Plasma Protein Therapeutics Market Research, 2031

The global plasma protein therapeutics market size was valued at $26.5 billion in 2021, and is projected to reach $44.3 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031. Plasma protein therapeutics are a class of drugs made from proteins that are found in human blood plasma. These proteins have various biological functions, including regulating blood clotting, immune response, and maintaining fluid balance in the body. Plasma protein therapeutics are used to treat a wide range of medical conditions, including bleeding disorders, immune deficiencies, and genetic disorders. They are often administered by injection or infusion and require careful monitoring to ensure proper dosage and minimize potential side effects.

Market dynamics

Increase in incidence of autoimmunological disorders, rise in adoption of various strategies by the key market players and rise in research and development activities for plasma protein therapeutics drive the growth of the plasma protein therapeutics market.

Autoimmune and neurological diseases are complex and often chronic conditions that can be difficult to treat, and many patients require lifelong management. Rise in incidence of the autoimmune disorders significantly drives the market growth. In addition, advancements in technology and research have led to the development of new and innovative plasma protein therapeutics that offer improved outcomes for patients. This has resulted in a growing market for plasma protein therapeutics and has fueled investment in research and development in this area.

Moreover, the plasma protein therapeutics market is experiencing significant growth due to the rise in adoption of strategies by key market players. These strategies are aimed at expanding their market presence and product portfolios, which in turn drives the growth of the market.

However, the stringent rules for donor screening, collection, testing, and storage of plasma, is projected to increase the cost and complexity of producing plasma protein products. This can limit the growth of the plasma protein therapeutics market as some companies may face difficulty in meeting the regulatory requirements, resulting in reduced supply of plasma protein products. On the other hand, technological advancements represent a significant opportunity for the growth of the plasma protein therapeutics market, and continued investment in research and development is expected to lead to further advancements during the plasma protein therapeutics market forecast.

Segmental Overview

The plasma protein therapeutics market is segmented into product type, application, distribution channel and region. By product type, the market is categorized into immunoglobulin, albumin, plasma factor derived VIII, and others. By application, the market is segregated into hemophilia, idiopathic thrombocytopenic purpura primary immunodeficiency and others. By distribution channel, the market is divided into hospital pharmacies, drug store & retail pharmacies and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

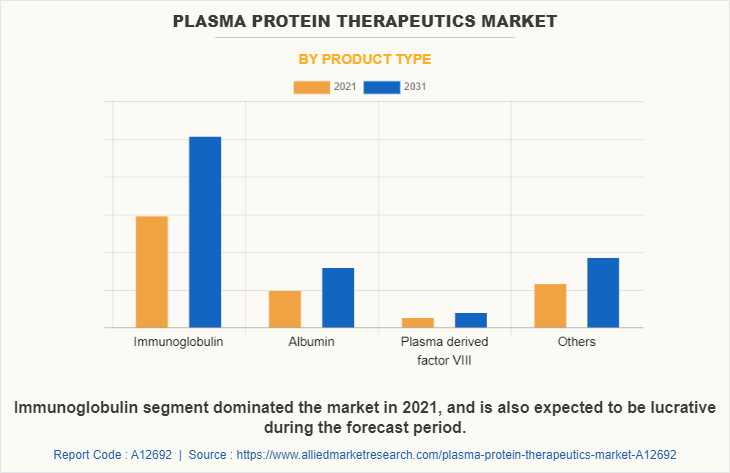

By Product Type

Depending on product type, the market is categorized into immunoglobulin, albumin, plasma derived factor VIII, and others. The immunoglobulin segment accounted for largest plasma protein therapeutics market size in 2021 and is expected to witness highest CAGR during the forecast period owing to increase in availability of innovative immunoglobulin products and developments in therapeutic administration, such as the subcutaneous immunoglobulin products.

