Pharmacy Benefit Management Market Research, 2033

Market Introduction and Definition

The global pharmacy benefit management market size was valued at $0.5 billion in 2023, and is projected to reach $1.0 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033. The growth of the pharmacy benefit management market is driven by several key factors, including rise in demand for cost-effective healthcare solutions, increase in prescription drug costs, and rise in emphasis on value-based care. PBMs help manage and reduce drug costs through formulary management, drug utilization review, and negotiating discounts with drug manufacturers. In addition, the expanding aging population, which requires more medications, and rise in prevalence of chronic diseases, are fueling the demand for PBM services. The ongoing adoption of technology in healthcare also enhances the efficiency and transparency of PBM operations, further driving the market growth. Pharmacy benefit management is a crucial service in the healthcare system that focuses on managing prescription drug benefits on behalf of health insurers, large employers, and other payers. Pharmacy benefit management services act as intermediaries between insurers and other members of the healthcare system, negotiating discounts and rebates with drug manufacturers, establishing and maintaining the formulary, and processing prescription drug claims. They play a significant role in controlling the cost of prescription drugs by negotiating pricing and promoting the use of cost-effective alternatives, such as generics.

Key Takeaways

- The pharmacy benefit management market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major pharmacy benefit management industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives

Key Market Dynamics

According to pharmacy benefit management market forecast analysis key factors driving the growth of the market are rise in prevalence of chronic diseases, increased prescription drug usage, complexity of drug pricing, and rise in focus on the minimizing medical errors. Rise in the prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and respiratory conditions, is a major driver for the pharmacy benefit management market. As these chronic conditions become more widespread, the demand for medications to manage them has increased significantly. Pharmacy benefit management services play a crucial role in controlling medication costs, ensuring patient access to necessary drugs, and optimizing therapeutic outcomes through formulary management, drug utilization reviews, and cost-sharing strategies.

The growing number of individuals requiring long-term medication therapy has intensified the need for effective pharmacy benefit management services to manage prescription drug benefits, thereby driving the market growth. In addition, as healthcare costs continue to rise, employers, insurers, and government programs increasingly rely on pharmacy benefit management services to manage the financial burden associated with chronic disease management, further propelling the pharmacy benefit management market growth

Furthermore, complexity of drug pricing, and rise in focus on minimizing medical errors is expected to drive the pharmacy benefit management market size. According to a 2024 article by the U.S. House Committee on Oversight and Accountability, in 2023, the U.S. healthcare system spent $772.5 billion on prescription drugs. Advancements in pharmaceutical research, leading to the development of new and specialized drugs that require careful management and distribution. Pharmacy benefit management services play a crucial role in negotiating drug prices, managing formularies, and ensuring that patients have access to necessary medications at lower costs. In addition, the complexity of managing multiple medications for chronic conditions necessitates the expertise of PBMs to optimize drug therapy and improve patient outcomes. Thus, the complexity of drug pricing, and rise in focus on minimizing medical errors is expected to contribute significantly to the growth of the market.

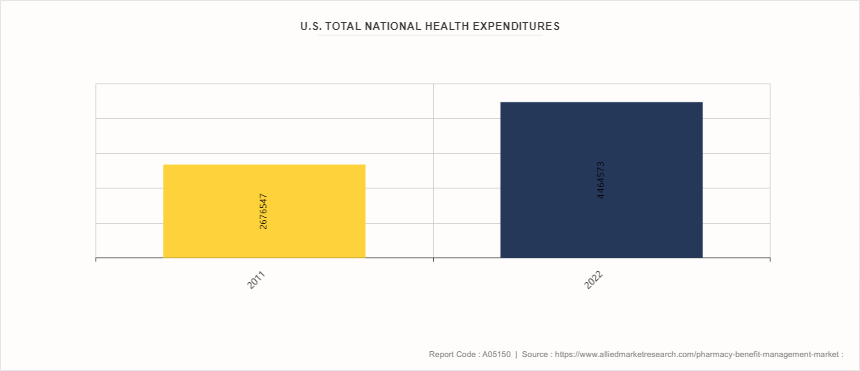

Increase in Healthcare Expenditure

According to pharmacy benefit management market opportunity analysis increase in healthcare expenditure is set to have a significant impact on the pharmacy benefit management market. As healthcare costs rise, employers, insurers, and government programs are increasingly seeking ways to manage and control these expenses. PBMs play a crucial role in this process by negotiating drug prices with manufacturers, managing drug formularies, and optimizing the use of medications to improve outcomes while reducing costs. With more resources being allocated to healthcare, PBMs are likely to witness increase in demand for their services as stakeholders look to them to help manage rising costs effectively.

This trend is likely to drive growth in the pharmacy benefit management market, as the need for efficient drug cost management and value-based healthcare solutions becomes more crucial. In addition, as healthcare expenditure increases, there will be a greater focus on ensuring that patients have access to necessary medications while controlling the overall cost burden.

