PIN Diode Market Research, 2032

The Global PIN Diode Market was valued at $2.7 billion in 2023 and is projected to reach $4.3 billion by 2032, growing at a CAGR of 5.6% from 2024 to 2032.

A PIN diode is a type of semiconductor diode with a wide, undoped intrinsic semiconductor region sandwiched between a p-type semiconductor and a n-type semiconductor. This structure distinguishes it from a regular p-n junction diode. The wide intrinsic layer makes the PIN diode an efficient RF switch, photodetector, and high-voltage rectifier due to its ability to handle large electric fields and high power. Widely used in RF and microwave applications, optical communication systems, and high-frequency switching circuits, a PIN diode offers fast response times, low capacitance, and high-frequency performance. Its efficiency under high-frequency conditions and capability to manage high voltage and current levels make it a crucial component in various electronic and communication systems.

Key Takeaways

- By type, the RF PIN diode segment dominated the PIN diode market size in terms of revenue in 2023 and is anticipated to grow at a high CAGR during the forecast period.

- By application, the RF switch segment dominated the PIN diode market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

- Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

- On May 15, 2024, the U.S. Department of Defense (DoD) announced a multi-million-dollar investment in R&D for PIN diodes. This initiative aims to enhance the performance and reliability of PIN diodes for use in military radar, communication, and electronic warfare systems. The DoD recognizes the critical role of PIN diodes in modern defense technologies and seeks to strengthen the domestic supply chain for these components.

- On May 10, 2024, the Chinese Ministry of Industry and Information Technology (MIIT) unveiled a comprehensive semiconductor development plan, including a focus on PIN diode technology. The plan outlines investments in research, manufacturing, and talent development to boost domestic PIN diode production capabilities. This initiative reflects China's commitment to becoming a global leader in semiconductor technology and reducing reliance on foreign suppliers.

- On May 5, 2024, the German Federal Ministry of Education and Research (BMBF) launched a new initiative to develop next-generation PIN diodes for high-frequency and high-power applications. The initiative is expected to fund research projects at universities and research institutions across the country, focusing on novel materials, designs, and fabrication techniques. This investment in PIN diode technology underscores Germany's commitment to maintaining its position as a leader in electronics and telecommunications.

- On May 1, 2024, the Indian Ministry of Electronics and Information Technology (MeitY) announced a series of incentives for domestic PIN diode manufacturers. This includes financial support for research and development, tax breaks, and streamlined regulatory processes. The initiative aims to boost domestic production of PIN diodes and reduce India's dependence on imports. MeitY believes that fostering a strong PIN diode manufacturing ecosystem will benefit various sectors, including telecommunications, aerospace, and defense.

Key Market Dynamics

The PIN diode industry is experiencing significant growth driven by a rise in demand for high-frequency and high-speed communication systems. The expansion of 5G networks and advancements in wireless communication technologies are major drivers, as PIN diodes are crucial components in RF switches, attenuators, and limiters required for these applications. Moreover, the growing adoption of optical communication systems, including fiber optics, boosts the demand for PIN photodiodes due to their high-speed response and efficiency in detecting light signals. In addition, the rise in the need for advanced radar and electronic warfare systems in the defense and aerospace sectors further propels the market growth.

However, the market faces challenges such as the high cost of manufacturing PIN diodes due to their complex fabrication process. Competition from alternative technologies, like varactor diodes and Schottky diodes, also poses a restraint. Despite these challenges, the increasing investments in research and development to enhance the performance and reduce the cost of PIN diodes present significant growth opportunities for the market. Furthermore, the expanding applications of PIN diodes in renewable energy systems, such as solar inverters, and the growing focus on energy-efficient electronic devices are expected to fuel future market growth.

