Plastic Pigment Market Outlook - 2032

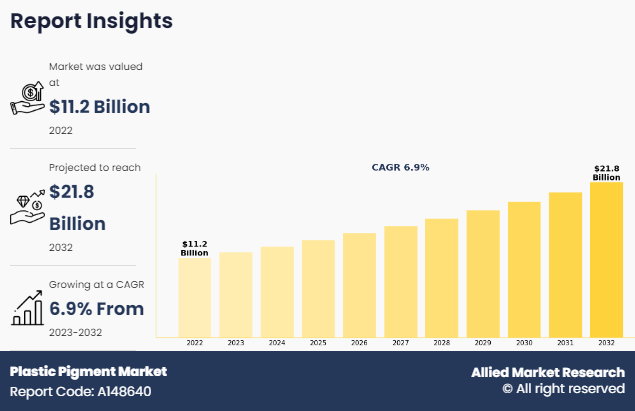

The global plastic pigment market size was valued at $11.2 billion in 2022, and is projected to reach $21.8 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032. The global plastic pigments market is poised for significant growth driven by surge in demand for vibrant colors and enhanced aesthetics in consumer goods and packaging products. Rise in demand for plastic pigments in major end-use industries such as automotive, construction, electronics and consumer goods is expected to further drive revenue growth of the global plastic pigments market.

Plastic pigments are colorants specifically formulated for coloring plastics during manufacturing. They possess properties such as high color strength, heat stability, and compatibility with various polymer matrices. These pigments are used in diverse applications, including packaging, automotive parts, consumer goods, and construction materials to enhance aesthetic appeal, brand identity, and product differentiation. In addition, these pigments offer vibrant colors, special effects, and UV resistance, ensuring durability and longevity in finished products. They contribute to eco-friendly initiatives by enabling the use of recycled plastics and sustainable materials in manufacturing processes.

Key Takeaways:

- Quantitative information mentioned in the global plastic pigments market includes the market numbers in terms of value ($million) concerning different segments, pricing analysis CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of type, end-use industry, and region. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, and opportunities), Porter’s five force analysis, key regulations across the region, and value chain analysis.

- A few companies, Atul Ltd., BASF SE, CLARIANT, DIC CORPORATION, Heubach GmbH, LANXESS, and Mazda Colours Ltd. hold a large proportion of the plastic pigments market.

- This report makes it easier for existing market players and new entrants to the plastic pigments industry to plan their strategies and understand the dynamics of the industry, which helps them to make better decisions.

Market Dynamics

Rise in use of plastic pigments in various end-use industries drives the growth of the plastic pigment market. In the automotive sector, plastic pigments play a significant role in enhancing both the aesthetic appeal and functional performance of vehicles. According to a report published by Press Information Bureau Ministry of Information and Broadcasting in 2023, India is aiming to double its automotive industry size to around $1.8 million by 2024.

Manufacturers utilize these pigments to color exterior body panels, interior components, and functional parts such as bumpers and grilles. Vibrant colors, metallic effects, and special finishes achieved through plastic pigments contribute to brand differentiation, consumer preferences, and overall market competitiveness. In addition, plastic pigments enhance the durability, weather resistance, and UV stability of automotive components, ensuring longevity and performance in harsh environmental conditions.

In the electronics industry, plastic pigments are instrumental in enhancing the appearance and functionality of electronic devices. The demand for electronic devices increased significantly during the forecast period. According to the Invest India, electronic products exports are expected to reach $120 billion by FY26. These pigments are used to color various plastic components such as casings, bezels, buttons, and connectors, helping to create visually appealing products that resonate with consumers. Furthermore, plastic pigments enable manufacturers to incorporate color-coding and branding elements into electronic devices, facilitating easy identification and brand recognition. Thus, rise in usage of plastic pigments in various end-use industries drives the growth of the plastic pigments market during the forecast period.

Moreover, surge in demand for vibrant colors and enhanced aesthetics in consumer goods and packaging products drives the plastic pigments market growth. Visual appeal is crucial for attracting customers and setting things apart in the highly competitive consumer market of today. Thus, plastic pigments are being used more by producers in a variety of industries, including electronics, food & beverage, cosmetics, and home goods to improve the visual attractiveness of their products.

