Pipe Coating Materials Market Research, 2033

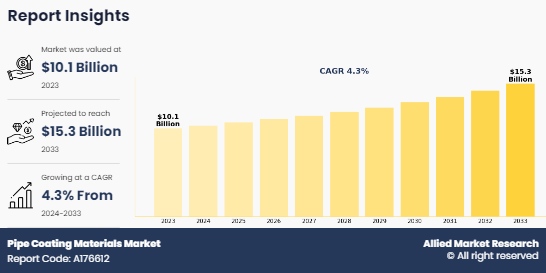

The global pipe coating materials market was valued at $10.1 billion in 2023, and is projected to reach $15.3 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033. The growth of the global pipe coating materials market is majorly driven by rise in demand for corrosion protection in oil and gas, and wastewater industries. Pipe coating materials play a crucial role by providing a protective barrier against corrosion, abrasion, and other forms of deterioration. However, surface preparation requirements are expected to pose a notable restraint in the pipe coating materials market during the forecast period. Advancements in smart coating technologies including self-sensing coatings and coatings with embedded sensors, are expected to provide lucrative opportunities in the pipe coating materials market during the forecast period.

Introduction

Pipe coating materials refer to a diverse range of substances applied to the exterior or interior surfaces of pipes to protect against corrosion, abrasion, chemical damage, and other forms of deterioration. These coatings serve a crucial role in various industries and applications, ensuring the longevity and integrity of pipelines used for transporting fluids, gases, or other substances. Pipe coating materials provide protection to the pipes against corrosion, abrasion, and other environmental factors, thereby extending their service life and ensuring the safety and integrity of the pipelines.

Polyethylene (PE) is a popular choice for pipe coating materials, particularly in applications where flexibility and impact resistance are essential. Polyethylene coatings are commonly used for buried pipelines in the oil and gas industry, water distribution systems, and sewage pipelines. The flexibility of polyethylene coatings allows them to withstand ground movement and stress from soil loads, making them ideal for underground installations. Moreover, polyethylene coatings offer excellent resistance to abrasion and chemicals, making them suitable for harsh operating environments.

Pipe coating materials play a crucial role in ensuring the integrity and longevity of water distribution networks. Polyethylene (PE) coatings are commonly used for both above-ground and buried water pipes due to their resistance to corrosion, chemicals, and abrasion. Concrete coatings provide additional mechanical protection for buried pipelines, preventing damage from soil pressure and water currents. Thermoplastic coatings such as polyvinyl chloride (PVC) and chlorinated polyvinyl chloride (CPVC) are employed for coating pipes and fittings in water treatment plants, offering chemical resistance and electrical insulation.

Pipe coating materials are essential for infrastructure development projects such as bridges, tunnels, and sewage systems. Fusion-bonded epoxy (FBE) coatings are commonly used for coating steel pipes and structural components, providing corrosion protection and durability. Concrete coatings offer mechanical protection for underground pipelines and sewage systems, preventing damage from soil pressure and water ingress. Polyethylene (PE) coatings are also used for water and sewer pipes, offering resistance to abrasion, chemicals, and environmental factors.

Key Takeaways

- The pipe coating materials industry market study covers data for a minimum of 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2024-2033).

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global pipe coating materials market and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The pipe coating materials market is highly fragmented with several players, including 3M, AkzoNobel, BASF SE, Arkema, PPG Industries, Inc., Axalta Coating Systems, LLC, Tenaris, The Sherwin-Williams Company, DENSO-Holding GmbH & Co. KG, and LyondellBasell Industries Holdings B.V. These players have adopted key developmental strategies such as acquisitions, product launches, mergers, and expansion to strengthen their foothold in the market.

Market Dynamics

The oil and gas pipelines are exposed to corrosive elements such as moisture, hydrogen sulfide, and carbon dioxide, which can lead to corrosion and structural degradation over time. Corrosion-related failures can result in costly leaks, environmental damage, and downtime. Therefore, the oil and gas industry invests heavily in corrosion protection measures, including the use of high-performance pipe coatings. These coatings act as a barrier between the pipeline surface and corrosive substances, extending the lifespan of the infrastructure and reducing maintenance costs.

In February 2022, Russia and Pakistan reached an agreement to construct a $2 billion gas pipeline, while India and Russia sealed a $40 billion deal for natural gas exports to India. These significant projects are anticipated to fuel growth in the pipe coating materials industry, offering promising opportunities for market players in the coming years.

In the wastewater industry, pipelines are used to transport sewage, industrial effluent, and stormwater from collection points to treatment facilities or disposal sites. These pipelines are exposed to aggressive chemicals, abrasive solids, and microbial activity, which can accelerate corrosion and deterioration.