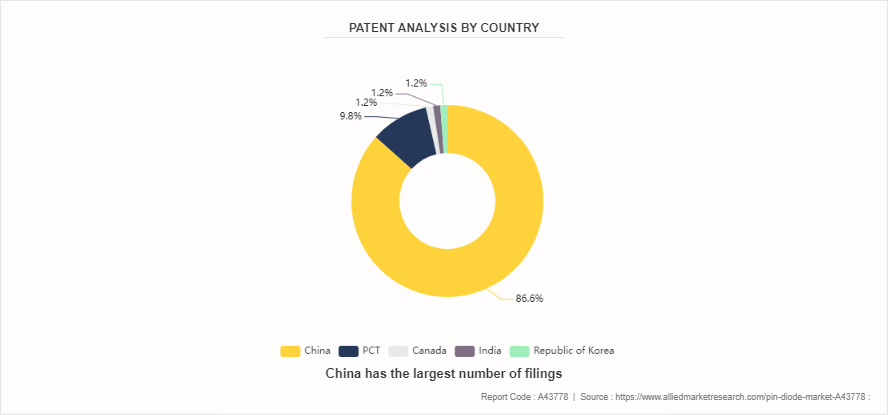

Patent Analysis of the Global PIN Diode Market

The global PIN Diode industry report is segmented according to the patents filed in China, PCT, Canada the Republic of Korea, and India. China has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries.

Market Segmentation

The PIN diode market analysis is segmented into type, application, and region. On the basis of the type, the market is divided into RF PIN diode, PIN photodiode, PIN switch diode, and others. By application, the PIN diode market is segmented into RF switches, photodetectors, high-voltage rectifiers, attenuators, RF limiters, and others. Region-wise, the PIN diode market data is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Market Segment Outlook

The RF PIN diode segment emerged as the dominant segment in the PIN diode market in 2023 due to its crucial role in high-frequency applications across various industries. RF PIN diodes are prized for their ability to handle high-power RF signals with minimal distortion, making them indispensable in telecommunications infrastructure, radar systems, and satellite communications. As global demand for faster data transmission and enhanced connectivity continues to surge, RF PIN diodes are increasingly deployed in wireless communication networks, including 5G technology, where they facilitate efficient signal reception and transmission. Moreover, their use in medical equipment for MRI machines and in automotive radar systems underscores their versatility and reliability. These factors collectively drive substantial revenue for the RF PIN diode segment and are expected to dominate the market during the forecast period.

The RF switch segment asserted its dominance in the PIN diode market in 2023 primarily due to the increasing demand for efficient signal routing and management in electronic devices. RF switches play a pivotal role in directing signals between antennas, amplifiers, and other components in wireless communication systems, ensuring optimal signal strength and fidelity. With the proliferation of smartphones, tablets, and IoT devices, there is a growing need for compact, high-performance RF switches that can handle complex signal paths without compromising speed or reliability. In addition, advancements in mobile and wireless technologies drive continuous innovation in RF switch design, catering to the evolving requirements of consumer electronics and telecommunications infrastructure. These factors contribute to the RF switch segment's substantial revenue generation in the PIN diode market, underscoring its critical role in modern communication ecosystems.

Regional/Country Market Outlook

In 2023, Asia-Pacific emerged as the leading revenue generator in the PIN diode industry, due to robust economic growth, coupled with rapid industrialization and urbanization, fostering significant demand for semiconductor components and electronic devices in this region. Asia-Pacific houses major manufacturing hubs for consumer electronics, telecommunications equipment, and automotive electronics, driving substantial sales volumes and revenue. Moreover, government initiatives aimed at promoting digital infrastructure and expanding internet connectivity further stimulate market growth in sectors such as telecommunications and IT services. Also, Asia-Pacific's large population and increasing disposable incomes fuel consumer demand for electronic gadgets, reinforcing the region's position as a pivotal market for semiconductors and electronic components.

Competitive Landscape

The PIN Diode Company List in the report includes MACOM Technology Solutions, Vishay Intertechnology, Infineon Technologies, Broadcom, NXP Semiconductors, ROHM Semiconductor, ON Semiconductor, Qorvo, Renesas Electronics, and Skyworks Solutions. Other top PIN diode market companies analyzed include Microsemi, Analog Devices, and others.

