Photoacoustic Imaging Market Research, 2031

The global photoacoustic imaging market size was valued at $76 million in 2021, and is projected to reach $132.3 million by 2031, growing at a CAGR of 5.7% from 2022 to 2031. Photoacoustic imaging offers greater penetration than pure optical imaging and better resolution than pure ultrasonic imaging. Consequently, it is advancing diagnostic imaging in new directions. In photoacoustic imaging, biological tissues are exposed to laser pulses. Specific tissues absorb energy and transform it into heat, which produces an acoustic emission that can be detected by ultrasonic transducers. Due to photoacoustic effect, anything that absorbs light, such as RNA, DNA, lipid, blood, and melanin (the pigment in the skin), can produce an ultrasonic wave.

Photoacoustic imaging is one of the greatest methods for visualizing blood vessels and angiogenesis as blood absorbs light much more strongly than the surrounding tissues. The photoacoustic imaging products are available in imaging systems, software, contrast agents, transducers, and accessories used for diagnosis and examination purposes.

“The photoacoustic imaging market was hindered during the lockdown period owing to a decrease in demand for lasers, imaging systems, and transducers. In addition, decrease in surgical procedures for cancer and cardiovascular diseases due to strict limitations during pandemic this has led to decrease in adoption of photoacoustic imaging products and restrains the photoacoustic imaging market growth.”

Photoacoustic Imaging Market Dynamics

Rise in the technological advancements for the manufacturing of photoacoustic imaging devices owing to massive pool of health-conscious consumers, creates an opportunity for the photoacoustic imaging market share. For instance, in May 2022, FUJIFILM VisualSonics Inc. a part of FUJIFILM Holdings Corporation leader in ultra-high frequency ultrasound and photoacoustic imaging systems, has announced the launch of its product Vevo F2, the world’s first ultra-high to low frequency (71MHz-1MHz) ultrasound and photoacoustic imaging system for preclinical use. Rise in the product launch of photoacoustic imaging devices by the various key players across the globe is set to affect the market growth positively. The growth of the photoacoustic imaging market size is expected to be driven by high potential in untapped, emerging markets, due to availability of the improved healthcare infrastructure, increase in the unmet healthcare needs, and surge in the demand for advanced photoacoustic imaging systems.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries. The demand for photoacoustic imaging is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the photoacoustic imaging market share. Factors such as rise in adoption of lasers, transducers, and photoacoustic components and increase in awareness toward chronic diseases and its early diagnosis, further drive the growth of the market.

Moreover, the rise in consumer awareness related to preventive healthcare and ease of accessibility boost the adoption of photoacoustic imaging. In addition, an increase in promotional activities by manufacturers for photoacoustic imaging devices is expected to fuel the adoption of photoacoustic imaging devices in the near future. Furthermore, minimally invasive surgeries have a high success rate. Thus, patients globally prefer the minimally invasive photoacoustic imaging for the diagnosis and treatment, which, in turn, boosts the market growth.

In contrast, high cost associated with the photoacoustic imaging devices and these devices require the high-level training which led to negatively impact on the growth of the market. In addition, lack of awareness regarding chronic diseases and early diagnosis this has led to decreases the demand for photoacoustic imaging products in emerging countries such as India, China, and Japan and further hampers the growth of the market.

The COVID-19 has disrupted workflows in the health care sector globally. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global photoacoustic imaging market experienced a decline in 2021 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries such as medical devices and supplies, healthcare, and industrial. However, the market is anticipated to witness recovery in 2021, and show stable growth for photoacoustic imaging market in the coming future. This is attributed to the increase in the prevalence of chronic diseases.