In June 2022, China Everbright Water, specializing in water environment management, won the contract for expanding and upgrading the industrial wastewater treatment facility in ZhangdianEast Chemical Industry Park, located in Zibo City, Shandong Province. This project, operating under a BOT (Build-Operate-Transfer) model, aims to enhance the treatment capacity to approximately 5,000 m3 of industrial wastewater per day. Pipe coatings provide a protective barrier between the pipeline surface and corrosive substances, preventing direct contact and inhibiting corrosion in wastewater treatment.

Pipes have various types of contaminants on their surfaces, such as oil, grease, dirt, rust, or mill scale. Removing these contaminants thoroughly is essential to ensure proper adhesion of the coating. However, removing contaminants, especially from aged or heavily corroded pipes, can be challenging and may require specialized cleaning techniques or chemical treatments. Coating specifications often require surfaces to be free from visible contaminants and to meet specific cleanliness standards, such as those outlined by standards organizations like the Society for Protective Coatings (SSPC) or the International Organization for Standardization (ISO). Achieving these cleanliness standards can be difficult, particularly in field applications where environmental conditions may not be ideal.

Segments Overview

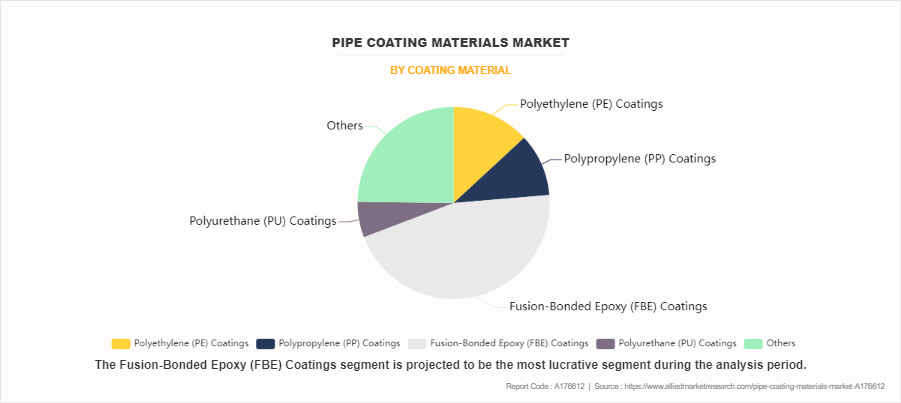

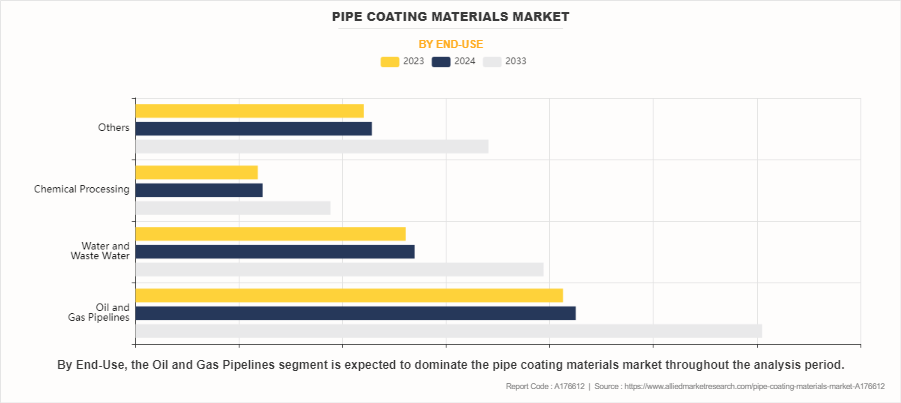

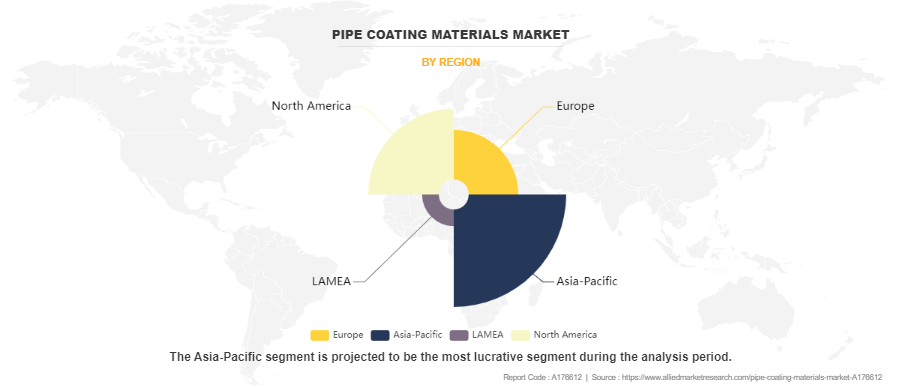

The global pipe coating materials market is segmented into coating material, end-use, and region. On the basis of coating material, the market is classified into polyethylene (PE) coatings, polypropylene (PP) coatings, fusion-bonded epoxy (FBE) coatings, polyurethane (PU) coatings, and others. On the basis of end use, the market is divided into oil and gas pipelines, water and wastewater, chemical processing, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of coating material, the fusion-bonded epoxy (FBE) coatings segment dominated the pipe coating materials market and accounting for more than one third of the market share in the market. FBE coatings are extensively used in the oil and gas industry for both onshore and offshore pipelines. These coatings protect pipelines from corrosion caused by the harsh environments they are exposed to, including soil, water, and chemicals. FBE coatings are applied to pipes used for transporting potable water, wastewater, and other fluids. They help prevent corrosion and maintain the integrity of the pipelines, ensuring safe delivery of water and efficient wastewater management In February 2021, IFS Coatings has launched a Fusion Bonded Epoxy powder coating for rebar that reportedly cures more quickly than standard formulations or at lower temperatures. The FBE powder will gel in 2-3 seconds and cure in only 12-15 seconds, depending on the temperature of the incoming bar.

On the basis of end use, the oil and gas pipelines segment dominated the pipe coating materials market accounting for more than one third of the market share. Pipe coatings is to prevent corrosion of the pipeline. External coatings are applied to the outer surface of the pipeline to protect it from corrosion caused by soil, water, and atmospheric conditions. Common types of external coatings include fusion-bonded epoxy (FBE), three-layer polyethylene (3LPE), three-layer polypropylene (3LPP), and concrete weight coatings.

