Pharmaceutical Packaging Market Research, 2035

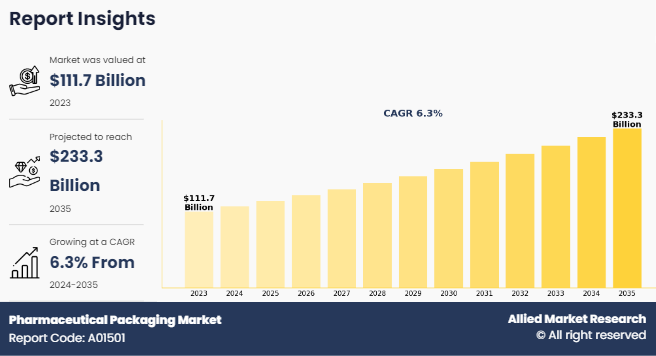

The global pharmaceutical packaging market was valued at $111.7 billion in 2023, and is projected to reach $233.3 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035. Increase in population and rise in prevalence of population affected by various diseases is the major factor driving the growth of the pharmaceutical packaging market. The World Health Organization (WHO) estimated that the world’s population is expected to increase by nearly 2 billion in the next 30 years, from the current 8 billion to 9.7 billion in 2050 and peak at nearly 10.4 billion in the mid-2080s. This population growth, coupled with a rise in disease prevalence, highlights the need for efficient pharmaceutical packaging solutions. The demand for packaging that ensures the safety, efficacy, and accessibility of pharmaceutical dosage forms is expected to grow in response to these demographic and health trends, thus driving market expansion.

Pharmaceutical packaging involves the process of securely enclosing pharmaceutical products in suitable containers to protect them from external elements such as light, moisture, and contamination. It encompasses the design, development, and production of packaging materials and systems tailored to the specific requirements of medications. Pharmaceutical packaging ensures the integrity, stability, and safety of drugs throughout their lifecycle, from manufacturing to distribution and use by patients, while also facilitating dosing accuracy, regulatory compliance, and patient convenience.

Key Takeaways

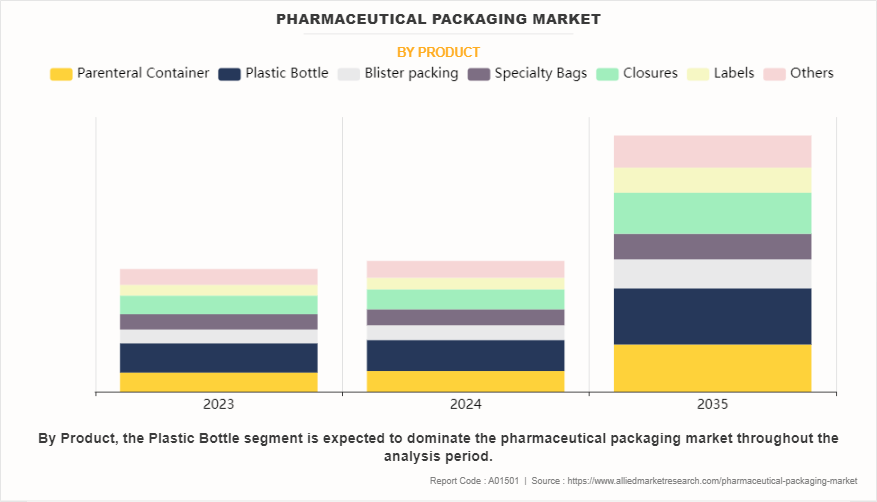

- On the basis of product, the plastic bottle segment dominated the pharmaceutical packaging market size in terms of revenue in 2023. However, the parenteral container segment is anticipated to register the fastest CAGR during the forecast period.

