Plant-based Milk Market Research, 2032

The global plant-based milk market size was valued at $2.8 billion in 2022, and is projected to reach $7.3 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

Plant-based milk refers to a non-dairy alternative to traditional animal milk that is derived from plants. It is a beverage that resembles milk in appearance and can be used as a substitute in various culinary and beverage applications. Plant-based milk is typically made by extracting the liquid from plants, such as nuts (e.g., almond), grains (e.g., oat), legumes (e.g., soy), or seeds (e.g., hemp). Plant-based milk options are widely available in grocery stores and come in different flavors and varieties to cater to individual preferences and dietary needs.

Market Dynamics

Rising awareness about the health benefits of plant-based diets has led consumers to look for healthier alternatives to traditional dairy milk. plant-based milk market offers various nutritional advantages, such as being lower in saturated fat and cholesterol, and often fortified with vitamins and minerals like calcium and vitamin D. Moreover, many individuals have dietary restrictions that prevent them from consuming dairy milk. Plant-based milk provides an excellent alternative for people with lactose intolerance, milk allergies, or other sensitivities to dairy products. The rise in vegan and vegetarian lifestyles has contributed significantly to the demand for plant-based milk market. As people adopt these dietary choices, they seek non-dairy options that align with their ethical beliefs and dietary preferences. Furthermore, plant-based milk is generally considered to have a lower environmental impact compared to conventional dairy milk production.

Concerns about the carbon footprint, water usage, and land degradation associated with the dairy industry have influenced consumers to opt for more sustainable alternatives like plant-based milk. In addition, the availability of a wide range of plant-based milk options has played a significant role in attracting consumers. Plant-based milk market can be made from various sources, including almonds, soy, oats, coconut, rice, and others. This variety allows individuals to choose a flavor and consistency that suits their taste preferences. The plant based milk industry has experienced continuous innovation and product development, leading to improved taste, texture, and functionality. In addition, effective marketing campaigns highlighting the health benefits, taste, and versatility of plant-based milk have increased consumer awareness and acceptance. Plant-based milk products are now more readily available in grocery stores, supermarkets, and foodservice establishments. Increased accessibility and visibility have made it easier for consumers to include plant-based milk into their diets.

Plant-based milk alternatives are often priced higher than traditional dairy milk. Plant-based milk alternatives require specific plant ingredients such as almonds, soybeans, oats, or coconuts the ingredients are holding maximum plant-based milk market. The production and sourcing of these ingredients can be more expensive compared to the relatively standardized process of obtaining cow's milk. The availability and seasonal fluctuations of these plant ingredients can affect their prices, further impacting the cost of plant-based milk production. Moreover, the manufacturing process for plant-based milk industry involves various steps, including grinding, blending, straining, and fortifying the plant material to create a milk-like consistency. These additional processing steps can add to the production costs of plant-based milk compared to the relatively straightforward process of collecting and pasteurizing cow's milk. Furthermore, plant-based milk often requires specialized packaging, such as tetra packs or cartons, to ensure shelf stability and prevent spoilage. These packaging materials can be more expensive than traditional milk cartons or bottles. In addition, the distribution and transportation costs associated with plant-based milk may be higher due to factors such as refrigeration requirements and a smaller market share compared to dairy milk. These factors contribute to the higher price point of plant-based milk alternatives, making them less accessible for price-sensitive consumers.

The adoption of vegan and vegetarian diets is expanding rapidly, driven by various factors such as health consciousness, ethical concerns, and environmental sustainability. This expanding consumer base presents a vast market for plant-based milk products. Moreover, many consumers are becoming more health-conscious and are actively seeking alternatives to traditional dairy milk. Plant-based milk offers various health benefits, such as being cholesterol-free, low in saturated fats, and containing essential nutrients. The increasing awareness of these health benefits contributes to the rising demand for plant-based milk. Furthermore, a significant portion of the population suffers from lactose intolerance or dairy allergies, leading them to seek alternatives to dairy milk. Plant-based milk provides a suitable solution as it is naturally free from lactose and allergenic substances which are present in dairy milk. In addition, the environmental impact of animal agriculture and the dairy industry has become a concern for many consumers. Plant-based milk production generally has a lower carbon footprint and requires fewer resources compared to conventional dairy production. As sustainability becomes an increasingly important factor in purchasing decisions, the plant-based milk market demand is expected to rise further.