Consumer preferences are shifting toward products that not only perform well but also stand out on the shelves, convey a sense of quality, and align with personal tastes and lifestyle choices. Vibrant colors, unique effects, and eye-catching packaging designs have become integral components of product branding and marketing strategies. Plastic pigments offer manufacturers a versatile and cost-effective means to achieve these objectives, allowing for a wide range of color options, special effects, and customized finishes.

Furthermore, rise in penetration of e-commerce platforms has underscored the importance of packaging aesthetics as products increasingly compete for attention in the digital realm. Packaging serves as the first point of contact between consumers and products, making it a critical factor in purchasing decisions. Plastic pigments enable the creation of visually striking packaging designs that resonate with consumers, enhance brand recognition, and drive sales. Thus, rise in demand for vibrant colors and enhanced aesthetics in consumer goods and packaging products is expected to boost the plastic pigments demand during the forecast period.

However, implementation of stringent regulations on volatile organic compound (VOC) emissions restrain the growth of the plastic pigment market. VOCs are organic chemicals that easily evaporate into the atmosphere, contributing to air pollution and posing health risks to humans and the environment. The U.S. EPA regulates VOCs at the federal level through 40 CFR 59, which is the National Volatile Organic Compound Emission Standards for Consumer and Commercial Products. Plastic pigment companies must adhere to increasingly stringent restrictions imposed by governments globally to mitigate VOCs and enhance air quality.

Manufacturers and end users of pigments are required by law to make investments in technologies and procedures that lower VOC emissions during the manufacturing and application phases. This often entails implementing costly emission control systems, adopting low-VOC formulations, and conducting regular monitoring and reporting of emissions. In addition, the transition to low-VOC or VOC-free pigment formulations may necessitate reformulation and testing of products, resulting in delays and added expenses. Thus, stringent regulations on VOC emissions hinder the growth of the plastic pigments industry.

On the contrary, advancements in pigment formulations offer significant growth opportunities for the expansion of the plastic pigments market. These advancements involve innovations in the chemical composition, particle size, dispersion characteristics, and color strength of plastic pigments. Manufacturers have been able to develop pigments that offer enhanced color intensity, improved durability, and superior resistance to environmental factors such as UV radiation and temperature variations by refining these aspects.

Moreover, advancements in plastic pigment formulations have led to the creation of pigments with tailored properties, catering to specific application requirements across various industries, including automotive, packaging, construction, and consumer goods. For instance, pigments engineered for automotive applications may prioritize factors such as heat stability and weather resistance, whereas those intended for packaging materials may focus on food safety compliance and lightfastness. Thus, advancements in plastic pigments formulations are anticipated to open new avenues for the expansion of the global plastic pigments market in the coming years.