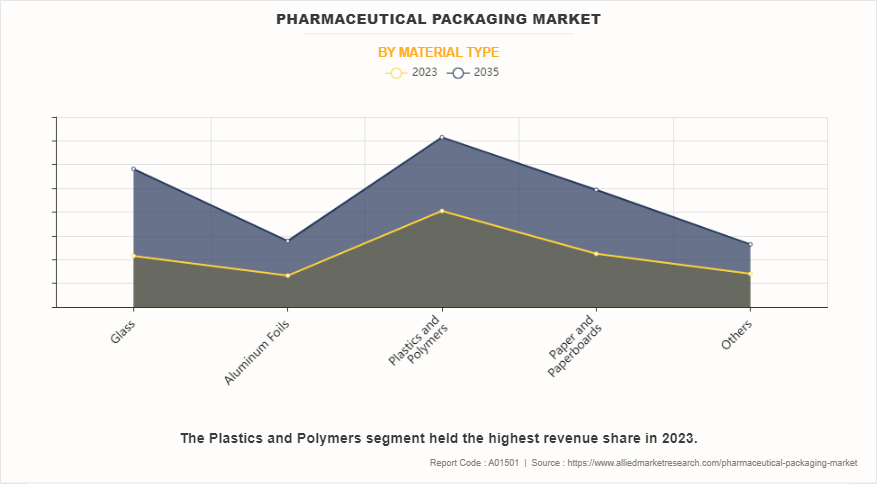

- By material type, the plastics and polymers segment were the major revenue contributor in pharmaceutical packaging market size in 2023. However, the glass segment is anticipated to register the fastest CAGR during the forecast period.

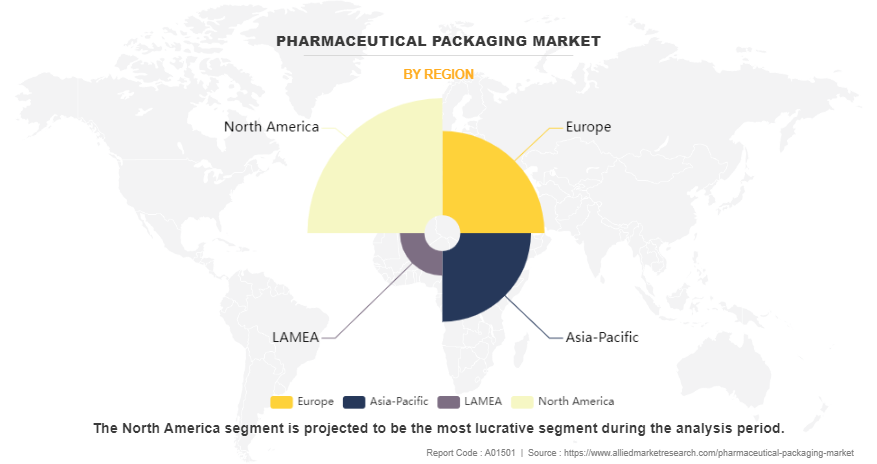

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The advanced manufacturing processes used to develop pharmaceutical packages are playing a pivotal role in the growth of the global pharmaceutical packaging market. Advanced manufacturing processes, including green packaging technologies, use environment-friendly materials to develop pharmaceutical packages which inflict minimal harm to the environment. The designs of these biodegradable and eco-friendly packaging materials are replacing the existing conventional packaging materials. The raw materials used for eco-friendly packaging include paper, cardboard, and corn starch. The use of biodegradable materials supports sustainability of all stages of pharmaceutical product lifecycle; thus, pharmaceutical manufacturers increase the demand of sustainable packaging.

In addition, the pharmaceutical drug manufacturing companies have started to adopt eco-friendly pharmaceutical packages to address environmental concerns. Several packaging companies are developing eco-friendly packaging products for pharmaceutical companies. For instance, in July 2023, Constantia Flexibles, announced the launch of a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes.

Further, in 2020, Amcor launched a recyclable, high-barrier flexible packaging that can reduce a pack’s carbon footprint by up to 64%. Moreover, Amcor was the first packaging company to commit to making all its packaging recyclable or reusable by 2025. Therefore, the above-mentioned reasons have contributed to eco-friendly packaging solutions, which resulted in uplifting the pharmaceutical packaging market growth.

