Physical Security Market Overview

The global physical security market size was valued at USD 104.6 billion in 2020, and is projected to reach USD 192.9 billion by 2030, growing at a CAGR of 6.5% from 2021 to 2030. The increase in the number in terror attacks and rise in awareness regarding personal privacy and data security boost the growth of the global physical security market. In addition, growth in technological advancements also positively impacts the growth of the physical security industry. Furthermore, the surge in use of mobile devices and smartphones for various activities has led to upsurge in the consumer demand for seamless security experiences, furthre driving the growth of the market.

Key Market Trends & Insights

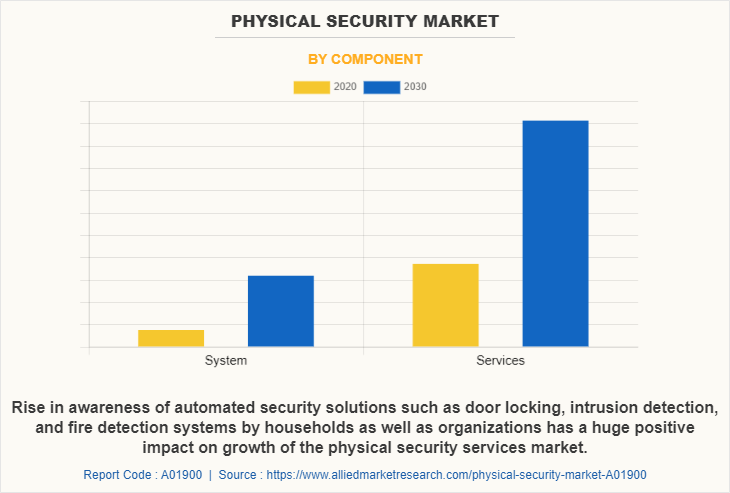

- By component, the service segment holds the largest market share during the forecast period.

- By industry vertical, BFSI segment is expected to witness growth at the highest rate during the forecast period.

- Region wise, Asia-Pacific is expected to witness significant growth during the forecast period.

Market Size & Forecast

- 2030 Projected Market Size: USD 192.9 Billion.

- 2020 Market Size: USD 104.6 Billion.

- Compound Annual Growth Rate (CAGR) (2021-2030): 6.5%.

- Asia-Pacific: Expected to witness highest growth during forecast period.

However, privacy concerns and lack of physical and logical security integration hamper the market growth. In addition, technological limitations in terms of accuracy, scalability, and reliability, can slow down the adoption of certain security systems, impeding the growth of the physical security market.

On the contrary, the rise in use of IoT devices offers a significant physical security market opportunities. By integrating sensors, cameras, and access control systems into a connected network, businesses enable real-time monitoring, improved situational awareness, and enhanced security management. Smart security solutions are gaining popularity, providing features like remote monitoring and predictive maintenance. In addition, the integration of AI and machine learning provides enhance physical security by automating threat detection, improving footage analysis, and providing predictive analytics, offering remunerative opportunities for the physical security market growth. Furthermore, cloud technology enables remote storage and management of security data, simplifying system scaling, ensuring redundancy, and enhancing data access.

For instance, on March 17, 2025, Hexagon introduced a new portfolio of physical security solutions to help organizations protect their facilities and assets. This suite included advanced video surveillance, intelligent access control, and real-time monitoring systems for enhanced situational awareness and rapid threat response. The solutions integrated cutting-edge sensors, cloud platforms, and AI-powered analytics for a unified, scalable approach to security management. Hexagon's launch aimed to streamline security operations, delivering actionable insights and optimizing efficiency, reinforcing their leadership in digital transformation and commitment to managing physical security risks effectively.

For instance, on Aug 13, 2024, Rhombus partnered with Convergint to enhance their security solutions. Convergint, with over 10,000 colleagues and 220 locations, brought significant expertise. Rhombus secured $71 million in 2024, expanding their offerings, including cameras, access control, IoT sensors, and integrations. Omar Khan, COO of Rhombus, emphasized their mutual dedication to innovative, scalable security solutions.