Segments Overview

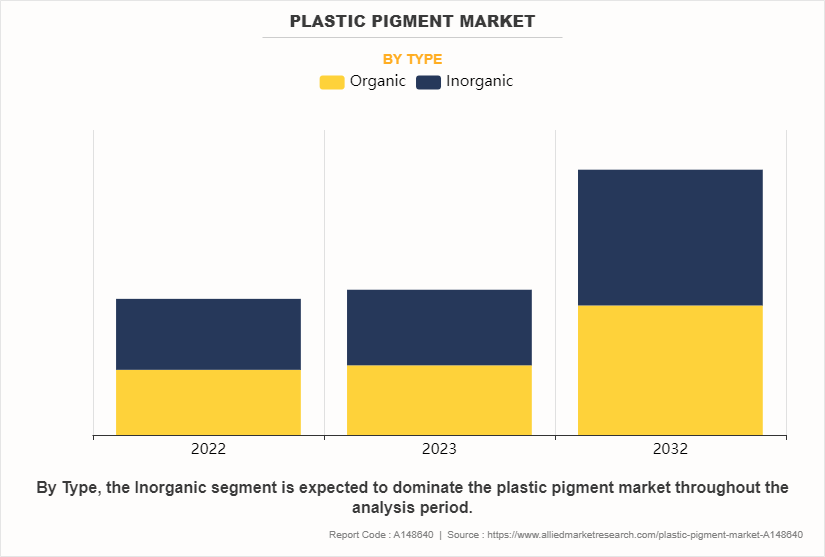

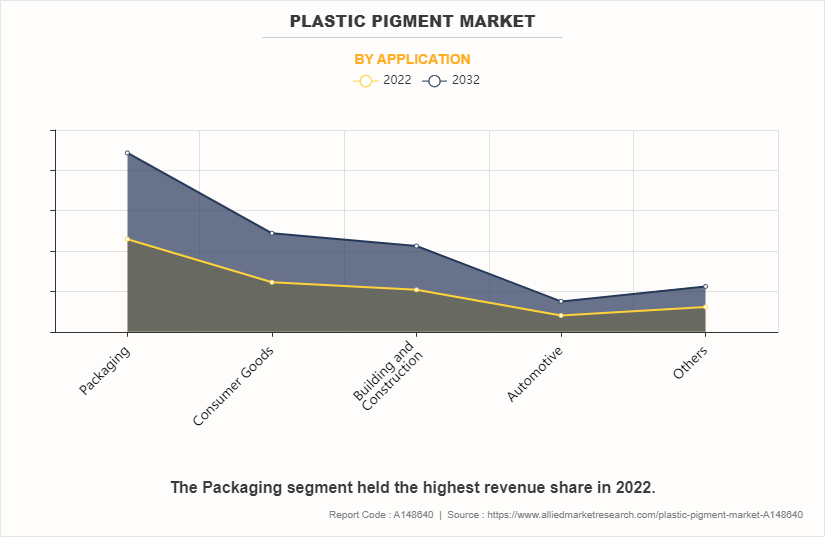

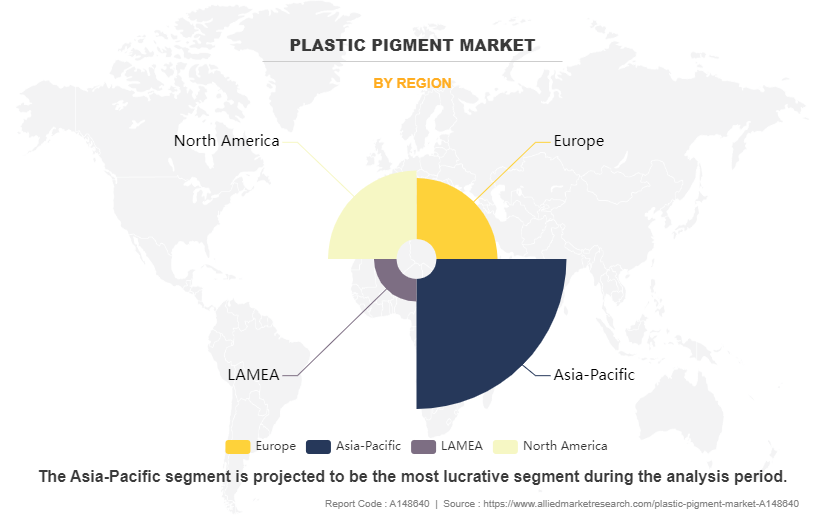

The global plastic pigments market is segmented into type, end-use industry, and region. On the basis of type, the market is bifurcated into inorganic pigments and organic pigments. By application, it is segregated into packaging, consumer goods, building & construction, and automotive. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

Plastic Pigment Market By Type

The inorganic segment accounted for the largest share in 2022. Inorganic pigments offer greater durability compared to organic pigments. They are resistant to light, heat, and chemicals, making them suitable for outdoor applications and products that require longevity. Furthermore, inorganic pigments typically have better color stability, meaning they are less prone to fading or changing color over time. This makes them ideal for products that need to maintain their appearance over extended periods.