Market Segmentation

The pharmacy benefit management industry is segmented on the basis of service, business model, end user, and region. By service, the market is classified into specialty pharmacy, drug formulatory management, benefit plan design and consultation, and other services. By business model, the market is divided into government health programs, employer-sponsored programs, and health insurance management. By end user, it is segregated into pharmacy benefit management organization, mail order pharmacies, retail pharmacies, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the pharmacy benefit management market share in 2023 owing to well-established and sophisticated healthcare system. The infrastructure supports the integration of pharmacy benefit management services, making it easier for these services to manage prescription drug benefits efficiently. The U.S. spends significantly more on prescription drugs than any other country, driven by both high drug prices and the large volume of prescriptions. Pharmacy benefit management service plays a crucial role in negotiating drug prices, managing formularies, and ensuring cost-effective drug utilization, which generates substantial revenue.

The Asia-Pacific region is experiencing rapid economic growth, leading to increased healthcare spending. Governments in countries like China, India, and Japan are investing heavily in healthcare infrastructure, which is expected to boost the adoption of pharmacy benefit management services.

- According to 2024 article by American Medical Association, health spending in the U.S. was about $4.5 trillion.

- According to the U.S. National Health Expenditures 2022 Highlights, spending for hospital care services increased by 2.2% in 2022 to reach $1.4 trillion.

- According to the U.S. National Health Expenditures 2022 Highlights, about 92% of the U.S. population has health insurance.

- According to the India Brand Equity Foundation, the Indian pharmaceutical industry is projected to grow at a CAGR of over 10% to reach a size of $130 billion by 2030.

Industry Trends

- According to the article by the Canadian Institute for Health Information published in November 2023, the healthcare expenditure in Canada reached $344 billion in 2023 from $334 billion in 2022.

- In July 2024, Pennsylvania Governor Josh Shapiro signed a bipartisan bill that aimed at regulating pharmacy benefit managers (PBMs) , which serve as middlemen between insurance companies and pharmacies and determine how much a pharmacy will get paid for the drugs it sells.

- According to a 2024 article by American Medical Association, health spending in the U.S. increased by 4.1% in 2022

Competitive Landscape

The major players operating in the pharmacy benefit management market include as CVS Health, Cigna Group, OptumRx Inc, Anthem Inc, Centene Corporation, Abarca Health LLC., Medimpact, Elixir Rx Solutions LLC, Express Scripts Holding Company, and SS&C Technologies, Inc. Other players in the market are Benecard Services, LLC, and CaptureRx Inc.

Recent Key Strategies and Developments

- In December 2023, CVS Health announced plans to launch CVS CostVantage with pharmacy benefit management services for their commercial payors in 2025 to ensure a smooth transition.

- In November 2023, OptumRx, Inc., the pharmacy benefits manager (PBM) operated by the healthcare company UnitedHealth, announced plans to move eight popular insulin products to preferred status on its standard formulary for commercially insured individuals in the U.S.

- In July 2023, CVS Caremark announced partnership with the discount drug service provider GoodRx to reduce out-of-pocket prescription costs for millions of people.

- In April 2023, Cigna’s pharmacy benefit management (PBM) unit announced the launch of a new pricing plan that will comprise of precise information on rebates as pharmacy middlemen are under increased scrutiny by the U.S. lawmakers for their opaque drug pricing practices.

- In October 2022, Cigna’s pharmacy benefit management business, Express Scripts, entered in a new strategic collaboration with Centene Corporation to increase the affordability and accessibility of prescription medications for consumers.

- In January 2022, Centene Corporation acquired Magellan Health, Inc. provided whole-health, integrated healthcare solutions with better health outcomes at lower costs.

- In November 2021, Anthem, Inc. agreed to acquire Integra Managed Care to grow its Medicaid business and increase its network.

- In April 2021, CVS Caremark entered in a larger contract with the Government-wide Service Benefit Plan, allowing CVS Health to regain the specialty pharmacy business.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmacy benefit management market analysis from 2024 to 2033 to identify the prevailing pharmacy benefit management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pharmacy benefit management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pharmacy benefit management market trends, key players, market segments, application areas, and market growth strategies.

Pharmacy Benefit Management Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.0 Billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Service |

|

| By Business Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | SS&C Technologies, Inc, CVS Health, Elixir Rx Solutions LLC, Medimpact, OptumRx Inc, Abarca Health LLC, Anthem Inc, Express Scripts Holding Company, Centene Corporation, The Cigna Group |

The forecast period for Pharmacy Benefit Management Market is 2024-2033.

The global pharmacy benefit management market size was valued at $0.5 billion in 2023

The base year is 2023 in Pharmacy Benefit Management Market

The market value of Pharmacy Benefit Management Market is projected to reach $1.0 billion by 2033

Major key players that operate in the Pharmacy Benefit Management Market are CVS Health, Cigna Group, OptumRx Inc, Anthem Inc, Centene Corporation

Loading Table Of Content...