Plywood Market Research: 2032

The global Plywood Market size was valued at $55.7 billion in 2022, and is projected to reach $100.2 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032. Plywood is available in various grades, thicknesses, and sizes, making it suitable for a wide range of applications in construction, furniture manufacturing, cabinetry, packaging, and other industries. It is commonly made from both hardwoods and softwoods, and the choice of wood species can affect the appearance, strength, and suitability of the plywood for different purposes. plywood is a wood panel made from thin layers of wood veneer or "plies" that are glued together. These plies are typically arranged with their grain direction perpendicular to each other, which enhances the strength and stability of the panel. The layers are bonded using adhesives under heat and pressure, resulting in a strong and versatile material.

Plywood Market Dynamics

A significant increase in the number of buildings can be seen across the globe. This is largely attributed to the increasing global population and rapid urbanization. For instance, according to U.S. Department of Housing and Urban Development, in 2023, 1,469,800 housing units were authorized by building permits in the U.S. Such buildings utilize wood-based panels in flooring, furniture, doors and window panels, and others.

Therefore, a rise in building construction is anticipated to increase the demand for plywood. The plywood industry is witnessing surge in growth owing to factors such as increasing number of dwellings, increasing disposable income, and development in the e-commerce industry. Furthermore, owing to the COVID-19 pandemic, people globally were forced to work from home, for which they demanded tables and chairs, leading to a boost in the plywood market.

There are numerous plywood grades available in the market, such as MR Grade, BWR Grade, BWP Grade, FR Grade, and others. The fire resistant plywood are more popular owing to its usage in commercial space. For instance, in May 2023, India based plywood manufacturer Greenply has developed a fire retardant plywood that addresses the pressing issue of hazardous fires in residential and commercial spaces.

The most common usage for plywood is in structural applications. Plywood is inherently resistant to stress and extreme weather conditions. Structural plywood is ideally suited for beams and hoardings, although it is also widely used in crates, bins, interior constructions, outdoor furniture, and boxes.

Structural plywood is used for wall and roof reinforcement. Furthermore, plywood's capacity to withstand warping, cracking, splitting, and shrinkage makes it a dependable building material. Its constant thickness also enables precise and accurate installation. These advantages have led architects and constructors to prefer plywood over more traditional options including solid wood or particle board. Many companies are focusing on improving its plywood production. For instance, in December 2023, Georgia-Pacific invested nearly $2 billion on its company and existing operations.

These capital improvement projects involve the development and completion of new facilities, along with the enhancement of current operations. Each investment allows Georgia-Pacific to improve service customers, boost productivity and efficiency, and provide more economic prospects in each facility's local economy.

Increasing demand and capacity expansions

The growth of manufacturing industries creates demand for flat commodities including plywood, which might enhance the plywood industry. The increased hospitability industry is raising the market for plywood. Furthermore, increased building activity and infrastructure development in countries including India and China have the potential to greatly boost the plywood market.

For instance, DURO Ply Industries Ltd., a plywood manufacturing veteran, continues to revolutionize the market with innovative approaches that are not only easy to implement but also add value. Their most recent launched, the DURO PLUS, is the only plywood option available in India. The DURO PLUS is a one-of-a-kind plywood that measures 9 feet and 10 feet, the most often utilized dimensions in block boards and doors.

Furthermore, invest in physical and storage infrastructure to meet increased manufacturing demand. This expansion is fueled by a number of reasons including economic development, building projects, and increased consumer demand for wood-based products. In order to take advantage of such customers, plywood makers are implementing flexible manufacturing methods, combining cutting-edge technology for increased efficiency, and undertaking extensive market analyses to align capacity increases with changing plywood market demands.

For Instance, in February 2022, Lumin, a major timberland and forest products company has invested US$136 million to develop its third industrial production plant in Uruguay. This development is projected to create more than 300 jobs and greatly enhance the country's sustainable plywood manufacturing. The adoption of sustainable methods, along with adherence to quality control standards, let the sector grow in the face of rising demand. As the plywood industry evolves, these strategic activities provide a strong reaction to plywood market trends and a solid platform for future success.

