Piping Systems Market Research, 2032

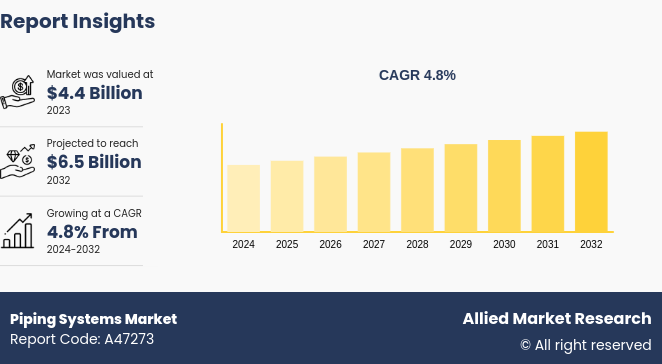

The global piping systems market was valued at $4.4 billion in 2023, and is projected to reach $6.5 billion by 2032, growing at a CAGR of 4.8% from 2024 to 2032.

Market Introduction and Definition

Piping systems are an interconnection of pipes, flanges, and valves. Pipes and valves are components of a piping system. Piping systems are generally used in power plants, chemical industries, oil & gas, construction and other industries. Piping systems vary greatly in complexity and scale, ranging from simple household plumbing networks to intricate configurations in industrial plants and refineries. They are constructed using a variety of materials, such as metals (steel, copper, stainless steel) , plastics (PVC, CPVC, HDPE) , and composites, selected based on factors such as the conveyed fluid's properties, environmental conditions, and regulatory standards.

Key Findings

The piping systems market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major piping systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Increase in exploration and drilling activities for oil around the globe is anticipated to drive the growth of the market. Growing success rate of petroleum extraction drives the Piping Systems Market opportunity. Increase in use of pipe and fittings in chemical industries and power plant, is anticipated to lead to the growth of the market. In addition, key market players are using product launch as a business growth strategy. For instance, in August 2023, GF Piping Systems got approval from DNV, BV, ABS, and LR for fire-retardant pipe jacket solution called HEAT-FIT, a corrosion-free, lightweight thermoplastic piping system. Such factors are expected to drive the piping system market growth.

Stainless-steel pipes’ increased demand is bound to have a major influence on the growth of the piping systems market. Stainless steel has extraordinary features that include durability and the ability to resist rusting, which are among the main reasons for its popularity in many applications.

Its robustness allows it to endure harsh conditions making it a preferred choice for mission-critical infrastructure projects, as well as many industrial applications where structural integrity is paramount. Furthermore, stainless steel is used in architectural designs due to its modern and sophisticated look, which adds aesthetic value to buildings. In addition, its unsurpassed resistance against corrosion makes it suitable for application in environments with high presence of corrosive agents such as chemical processing plants or offshore structures. As businesses prioritize lifespan, eco-friendliness, and performance when making investments in their infrastructure, global demand for stainless-steel pipes is expected to dramatically rise; thus, fueling expansion of the pipe systems market globally.

However, high initial capital investment and availability of substitute products are projected to hamper the growth of the global piping systems market. On the contrary, increase in spooling application in piping system is expected to provide lucrative opportunities for the piping system market during the piping systems market forecast period. The Piping Systems Market growth is expected to accelerate due to increasing demand for infrastructure development and industrial projects globally.

