Poly Aluminium Chloride (PAC) Market Research, 2033

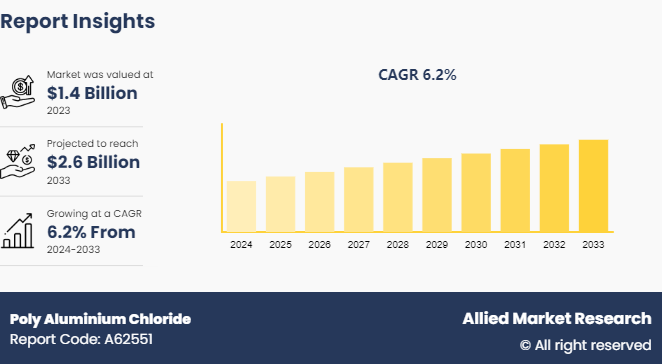

The global poly aluminium chloride (PAC) market was valued at $1.4 billion in 2023, and is projected to reach $2.6 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Market Introduction and Definition

Poly aluminum chloride (PAC) is a widely used water treatment chemical composed of aluminum, chlorine, and varying amounts of water. It is synthesized through the partial hydrolysis of aluminum chloride, resulting in a polymeric structure. It is available in both liquid and solid forms, with its color ranging from colorless to yellow, depending on its purity and specific formulation. One of the key properties of PAC is its high coagulation efficiency, making it an effective agent for removing suspended particles, organic matter, and heavy metals from water. This high efficiency is due to its polymeric structure, which provides a large surface area and enhances its ability to form flocs. Compared to traditional coagulants such as alum (aluminum sulfate) , PAC works effectively over a broader pH range and produces less sludge, which simplifies sludge management and reduces disposal costs.

In addition, PAC is known for its rapid reaction time and reduced chemical consumption, leading to cost savings in water treatment processes. Its versatility extends to various applications, including portable water treatment, wastewater treatment, and industrial water processes. The advantages of using PAC, such as improved water clarity, reduced turbidity, and enhanced filtration efficiency, make it a preferred choice in both municipal and industrial water treatment settings.

Key Takeaways

- The poly aluminum chloride market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- More than 1,200 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The surge in demand for clean water is a pivotal driver for the growth of the poly aluminum chloride (PAC) market. As global populations increase and industrial activities expand, the need for effective water purification solutions becomes more pressing. PAC plays a critical role in water treatment processes due to its superior coagulation and flocculation properties, which help in removing contaminants and impurities from water. This is particularly important in regions facing water scarcity and pollution challenges, where ensuring access to clean and safe water is paramount.

Furthermore, urbanization is accelerating at an unprecedented rate, leading to higher volumes of municipal wastewater that require treatment before being released back into the environment. PAC is highly effective in treating both drinking water and wastewater, making it indispensable for municipal water treatment facilities. The compound's efficiency in operating over a wide pH range and producing less sludge compared to traditional coagulants like alum also enhances its appeal. China has 1, 599 municipal wastewater treatment facilities spread throughout its counties and about 1, 944 municipal wastewater treatment plants spread throughout its city/urban zones. It has 140 and 29 million cubic meters of processing capacity per day, respectively. The 14th Five-Year Plan (FYP) released new wastewater reuse standards from China. It requires a quarter of all sewage to be processed to reuse standards by 2025.

Water purification is expected to rise dramatically during the predicted period due to many government initiatives. The Council on Energy, Environment, and Water (CEEW) intends to enhance wastewater management in India through the 2030 Water Resources Group. In addition, the CEEW seeks to augment private investments in enterprises that manufacture chemicals for water treatment, enabling them to construct raw materials and wastewater treatment facilities. In addition, the $ 170 million Stormwater Treatment Area 1 West Expansion project calls for the building of water treatment facilities on 2, 509 hectares of land in Florida, U.S.

In addition, the industrial sector's demand for high-quality water for various processes, along with stringent environmental regulations mandating proper wastewater treatment, further fuels the PAC market. Industries such as textiles, paper, and food processing rely heavily on PAC to meet regulatory standards and maintain operational efficiency. Thus, the escalating need for clean water across different sectors is a significant catalyst for the growth of the PAC market.

