Plastic Surgery Devices Market Research, 2031

The global plastic surgery devices market size was valued at $1,420.0 million in 2021, and is projected to reach $3,056.8 million by 2031, growing at a CAGR of 8.0% from 2022 to 2031. Plastic surgery is a type of surgery done to enhance a person's look.

It is a distinct area of medicine that is concerned with improving appearance through surgical and medical procedures. Plastic surgery can be done to enhance or reconstruct any area of the face or body. The decision to undergo plastic surgery is a personal one that patients make on their own. It comprises liposuction, facelifts, rhinoplasty, breast augmentation, eyelid surgery, facial rejuvenation, facial contouring, and skin rejuvenation. These operations are done to alter or restore bodily parts such as the skin, maxillofacial, breast, cranium, and torso, among others. Awls, chisels, curettes, gouges, mallets, pliers, osteotomes, rasps, rongeurs, wire & pin instruments, electrosurgical instruments such as bipolar and monopolar forceps, cables, and electrosurgical units are some plastic surgical instruments used to conduct aesthetic and reconstructive procedures.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The plastic surgery devices market grew at a CAGR of around 8.0% during 2022-2031. Most of the growth during this period was derived from North America owing to the improving awareness about aesthetic appearance, rising disposable incomes, as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global plastic surgery devices market size is majorly driven by increase in the number of plastic surgery procedures and rise in number of product launches and product approvals for plastic surgery devices. For instance, according to the International Society of Aesthetic Plastic Surgery, in 2020, it was reported that, approximately 10,129,528 total cosmetic procedures were performed by plastic surgeons worldwide. Increase in number of plastic surgery procedures drives the growth of the plastic surgery devices market. Surgical cosmetic procedures include breast augmentation, eyelid surgery, liposuction, rhinoplasty (nose reshaping), facelift, breast lift, cheek implant, lip augmentation, and neck lift. According to the International Society of Aesthetic Plastic Surgery, in 2020, it was reported that, approximately 1,624,281 total breast augmentation procedures were performed by plastic surgeons worldwide. As per the same source, in 2020, it was reported that, 1,525,197 liposuction procedures were performed across the globe.

In addition, according to the American Society of Plastic Surgeons, in 2020, it was reported that around 352,555 rhinoplasty procedures were performed in the U.S. in 2020. It was analyzed that rhinoplasty was the leading surgical procedure performed in the U.S. in 2020. As per the same source, in 2020, approximately 211,067 liposuction surgeries were performed in the U.S.

Moreover, increase in number of female populations propel the demand for cosmetic surgical procedures and drive the growth of the market. According to the American Society of Plastic Surgeons, in year 2020, it was reported that around 2 million cosmetic surgical procedures were conducted among the female population in the U.S.

Rising number of geriatric populations is anticipated to drive the growth of the market. The natural aging process, lifestyle factors, and environment all contribute to unwanted wrinkles, fine lines, age spots, and uneven skin tone. Growing urge among old age population to look young and fit causes increase in the demand for facial aesthetic procedures. Thus, this factor is anticipated to propel the growth of the plastic surgery devices market. For instance, according to the United Nations, in 2019, it was reported that there were 703 million population aged 65 years or above, across the world. Moreover, in 2020, according to a report shared by American Society of Plastic Surgeons, in the U.S. approximately 3.2 million minimally invasive aesthetic procedures were performed in the age group of 55 to 69 years.

In addition, increase in self-awareness among young population regarding aesthetic appearance propels demand for plastic surgery devices industry. In addition, change in lifestyle of young generation has led to issues such as weight gain and hair loss, making them conscious about their appearance, which increases the need for cosmetic surgeries. For instance, liposuction surgery removes excess fat and improves body structure by contouring, which encourages young population to go for such kind of surgeries. Cosmetic surgeries are also helpful in breast augmentation and nose reshaping, which attracts the young generation.

Increase in number of licensed medical centers, and rise in number of plastic surgery devices industry fuels the growth of plastic surgery devices market. The reason behind increasing number of medical centers is attributed to increase in demand for minimally invasive treatment among young population. Increase in skin damage and changes in lifestyle are the major factors that lead to rise in number of medical spas.