Moreover, the incorporation of digital and physical security systems enhances cybersecurity solutions, protecting critical infrastructure such as power plants, transportation hubs, and data centers. In addition, the increase in remote work and demand for flexible security solutions create opportunities for managed security services (MSS). These services offer 24/7 protection through remote monitoring, video surveillance, and alarm response, eliminating the need for on-site personnel. Furthermore, the surge in emerging economies in Asia-Pacific, Africa, and Latin America due to rise in the urbanization and industrialization in these regions are driving demand for advanced security systems. This presents a significant opportunity for companies operating in the physical security services market, as they now have access to a large and expanding customer base in these rapidly developing regions. Moreover, the upsurge in the mergers, acquisitions, and partnerships enable companies to enhance capabilities, diversify product portfolios, and strengthen market presence, boosting their competitive edge. This trend is helping to boost their competitive edge, which in turn drives further growth in the physical security services market, offering lucrative opportunities for the growth of the market.

For instance, on December 12, 2024, DeNexus expanded its DeRISK solution to include physical security for data centers, providing a framework for justifying investments in physical and cybersecurity. The new capability modeled physical-to-cyber risk, helping security leaders understand exposures, estimate financial losses, and plan risk mitigation. With AI driving data center growth, DeNexus emphasized the importance of integrated physical and cyber security.

Physical security measures are designed to protect buildings and safeguard the equipment inside. In short, they keep unwanted people out and give access to authorized individuals. While network and cybersecurity are important, preventing physical security breaches and threats is the key to keeping the technology and data safe, as well as any staff or faculty that have access to the building. It provides safety from natural disasters, fire, theft, vandalism, and terrorism. It includes multiple layers containing interdependent systems, including security guards, CCTV surveillance, locks, protective barriers, access control protocols, and other similar techniques.

Physical Security Market Segment Review:

The physical security market is segmented on the basis of component, system type, service type, enterprise size, industry vertical, and geography. On the basis of component, it is classified into system, and services. On the basis of systems type, it is bifurcated into physical access system, video surveillance system, perimeter intrusion and detection, physical security information management, and others. On the basis of service type, it is segregated into access control as a service, video surveillance as a service, remote monitoring services, security system integration services, and others. On the basis of enterprise size, it is categorized into large enterprises, and SMEs. On the basis of industry vertical, it is divided into BFSI, government, retail, transportation, residential, IT and Telecom, and others. On the basis of region, the physical security market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the service segment holds the largest physical security market share and is expected to grow at the highest rate during the forecast period, owing to the rise in awareness of automated security solutions, such as door locking, intrusion detection, and fire detection systems by households and organizations had a huge positive impact on the physical security services market.

Region-wise, the physical security industry was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to rise in adoption of physical security solutions in critical infrastructures, such as chemical industries, nuclear plants, and oil & gas facilities across North America. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to high demand for physical security solutions and growth incidences of terror attacks, particularly in Iraq, Pakistan, Afghanistan, India, and others have necessitated the heavy adoption of physical security solutions in the region. These factors are expected to drive the physical security market growth in the Asia-Pacific region.

For instance, on March 12, 2025, Quanergy Solutions partnered with Netsocs to enhance security and operational intelligence using Quanergy's 3D LiDAR sensors and Netsocs' management platform. This collaboration allowed flexible deployment options and transformed investments into operational expenses (OPEX). Gerald Becker from Quanergy and Carlos Jimenez from Netsocs highlighted the partnership's benefits in delivering real-time analytics and improving decision-making and efficiency.

For instance, on January 24, 2025, Hanwha Vision launched its Wisenet Access Control System, integrating access management with video surveillance. The system included door controllers, readers, and software, working with Wisenet Wave and SSM for real-time control and monitoring. Operators managed access points remotely, viewed live video feeds, and used an intuitive interface for quick actions. Event overlays and bookmarks enhanced situational awareness and investigation.