Recent Key Strategies and Developments

- On March 20, 2024, MACOM announced a strategic partnership with a leading aerospace and defense contractor to develop custom PIN diode solutions for next-generation radar systems. This collaboration is set to leverage MACOM's expertise in high-performance PIN diodes and the contractor's system-level knowledge to create advanced radar technologies with enhanced detection and tracking capabilities.

- On January 25, 2024, Infineon Technologies reported significant growth in its PIN diode business, driven by an increase in demand from the automotive and industrial sectors. The company attributed this growth to its focus on developing innovative PIN diode solutions that address the evolving needs of these markets, such as higher efficiency, reliability, and integration.

- On December 18, 2023, Broadcom (formerly Avago Technologies) announced a major investment in its PIN diode manufacturing facilities to expand production capacity and meet the growing demand for these components. This investment is expected to enable Broadcom to deliver PIN diodes to a wider range of customers in various industries, including telecommunications, aerospace, and defense.

- On October 30, 2023, ROHM Semiconductor introduced a series of low-capacitance PIN diodes designed for high-frequency applications such as wireless communication and radar systems. These diodes feature reduced parasitic capacitance, which improves their high-frequency performance and allows for more efficient circuit designs.

- On September 15, 2023, ON Semiconductor reported strong growth in its PIN diode product line, driven by demand from the automotive, industrial, and medical markets. The company highlighted its focus on developing PIN diodes with enhanced performance, reliability, and cost-effectiveness to meet the diverse needs of its customers.

Key Sources Referred

- Semiconductor Industry Association (SIA)

- SEMI.org

- IEEE Electron Devices Society (EDS)

- U.S. Department of Energy

- Global Semiconductor Alliance (GSA)

- World Economic Forum

- European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pin diode market

- PIN Diode market forecast from 2024 to 2032 to identify the prevailing pin diode market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the PIN diode market segmentation assists to determine the prevailing market opportunities.

- PIN Diode market size by Country and each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global PIN diode market trends, PIN Diode company list, market segments, PIN Diode market share by companies, PIN Diode sector analysis, application areas, PIN diode forward bias, PIN diode reverse bias, and market growth strategies.

PIN Diode Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.3 Billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2024 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Qorvo, NXP Semiconductors, MACOM Technology Solutions, Infineon Technologies, Broadcom, ROHM Semiconductor, Renesas Electronics, Skyworks Solutions, ON Semiconductor, Vishay Intertechnology |

The PIN diode market was valued at $2.7 billion in 2023 and is estimated to reach $4.3 billion by 2032, exhibiting a CAGR of 5.6% from 2024 to 2032.

Asia-Pacific emerged as the largest region in terms of revenue in the PIN diode market, owing to the presence of world's largest electronics manufacturing hubs, such as China, Japan, South Korea, and Taiwan, which significantly contribute to the production and consumption of PIN diodes. The robust growth of the semiconductor industry, coupled with substantial investments in telecommunications infrastructure, particularly with the rollout of 5G technology, has driven the demand for PIN diodes.

In terms of application, the RF switch segment led the market size in 2023, driven by the rapid expansion of telecommunications infrastructure and the necessity for efficient signal routing in advanced communication systems. The proliferation of wireless devices and the rising demand for high-speed data transmission underscored the importance of RF switches, thus propelling their market dominance. Additionally, the growth of 5G networks and the ongoing advancements in IoT technologies have furth

The global PIN diode market is experiencing growth driven by increasing demand in RF communication, automotive, and consumer electronics sectors. Key trends include advancements in 5G technology, rising applications in photodetectors, and growing adoption in switching and attenuating applications, particularly in defense and telecommunication industries.

The companies analyzed in the report include MACOM Technology Solutions, Vishay Intertechnology, Infineon Technologies, Broadcom, NXP Semiconductors, ROHM Semiconductor, ON Semiconductor, Qorvo, Renesas Electronics, and Skyworks Solutions. Other top PIN diode market companies analyzed include Microsemi, Analog Devices, and others.

Loading Table Of Content...