In addition, the rise in patient-centered medicine, evolving alongside personalized medicine and tailored therapeutics, aims to enhance health outcomes for individual patients by considering their goals, preferences, values, and economic resources. Biologic drugs, derived from microorganisms, animals, humans, or plants, are often heat-sensitive, necessitating specialized packaging to maintain their efficacy and safety. As the demand for patient-centric approaches grows, pharmaceutical companies are increasingly investing in innovative packaging solutions to ensure the stability and integrity of biologic medications. This trend is expected to drive market growth, as packaging plays a crucial role in safeguarding the potency and effectiveness of biologic drugs, ultimately improving patient outcomes and satisfaction in everyday clinical practice.

However, stringent government regulations and standards for packaging hinder the growth of the market. This is because any new pharmaceutical packaging company trying to enter the market is required to abide by those regulations, for the approval of packages. It is important for innovators to understand the extensive network of regulations that may affect a particular innovation. For instance, the basic requirements for flexible packaging materials as per the U.S. FDA are that the product should be manufactured as per cGMP Guidelines provided under directive 21 CFR parts 11.

The products used for primary packaging of pharmaceutical products should be manufactured under clean-room conditions meeting Class 1,00,000 cleanliness standards. Thus, these stringent regulations and standards act as barriers for new entrants and obstruct the growth of the pharmaceutical packaging market.

Segments Overview

The pharmaceutical packaging industry is segmented into product, material type, packaging type, and region. By product, the market is classified into parenteral containers, plastic bottles, blister packaging, closures, specialty bags, labels, and others. On the basis of material type, the market is fragmented into glass, aluminum foils, plastics and polymers, paper and paperboards, and others. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, North Africa and rest of Middle East & Africa).

By Product

Depending on the product, the market is segmented into parenteral containers, plastic bottles, blister packaging, closures, specialty bags, labels, and others. The plastic bottles segment accounted for the largest pharmaceutical packaging market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period. This dominance is attributed to several factors, including the widespread adoption of plastic bottles for packaging various pharmaceutical liquids and solids due to their versatility, lightweight nature, durability, cost-effectiveness, and compatibility with stringent regulatory requirements, driving continued demand and market growth for plastic bottles in pharmaceutical packaging.

However, the parenteral containers segment is expected to exhibit the fastest CAGR during the pharmaceutical packaging market forecast period owing to several factors. This growth is attributed to several factors, including the rise in demand for injectable medications, increase in prevalence of chronic diseases, advancements in biopharmaceuticals, and expanding applications of parenteral drug delivery systems. Additionally, stringent regulatory requirements and a focus on patient safety further drive the adoption of specialized parenteral containers, thus fueling market growth.

By Material type

Depending on material type, the market is divided into glass, aluminum foils, plastics and polymers, paper and paperboards, and others. The plastics and polymers segment accounted for the largest pharmaceutical packaging market share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period owing to the versatility, durability, and cost-effectiveness of plastic packaging solutions. Additionally, ongoing innovations in plastic materials and manufacturing technologies continue to enhance the performance and functionality of plastic packaging, further solidifying its position in the market.

However, the glass segment is expected to exhibit the fastest CAGR during the forecast period. This growth is attributed to the exceptional barrier properties, inertness, and perceived quality of glass packaging, particularly for sensitive pharmaceutical products. Additionally, increasing demand for eco-friendly and recyclable packaging materials further drives the adoption of glass in pharmaceutical packaging, propelling its growth during the forecast period.

By Region

Region-wise, the pharmaceutical packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America acquired the largest share in terms of revenue in 2023 and is expected to maintain its lead during the forecast period owing to factors such as robust pharmaceutical industry growth, stringent regulatory standards ensuring high-quality packaging, increasing demand for innovative packaging solutions, and a strong focus on patient safety and adherence. These elements collectively drive the North America's position as a leader in pharmaceutical packaging.

However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period. This growth is fueled by expanding pharmaceutical markets, rising healthcare expenditures, increasing demand for medications, and rapid industrialization. Additionally, the region benefits from a growing population, rising disposable incomes, and advancements in healthcare infrastructure, which drive the demand for sophisticated and innovative pharmaceutical packaging solutions.