Significant growth of furniture industry in Asia-Pacific

The furniture sector in Asia-Pacific region is growing with CAGR of 6.3% during the forecast period. Plywood market is in high demand as it is an important material in furniture making. Globally, the construction business is expanding rapidly in countries such as India, China, and Japan, and such a trend is projected to boost demand in the future years in Asia-Pacific. This is leading to an increasing demand for plywood, which is widely utilized in construction, from flooring and walls to roofing and packing. The advent of technology has made it easier to manufacture plywood.

This has resulted in lower manufacturing costs, which are predicted to boost industry development. The rise in disposable incomes and the expansion of the middle class are driving up demand for higher-quality plywood goods. The government supports the business and is taking different initiatives to encourage its growth.

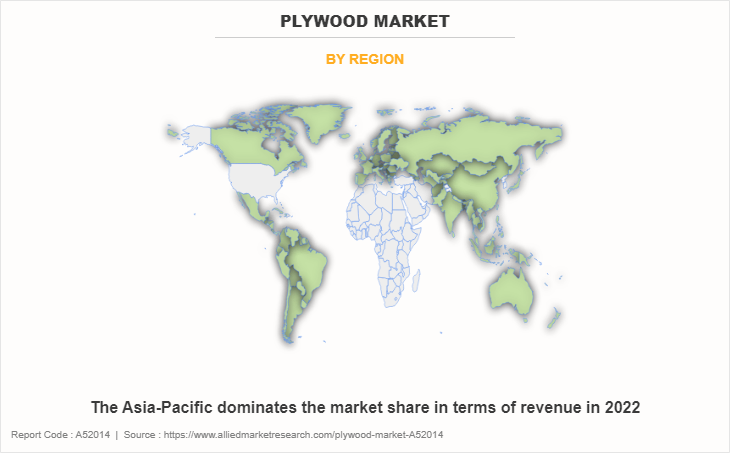

Furthermore, Asia is the largest plywood market, accounting for more than half of total worldwide demand and China is the world's top producer and consumer of plywood. Plywood from Asia-Pacific is supplied to major regions including North America, Europe, and Africa for usage in several applications. The plywood industry in Asia-Pacific contributes to the significant growth of the global economy and it also plays a vital part in the region's growth. For instance, in July 2022, Greenply Industries Limited, one of the largest interior infrastructure brands in India launched its new brand campaign for the innovative Zero Emission (E-0) product range Green Platinuma.

The expansion of the middle-class category in several Asia-Pacific nations has raised demand for furniture, boosting use of plywood, a critical raw material in the furniture manufacturing sector. Moreover, plywood is also used in multiple industrial applications, such as packaging and manufacturing, which is consistent with the region's general industrial demand. Such development is fueling demand for plywood.