Segmental Overview

The plant-based milk market is segmented on the basis of type, distribution channel, end user, and region. By type, the market is divided into almond, soy, rice, oat, coconut, and others. By distribution channel, the market is classified into online, supermarket, and convenience stores . By end user, the market is classified into retail/household, foodservices industry, and food & beverage industry. By region, the plant-based milk market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

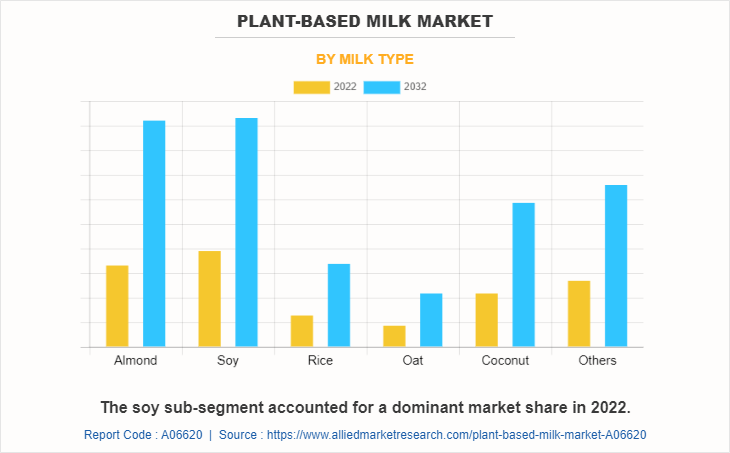

By Milk Type

By milk type, the soy sub-segment dominated the plant based milk market in 2022. Soy milk is naturally free from common allergens like dairy, lactose, and nuts. This makes it an attractive option for people with lactose intolerance or allergies to dairy or nuts. The rising prevalence of lactose intolerance and food allergies is driving the demand for soy milk among these consumer groups. Moreover, the increasing adoption of vegan and plant-based diets is a significant driver for the soy milk segment. Soy milk is derived from plants and aligns with the principles of veganism, making it a popular choice among vegans and those seeking plant-based alternatives. The soy milk segment benefits from the perception that it has a lower environmental impact compared to dairy milk. Producing soy milk requires fewer natural resources, such as water and land, and generates fewer greenhouse gas emissions compared to dairy farming. These are predicted to be the major factors affecting the plant based milk market during the forecast period.

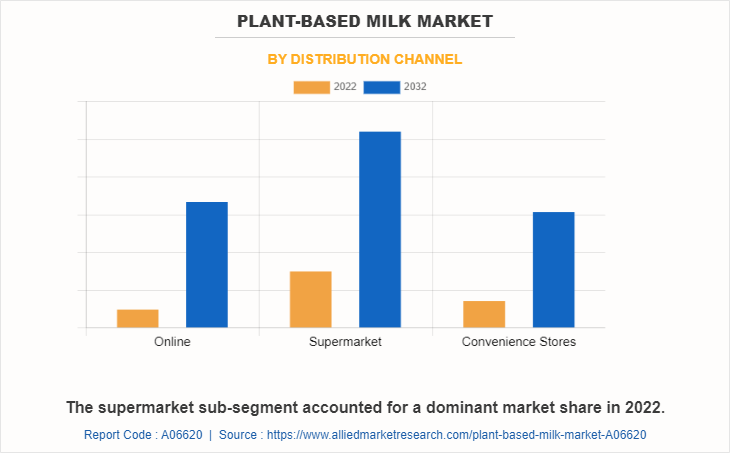

By Distribution Channel

By distribution channel, the supermarket sub-segment dominated the global plant-based milk market share in 2022. Supermarkets have been expanding their product offerings in response to the increasing demand for plant-based milk. They are partnering with various brands and manufacturers to ensure a diverse range of options, flavors, and formulations are available on their shelves. This expansion allows consumers to choose from a wide selection of plant-based milk products, encouraging them to make repeat purchases. Furthermore, supermarkets play a crucial role in promoting and marketing plant-based milk products. They often highlight the benefits of these products through in-store signage, advertisements, and digital marketing campaigns. Such efforts raise awareness and educate consumers about the availability and advantages of plant-based milk.