Photoacoustic Imaging Market Segmental Overview

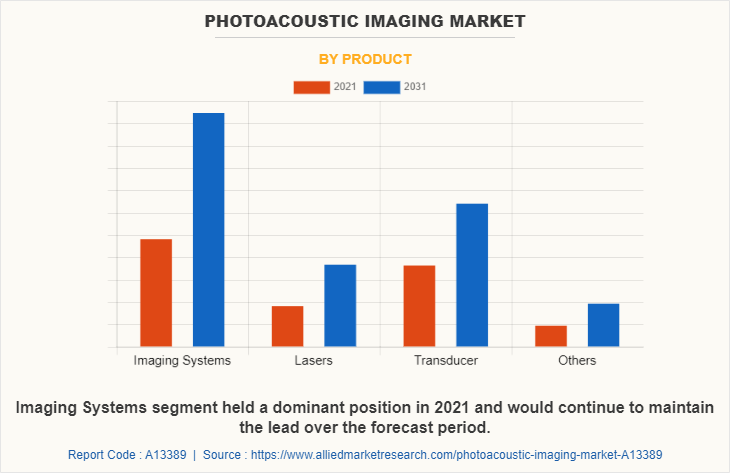

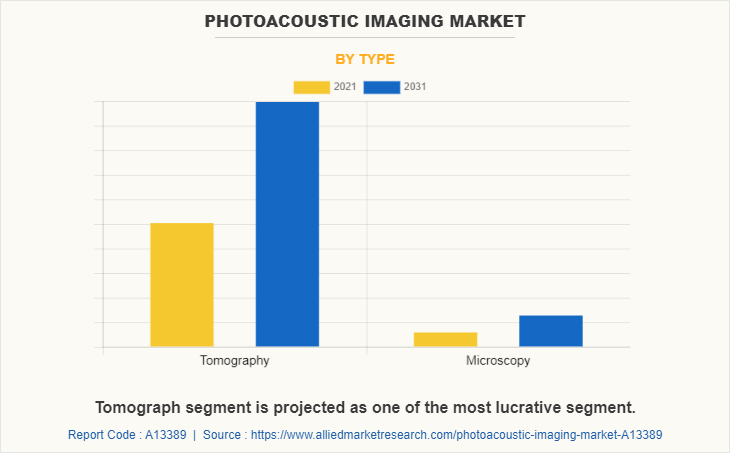

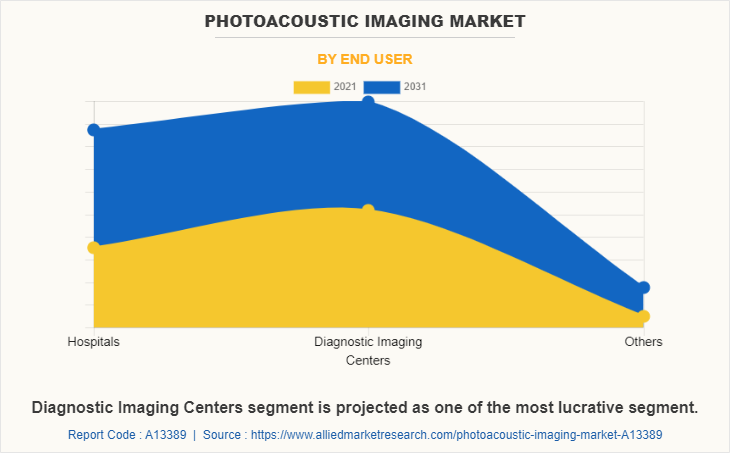

The photoacoustic imaging market is segmented into product, type, end user, and region. On the basis of product, the market is categorized into imaging systems, lasers, transducer, and others. On the basis of type, the market is segregated into tomography and microscopy. On the basis of end user, the market is classified into the hospitals, diagnostic imaging centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product

By product the market is segmented into imaging systems, lasers, transducer, and others. The imaging systems segment dominated the global market in 2021 and is expected to remain dominant throughout the photoacoustic imaging market forecast period, owing to increase in demand for advanced imaging devices and the rise in frequency of research activities.

By Type

By type photoacoustic imaging industry is segregated into tomography and microscopy. The tomography segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to advanced features in photoacoustic imaging tomography (PAT) in terms of spatial resolution, frame rates, and detection sensitivity.

By End User

By end user the photoacoustic imaging industry is classified into hospitals, diagnostic imaging centers, and others. The diagnostic imaging centers segment held the largest market share in 2021. This was attributed to well-equipped infrastructure, rise in patient admission for diagnosis, and adoption of technologically advanced biomedical photoacoustic imaging devices. However, hospitals segment is expected to register highest CAGR during the forecast period. This is attributed to increase in patient’s preference toward hospitals as it safely provides treatment under the observation of skilled physicians.

By Region

By region the photoacoustic imaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the photoacoustic imaging market in 2021 and is expected to maintain its dominance during the forecast period.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of medical devices manufacturing companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, the rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of imaging systems, drive the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the photoacoustic imaging market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region. In addition, the rise in contract manufacturing organizations within the region provides a great opportunity for new entrants in this region.

Competitive Analysis

Competitive analysis and profiles of the major players in the photoacoustic imaging in biomedicine, such as EKSPLA, FUJIFILM Holdings Corporation, illumiSonics Inc., InnoLas Laser GmbH, iTheraMedical, OPOTEK LLC, Photosound Technologies Inc, Seno Medical, TomoWave Laboratories, Inc., and Verasonics, Inc. are provided in this report.