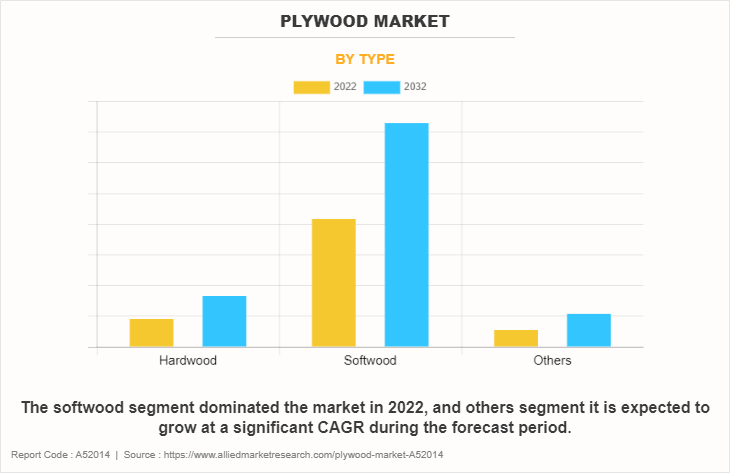

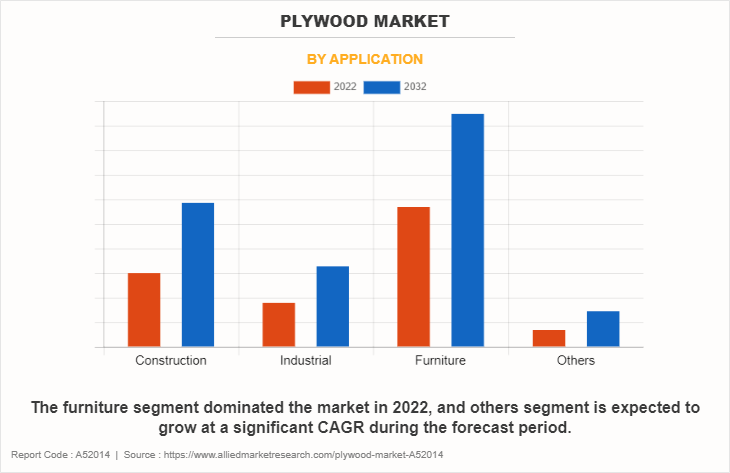

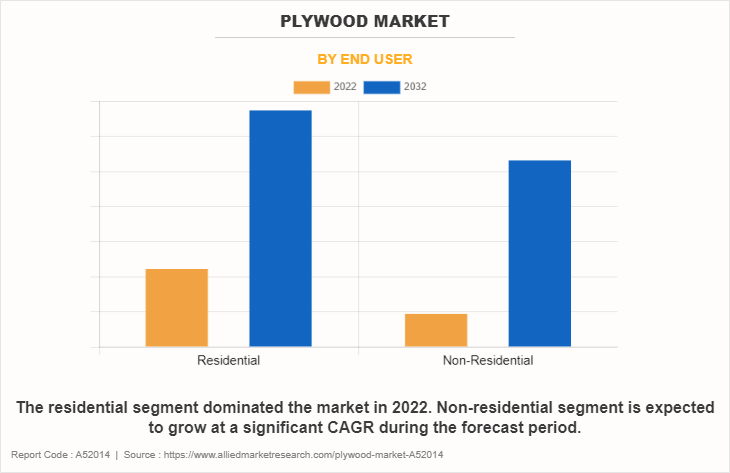

The plywood market is segmented into type, application, end user, and region. On the basis of type, the market is bifurcated into hardwood, softwood, others. On the basis of application, it is divided into construction, industrial, furniture, others. On the basis of end user, it is categorized into residential, non-residential.

Region wise, the plywood market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). On the basis of region, Asia-Pacific is expected to be the largest market shareholder owing to the country constantly increasing customer expenditure to integrate advanced plywood interior such as furniture and exterior across plywood sector.

Competitive Analysis

Competitive analysis and profiles of the major global plywood market players that have been provided in the report include Weyerhaeuser Company; Georgia-Pacific; LLC, Boise Cascade Company; Greenply Industries; Uniply Industries Ltd.; JAYA TIASA HOLDINGS BERHAD; UPM Plywood; SUBUR TIASA HOLDINGS BERHAD; SVEZAs; and Duro Ply Industries Limited. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Top Impacting Factors

The global plywood market is expected to witness notable growth owing to growing demand for plywood, growing building & construction industry, and significant growth of furniture industry.

Key Developments / Strategies for Plywood Market Growth

In January 2023, according to Decorative Hardwoods Association, imports of the U.S. hardwood plywood increased by about 25% in value to more than $2 billion and almost 8% in volume to more than 3.1 billion square feet. These huge gains follow a 35% rise in volume in 2021. Indonesia and Vietnam led growth in 2022, as the value of imports from Indonesia surged by a stunning 55% while imports from Vietnam expanded by 33%.

In June 2022, Boise Cascade Company announced that it had reached an agreement to acquire Coastal Plywood Company, including its two manufacturing locations, from Coastal Forest Resources Company for $512 million. Moreover, Coastal provides premium plywood, lumber, and treated wood products across the eastern U.S. The acquisition agreement includes operations in Havana, Florida and Chapman, Alabama, with around 750 employees.

In December 2022, PotlatchDeltic Corporation and CatchMark Timber Trust, Inc. announced that they had reached a formal agreement to combine in an all-stock transaction. PotlatchDeltic's purchase expanded and diversified a premier integrated wood REIT while continuing to increase shareholder value.