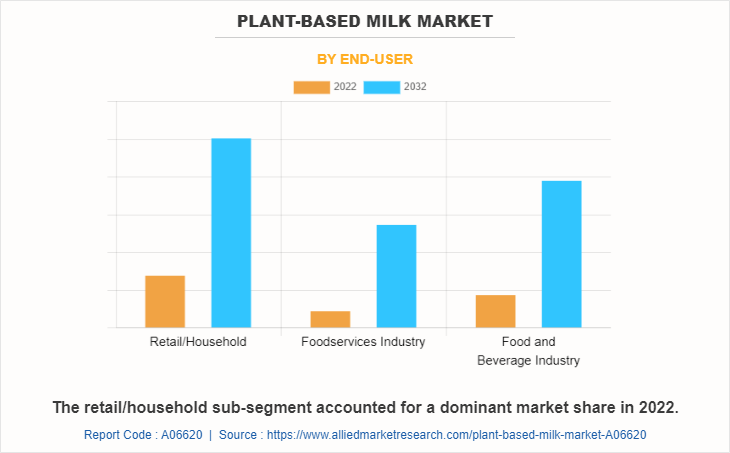

By End User

By end user, the retail/household sub-segment dominated the global plant-based milk market share in 2022. Increasing consumer awareness about health & wellness has been a significant growth driver of the plant-based milk market. Many people are adopting plant-based diets due to concerns about lactose intolerance, milk allergies, or the desire for a healthier lifestyle. Plant-based milk is often perceived as a healthier alternative to dairy milk due to its lower cholesterol, saturated fat, and calorie content. Moreover, increasing awareness about the environmental impact of animal agriculture, including greenhouse gas emissions and water usage, has led to a shift toward more sustainable options. Plant-based milk is perceived as a more environmentally friendly choice, as it requires fewer resources and produces fewer emissions compared to traditional dairy production. Retailers have responded to increasing consumer demand by stocking a wider range of plant-based milk products, making them easily accessible to consumers.

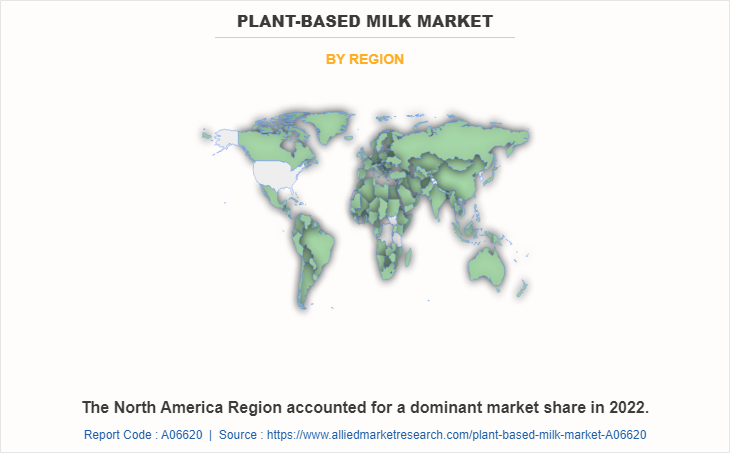

By Region

By region, North America dominated the global market in 2022. The rising awareness of the health benefits associated with plant-based diets has driven the demand for plant-based milk in North America. Many consumers perceive plant-based milk as a healthier alternative to traditional dairy milk, as it is often lower in calories, cholesterol, and saturated fat. Moreover, there has been a significant rise in consumer demand for plant-based milk products in North America. Consumers are becoming more health-conscious and are seeking dairy alternatives due to various reasons such as lactose intolerance, allergies, ethical concerns, and environmental sustainability. Furthermore, concerns about the environmental impact of the dairy industry, including greenhouse gas emissions, water usage, and deforestation, have driven consumers towards plant-based milk options in the region. Plant-based milk, particularly those made from soy, almond, or oat, are considered more environmentally friendly alternatives.

Competitive Landscape

The key players profiled in this report include Pacific Foods of Oregon, Inc., The Hain Celestial Group Inc., Edward & Sons, Earth’s Own Food Company Inc., Goya Foods, Mc Cormick & Co., Sunopta Inc., Chef’s Choice Food Manufacturer Company Limited, The Hershey Company, Vitasoy International Holdings Limited, Turtle Mountain LLC, and Natura Foods. Investment and agreement are common strategies followed by major market players. For instance, in July 2022, New Zealand Functional Foods, an oat milk company in Southland, received $6 million in support from the New Zealand government. A carbon-neutral oat milk factory that can manufacture more than 65 million liters of milk annually is being built at Makarewa by New Zealand Functional Foods. New Zealand Functional Foods is attempting to raise $60 million to develop the factory and meet the working capital needs..

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global plant-based milk market trends along with the plant-based milk market forecast.

- The report elucidates the plant-based milk market opportunities along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the plant-based milk market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the plant-based milk market growth.

Plant-based Milk Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.3 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 323 |

| By Milk Type |

|

| By Distribution Channel |

|

| By End-User |

|

| By Region |

|

The global plant-based milk market size was valued at $2.8 billion in 2022, and is projected to reach $7.3 billion by 2032

The global Plant-based Milk market is projected to grow at a compound annual growth rate of 10.3% from 2023 to 2032 $7.3 billion by 2032

The key players profiled in this report include Pacific Foods of Oregon, Inc., The Hain Celestial Group Inc., Edward & Sons, Earth’s Own Food Company Inc., Goya Foods, Mc Cormick & Co., Sunopta Inc., Chef’s Choice Food Manufacturer Company Limited, The Hershey Company, Vitasoy International Holdings Limited, Turtle Mountain LLC, and Natura Foods.

By region, North America dominated the global market in 2022.

Rising awareness about the health benefits of plant-based diets, such as lower saturated fat and cholesterol?, Increasing environmental consciousness and concerns about the carbon footprint associated with the dairy industry

Loading Table Of Content...

Loading Research Methodology...