer a balance between automation and flexibility.

However, the automatic segment is projected to manifest the highest CAGR from 2023 to 2032. This is attributed to the various advantages of automated packaging equipment such as efficiency, consistent product quality, cost-effectiveness, enhanced productivity, and flexibility.

By End User

The pharmaceutical companies segment accounted for the largest pharmaceutical packaging equipment market share in 2022, owing to higher adoption of packaging equipment that incorporates modern technologies, such as automation, robotics, and smart packaging features by pharmaceutical manufacturing companies.

However, the contract manufacturing companies segment is anticipated to register the fastest CAGR during the forecast period, owing to contract manufacturers often producing a wide range of pharmaceutical products for different clients. This diversity in product portfolios requires flexible and versatile packaging equipment that can handle various drug formulations, dosage forms, and packaging formats.

By Region

The pharmaceutical packaging equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the global pharmaceutical packaging equipment market in terms of revenue in 2022 and is expected to register the fastest CAGR during the forecast period. This is attributed to the rising population, escalating healthcare expenditures, and rapid technological advancements that significantly contribute to market expansion. The surge in the incidence of chronic diseases and infectious conditions in countries such as China, India, and Southeast Asian nations has increased the demand for medication, which further drives the growth during the pharmaceutical packaging equipment market forecast.

The developing biopharmaceutical industry in Asia-Pacific, driven by increased healthcare spending and a rise in emphasis on novel therapeutic approaches, fuels the demand for pharmaceutical packaging equipment. In addition, supportive government initiatives, collaborations between industry stakeholders, and strategic partnerships contribute to the expansion of the pharmaceutical packaging equipment market in the region, positioning Asia-Pacific as a significant region in the global healthcare and life sciences landscape. Thus, all the above factors contribute to the growth of the pharmaceutical packaging equipment market in this region.

Asia-Pacific offers profitable opportunities for key players operating in the pharmaceutical packaging equipment market, thereby registering the fastest growth rate during the forecast period, owing to the developments in healthcare infrastructure, the rise in manufacturing activities, as well as the well-established presence of domestic companies in the region. In addition, the surge in contract manufacturing organizations within the region provides a great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the pharmaceutical packaging equipment market, such as Syntegon Holding GmbH, OPTIMA Industries GmbH & Co. KG., Industria Macchine Automatiche S.p.A., Korber AG, Bausch + Ströbel, Coesia S.P.A., Marchesini Group S.p.A., Romaco Group, Multivac Group, and ACG Group. Major players have adopted product launch and collaboration as key developmental strategies to improve the product portfolio of the pharmaceutical packaging equipment market.

Recent Partnerships in the Pharmaceutical Packaging Equipment Market

- In November 2021, Syntegon entered a strategic partnership with Bayer for the development of new continuous manufacturing processes for oral solid dosage (OSD) forms.

Recent Acquisition in the Pharmaceutical Packaging Equipment Market

- In March 2021, Romaco acquired a Spanish processing technology manufacturer, specializing in technologies for the pharmaceutical industry.

- In July 2023, IMA acquired 60% of Phoenix Italia S.r.l. and 100% of its subsidiary Phoenix Tech S.r.l.Phoenix Italia develops, manufactures, and sells labeling solutions for distributors, system integrators, and original equipment manufacturers.

- In July 2023, IMA acquired 70% of Mespic S.r.l. and 100% of its Illinois-based subsidiary Mespic North America Corporation, from its sole shareholder Holding FGLG S.r.l.. Mespic S.r.l. develops, manufactures, and sells tailor-made machines, from conveyors to wrapping machines, from case packers to palletizers, and complete turn-key systems for the end-of-line.

Recent Collaboration in the Pharmaceutical Packaging Equipment Market

- In July 2021, Huhtamaki and Syntegon collaborated to launch a paper-based blister pack.

Recent Expansion in the Pharmaceutical Packaging Equipment Market

- In March 2021, Syntegon expanded its portfolio to produce parenteral pharmaceuticals using Pharmatec SVP process systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmaceutical packaging equipment market analysis from 2022 to 2032 to identify the prevailing pharmaceutical packaging equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pharmaceutical packaging equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pharmaceutical packaging equipment market trends, key players, market segments, application areas, and market growth strategies.

Pharmaceutical Packaging Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.2 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 395 |

| By Machine Type |

|

| By Formulation Type |

|

| By Automation Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | körber ag, Coesia S.p.A., Marchesini Group S.p.A., Romaco Group, Syntegon Technology GmbH, Industria Macchine Automatiche S.p.A., Multivac Group, Bausch + Ströbel, ACG Group, Inc., OPTIMA industries GmbH & Co. KG. |

Analyst Review

The pharmaceutical packaging equipment market is being propelled by several key drivers such as the adoption of packaging equipment in pharmaceutical and biotechnological companies, technological advancement in pharmaceutical packaging equipment, and increasing demand for efficient, safe, and compliant packaging equipment.

Pharmaceutical manufacturers are continually looking for ways to enhance operational efficiency and reduce production costs. Packaging equipment that offers high-speed capabilities, automation, and reduced downtime contributes to overall operational excellence and drives market growth.

Region-wise, Asia-Pacific dominated the global pharmaceutical packaging equipment market in terms of revenue in 2022 and is expected to register the fastest CAGR during the forecast period. This is attributed to a rise in population, an increase in healthcare spending, and rapid technological advancements. The rise in the prevalence of chronic diseases and infectious conditions in countries such as China, India, and Southeast Asian countries fuels the demand for medication, which further increases the adoption of pharmaceutical packaging equipment.

The growth of the pharmaceutical packaging equipment market is primarily driven by rise in prevalence of chronic disorders, surge in technological advancements, and rise in demand for pharmaceutical packaging equipment in pharmaceutical industry.

Pharmaceutical packaging equipment is machinery used to enclose and protect products by encasing them in a container for sale, distribution, shipping, storage, and usage. It completes a process that is an essential part of marketing and presents the proper image and design of a product.

The Syntegon Holding GmbH, Industria Macchine Automatiche S.p.A., Korber AG, Bausch + Marchesini Group S.p.A.. held a high market position in 2022.

The filling machine segment is the most influencing segment in pharmaceutical packaging equipment market owing to technological advancements in filling equipment that contribute to improved efficiency, flexibility, and adaptability. Innovations such as smart sensors, data analytics, and real-time monitoring enhance the overall performance of filling machines.

The base year is 2022 in the pharmaceutical packaging equipment market.

The forecast period for the pharmaceutical packaging equipment market is 2023 to 2032.

The total market value of the pharmaceutical packaging equipment market is $7.6 billion in 2022.

The market value of the pharmaceutical packaging equipment market in 2032 is $15.2 billion.

Loading Table Of Content...

Loading Research Methodology...