What are the Top Impacting Factors in the Market

Surge in Terror Attacks

Governments of various countries have increased their spendings on physical security due to rise in terrorism and increase in security concerns, globally. Key government institutions, such as embassies, parliaments, courts, and government offices focus on installing advanced video surveillance and access control systems. Newer technologies, such as drones, smart fence sensors, and mass notification systems (MNS) are used for surveillance at major events or assemblies in tier I cities.

Moreover, several government agencies have implemented strict policies and guidelines for the installation of physical security systems. For instance, the U.S. Government enacted various laws, regulations, and industry guidelines, such as Federal Information Security Act of 2002, Payment Card Industry Data Security Standard (PCI DSS), Privacy Act (5 U.S.C. 552a), and Integrated Physical Security Standards & Procedures (IPSSP) for security requirements. This helps to boost the physical security software market towards growth.

Increase in Awareness for Physical Security

- The household and organizational awareness about physical security solutions has increased over the years, owing to increase in theft and robberies. Automated home security solutions for door locking, intruder detection, fire detection, and LPG gas leakage detection witnessed a significant growth. This is due to quick adoption of security systems in the premises of stakeholders to protect their assets, belongings, and human capital from any kind of threat or unauthorized access. These factors are anticipated to fuel the physical security market growth during the forecast period.

Key Physical Security Companies

The following are the leading companies in the physical security market. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the physical security market.

ADT Inc.

BAE Systems

Cisco system Inc.

Genetec Inc.

HONEYWELL INTERNATIONAL, INC.

Johnson Controls

PELCO Corporation

Robert Bosch GmbH

STANLEY CONVERGENT SECURITY SOLUTIONS, INC.

Senstar Corporation.

What are the Most Recent Product Launches in the Physical Security market

On Jan 16, 2025, Spot AI launched its Remote Security Agent, combining contextual awareness with automated deterrence to address rising retail crime and property theft. Building on its November 2024 Video AI Agents launch, this new solution offers retailers a more effective approach by integrating hardware with AI agents.

Nov 20, 2024, HiveWatch announced a breakthrough in enterprise security operations using Anthropic's Claude AI technology to transform traditional security monitoring into strategic intelligence operations. The new HiveWatch® AI Operator used Claude's advanced capabilities to filter and contextualize security alerts, reducing false alarms and spotting complex threats. It was customizable based on Standard Operating Procedures (SOPs) and could acknowledge, analyze, escalate, and respond to alarms in real time, while maintaining meticulous incident records.

On February 19, 2025, Verkada announced a $200 million Series E funding round led by General Catalyst, valuing the company at $4.5 billion. Founded in 2016, Verkada has raised over $700 million. Its six product lines include video security cameras, access control, environmental sensors, alarms, workplace, and intercoms, all integrated into a cloud-based platform. The new funding will enhance AI capabilities and expand its security platform.

The report focuses on growth prospects, restraints, and trends of the blockchain in insurance outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, in the physical security market.

Government Regulations:

The physical security industry is anticipated to experience a substantial surge in demand, driven by the advancement of cutting-edge technologies like AI, biometrics, and the Internet of Things (IoT). However, this market expansion also necessitates the establishment of regulatory frameworks and government regulations. Key barriers to achieve the goals of growth in the physical security sector include cost-related issues, regional disparities, and varying political and commercial dynamics that affect implementation. Furthermore, there are regulatory challenges concerning the safeguarding of data produced by security systems, encompassing everything from surveillance videos to access control records.

Government regulations are pivotal in ensuring the security and privacy of individuals while utilizing advanced physical security systems. These regulations focus on preventing unauthorized access to sensitive data and ensuring that surveillance practices do not infringe on privacy rights. Strict rules are set around data storage, access, and sharing, particularly in industries dealing with sensitive information such as government, finance, and defense sectors.

Market Trends Insights:

The physical security market is expected to witness several noteworthy trends in the market. One of the significant trends in the market is the use of biometric security systems, like facial recognition, fingerprint scanning, and retina scans for access control and identity verification, which provides high security than traditional methods (e.g., PINs, passwords) and are more hygienic and convenient. In addition, there is shift in preference toward the integration of mobile devices with physical access control systems, offering greater convenience for unlocking doors and accessing restricted areas. Furthermore, mobile apps for security monitoring and incident management provide real-time alerts and control from anywhere. In addition, drones and robotic security solutions are gaining traction for perimeter security and surveillance. Drones provide real-time footage of large areas, especially hard-to-reach spots, while robotic patrols in places like warehouses and parking lots enhance security and reduce human error. These advancements are part of the rising demand for smart security solutions, which integrate cutting-edge technology to improve efficiency and effectiveness.

