Point-of-Care Glucose Testing Market Research, 2032

The global point-of-care glucose testing market size was valued at $3 billion in 2022, and is projected to reach $4.8 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032. Point-of-care glucose testing is a type of medical testing that measures blood glucose levels at the point of care or at the bedside of the patient, rather than sending blood samples to a laboratory for analysis. Point-of-care glucose testing is commonly used in the management of diabetes, a chronic condition in which the body is unable to properly regulate blood glucose levels. Point-of-care glucose testing products include strips, lancets and lancing devices, and meters.

Market dynamics

The point-of-care glucose testing market share witnessed growth owing to a rise in prevalence of diabetes that further increased the demand for point-of-care glucose testing devices. For instance, according to the Centers for Disease Control and Prevention (CDC) 2023, more than 37 million people in the U.S. have diabetes, and 1 in 5 of them are unaware of their diabetes.

According to the International Diabetes Federation (IDF) Atlas 10th edition, in 2021, 51 million (1 in 7 adults) individuals in North America and Caribbean region were suffering from diabetes. In addition, as per the International Diabetes Federation (IDF) Diabetes Atlas 10th edition, the cases of diabetes are estimated to increase to 57 million by 2030 and 63 million by 2045 in North America. Furthermore, the rise in technological advancement in glucose testing devices, and the rise in risk factors that lead to diabetes further increases the demand for point-of-care glucose testing devices and drives the growth of the market.

Moreover, the aging population is more susceptible to disease due to loss of muscle mass, obesity, lack of exercise, increase in insulin resistance, and impaired pancreatic islet function with aging. For instance, according to International Diabetes Federation (IDF) Diabetes Atlas, 9th edition 2020, 195.2 million people aged above 65 years will be affected by diabetes in 2030 and 276.2 million people aged above 65 years will be affected by diabetes in 2045. Therefore, the increase in geriatric population suffering from diabetes drives the growth of the point-of-care glucose testing market. Hence, such factors drive the growth of the point-of-care glucose testing market.

Furthermore, increase in awareness for glucose monitoring devices, and untapped market opportunities in the developing regions are expected to open new avenues for the growth of the point-of-care glucose testing market share across the world during the forecast period. Moreover, the key players such as Abbott Laboratories, LifeScan, Inc., and F. Hoffmann-La Roche AG have increased their presence in these emerging markets, as they anticipate a potential growth opportunity for point-of-care glucose testing market, due to the presence of a massive population base. Hence, all these factors drive the growth of the point-of-care glucose testing market size during the forecast period.

Segmental Overview

The point-of-care glucose testing market is segmented on the basis of product type, application, end user, and region. On the basis of product type, the market is classified into lancing devices & strips, and blood-glucose meter. The blood-glucose meter segment is further bifurcated into Lifescan one touch ultra & Lifescan one touch verio; Accuchek Aviva Plus & Accuchek; FreeStyle Lite & FreeStyle precision neo; Contour Next; and others. On the basis of application, the market is classified into type-1 diabetes, and type-2 diabetes. As per end user, it is segregated into hospitals & clinics, home care settings, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By product type

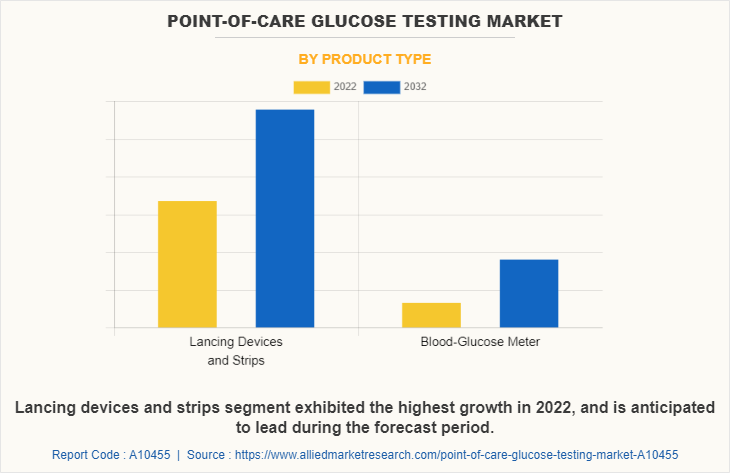

The point-of-care glucose testing market is segmented into lancing devices & strips, and blood-glucose meter. The lancing devices & strips segment generated maximum revenue in 2022, owing to high adoption of lancing devices & strips, and the availability of various lancing devices & strips. The blood-glucose meter segment is expected to witness the highest CAGR during the forecast period, owing to rise in cases of diabetes and rise in awareness regarding diagnosis of diabetes.