In December 2022, Martco, LLC, the parent company of RoyOMartin, a third-generation family-owned wood sourcing and manufacturing firm, had announced a $9.5 million investment in technologically advanced production equipment for its Natchitoches Parish lumber plant.

In December 2021, UPM Plywood invested U.S. $11.324 million in the expansion of its plywood factory in Joensuu. The investment comprises additional manufacturing lines, expanded workplaces, and 720 square meters of entirely new production space. UPM's investment improves the mill's supply security and ensures the high quality of demanding goods, therefore increasing its competitiveness.

In December 2021, Greenlam had announced that it has invested $114 million in the coming two-three years from (2022-2024) towards setting up of the third laminate plant and made a foray into the plywood and particle board business.

Plywood Market Report Key Highlighters

The plywood market report studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the plywood market.

- The plywood market share is marginally fragmented, with players such as Weyerhaeuser Company; Georgia-Pacific; LLC, Boise Cascade Company; Greenply Industries; Uniply Industries Ltd.; JAYA TIASA HOLDINGS BERHAD; UPM Plywood; SUBUR TIASA HOLDINGS BERHAD; SVEZAs; and Duro Ply Industries Limited. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the plywood market are tracked and monitored.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global plywood market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global plywood market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global plywood market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter's five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the market share of key vendors and the global plywood market.

- The key players within the plywood market overview are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the plywood industry.

- A comprehensive analysis of all the regions is provided to determine the prevailing plywood market opportunity.

Plywood Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 100.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 197 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Century Ply |

Analyst Review

Plywood is one of the most flexible building materials known, with extensive industrial applications. Plywood is an engineered wood that is created by gluing together individual sheets or plies of wood to form a sturdy material. It is sturdy, resilient, and inexpensive, and does not warp or break readily. Plywood for industrial use varies in strength and characteristics based on the type of timber used. Structural plywood is used to build permanent constructions that require great strength and longevity. It is often composed of hardwood. Structural plywood should be able to tolerate extreme weather conditions and hold up under high stress. Although the purpose of this plywood is strength rather than looks, it frequently has a lot of knots and holes.

Moreover, interior or internal plywood is the third most significant form of plywood for industrial applications. This sort of plywood is ideal for all types of interior applications. They have a nice look and finish. This plywood, however, is not extremely resistant to moisture or heat and should not be exposed to adverse weather conditions for an extended period of time. Aesthetics are more important than durability in this style. For instance, in June 2023, Duroply, India's premium and most experienced plywood manufacturer among the main companies, has released another unique product, 'Techply', India's first ready-to-install plywood and board. Techply is a highly customizable product that can be utilized as per consumer requirement. Moreover, Techply is aimed at ambitious consumers who want to complete their interiors with branded plywood. Duroply, an innovative company, has issued the industry's first 21-year warranty on Techply. Such development is fueling the demand for innovative plywood material in various industrial applications. Moreover, it promotes economic growth and stability which has an impact on the demand for plywood. Growth in emerging nations, including India, China, Japan, Brazil, Mexico, and Indonesia, that have experienced rapid urbanization and infrastructure developments have the potential to considerably increase demand.

Furthermore, the plywood sector, among many others, struggled during the COVID-19 epidemic. Lockdowns and economic uncertainty caused supply chain disruptions, limited labor availability, and changing demand, all of which had an impact on the sector. The relationship between market demand and supply chain issues in the plywood sector is dynamic and driven by a variety of internal and external variables. To solve these difficulties, industry producers must adopt sustainable practices, engage in effective supply chain management, and innovate.

Urbanization and growth in population are the upcoming trends of Plywood Market in the world

Furniture is the leading application of Plywood Market

Asia-Pacific region is the largest regional market for Plywood market

The global plywood market was valued at $55,663.5 million in 2022

Weyerhaeuser Company; Georgia-Pacific; LLC, Boise Cascade Company; Greenply Industries; Uniply Industries Ltd.; JAYA TIASA HOLDINGS BERHAD; UPM Plywood; SUBUR TIASA HOLDINGS BERHAD; SVEZAs; and Duro Ply Industries Limited.

The global plywood market is projected to reach $100,155.6 million by 2032

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on type, the softwood segment was the highest revenue contributor to the market

Loading Table Of Content...

Loading Research Methodology...