Region-wise, Asia-Pacific dominated the pipe coating materials market, growing with a CAGR of 4.7% during the forecast period. Many countries in the Asia-Pacific region, such as China, India, and Australia, have significant oil and gas industries. Pipelines are crucial for transporting these resources from extraction sites to refineries and distribution centers. Rapid urbanization and industrialization in countries such as China, India, and Southeast Asian nations have led to extensive infrastructure development projects. This includes the construction of water supply pipelines, sewage systems, and transportation networks, all of which require coated pipes for durability and protection against corrosion and environmental degradation. In May 2022, China is preparing to spend heavily over the next four years on expanding its natural gas pipeline system to transport greater volumes of natural gas to more clients and utilities. By 2025, China is expected to spend $1.6 trillion to $1.9 trillion on doubling the national gas network to 163,000 kilometers, according to Ding Zhimin, the former deputy director of the Policy & Law Department of the National Energy Administration.

Competitive Analysis

The major players operating in the pipe coating materials market include 3M, AkzoNobel, BASF SE, Arkema, PPG Industries, Inc., Axalta Coating Systems, LLC, Tenaris, The Sherwin-Williams Company, DENSO-Holding GmbH & Co. KG, and LyondellBasell Industries Holdings B.V.

Recent Key Developments in the Pipe Coating Materials Market

- In July 2022, The Sherwin-Williams Company finalized its acquisition of Sika AG's European industrial coatings division. This newly acquired segment will integrate into Sherwin-Williams' Performance Coatings Group operational segment.

- In May 2022, Shawcor announced an $81 million contract for thermal insulation and anticorrosion coating services from an unnamed Western Hemisphere facility. The project initiation begins in the fourth quarter of 2022. In December 2022, the company booked $200 million worth of other project contracts in Latin America. Shawcor restructured in 2022 as a unit of Mattr before the Tenaris buyout.

- In August 2021, PPG unveiled a new coating called PPG HI-TEMP 1027 HD. This innovative product is designed to tackle corrosion in demanding conditions, particularly corrosion-under-insulation (CUI) scenarios. It offers superior protection for pipes, vessels, and various industrial components even during plant operations.

- In November 2023, Seal for Life Industries is to introduce the latest addition to their renowned POWERCRETE brand. The POWERCRETE unveils its newest innovation DD 410, an advanced ARO coating. This new product enhances their existing range of Liquid Epoxy Polymer Concrete coatings, reinforcing their commitment to safeguarding the pipeline industry's critical infrastructure.

Public Policies of Pipe Coating Materials Market

- The Pipeline and Hazardous Materials Safety Administration (PHMSA) of the U.S. Department of Transportation sets forth regulations for pipeline safety, including coating requirements for external corrosion control. These regulations require that each buried or submerged pipeline must have an external coating for external corrosion control if the pipeline is constructed, relocated, replaced, or otherwise changed after the applicable date in §195.401(c).

- The Environmental Protection Agency (EPA) of the U.S. Environmental Protection Agency sets forth regulations for environmental protection, including regulations for the management of hazardous waste and the prevention of air and water pollution. These regulations require that consumers manage hazardous waste in accordance with the Resource Conservation and Recovery Act (RCRA) and prevent the release of hazardous substances into the environment during the application of pipe coatings.