By Application

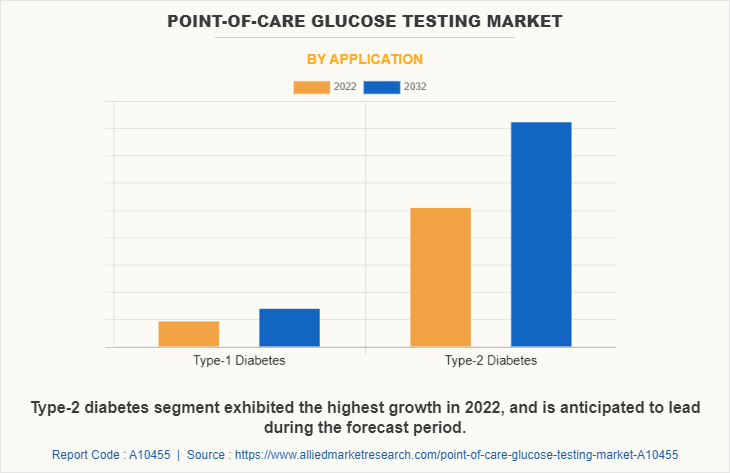

The point-of-care glucose testing market is segmented into type-1 diabetes, and type-2 diabetes. The type-2 diabetes segment generated maximum revenue in 2022, owing to high number of patient suffering from type-2 diabetes across the world. The same segment is expected to witness a highest CAGR during the forecast period, owing to an increase in cases of type-2 diabetes day by day and increase in research regarding type-2 diabetes.

By End user

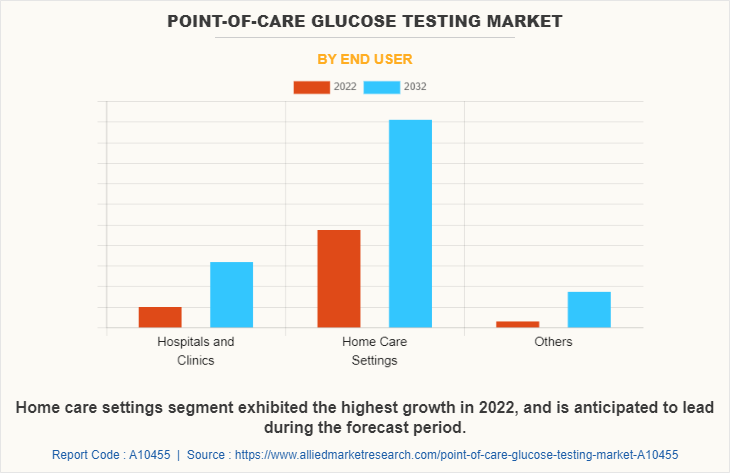

The point-of-care glucose testing market is segregated into hospitals & clinics, home care settings, and others. The home care settings segment led the market in 2022, owing to high use of point-of-care glucose testing device in home care settings and high number of diabetes patients check the diabetes for observing the effect of meal in home. The same segment is expected to witness the highest CAGR during the forecast period, owing to rise in geriatric population who require medical care in their home, and rise in awareness among people regarding use of point-of-care glucose testing device in home.

By Region

The point-of-care glucose testing market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the point-of-care glucose testing market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Abbott Laboratories, ACON Laboratories, Inc., Nova Biomedical, Prodigy Diabetes Care, LLC., Platinum Equity Advisors, LLC (Lifescan, Inc.), and Trividia Health, Inc., and the rise in the number of diabetes patients in the region drive the growth of the market. The presence of well-established healthcare infrastructure, high purchasing power, rise in the adoption rate of point-of-care glucose testing products, and a significant rise in capital income in developed countries are expected to drive market growth.

Asia-Pacific is expected to grow at the highest rate during the point-of-care glucose testing market forecast period. The point-of-care glucose testing market growth in this region is attributable to rise in the number of patient suffering from diabetes in this region, as well as increase in the purchasing power of populated countries, such as China and India. Moreover, China and India jointly have a large pool of diabetic patients, which makes them highly opportunistic for investment.

Competition Analysis

Competitive analysis and profiles of the major players in the point-of-care glucose testing industry, such as Abbott Laboratories, ACON Laboratories, Inc., Ascensia Diabetes Care Holdings AG, EKF Diagnostics Holdings plc, F. Hoffmann-La Roche Ltd., Nipro, Nova Biomedical, Platinum Equity Advisors, LLC (Lifescan, Inc.), Prodigy Diabetes Care, LLC, and Trividia Health, Inc. are provided in the report. There are some important players in the market such as Abbott Laboratories, EKF Diagnostics Holdings plc, Platinum Equity Advisors, LLC (Lifescan, Inc.), Hoffmann-La Roche Ltd., and Ascensia Diabetes Care Holdings AG which have adopted agreement, collaboration, partnership, product development, product approval, and product launch as key developmental strategies to improve the product portfolio of the point-of-care glucose testing industry.