On the other hand, high costs associated with cosmetic surgical procedures are anticipated to limit the growth of the plastic surgery devices market during the forecast period. In addition, cosmetic surgical procedures are associated with various side-effects such as mild bleeding, allergy reaction, scarring, infection, blood clot, and separation at incision sites. Plastic surgery devices is not recommended for patients diagnosed with skin inelasticity, and weak bone structures. Thus, this factor is expected to hamper the market growth during the plastic surgery devices market forecast.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global plastic surgery devices market share. Most of the aesthetic and reconstructive surgeries were postponed or rescheduled due to conversion of dermatology clinics into COVID hospitals. A number of clinics and hospitals were restructured to increase hospital capacities for patients diagnosed with COVID-19. Non-essential surgical procedures were cancelled due to the pandemic. Plastic surgery procedures are non-emergency procedures that significantly hampered revenue of aesthetic companies. In addition, sudden sharp cut in monthly income of people is anticipated to have a negative impact on the plastic surgery devices market. Implementation of lockdown, owing to the COVID-19 outbreak resulted in decline in number of patient visits for aesthetic procedures during the pandemic, which hampered the plastic surgery devices market growth.

Segmental Overview

The plastic surgery devices market share is segmented into type, application and end user and region. By type, the market is segmented into handheld and electrosurgical. Electrosurgical segment is further classified into bipolar, monopolar, and others. Others segment includes cables and electrosurgical units. By application, market is segmented into aesthetic surgery and reconstructive surgery. By end user, the market is segmented into ambulatory surgical facility, hospital & clinics, and cosmetic surgical centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

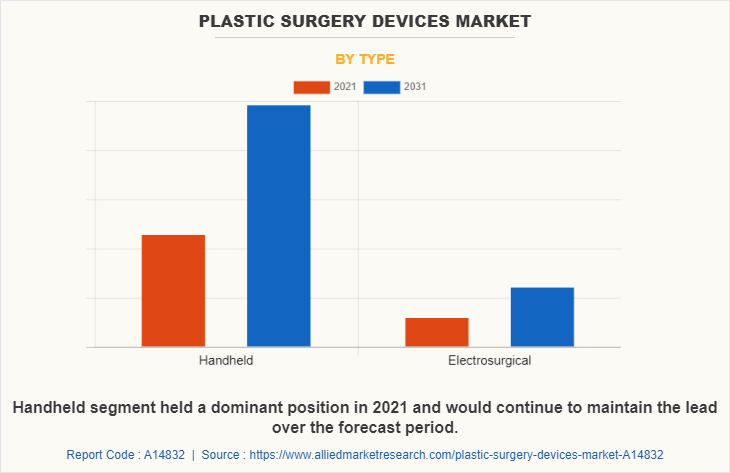

By Type

On the basis of type, the market is classified into handheld, electrosurgical, and others. The handheld segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to increase in the number of product launches for electrosurgical instruments and high presence of key players who manufacture electrosurgical instruments.

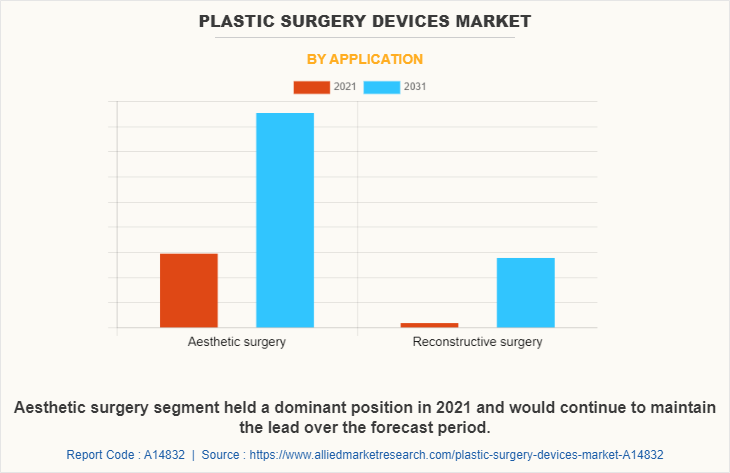

By Application

On the basis of application, the market is classified into aesthetic surgery and reconstructive surgery. The aesthetic surgery segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to technological advancement in aesthetic and plastic surgery sector and increase in awareness among people regarding aesthetic appearance.