Competitive Analysis

The major players such as Amcor Plc. and West Pharmaceutical Services, Inc have adopted product launch, collaboration, partnership, product development, and product approval as key developmental strategies to strengthen their foothold in the competitive market. For instance, in April 2023, Sudpack company announced the launch of its PharmaGuard blister, a polypropylene-based blister packaging. This new product offers an outstanding water vapor barrier along with effective barrier resistance against UV and oxygen.

Recent Developments in Pharmaceutical Packaging Industry

- In July 2023, Constantia Flexibles announced the launch of a new pharmaceutical packaging solution called REGULA CIRC, which utilizes coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization not only enhances the sustainability of the packaging but also improves material recovery during recycling processes.

- In June 2022, Becton, Dickinson and Company, a leading global medical packaging type company, and Frazier Healthcare Partners, a leading private equity firm focused exclusively on the health care sector, announced a definitive agreement for BD to acquire Parata Systems, an innovative provider of pharmacy automation solutions, for $1.525 billion. Parata provides pharmacy packaging type solutions to reduce costs, enhance patient safety, and improve the patient experience by offering a comprehensive pharmacy automation portfolio with medication adherence packaging, high-speed robotic dispensing technologies and pharmacy workflow solutions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmaceutical packaging market analysis from 2023 to 2035 to identify the prevailing pharmaceutical packaging market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pharmaceutical packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pharmaceutical packaging market trends, key players, market segments, application areas, and market growth strategies.

Pharmaceutical Packaging Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 275 |

| By Product |

|

| By Material type |

|

| By Region |

|

| Key Market Players | SCHOTT Pharmaceutical Packaging, Berry Global Group, Inc, CCL Industries Inc., Aptar Group, Inc., Gerresheimer AG, Nipro Corporation, Amcor plc., West Pharmaceutical Services, Inc., BD (Becton, Dickinson and Company), Catalent Inc. |

Analyst Review

The pharmaceutical packaging market is expected to grow owing to an increase in demand for smart packaging options and other innovative packaging products. In addition, increase in chronic diseases has led to new vaccine approvals that needs pharmaceutical packaging, which is expected to account for major revenue generation during the forecast period.

In addition, various advancements and R&D innovations are expected to boost the growth of the market. Numerous players are entering the pharmaceutical packaging market with innovative products due to contract packaging. The growth of the pharmaceutical packaging market is anticipated to largely be contributed by rise in incidences of lifestyle diseases and increase in the geriatric population.

Furthermore, North America is expected to remain dominant during the forecast period, due to surge in the use of pharmaceutical packaging. This is attributed to high purchasing power, coupled with rise in adoption rate of smart and advanced packages. Furthermore, the presence of major market players fosters innovation and product development. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to key players, due to requirements for brand enhancement and differentiation, new packaging material development, increase in awareness of environmental issues, and the adoption of new regulatory requirements on recycling packages are projected to boost the growth of the Asia-Pacific pharmaceutical packaging market.

The total market value of Pharmaceutical packaging market is $111.7 billion in 2023.

The forecast period for Pharmaceutical packaging market is 2024 to 2035

The market value of Pharmaceutical packaging market in 2035 is $233.2 billion

The base year is 2023 in Pharmaceutical packaging market .

Top companies such as are Amcor Plc., Aptar Group, Inc., Catalent Inc., CCL Industries Inc., Becton, Dickinson and Company, held a high market position in 202

3. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The plastic bottles segment is the most influencing segment in Pharmaceutical packaging market.This dominance is attributed to multiple factors, including the widespread use of plastic bottles to package diverse pharmaceutical liquids and solids. Their versatility, lightweight construction, durability, and cost-effectiveness, coupled with compliance with stringent regulations, fuel sustained demand and growth in the pharmaceutical packaging market for plastic bottles.

The major factor that fuels the growth of the pharmaceutical packaging market are increasing demand for pharmaceuticals, innovations in packaging materials and technologies and growing focus on patient safety and compliance.

Pharmaceutical packaging refers to the process of enclosing pharmaceutical products in suitable containers to protect them from external factors such as light, moisture, oxygen, and contamination. It encompasses the design, development, and production of packaging materials and systems tailored to the specific requirements of medications.

Loading Table Of Content...

Loading Research Methodology...