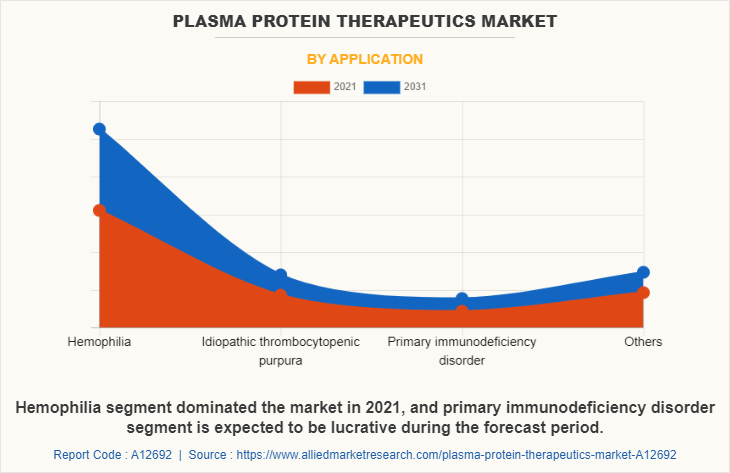

By Application

On the basis of application, the market is classified into hemophilia, idiopathic thrombocytopenia purpura, primary immunodeficiency and others. The hemophilia segment dominated the plasma protein therapeutics market share in 2021 owing to the rise in people diagnosed with hemophilia and increase in availability of plasma protein therapeutics options for hemophilia. Primary immunodeficiency is projected to register a highest CAGR during the forecast period, owing to rise in awareness regarding use of plasma protein therapeutics for the treatment of the primary immunodeficiencies and their high prevalence.

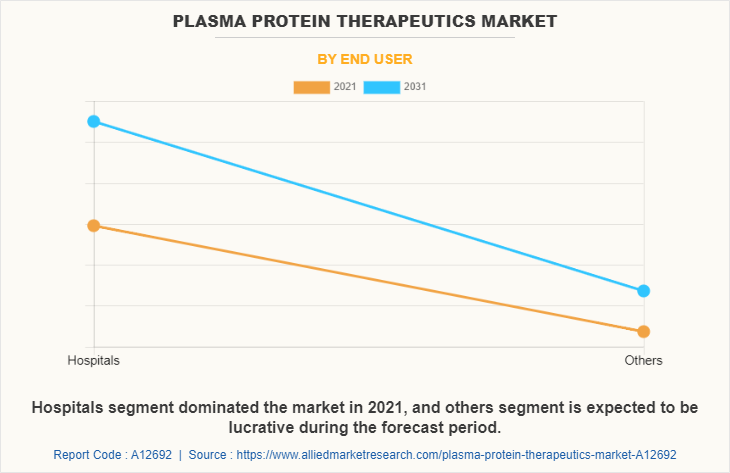

By End User

On the basis of end user, the market is categorized into hospitals and others. The hospitals segment occupied highest plasma protein therapeutics market share in 2021 owing to increase in the number of patients visits in hospitals suffering from autoimmune conditions such as hemophilia and ease of access of protein therapeutics in hospital. The others segment is projected to register highest CAGR owing to cost-effectiveness, ease of scheduling visits, and emphasis on patient accessibility and convenience.

By Region

The plasma protein therapeutics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is witnessing a rise in investments for plasma protein therapeutics research, increase in cases of rare diseases and high prevalence of immunological disorders. In addition, rise in number of key players manufacturing plasma protein therapeutics further drives the market growth in this region. However, Asia-Pacific is expected to witness highest growth during the forecast period, owing to factors such as the manufacturing of high-quality medications, increasing immunological disorders. In addition, increase in healthcare infrastructure in this region further propels the plasma protein therapeutics market growth.

Furthermore, presence of well-established healthcare infrastructure and high purchasing power are expected to drive the market growth. Moreover acquisitions, product launch, and product approvals adopted by the key players in this region boost the plasma protein therapeutics market opportunity.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributed to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, Asia-Pacific offers profitable opportunities for key players operating in the plasma protein therapeutics market, thereby registering the fastest growth rate during the forecast period, owing to the surge in infrastructure of industries, rise in disposable incomes, as well as well-established presence of domestic companies in the region.