Health and safety concerns present a significant restraint on the growth of the poly aluminum chloride (PAC) market. PAC, used widely in water treatment and various industrial processes, is known for its effective coagulation properties. However, its corrosive nature poses serious health risks to workers handling the chemical and potential hazards during its application. Direct contact with PAC can cause skin and eye irritation, and inhalation of dust or fumes can lead to respiratory issues. These health risks necessitate stringent safety measures and protective equipment, which increase operational costs and complicate its use.

In addition, industries utilizing PAC must adhere to rigorous health and safety regulations to protect their workforce, adding another layer of compliance costs. This complexity can deter smaller companies from adopting PAC, opting instead for safer alternatives that require less stringent safety protocols. Moreover, any incidents or accidents involving PAC can lead to legal liabilities and damage to a company’s reputation, further dissuading its use. As a result, while PAC is an effective chemical in its applications, the associated health and safety concerns are a significant barrier to its market growth, limiting its adoption across various industries and pushing demand towards safer, more user-friendly alternatives.

The expansion of the paper and pulp industry presents a significant opportunity for the growth of the poly aluminum chloride (PAC) market. PAC is widely used in this industry for its efficiency in improving paper quality and production processes. It serves as a retention aid, enhancing the retention of fine particles and fillers during paper formation, which results in better paper strength and quality. In addition, PAC is employed as a sizing agent, helping to control the paper's water absorption properties, and for pitch control, reducing the issues caused by sticky substances in the pulp.

As the global demand for paper products continues to rise, driven by packaging, printing, and hygiene applications, particularly in emerging markets, the need for effective and efficient production chemicals like PAC is increasing. This is further amplified by the industry's focus on sustainability and waste reduction, where PAC's ability to reduce sludge volume and improve wastewater treatment processes makes it a preferred choice. Consequently, the ongoing growth and modernization of the paper and pulp industry, especially in regions experiencing rapid industrialization and economic development, are expected to drive significant demand for PAC, supporting its market expansion.

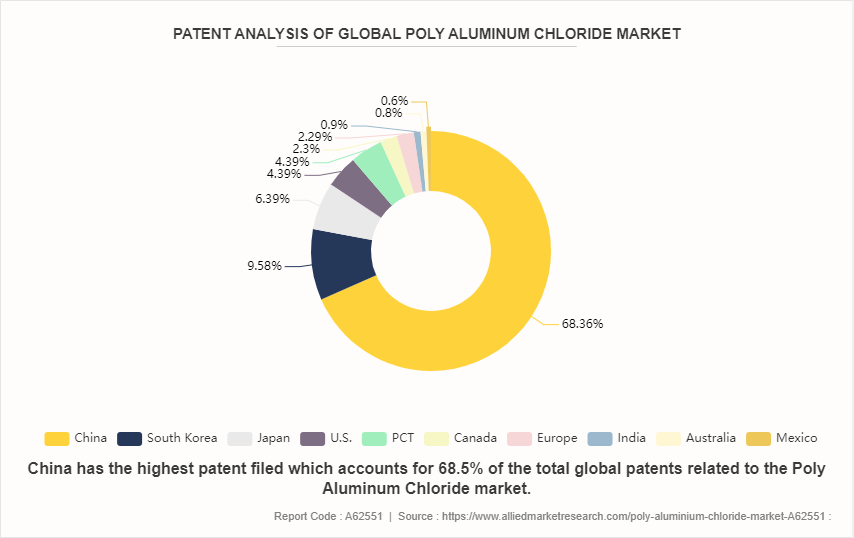

Patent Analysis of Global Poly Aluminum Chloride Market

In the poly aluminum chloride market within the Asia-Pacific region, China dominates with a substantial 68.5% share, reflecting its robust industrial and manufacturing capabilities. South Korea and Japan follow with 9.6% and 6.4%, respectively, underscoring their advanced technological and chemical industries. The U.S. and the PCT each hold 4.4%, highlighting their significant contributions to patent filings and innovations. Canada and the European Patent Office, both at 2.3%, demonstrate notable but smaller presences. India, Australia, and Mexico have minimal shares, at 0.9%, 0.8%, and 0.6% respectively, indicating emerging but growing involvement in this market sector.

