Plastic Lumber Market Research, 2032

The global plastic lumber market was valued at $5.3 billion in 2022 and is projected to reach $15.8 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Report Key Highlighters:

- The plastic lumber market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The plastic lumber market is highly fragmented, with several players including Genova Products Inc., Trex Company, Inc., American Recycled Plastic, KWK Plastic Lumber Co., Ltd., Ecoville, CMI, PlasTEAK, Fiberon, TANGENT Technologies, LLC., and Repeat Plastics Australia Pty Ltd.

Plastic lumber is a versatile building material made from recycled plastics, typically high-density polyethylene (HDPE) or a combination of various plastic types. It serves as an eco-friendly alternative to traditional wood lumber, offering several key properties and benefits.

Plastic lumber is highly durable and resistant to rot, decay, and insect infestations, making it ideal for outdoor applications such as decking, fencing, and outdoor furniture. Its longevity far surpasses that of natural wood, reducing the need for frequent replacements. Moreover, plastic lumber is impervious to moisture, preventing swelling or warping, and it can withstand harsh weather conditions, including UV exposure, without fading or deteriorating.

It is environmentally friendly as it diverts plastic waste from landfills, reducing the ecological footprint. It requires minimal maintenance, doesn't require painting or staining, and is easy to clean. In addition, plastic lumber is available in various colors and textures, providing design flexibility. It also contributes to sustainable forestry practices by reducing the demand for timber.

The plastic lumber market is poised for significant growth, largely driven by its remarkable versatility and design flexibility. Its adaptability for various applications is a key factor fueling its demand.

Plastic lumber can be molded and engineered to mimic the appearance and texture of natural wood while retaining the durability and resistance to decay and pests that traditional wood lacks. This makes it an attractive choice for a wide range of applications, including decking, fencing, outdoor furniture, and even structural components in construction. Moreover, its design flexibility allows for customization in terms of color, size, and shape, enabling architects and designers to create innovative and aesthetically pleasing solutions. With increasing emphasis on eco-friendly materials and design versatility, the plastic lumber market is set to flourish, providing sustainable and customizable options for a variety of industries and applications.

Government regulations and incentives are poised to play a pivotal role in driving the plastic lumber market.

With growing environmental concerns surrounding traditional lumber production and plastic waste, governments globally are increasingly implementing stringent regulations to curtail deforestation and reduce plastic pollution. These regulations often mandate the use of sustainable and eco-friendly alternatives like plastic lumber in construction and landscaping projects. Simultaneously, governments are offering incentives and subsidies to promote the adoption of plastic lumber, incentivizing businesses, and consumers to choose this eco-conscious option.

These incentives may include tax breaks, grants, or rebates for using recycled plastic materials. As a result, the plastic lumber market is experiencing significant growth, with manufacturers investing in R&D to improve the quality and durability of these products. As more regions recognize the environmental benefits and economic advantages of plastic lumber, it is expected to become an increasingly popular choice in the construction industry, further reducing the ecological footprint and contributing to a more sustainable future.

The high cost of plastic lumber is poised to present a significant challenge to the growth of the plastic lumber market. Plastic lumber, a versatile alternative to traditional wood, is gaining traction due to its durability, resistance to environmental factors, and sustainability benefits. However, the cost associated with producing plastic lumber remains a limiting factor. The manufacturing of plastic lumber involves a complex and resource-intensive process. It requires the collection, sorting, and recycling of plastic waste, which necessitates significant investments in machinery and infrastructure. Moreover, the process often involves the incorporation of additives and pigments to enhance the material's properties, further increasing production costs.

In addition, plastic lumber manufacturers must adhere to stringent quality control measures and compliance with environmental regulations, which can drive up operational expenses. Furthermore, the cost of raw materials used in plastic lumber production is a critical factor. The prices of recycled plastics, the primary input for plastic lumber, are subject to market fluctuations. As demand for recycled plastics increases across various industries, the cost of sourcing these materials can become prohibitively high.

Infrastructure developments will offer lucrative opportunities for the plastic lumber market. As the global demand for sustainable construction materials continues to rise, plastic lumber, made from recycled plastics, is emerging as a compelling solution for the infrastructure sector. This innovative material boasts several advantages, including durability, resistance to environmental degradation, and low maintenance requirements.