Another notable trend in the physical security market is the integration of cybersecurity with physical security systems. Cyber-physical security ensures both physical systems (e.g., cameras, access control) and digital systems (e.g., network infrastructure) are protected from attacks. As devices become more connected, securing them from cyberattacks is essential to prevent disruptions and data breaches. In addition, there is rise of smart buildings and smart cities driving demand for integrated physical security solutions. These systems connect various building management and security components (e.g., lighting, HVAC, access control, video surveillance) to a central platform for centralized control and management. Security in these environments is more proactive, data-driven, and efficient, with predictive analytics identifying potential risks before they become serious issues. Furthermore, there is increase in the adoption of remote monitoring and managed security services (MSS) to reduce costs and enhance security efficiency. Remote monitoring provides 24/7 surveillance and incident management across multiple sites without physical presence. MSS offers end-to-end solutions, appealing to small and medium-sized (SMEs) businesses.

For instance, on February 20, 2025, Gallagher Security and ADT celebrated 25 years of partnership, highlighting their successful collaboration in the security sector. Known for access control and perimeter security, Gallagher and ADT have worked on various projects, starting with a mining project in Queensland. In 2023, ADT became the first Premium Partner for Gallagher's SMB cloud-based access control solution, supporting over 140 joint customers in Australia.

Another significant trend is the rise of intrusion detection and prevention systems. These systems, often integrated with other security measures, provide proactive surveillance to prevent unauthorized access and respond to potential threats. Intrusion detection systems (IDS) can identify suspicious activities and alert security personnel in real time, enhancing the overall security posture of businesses and facilities. This is expecte to drive the physical security market growth in the upcoming years.

Regional Insights:

The physical security market is expanding globally due to the increasing need for protecting assets, infrastructure, and people from security threats. This growth is fueled by rising concerns over terrorism, theft, and other criminal activities, as well as advancements in security technologies. The major regions influencing the market include North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

North America physical security market leads the global physical security market, driven by significant investments in security solutions for public safety and critical infrastructure. The U.S. dominates the region, with a focus on advanced security systems for government buildings, airports, and data centers. Increasing incidents of workplace violence and school shootings have also led to higher demand for physical security solutions, such as surveillance systems and access control technologies. Additionally, Canada contributes to market growth with its emphasis on securing transportation and energy infrastructure.

Europe physical security market is another key region for the physical security market, with countries like the UK, Germany, and France at the forefront. The rising number of terrorist attacks in the past decade has driven European governments to invest heavily in security measures for public spaces, transportation hubs, and critical infrastructure. Moreover, the increasing adoption of smart city initiatives and urban surveillance systems is boosting the demand for advanced physical security solutions in the region.

Asia-Pacific physical security market is witnessing significant growth in the physical security market, driven by rapid urbanization, infrastructure development, and increasing concerns over crime and terrorism. Countries like China, India, and Japan are key contributors. China, in particular, has invested heavily in large-scale surveillance systems and facial recognition technologies to monitor public spaces and reduce crime rates. India is also adopting physical security technologies for its smart city projects and critical infrastructure protection.

Latin America and the Middle East & Africa physical security market are gradually adopting advanced physical security solutions. In Latin America, Brazil and Mexico are seeing rising demand due to increasing crime rates and the need to secure public spaces. In the Middle East, the UAE and Saudi Arabia are investing in physical security systems to protect vital assets such as airports, oil and gas infrastructure, and commercial buildings, driven by both security concerns and the ongoing push toward modernization.

What Strategic Partnerships have Recently Emerged in the Industry

August 2023: The U.S. Department of Homeland Security announced new investments in physical security measures at major airports, including advanced screening systems and facial recognition technology for passenger safety.