Competition Analysis

Competitive analysis includes profiles of the major players in the plasma protein therapeutics industry, such as ADMA Biologics Inc, Baxter Inc, Bayer AG, Bio products laboratory, Baxter International, Grifsols, Kedrion SpA, Octapharma USA Inc, Taibang Biological Group Co. Ltd, and Takeda Pharmaceutical Company Limited. Major players have adopted collaboration, product development, acquisition, agreement, product approval and product launch as key developmental strategies to improve the product portfolio of the plasma protein therapeutics market.

Recent Product Launch In the Plasma Protein Therapeutics Market

• In May 2020, Bio Products Laboratory (BPL) announced that the US launch of ALBUMINEX 5% (human albumin) solution for injection and ALBUMINEX 25% (human albumin) solution for injection., .

• In September 2021, Grifols announced that TAVLESSE (fostamatinib), used to treat chronic immune thrombocytopenia (ITP) in adult patients refractory to other treatments, is available in France, Italy and Spain and reimbursable from their respective health systems.

Recent Product Development In the Plasma Protein Therapeutics Market

• In December 2022, Biotest AG announced that, the first of 20 patients has been enrolled in a clinical phase II pilot study for the treatment of chronic hepatitis B with hyperimmunoglobulins at the Hanover Medical School.

• In June 2022, Biotest AG announced that the planned interim analysis of the phase III AdFIrst (Adjusted Fibrinogen Replacement Strategy) trial with Fibrinogen in patients with acquired fibrinogen deficiency was successful.

• In May 2020, Biotest AG announced the completion of the clinical trial 984. In the phase I/III study, patients with congenital fibrinogen deficiency were treated with the fibrinogen concentrate (BT524) developed by Biotest in the case of acute bleeding or as prophylactic treatment before surgery.

• In July 2022, Takeda announced that ADVANCE-1, a randomized, placebo-controlled, double-blind Phase 3 clinical trial evaluating HYQVIA [Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase] for the maintenance treatment of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP), met its primary endpoint.

Recent Product Approval In the Plasma Protein Therapeutics Market

• In November 2022, Biotest AG announced that the German competent authority, the Paul-Ehrlich-Institute, has approved the new intravenous immunoglobulin Yimmugo (IgG Next Generation) in Germany.

• In April 2021, Kedrion Biopharma and Kamada Ltd. announced that the U.S. Food and Drug Administration (FDA) has approved a label update for KEDRAB (Rabies Immune Globulin [Human]), establishing the product’s safety and effectiveness in children.

• In December 2021, CSL Limited announced that Hizentra received orphan-drug exclusivity from the U.S. Food and Drug Administration (FDA) for the treatment of adult patients with chronic inflammatory demyelinating polyneuropathy (CIDP) as maintenance therapy to prevent relapse of neuromuscular disability and impairment. CIDP is a rare autoimmune disorder that affects the peripheral nerves and has the potential to cause significant disability.

• In February 2020, CSL Limited announced that the U.S. Food and Drug Administration (FDA) has granted Privigen (Immune Globulin Intravenous (Human), 10% Liquid) orphan-drug designation as an investigational therapy in the treatment of Systemic Sclerosis (SSc). SSc is a chronic and potentially life-threatening autoimmune disorder characterized by a build-up of scar tissue (fibrosis) in the skin and other organs.

• In January 2022, Bio Products Laboratory (BPL) announced that the National Medical Products Administration (NMPA) for China has granted BPL a license to market ALBUMINEX 25% product to China.

• In March 2022, Grifols announced that XEMBIFY, its innovative 20% subcutaneous immunoglobulin (SCIG), has been approved by several European Union member state health authorities as well as the U.K.’s to treat primary and select secondary immunodeficiencies.