Presence of several major players, such as illumiSonics Inc., Photosound Technologies Inc., OPOTEK LLC, TomoWave Laboratories, Inc. Verasonics, Inc., and Seno Medical and advancement in manufacturing technology of biomedical photoacoustic imaging in the region drive the growth of the market. In addition, the rise in demand for photoacoustic imaging devices is due to an increase in people's concern for maintaining a healthy lifestyle and continuous growth in the geriatric population. Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of advanced photoacoustic imaging is expected to drive the market growth. Furthermore, product launch, mergers, partnership, and product upgradation adopted by the key players in this region boost the growth of the market. For instance, in June 2022, Seno Medical’s Imagio Breast Imaging System, a revolutionary new modality in breast imaging, has received supplemental premarket approval (PMA) from the Center for Devices and Radiological Health (CDRH) of the US Food & Drug Administration (FDA)

Some Examples of Product Launches in The Market

In April 2020, Ekspla introduced a new high-energy laser source version for photoacoustic imaging applications. This PhotoSonus+ photoacoustic imaging laser source includes a high energy Q-switched laser, parametric oscillator, power supply, and cooling unit, all of which are incorporated into a single strong cart-type housing for mobility, usability, and minimal maintenance costs.

In May 2022, FUJIFILM VisualSonics Inc. a part of FUJIFILM Holdings Corporation leader in ultra-high frequency ultrasound and photoacoustic imaging systems, has announced the launch of its product Vevo F2, the world’s first ultra-high to low frequency (71MHz-1MHz) ultrasound and photoacoustic imaging in biomedicine for preclinical use.

Partnership in The Market

In January 2021, EKSPLA announced the partnership with Opton Laser International (OLI), a France based leading distributor of lasers and photonic products. This acquisition will help in selling and distributing all EKSPLA products, excluding fiber lasers.

FUJIFILM VisualSonics Inc, a part of FUJIFILM Holdings Corporation announced the partnership with PIUR IMAGING, the European leader in tomographic ultrasound imaging to bring UHF, three-dimensional (3D) ultrasound imaging technology for clinicians and researchers.

Product Approval

In June 2022, Seno Medical received the supplemental FDA premarket approval (PMA from the Center for Devices and Radiological Health (CDRH) of the U.S. Food & Drug Administration (FDA) to its product Imagio Breast Imaging System, a revolutionary new modality in breast imaging.

In January 2021, the Center for Devices and Radiological Health (CDRH) of the U.S. Food & Drug Administration (FDA) has granted the Seno Medical premarket approval (PMA) for its product diagnostic breast cancer imaging technology that helps physicians better differentiate between benign and malignant breast lesions.

Product Upgradation

In October 2021, iThera Medical announced the launch of its new inVision TRIO preclinical optoacoustic imaging system. The upgradation in this product is 3 imaging modes in 1 system. The inVision TRIO is the first imaging system in the world to include transmission ultrasonic computed tomography (TUCT), which expands the range of biological applications that may be covered by systems for optoacoustic imaging developed by iThera Medical.

Ekspla updated its range of high-energy tunable wavelength lasers. These tunable nanosecond lasers are now even more adaptable and can adjust to certain applications and/or requirements due to a variety of options and model updates. The two primary high-energy tunable laser series, the NT340 and NT350, have had major enhancements accomplished.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the photoacoustic imaging market analysis from 2021 to 2031 to identify the prevailing photoacoustic imaging market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the photoacoustic imaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global photoacoustic imaging market trends, key players, market segments, application areas, and market growth strategies.

Photoacoustic Imaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 132.3 million |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Product |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | InnoLas Laser GmbH, Photosound Technologies Inc., FUJIFILM Holdings Corporation, OPOTEK LLC, Verasonics, Inc., TomoWave Laboratories, Inc., iThera Medical GmbH, EKSPLA, Seno Medical Instruments, Inc., illumiSonics Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the global photoacoustic imaging market. The global photoacoustic imaging market is expected to exhibit high growth potential attributable to factors such as rise in the demand for minimally invasive surgical procedures. Moreover, favorable FDA approvals and reimbursement policies pertaining to photoacoustic imaging devices in develop courtiers such as the U.S. and Germany drive growth of the global photoacoustic imaging market.?

Photoacoustic imaging is used in clinical research and management of patients with cancer. There are several advantages associated with photoacoustic imaging such as greater sensitivity for the detection of specific probes, without any exogenous molecular imaging agents to detect tissue oxygenation, and less image noise.

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to a rise in knowledge about advanced devices which are expected to boost the demand for photoacoustic imaging in this region. However, Asia-Pacific is expected to register the fastest CAGR during the forecast period due to a rise in demand for minimally invasive surgical procedures and development of healthcare infrastructure.

Increase in incidences of chronic diseases, rise in product approval for imaging systems and rise in demand for minimally invasive procedures are the factors responsible for the market growth.

Oncology is the leading application of Photoacoustic Imaging Market.

North America is the largest regional market for Photoacoustic Imaging.

The market value of photoacoustic imaging market in 2031 is $132.33 million.

Top companies such as FUJIFILM Holdings Corporation, EKSPLA, Verasonics, Inc., OPOTEK LLC, and InnoLas Laser GmbH held high market share in 2021.

The total market value of photoacoustic imaging market is $75.98 million in 2021.

The forecast period for photoacoustic imaging market is 2022 to 2031.

Loading Table Of Content...