Different Applications of Pipelines to Possess Specific Coating Materials

- Process Pipeline - For the surface of non-insulated pipelines below 120℃, the matching coating system is epoxy/inorganic zinc silicate + epoxy coating paint + aliphatic polyurethane topcoat. Within 120℃, epoxy paint and polyurethane paint can be used. At 120-230℃, acrylic silicone or phenolic epoxy paint can be used. At 200-400°C, inorganic zinc silicate is used.

- Buried pipeline - For buried pipelines in petrochemical plants, epoxy asphalt coatings, modified thick-build epoxy coatings, solvent-free phenolic epoxy coatings, polyurethane foam-polyethylene anticorrosive insulation layer are practically used.

- Gas pipeline - Internal pipeline coating materials for natural gas pipelines consist primarily of epoxy powder, liquid epoxy, and phenolic epoxy coatings. Epoxy resin coatings offer minimal volume shrinkage upon curing, low thermal expansion coefficients, and high resistance to temperature and stress.

- Sewage pipeline- Steel sewage pipes are coated with a durable epoxy coal tar two-cloth-five-oil fiber reinforced plastic or polymer (FRP) system, with various topcoat options including epoxy coal tar mortar paint, modified high build epoxy paint, solvent-free epoxy glass flake, and vinyl ester glass flake paint.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pipe coating materials market analysis from 2023 to 2033 to identify the prevailing pipe coating materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pipe coating materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pipe coating materials market trends, key players, market segments, application areas, and market growth strategies.

Pipe Coating Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.3 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Coating Material |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | The Sherwin-Williams Company, 3M, BASF SE, DENSO-Holding GmbH & Co. KG, AkzoNobel, PPG Industries, Inc., Axalta Coating Systems, LLC, LyondellBasell Industries Holdings B.V., Tenaris S.A., Arkema |

Analyst Review

According to the opinions of various CXOs of leading companies, the global pipe coating materials market was dominated by the fusion-bonded epoxy (FBE) coatings segment.

An increase in demand for wastewater treatment drives the growth of the pipe coating materials market. Wastewater treatment has become a critical aspect of environmental protection and public health maintenance in both developed and developing countries. Wastewater contains various corrosive elements and chemicals that can degrade pipes over time if left unprotected. Coating materials act as a barrier between the pipe surface and the corrosive elements present in the wastewater, preventing corrosion and extending the lifespan of the pipes.

In November 2022: WABAG LIMITED signed an agreement with the Asian Development Bank (ADB) for raising a fund of (INR 200 crores) $24.6 million through unlisted Non-Convertible Debentures carrying five years and three-month tenors. ADB subscribed to it over 12 months for its water treatment business where pipe coating materials gaining popularity to prevent leaks and spills from corroded pipes, reducing the risk of environmental contamination and ensuring compliance with regulatory standards.

However, weather and environmental factors are expected to restrain the growth of the pipe coating materials market during the forecast period. High temperatures can accelerate the curing process of certain coating materials, potentially leading to insufficient adhesion or premature drying. Conversely, extremely high temperatures can cause coatings to blister, crack, or degrade over time. Cold temperatures can slow down the curing process and increase the viscosity of coating materials, making it more challenging to apply evenly. Inadequate curing in cold conditions can result in poor adhesion and reduced coating effectiveness.

The Asia-Pacific region is projected to register robust growth during the forecast period. India's growing industrial and infrastructure sectors contribute to the demand for pipe coatings. With increasing investments in oil and gas exploration, water supply projects, and urban development, there is a rising need for coatings such as fusion-bonded epoxy (FBE), polyethylene (PE), and polyurethane (PU).

The global pipe coating materials market was valued at $10.1 billion in 2023, and is projected to reach $15.3 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033.

The major players operating in the pipe coating materials market include 3M, AkzoNobel, BASF SE, Arkema, PPG Industries, Inc., Axalta Coating Systems, LLC, Tenaris, The Sherwin-Williams Company, DENSO-Holding GmbH & Co. KG, and LyondellBasell Industries Holdings B.V.

The global pipe coating materials market is segmented into coating material, end use, and region. On the basis of coating material, the market is classified into polyethylene (PE) coatings, polypropylene (PP) coatings, fusion-bonded epoxy (FBE) coatings, polyurethane (PU) coatings, and others. On the basis of end use, the market is divided into oil and gas pipelines, water and wastewater, chemical processing, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Rise in demand for corrosion protection in oil and gas, and wastewater industries and increase in demand for wastewater treatment are the main drivers of the pipe coating materials market.

Asia-Pacific is the largest region for the pipe coating materials market.

Fusion-bonded epoxy (FBE) coatings is the leading application of pipe coating materials market.

Advancements in smart coating technologies are the upcoming trends of pipe coating materials market in the world.

Loading Table Of Content...

Loading Research Methodology...