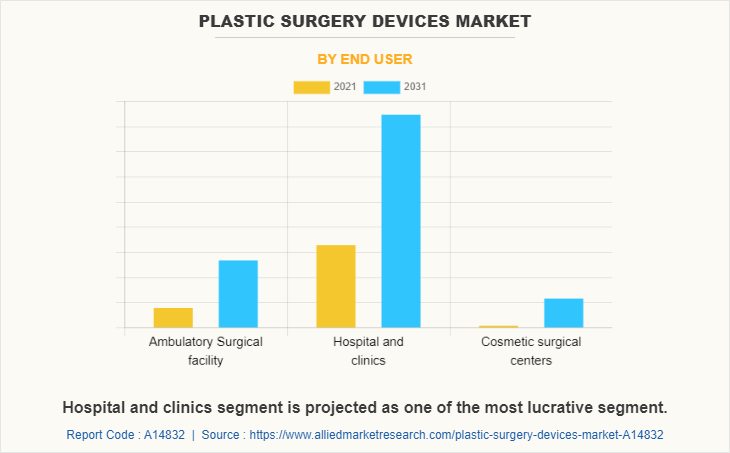

By End User

On the basis of end user, the market is classified into ambulatory surgical facility, hospital & clinics, and cosmetic surgical centers. The hospitals and clinics segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to increase in the number of hospitals and rise in the expenditure by government to develop healthcare infrastructure.

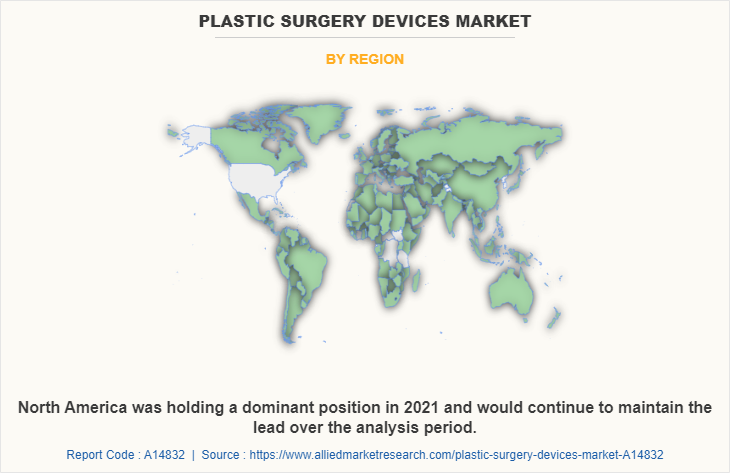

By Region

The plastic surgery devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the plastic surgery devices market in 2021, and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as Anthony Products, Inc., Becton, Dickinson and Company, Symmetry Surgical Inc., Sklar Corporation, and Corza Medical and advancement in manufacturing technology of plastic surgery devices in the region drive the growth of the market. In addition, surge in concern among people for maintaining an aesthetic appearance, consistent growth in geriatric population, and increase in the demand for aesthetic and reconstructive procedures in the region is expected to propel the growth of market.

Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of electrosurgical instruments are expected to drive the market growth. Furthermore, product launch, mergers, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market. For instance, in January 2021, Merz Aesthetics, the world’s largest dedicated medical aesthetics business, and Candela Corporation, the leading global medical aesthetic device company, announced commercial collaboration for creating broad medical aesthetics portfolio.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of aesthetic companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in personalized medicine expenditure and adoption of high-tech processing to improve the production of plastic surgery devices, drive the growth of the market. Furthermore, increase in awareness among people in Asia-Pacific for aesthetic appearance and rise in awareness regarding availability of plastic surgery and reconstructive surgery boost the market growth.