With governments and industries globally increasingly prioritizing eco-friendly building practices, plastic lumber's sustainable credentials make it a highly attractive option. Its versatility allows it to replace traditional wood in a wide range of applications, such as bridges, decks, and boardwalks, where it excels in resisting rot, termites, and decay. Moreover, plastic lumber's longevity and reduced need for replacement contribute to cost savings in the long run, making it an economically sound choice for infrastructure projects.

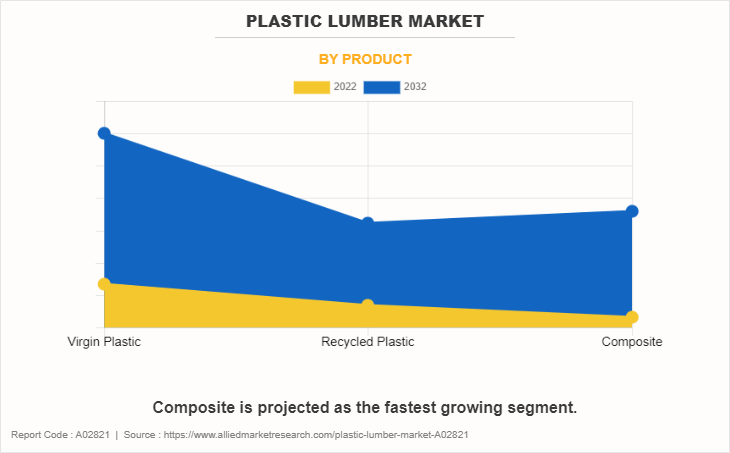

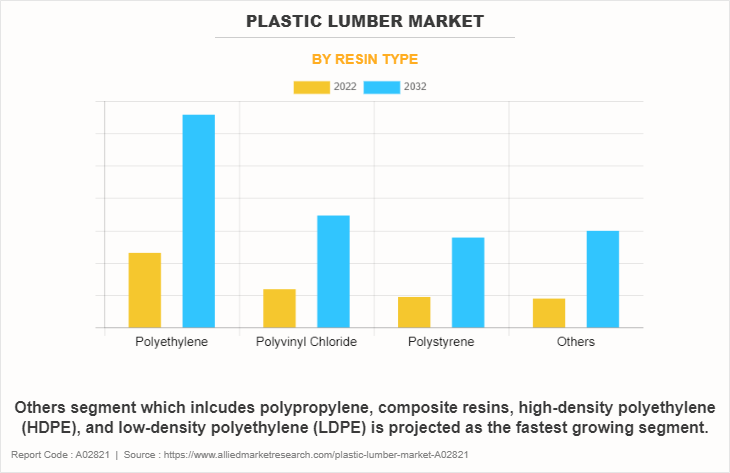

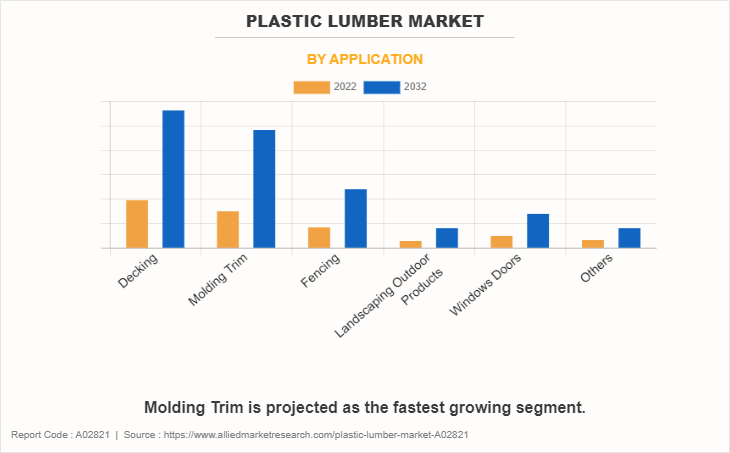

The plastic lumber market is segmented on the basis of product, resin type, application, and region. By product, the market is divided into virgin plastic, recycled plastic, and composite. On the basis of resin type, it is categorized into polyethylene, polyvinyl chloride, polystyrene, and others. As per application, it is categorized into decking, molding trim, fencing, landscaping outdoor products, windows doors, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global plastic lumber market are Genova Products Inc., Trex Company, Inc., American Recycled Plastic, KWK Plastic Lumber Co., Ltd., Ecoville, CMI, PlasTEAK, Fiberon, TANGENT Technologies, LLC., and Repeat Plastics Australia Pty Ltd.