Recent collaboration in the point-of-care-glucose testing market

In February 2023, Ascensia Diabetes Care, a global diabetes care company, announced collaboration with SNAQ, that offers key insights on food and nutrition for people with diabetes (PWDs). Collaborating to integrate their technologies, Ascensia and SNAQ empower more PWDs to make impactful mealtime decisions, with a goal to improve diabetes management.

In August 2021, LifeScan and Cecelia Health Sign expanded their multi-year partnership to offer live diabetes telehealth support in combination with OneTouch solutions integrated holistic health tools and OneTouch blood glucose monitoring. Cecelia Health has been an incredibly important partner to LifeScan by bringing their unmatched Certified Diabetes Care and Education Specialist capabilities through the OneTouch Reveal app to care for, educate, and empower people with diabetes.

In August 2021, LifeScan and Fitbit announced a collaboration to offer people with diabetes a more complete view of how lifestyle factors like daily activity, nutrition and sleep can impact blood glucose levels, while also providing tools that can help lead to healthy lifestyle changes.

Recent partnership in the point-of-care-glucose testing market

In August 2020, PHC Holdings Corporation and Ascensia Diabetes Care, announced a strategic partnership with Senseonics Holdings, Inc., a medical technology company focused on the development and commercialization of long-term, implantable continuous glucose monitoring (CGM) systems for people with diabetes. The partnership comprises a global commercialization and distribution agreement and a concurrent financing agreement.

Recent product launch in the point-of-care-glucose testing market

In January 2022, Roche launched the cobas pulse system, an industry first professional blood glucose management solution with mobile digital health capabilities to improve patient care.

In March 2021, EKF Diagnostics announced the global launch of its STAT-Site WB handheld analyzer which delivers -ketone and glucose measurements from whole blood in seconds. The STAT-Site WB is used for the quantitative determination of -ketones (Beta-Hydroxybutyrate or BHB) and glucose in whole blood taken from capillary or venous samples. The easy-to-use analyzer is reagent free, utilizing two different test strips to deliver results in just 10 seconds for -ketones and 5 seconds for glucose.

In November 2020, Abbott launched revolutionary Freestyle Libre system in India providing real-time continuous glucose monitoring for people with diabetes. FreeStyle Libre is designed for users to be able to check their glucose readings much more simply and frequently, and data show that higher scanning frequency of the technology has been shown to significantly improve time in optimal glucose range.

Recent product approval in the point-of-care-glucose testing market

In October 2022, the U.S. Food and Drug Administration (FDA) has cleared Nova Primary as a blood glucose reference analyzer. Manufacturers of blood glucose measuring devices and clinical diabetes researchers have relied on the YSI 2300 as a reference and correlation analyzer. The U.S. FDA clearance, Nova Primary, is now available in the U.S. and worldwide.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the point-of-care glucose testing market analysis from 2022 to 2032 to identify the prevailing point-of-care glucose testing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the point-of-care glucose testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global point-of-care glucose testing market trends, key players, market segments, application areas, and market growth strategies.

Point-of-Care Glucose Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.8 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 408 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Trividia Health, Inc., Ascensia Diabetes Care Holdings AG, Nova Biomedical Corporation, Nipro, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Platinum Equity Advisors LLC, Prodigy Diabetes Care LLC, ACON Laboratories, Inc., EKF Diagnostics Holdings plc |

Analyst Review

According to the perspectives of CXOs, the global point-of-care glucose testing market is expected to witness a steady growth in the future. This is majorly attributed to the rise in the number of people suffering from diabetes and rise in demand for glucose testing meter. In addition, the rise in geriatric population, technological advancements in point-of-care glucose testing devices, and changes in lifestyle of people, which make them highly susceptible to develop diabetes, drives the growth of the market. Thus, point-of-care glucose testing devices are gaining popularity among patients as well as healthcare providers, owing to the benefits associated with them and their easy operation.

North America is expected to witness the highest growth, in terms of revenue owing to an availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in use of point-of-care glucose testing devices, increase in cases of diabetes, unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

Point-of-care glucose testing (POCGT) refers to the measurement of blood glucose levels using a portable device that can be used at the patient's bedside or in a doctor's office. This type of testing is often used to diagnose and monitor diabetes, a chronic condition in which the body is unable to regulate blood glucose levels properly.

The total market value of the Point-of-Care Glucose Testing is $3003.30 million in 2022.

The forecast period for Point-of-Care Glucose Testing market is 2023 to 2032

Top companies such as Abbott Laboratories, Roche, Ascensia Diabetes Care Holdings AG and LifeScan held a high market position in 2022.

Lancing devices and strips segment dominated the global market in 2022 and expected to continue this trend throughout the forecast period.

Increase in the incidence rate of diabetes, rise in geriatric population, technological advancements in blood glucose monitoring devices and rise in risk factors that leads to diabetes.

The factors that restrain the growth of the market is inaccurate results.

The overall impact of COVID-19 remains positive on the point-of-care glucose testing Market.

Loading Table Of Content...

Loading Research Methodology...