July 2023: Axis Communications, a leader in network video, launched new high-resolution thermal cameras to enhance perimeter protection for critical infrastructure, targeting markets in North America and Europe.

June 2023: Hikvision, a leading global provider of security products, announced the introduction of AI-powered surveillance systems in India, aimed at improving public safety and supporting the country’s smart city initiatives.

April 2023: Bosch Security Systems expanded its portfolio in Europe by launching an intelligent video surveillance solution equipped with machine learning to optimize security in crowded public areas like train stations and airports.

What are the Key Benefits for Stakeholders:

The study provides an in-depth analysis of the global physical security market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global physical security market trends, physical security market analysis is provided in the report.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quantitative analysis of the market from 2021 to 2030 is provided to determine the physical security software market potential.

Physical Security Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Systems Type |

|

| By Service Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | HONEYWELL INTERNATIONAL, INC., Cisco system Inc., Senstar Corporation, Genetec Inc., PELCO Corporation, BAE Systems plc, Johnson Controls, Robert Bosch GmbH, STANLEY CONVERGENT SECURITY SOLUTIONS, INC., ADT CORPORATION |

Analyst Review

The advent of Internet of Things (IOT) has transformed the outlook of the global physical security market. Physical security comprises three essential elements, such as access control, surveillance, and testing. The physical sites are secured against attacks, accidents, or environmental disasters using locks, fencing, biometric access control systems, access control cards, and fire suppression systems. Physical locations are monitored by surveillance cameras and notification systems, including heat sensors, intrusion detection sensors, and smoke detectors. Disaster recovery procedures and policies require periodic scrutiny to ensure better safety and reduce the time taken for recovering from disasters.

Key providers of the physical security market, such as Robert Bosch GmbH, Cisco system Inc. and Honeywell International, Inc. account for a significant share in the market. With the growing requirement for edge analytical software, various companies invest in the R&D initiatives to enhance their capabilities. For instance, in September 2021, Robert Bosch GmbH and Capgemini entered into a strategic collaboration to focus on the consistent expansion of Bosch Connected Industry’s Nexeed Industrial Application System and strengthen client activities. The collaboration between two leading providers of Industry 4.0 software and services helps to create a broad range of offerings, from which industrial companies in particular are expected to benefit in the digitization and sustainability of their production plants.

In addition, in October 2021, Cisco System Inc. announced its partnership with COP26. With the goal of increasing inclusivity and supporting resilience, Cisco is expected to provide the technology to securely connect both, those on-site and permitted registered delegates who are unable to be onsite, through Webex. By partnering with the UK Government, legislate for Webex is expected to support COP26 as crucial negotiations take place between world leaders.

Furthermore, with further growing in investment globally, looking at the increase in demand for physical security, various companies are expanding their current capabilities by adopting the product launch strategy with increasing diversification among customers. For instance, in November 2021, Honeywell International, Inc. launched a Pro-Watch 5.5, the latest iteration of its Pro-Watch Integrated Security Suite. The Honeywell Pro-Watch Integrated Security Suite is a software platform designed for enterprise and critical infrastructure markets to help protect people and property, optimize productivity, and ensure compliance with industry regulations, all while helping to reduce operational costs.

The global physical security market size was valued at USD 104.6 billion in 2020, and is projected to reach USD 192.9 billion by 2030

The global physical security market is projected to grow at a compound annual growth rate of 6.5% from 2020-2030 to reach USD 192.9 billion by 2030

The key players that operate in the physical security industry are ADT Inc., BAE Systems, Cisco system Inc., Genetec Inc., HONEYWELL INTERNATIONAL, INC., Johnson Controls, PELCO Corporation, Robert Bosch GmbH, STANLEY CONVERGENT SECURITY SOLUTIONS, INC., and Senstar Corporation.

Region-wise, the physical security industry was dominated by North America in 2020, and is expected to retain its position during the forecast period.

Growth in the number in terror attacks and rise in awareness boost the growth of the global physical security market. In addition, growth in technological advancements also positively impacts the growth of the physical security market.

Loading Table Of Content...