Other players include AZEK Building Products, Envision Decking, Lumberock, Bedford Technology, Bear Board, Nexwood, EPS Plastic Lumber.

The virgin plastic segment accounted for the largest share in 2022 accounting for more than two-fifths of the global plastic lumber market revenue. Increasing global population and urbanization drive demand for plastic products in construction, packaging, and consumer goods. Secondly, industrialization in emerging economies leads to higher consumption. Lastly, limited recycling infrastructure and low oil prices favor virgin plastic production over recycling. These factors collectively contribute to the growth of virgin plastic production.

The composite is expected to register the highest CAGR of 13.1%. Composites have experienced significant growth due to their unique combination of properties, including high strength-to-weight ratios, corrosion resistance, and design flexibility. Industries such as aerospace, automotive, and construction have embraced composites for their ability to reduce weight, improve fuel efficiency, and enhance performance. Technological advancements in manufacturing processes and materials have also contributed to the increased adoption of composites in various applications, further fueling their growth.

The polyethylene segment accounted for the largest share of in 2022 accounting for more than two-fifths of the global plastic lumber market revenue. The versatility, low cost of production, and lightweight properties of polyethylene make it popular in various industries, including packaging, construction, and automotive. Moreover, its resistance to moisture, chemicals, and UV radiation enhances its durability. In addition, innovations in recycling and sustainable practices have further fueled its growth due to increasing environmental concerns.

Other segments which consist of polypropylene, composite resins, high-density polyethylene (HDPE), and low-density polyethylene (LDPE) are expected to register the highest CAGR of 12.6%. The widespread use of polypropylene, composite resins, high-density polyethylene (HDPE), and low-density polyethylene (LDPE) in industries such as packaging, automotive, and textiles drives demand. Additionally, low cost, lightweight nature, and excellent chemical resistance make these resins an attractive choice.

The decking segment accounted for the largest share in 2022 accounting for more than one-third of the global plastic lumber market revenue. The increasing trend toward outdoor living spaces has created a higher demand for decking materials. In addition, the desire for low-maintenance and durable decking options has led to the popularity of composite and PVC decking. Environmental concerns have also fueled the use of sustainable materials.

Molding Trim is expected to register the highest CAGR of 12.2%. Architectural trends and interior design preferences play a significant role, as they drive the demand for decorative moldings. In addition, advancements in materials and manufacturing techniques contribute to the expansion of molding trim options. Economic factors, such as new construction and home remodeling, also impact the market.

Europe garnered the largest share in 2022 accounting for nearly two-fifths of the global plastic lumber market revenue. Increasing environmental awareness and sustainability concerns have driven demand for eco-friendly building materials, with plastic lumber being a viable alternative to traditional wood. In addition, stringent regulations aimed at reducing deforestation and promoting recycling have created a favorable regulatory environment. Furthermore, the durability, low maintenance, and long lifespan of plastic lumber make it an attractive choice for construction projects. Moreover, technological advancements in manufacturing processes have improved the quality and variety of plastic lumber products, further fueling market growth in Europe.

Key development strategies undertaken by key players

In March 2020, TANGENT Technologies, LLC. acquired Bedford Technology, a leading plastic lumber extruder in North America with excellence in structural and semi-structural product lines, primarily used in marine infrastructure projects, boardwalks, and fencing, as well as a broad range of industrial applications. This acquisition expanded the manufacturing capabilities of both companies to service the customers' needs and continued to develop industry-leading product offerings, leading to the growth of the plastic lumber market.

In March 2020, CMI, a portfolio company of Capital Partners, completed the acquisition of Engineered Plastic Systems (EPS) including the Lumberock, Bear Board, and Perennial Park Products brands. With this acquisition, CMI will have access to mono-extruded HDPE decking boards, deck railing, and fence railing from EPS, expanding its extrusion expertise, regional production footprint, and capacity to provide a wider range of products to both new and existing clients.

In October 2021, Trex Company, Inc. announced plans to develop a new multi-faceted production site in Little Rock, U.S. This expansion will enable the company to provide customers significantly better access to Trex residential products where and when they need them and position the company for future growth. This expansion will increase the production capacity of plastic lumber products leading to market growth.

In October 2021, Fiberon upgraded and expanded its manufacturing operations and facility in New London, NC with a new investment of more than $20 million over the next three years. This expansion will increase the production capacity of plastic lumber products leading to the growth of the market.