Plastic Pigment Market By Application

The packaging segment accounted for the largest share in 2022. With a highly competitive market, brands seek ways to stand out on the shelves. Vibrant and appealing packaging colors achieved through plastic pigments help products catch consumers' attention and differentiate them from competitors. Moreover, consumers are attracted to visually appealing packaging that conveys quality and freshness. Plastic pigments enable manufacturers to create packaging in a wide range of colors and finishes, catering to diverse consumer preferences and creating memorable brand experiences. Additionally, packaging serves as a powerful marketing tool, communicating brand identity, values, and product benefits. Plastic pigments allow for the creation of customized packaging designs that reinforce brand messaging and attract target consumers.

Plastic Pigment Market By Region

Asia-Pacific garnered the largest share in 2022. The Asia-Pacific region is experiencing rapid industrialization and urbanization, leading to increased demand for plastic products across various sectors such as packaging, automotive, construction, and consumer goods. This growth fuels the demand for plastic pigments used in the manufacturing of these products. Furthermore, many countries in the Asia-Pacific region, such as China, India, Japan, South Korea, and Southeast Asian nations, have robust manufacturing sectors that produce a wide range of plastic-based products for domestic consumption and export. The growing manufacturing activities drive the demand for plastic pigments for coloration and aesthetic enhancement of these products.

Competitive Analysis

The major players operating in the global plastic pigments market are Atul Ltd., BASF SE, CLARIANT, DIC CORPORATION, Heubach GmbH, LANXESS, Mazda Colours Ltd., Sudarshan Chemical Industries Limited, The Chemours Company, and Tronox Holdings Plc. Other players include ALTANA AG, Huntsman International LLC, Kronos Worldwide, Inc., Shepherd Color, Venator Materials PLC., and Vibrantz.

These players have adopted various developmental strategies to strengthen their foothold in the market. For instance, on July 20, 2021, CLARIANT increased its sustainable efforts with the launch of pigments certified OK compost INDUSTRIAL. These pigments will be used to provide color to biodegradable plastic products, including packaging. This type of innovation and products is expected to propel the growth of the plastic pigments market.

Recent Developments in Plastic Pigments Industry

On January 26, 2023, The Chemours Company introduced Ti-Pure TS-1510, a highly efficient rutile titanium dioxide (TiO2) pigment designed to enhance processing performance in plastics applications, including polyolefin masterbatch. This product launch is expected to boost the demand for plastic pigments.

On June 30, 2021, DIC CORPORATION acquired BASF SE's global pigments business, known as BASF Colors & Effects (BCE). The acquisition will establish DIC Group as a leading pigment supplier, providing customers with a significantly greater variety of adaptable solutions. DIC Group is currently a global manufacturer of pigments, including those for electronic displays, cosmetics, coatings, inks, plastics, and specialist applications.

On September 27, 2021, LANXESS developed a black pigment Bayferrox 303 T for coloring recyclable plastic packaging. This product launch is expected to propel the growth of the plastic pigments market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic pigment market analysis from 2022 to 2032 to identify the prevailing plastic pigment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic pigment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic pigment market trends, key players, market segments, application areas, and market growth strategies.

Plastic Pigment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21.8 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Atul Ltd., LANXESS, Mazda Colours Ltd., DIC CORPORATION, BASF SE, Heubach GmbH & Co. KG, Sudarshan Chemical Industries Limited, Tronox Holdings Plc, The Chemours Company, Clariant AG. |

Growing demand in packaging industry, rapid technological advancements, growth in automotive and construction sector are the upcoming trends of Plastic Pigment Market in the world.

Packaging is the leading application of Plastic Pigment Market.

Asia-Pacific is the largest regional market for Plastic Pigment.

The global plastic pigment market was valued at $11.2 billion in 2022, and is projected to reach $21.8 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The major players operating in the global plastic pigments market are Atul Ltd., BASF SE, CLARIANT, DIC CORPORATION, Heubach GmbH, LANXESS, Mazda Colours Ltd, Sudarshan Chemical Industries Limited, The Chemours Company, and Tronox Holdings Plc. Other players include ALTANA AG, Huntsman International LLC, Kronos Worldwide, Inc., Shepherd Color, Venator Materials PLC., and Vibrantz.

Loading Table Of Content...

Loading Research Methodology...