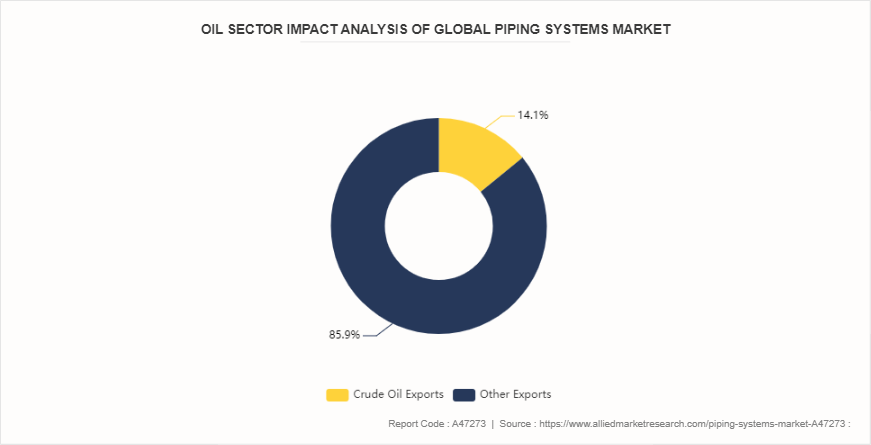

Oil sector impact analysis of Global Piping systems Market

According to Canada Energy Regulator the statistic published on November 2023 states that between 1990 and 2019, Canada experienced a substantial increase in the total value of its merchandise exports, nearly quadrupling from $151.8 billion to $598.2 billion. Over this three-decade period, the value of crude oil exports surged more than fifteen-fold, constituting 14.1% of Canada's total exports by 2019. In addition, Canadian crude oil production witnessed significant growth, soaring from 1.7 million barrels per day (b/d) in 1990 to 4.7 million b/d in 2019. Initially, conventional types of oil, including light and heavy, combined with condensate*, dominated production during the 1990s and early 2000s. However, since 2009, production from oil sands deposits in Alberta emerged as the primary contributor to Canadian oil production, marking a transformative shift in the country's energy landscape. This growth in Canadian crude oil production, especially from oil sands deposits, is expected to have a notable impact on the global piping system market, driving increased demand for pipelines and associated infrastructure to transport oil and related products across domestic and international markets. The Piping Systems Market size has shown resilience in recent years, reflecting its essential role in various industries such as oil and gas, construction, and manufacturing.

Market Segmentation

The global piping system market is segmented on the basis of product type, material, end user, and region. On the basis of product type, the market is divided into metal piping systems, plastic piping systems, and composite piping systems. On the basis of material, the market is divided into stainless steel, carbon steel, alloy steel, and others. Based on end user, the market is categorized into power plants, petroleum refineries, offshore and marine, chemical and fertilizers, and others. Region-wise, the market is studied across North America (the U.S., Canada, and Mexico) , Europe (the UK, France, Germany, Italy, and Rest of Europe) , Asia-Pacific (China, Japan, India, South Korea and Rest of Asia-Pacific) , and LAMEA (Latin America, the Middle East, and Africa) . In 2022, Asia-Pacific was the highest contributor to the piping systems market share and is anticipated to secure a leading position during the forecast period.

Market Segment Outlook

Based on material, the carbon steel segment held the highest market share in 2023 owing to its cost-effectiveness, durability, and widespread availability, making it a preferred choice across various industries for diverse applications.

Based on end user, the petroleum segment held the highest market share in 2023, owing to their extensive demand for pipelines and infrastructure to transport crude oil, refined products, and natural gas globally.

Based on product type, the metal pipes segment held the highest market share in 2023. This is owing to their robustness, high-pressure handling capability, and suitability for diverse applications across industries such as oil and gas, construction, and manufacturing.

Competitive Landscape

Competitive analysis and profiles of the major players in the piping systems market are provided in the report. Major companies in the report include ASTRAL LIMITED, Prince Pipes And Fittings Ltd., ArcelorMittal, JM EAGLE, INC., Nippon Steel Corporation, Tata Steel Limited, Tenaris SA., United States Steel Corporation, Sumitomo Corporation, and Nucor Corporation (Nucor Tubular Products) .

Recent Key Strategies and Developments

In May 2024, GF Piping Systems supplied 5, 000 valves for a groundbreaking bioplastics production in China. Partnering with Tianjin-based Oumingzhuang Biological Technology (OMZ) , GF provided valve solutions for the latest ion exchanger generation, enhancing efficiency and reducing wastewater discharge. OMZ specializes in process equipment for biodegradable plastics manufacturing.

In November 2023, GF Piping Systems, a division of GF, acquired a 51% stake in Corys Piping Systems LLC, situated in Dubai (UAE) . This joint venture positions both companies as leaders in premium flow solutions across various market segments in the region.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the piping systems market segments, current trends, estimations, and dynamics of the piping systems market analysis from 2023 to 2032 to identify the prevailing piping systems market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the piping systems market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global the piping systems market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global piping systems market trends, key players, market segments, application areas, and market growth strategies.

Piping Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.5 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Product Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Prince Pipes And Fittings Ltd., ArcelorMittal, JM EAGLE, INC., Nucor Corporation (Nucor Tubular Products), United States Steel Corporation, Tenaris SA, Sumitomo Corporation, Nippon Steel Corporation, ASTRAL LIMITED, Tata Steel Limited |

The global Piping Systems market was valued at $6.5 billion by 2032, registering a CAGR of 4.8% from 2024 to 2032.

The forecast period in the Piping Systems market report is 2024 to 2032.

The base year calculated in the Piping Systems market report is 2023.

The top companies analyzed for Piping Systems market report are ASTRAL LIMITED, Prince Pipes And Fittings Ltd., ArcelorMittal, JM EAGLE, INC., Nippon Steel Corporation, Tata Steel Limited, Tenaris SA., United States Steel Corporation, Sumitomo Corporation, and Nucor Corporation (Nucor Tubular Products).

The carbon steel segment is the most influential segment in the Piping Systems market.

Loading Table Of Content...