In October 2021, Fiberon introduced new composite cladding for rain screen applications that combines the elegance and comfort of wood with the strength of low-maintenance, high-performance composite materials. It is free of harmful chemicals and preservatives and contains 94 percent pre- and post-consumer recycled content. Furthermore, it is produced using environmentally friendly methods, saving more than 70,000 tons of wood and plastic every year from landfills and incinerators. This product launch will increase the demand for the plastic lumber market.

In May 2022, Trex Company, Inc. introduced Trex Transcend Lineage, a new generation of premium composite decking boards with enhanced aesthetics and performance. Like all Trex decking, Lineage boards are constructed from recycled and reclaimed materials and include an ultra-durable integrated shell that is stain, scratch, and mold resistant as well as a unique, high-traffic formulation. They are easy to maintain and do not decay, warp, fracture, or splinter like wood. This product launch will stimulate the growth of the plastic lumber market.

In September 2022, Fiberon launched Wildwood composite cladding, which provides the unrivaled beauty and warmth of wood combined with the durability of high-performance, low-maintenance materials. Wildwood is produced using sustainable techniques and contains 94% pre- and post-consumer recycled material. This product launch will strengthen the portfolio of plastic lumber products.

On September 2022, Fiberon constructed a new manufacturing facility in Columbia, Tennessee that will manufacture polyethylene (PE) decking and composite cladding using the same sustainability measures utilized in their existing plants. There will also be an on-site recycling facility that will convert baled plastic waste into pellets used in Fiberon products. This expansion will increase the demand for the plastic lumber market.

In November 2022, Fiberon announced a distribution partnership with Hixson Lumber Company, a major supplier of wood products. The partnership expands Fiberon's reach in Texas, Louisiana, Arkansas, and Oklahoma. The Fiberon products available to order through Hixson Lumber include PE composite and PVC decking; deck fasteners; composite and aluminum railing; and Wildwood PE composite cladding. This partnership will boost the demand for plastic lumber products leading to market growth.

In June 2023, Trex Company, Inc. introduced Trex Select T-Rail in which the components are made from a minimum of 40% recycled materials. The composite railing system, featuring a popular T-shaped top rail, is designed to make the beauty and convenience of Trex's high-performance composite and aluminum railing available to a wider audience with pricing that competes head-to-head with PVC vinyl railing. This product launch will boost the demand for plastic lumber products.

Public Policies:

Environmental Regulations: Environmental regulations in North America aimed to promote the use of recycled plastics in construction materials, including plastic lumber. These regulations focused on reducing the environmental impact of plastic waste and encouraging the recycling and reuse of plastics. Local and state governments often set recycling targets and standards for the use of recycled content in construction projects.

Recycling Programs: Municipalities and states across North America have established recycling programs to divert plastic waste from landfills. Some regions implemented extended producer responsibility (EPR) programs, which required manufacturers to take responsibility for recycling or managing the end-of-life disposal of their products, including plastic materials.

Building Codes and Standards: Building codes and standards were being updated to include provisions for the use of plastic lumber and other recycled materials in construction. These codes and standards aim to ensure the safety and performance of plastic lumber in various applications.

Green Building Initiatives: Organizations such as the U.S. Green Building Council (USGBC) and its LEED (Leadership in Energy and Environmental Design) certification program encouraged the use of sustainable building materials, including plastic lumber. Projects that incorporated sustainable and recycled materials could earn LEED credits.

Waste Management and Recycling Regulations: Europe has been actively promoting recycling and sustainable waste management practices. Policies such as the Waste Framework Directive and the Packaging and Packaging Waste Directive set targets for recycling and recovery of plastics. These regulations indirectly affect the plastic lumber market by increasing the availability of recycled plastic materials.

Single-Use Plastics Directive: The European Union (EU) adopted the Single-Use Plastics Directive, which aims to reduce the impact of certain plastic products on the environment, particularly in marine ecosystems. It includes bans or restrictions on single-use plastics like straws, cutlery, and plates. This policy indirectly encourages the use of alternative materials, including plastic lumber, for various applications.

Circular Economy Action Plan: The EU's Circular Economy Action Plan promotes the transition to a circular economy, focusing on sustainable production and consumption. This plan supports the use of recycled materials, including plastics, in various sectors, potentially benefiting the plastic lumber market.