Asia-Pacific offers profitable opportunities for key players operating in the plastic surgery devices market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising disposable incomes, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competitive Analysis

Competitive analysis and profiles of the major players in the plastic surgery devices market include Anthony Products, Inc., Becton, Dickinson and Company, Bolton Surgical Ltd., Corza Medical, Integra Lifesciences, Sklar Corporation, Symmetry Surgical Inc., Tekno-Medical Optik-Chirurgie GmbH, and Zimmer Biomet Holdings, Inc. There are some important players in the market such as Zimmer Biomet Holdings, Inc. and others who have launched new products for plastic surgery. Major players have adopted product launch, product expansion, and acquisition as key developmental strategies to improve the product portfolio of the plastic surgery devices market.

Some examples of product launches in the market

In March 2019, Zimmer Biomet, a global leader in musculoskeletal healthcare announced U.S. Food and Drug Administration 510(k) clearance of the ROSA ONE Spine System for robotically assisted minimally invasive and complex spine surgeries, strengthening the company's comprehensive ROSA ONE Brain and ROSA Knee portfolio.

Collaboration in the market

In January 2021, Merz Aesthetics, the world’s largest dedicated medical aesthetics business, and Candela Corporation, the leading global medical aesthetic device company, announced commercial collaboration for creating broad medical aesthetics portfolio.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic surgery devices market analysis from 2021 to 2031 to identify the prevailing plastic surgery devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic surgery devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic surgery devices market trends, key players, market segments, application areas, and market growth strategies.

Plastic Surgery Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.1 billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 218 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Integra LifeSciences Holdings, Becton, Dickinson and Company, TEKNO-MEDICAL OPTIK-ChIRURGE GMBH, KARL STORZ SE & CO.KG, ANTHONY PRODUCTS, INC., bolton surgical ltd., ZIMMER BIOMET HOLDINGS, INC, SYMMETRY SURGICAL INC, Corza Medical, SKLAR CORPORATION |

Analyst Review

Plastic surgery is a voluntary surgical or medical technique, which is performed to enhance the body appearance. It is also a unique discipline of medicine, which focuses on enhancing appearance through surgical and medical techniques. It can be performed on all areas of head, neck, and body. Different types of handheld and electrosurgical instruments are used to perform aesthetic and reconstructive surgeries. The market for plastic surgery devices is driven by increase in number of cosmetic procedures, rise in number of key players that launch various plastic surgery devices, increase in number of licensed medical spas, and growth in self- awareness among young population regarding aesthetic appearance. Side-effects associated with cosmetic procedures are anticipated to hinder growth of the market. Development of advanced technology products to boost the demand for cosmetic surgical procedures provides opportunity to propel the growth of the market.

Rise in adoption of key strategies such as collaboration, acquisition, agreement, and partnership by key players who manufacture plastic surgery devices fuels the growth of the market. For instance, in January 2021, Merz Aesthetics, the world’s largest dedicated medical aesthetics business, and Candela Corporation, the leading global medical aesthetic device company, announced commercial collaboration for creating broad medical aesthetics portfolio.

In addition, rise in the number of product approval for new technologies fuels the market growth. For instance, in March 2019, Zimmer Biomet, a global leader in musculoskeletal healthcare announced U.S. Food and Drug Administration 510(k) clearance of the ROSA ONE Spine System for robotically assisted minimally invasive and complex spine surgeries, strengthening the company's comprehensive ROSA ONE Brain and ROSA Knee portfolio.

The top companies that hold the market share in plastic surgery devices market are Anthony Products, Inc., Becton, Dickinson and Company, Bolton Surgical Ltd., Corza Medical, Integra Lifesciences, Sklar Corporation, Symmetry Surgical Inc., Tekno-Medical Optik-Chirurgie GmbH, and Zimmer Biomet Holdings, Inc.

The key trends in the plastic surgery devices market are increase in the number of plastic surgery procedures and rise in number of product launches and product approvals for plastic surgery devices.

Asia-Pacific is expected to register highest CAGR from 2022 to 2031, owing to increase in number of plastic surgery procedures and rise in awareness among people regarding aesthetic appearance.

The base year for the report is 2021.

Yes, plastic surgery devices companies are profiled in the report

The total market value of plastic surgery devices market is $1,420 million in 2021.

The forecast period in the report is from 2022 to 2031

The market value of plastic surgery devices market in 2022 was $1,527.9 million

Loading Table Of Content...