Recent Acquisition In the Plasma Protein Therapeutics Market

• In January 2021, Kedrion S.p.A. announced the exercise of the option to acquire the remainder of the plasma-derived business under the terms of the Share Purchase Agreement entered by the Company and Liminal Bioscience.

• In April 2022, Grifols announced that the completion of the acquisition of 100% of the share capital of Tiancheng (Germany) Pharmaceutical Holdings AG, a German company that holds 89.88% of the ordinary shares and 1.08% of the preferred shares of Biotest AG, a European healthcare company specialized in innovative hematology and clinical immunology.

Recent Agreement In the Plasma Protein Therapeutics Market

• In May 2021, Kedrion Biopharma and Kamada Ltd. announced that the U.S. Food and Drug Administration (FDA) has approved a label update for KEDRAB (Rabies Immune Globulin [Human]), establishing the product’s safety and effectiveness in children.

• In September 2022, Grifols announced that it has signed a pioneering long-term agreement with Canadian Blood Services, Canada’s national blood authority, to greatly increase the country’s self-sufficiency in immunoglobulin (Ig) medicines, essential plasma-protein therapies used to treat a wide range of immunodeficiencies and other medical conditions.

Recent Collaboration In the Plasma Protein Therapeutics Market

• In April 2020, Biotest, BPL, LFB, and Octapharma have joined an alliance formed by CSL Behring and Takeda Pharmaceutical Company Limited to develop a potential plasma-derived therapy for treating COVID-19.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plasma protein therapeutics market analysis from 2021 to 2031 to identify the prevailing plasma protein therapeutics industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plasma protein therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plasma protein therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Plasma Protein Therapeutics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 44.3 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 262 |

| By Product type |

|

| By Application |

|

| By End user |

|

| By Region |

|

| Key Market Players | ADMA Biologics Inc, Bio Products Laboratory Ltd, Baxter International Inc., Bayer AG, CSL Limited, Taibang Biological Group Co., Ltd, Kedrion, SpA, Grifols, S.A., Octapharma AG, Takeda Pharmaceutical Company Limited |

Analyst Review

This section provides various opinions of top-level CXOs in the global plasma protein therapeutics market. According to the insights of CXOs, increase in research and rise in investments for plasma protein therapeutics globally is expected to offer profitable opportunities for the expansion of the market. In addition, several companies developing advanced and innovative plasma protein therapeutics also propel the market growth.

CXOs further added that increase in use of plasma protein therapeutics for treatment of various diseases such as hemophilia, idiopathic thrombocytopenic purpura, and primary immunodeficiency in developing regions has largely contributed in the market revenue in 2021, and is expected to maintain this trend throughout the forecast period. In addition, awareness regarding treatments using plasma protein therapeutics for various diseases across globe and increase in demand for next innovative medications in many countries significantly contribute toward revenue generation.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in awareness toward plasma protein therapeutics and rise in government initiatives promoting research activities for development of new advanced plasma protein therapeutics. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of plasma protein therapeutics development and increase in use for treatment of various diseases.

Increase in the demand for plasma protein therapeutics owing to its effectiveness and specific treatments for a variety of diseases, including immunological disorders and autoimmune disorders are the upcoming trends of plasma protein therapeutics market.

Hemophilia is the leading application of plasma protein therapeutics market.

North America is the largest regional market for plasma protein therapeutics market.

The global plasma protein therapeutics market was valued at $26.53 billion in 2021.

ADMA Biologics Inc, Bayer AG, Bio products laboratory, Baxter International, CSL Limited, Grifsols, Kedrion SpA, Octapharma USA Inc, Taibang Biological Group Co. Ltd, and Takeda Pharmaceutical Company Limited are the top companies to hold the market share in plasma protein therapeutics market.

2021 is the the base year of plasma protein therapeutics market.

2022 to 2031 is the the forecast year of plasma protein therapeutics market.

Loading Table Of Content...

Loading Research Methodology...