Green Public Procurement (GPP): Many European countries have implemented GPP policies that encourage public authorities to consider environmental criteria when purchasing products. This may create a market for sustainable building materials, including plastic lumber, in public construction projects.

Plastic Waste Import Bans: Several countries, including China and Malaysia, have imposed bans or restrictions on the import of plastic waste from other countries. These bans are aimed at reducing the amount of plastic waste entering their territories and have implications for the availability of raw materials for plastic lumber production.

Russia-Ukraine War Impact Analysis:

The Russia-Ukraine conflict can disrupt supply chains for various materials, including plastic lumber. Ukraine and Russia are both key suppliers of raw materials like polymers, which are used in the production of plastic lumber. Any interruptions in the supply of these materials can lead to price fluctuations and availability issues.

Political instability and conflict in the region can result in price volatility for oil and natural gas, which are essential for the production of plastics. Plastic lumber, being a plastic-based product, can be influenced by fluctuations in the prices of these raw materials, affecting manufacturing costs and, subsequently, product prices.

Geopolitical conflicts can create uncertainty in global markets. Investors and businesses may be hesitant to make long-term investments in regions affected by conflict. This uncertainty can impact the expansion and development of the plastic lumber industry in the affected areas.

Trade disruptions, sanctions, and export restrictions imposed on Russia and Ukraine can affect the global trade of plastic lumber. Companies in the plastic lumber market may face challenges related to importing raw materials or exporting finished products to or from these regions.

The conflict may deter companies from expanding or investing in markets in the region. Plastic lumber manufacturers may seek alternative markets for growth, potentially shifting the dynamics of the industry.

The plastic lumber market often positions itself as an environmentally friendly alternative to traditional lumber, emphasizing sustainability and recycling. The conflict may influence public perception, leading to questions about the environmental sustainability of plastic lumber production, depending on the source of raw materials and the overall carbon footprint.

To mitigate the risks associated with international supply chain disruptions, some countries or regions may prioritize local production and self-sufficiency in materials. This could lead to an increased focus on recycling and domestic plastic lumber production.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic lumber market analysis from 2022 to 2032 to identify the prevailing plastic lumber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic lumber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic lumber market trends, key players, market segments, application areas, and market growth strategies.

Plastic Lumber Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.8 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 309 |

| By Application |

|

| By Product |

|

| By Resin Type |

|

| By Region |

|

| Key Market Players | TANGENT Technologies, LLC., KWK Plastic Lumber Co., Ltd., Repeat Plastics Australia Pty Ltd., Ecoville, CMI, Fiberon, American Recycled Plastic, Genova Products Inc., PlasTEAK, Trex Company, Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, growing environmental concerns and the need for sustainable construction materials have significantly boosted the demand for plastic lumber. This eco-friendly alternative to traditional wood offers advantages such as resistance to rot, insects, and moisture, making it ideal for outdoor applications. In addition, stringent regulations on logging and deforestation have further driven the adoption of plastic lumber in the construction industry, as it helps reduce the carbon footprint and promotes responsible resource management.

However, higher upfront costs compared to traditional wood and concerns regarding plastic waste management and recycling act as restraining factors for the market growth. In addition, limited consumer awareness and skepticism regarding the longevity and performance of plastic lumber continue to hinder its widespread adoption.

The CXOs further added that a growing emphasis on circular economies and sustainability can create opportunities for recycling programs and initiatives that reduce the environmental impact of plastic lumber production. Moreover, the construction industry's continual expansion, particularly in developing regions, offers a substantial market opportunity for plastic lumber as a sustainable building material, which, if harnessed effectively, can drive significant growth and profitability in the years to come.

The global plastic lumber market was valued at $5.3 billion in 2022 and is projected to reach $15.8 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Plastic Lumber Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Europe is the largest regional market for Plastic Lumber.

Government regulations and incentive and durability and low maintenance are the driving factors of the Plastic Lumber Market.

Rising demand for eco-friendly products is the upcoming trend of Plastic Lumber Market in the world.

Genova Products Inc., Trex Company, Inc., American Recycled Plastic, KWK Plastic Lumber Co., Ltd., Ecoville, CMI, PlasTEAK, Fiberon are the top companies to hold the market share in Plastic Lumber.

Molding Trim is the leading application of Plastic Lumber Market.

Loading Table Of Content...

Loading Research Methodology...