Market Segmentation

The poly aluminum chloride market is segmented into form, end-use industry, and region. By form, the market is classified into solid and liquid. By end-use industry, the market is divided into oil & gas, water treatment, cosmetic & personal care, paper & pulp, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the poly aluminum chloride market include GEO Specialty, Chemicals, Inc., Feralco AB Ltd, Airedale Chemical Company Ltd., USALCO, Aditya Birla Chemicals (India) Limited, Kemira Oyg, Coyne Chemicals, Central Glass Co. Ltd., Summit Chemical Specialty Products, LLC., Gujarat Alkalies and Chemicals. Other players in the Poly Aluminum Chloride market include Gulbrandsen Technologies, Inc. and Hengyang Jianheng Industry Development Co., Ltd.

Recent Key Strategies and Developments

- In February 2021, the Steuben Lakes Regional Waste District (SLRWD) renovated the Angola Wastewater Treatment Plant to provide water filtration services. Instead of employing ferrous chloride, poly aluminum chloride was used to increase the system's phosphorus removal.

- In May 2021, the Venator Group company Venator Wasserchemie GmbH entered into a legally binding agreement to sell its share capital, according to a statement released by Feralco AB's subsidiary Feralco Deutschland GmbH.

Industry Trends

- In Mexico, the water treatment sector is anticipated to grow at a robust rate. In addition, there were a lot of wastewater treatment plants in the whole country. It has 2,639 wastewater treatment plants, 874 potable water treatment plants, 435 desalination units, and about 2,477 municipal wastewater treatment plants. According to ongoing study conducted in the country, the government should concentrate primarily on building municipal wastewater treatment facilities, primarily in urban areas. This is expected to increase demand for poly aluminum chloride.

- Municipal wastewater treatment is the main use of wastewater technology by Indian city municipal authorities. By 2050, India, China, Indonesia, Nigeria, and the U.S. are projected to be at the center of the global urban population boom, forecasts the World Bank.

- In addition, there has been a notable surge in municipal water treatment across the nation as a result of government measures aimed at ensuring that the growing number of rural residents have access to sufficient and clean drinking water on their property.

- The Ministry of Jal Shakti of the Government of India reports that in 2022, the proportion of rural residents with access to adequate and clean drinking water within their premises rose from 55.23% to 61.52%. In addition, by 2024 or 2025, the Indian government wants all its citizens to have access to safe and sufficient drinking water inside of buildings. It will improve the nation's municipal water treatment facilities.

- The increase in demand for wastewater treatment and water treatment chemicals are expected to boost the demand for poly aluminum chloride.

Regional Industry Outlook

Asia-Pacific has witnessed a surge in demand for Poly Aluminum Chloride. Rapid industrialization and urbanization lead to increased wastewater treatment needs, where PAC is extensively used for purification purposes. In addition, stringent government regulations regarding water quality and environmental protection propel the adoption of PAC as an effective solution for water treatment. Furthermore, the growing population and expanding industries in emerging economies boost the demand for PAC in various applications such as pulp and paper, textile, and oil and gas sectors. Moreover, the shift towards sustainable and eco-friendly alternatives further augments the demand for PAC in the region.

- China Everbright Water, an environmental protection organization that specializes in water environment management, won the contract in June 2022 to expand and upgrade the Zhangdian East Chemical Industry Park Industrial Wastewater Treatment facility in Zibo City, Shandong Province. This project has a planned daily industrial wastewater treatment capacity of about 5,000 cubic meters and will be run on a BOT (Build-Operate-Transfer) model.

- The International Trade Administration states that between 2021 and 2025, China intends to construct or rehabilitate 80,000 km of sewage collecting pipeline networks and expand the capacity of sewage treatment by 20 million cubic meters per day.

- The number of chemical production facilities has also increased in India. Furthermore, the Indian power generation industry is always changing.

- The Indian government declared in the Union Budget 2022 that it is expected to spend $7, 271.9 million (INR 60 lakh crore) to supply potable water to every family, which will increase the demand for water treatment in the nation.

- A contract worth 1.06 million (EUR 700 million) was given to SEZ by the Municipal Corporation of Greater Mumbai in September 2022 to design, build, and operate (DBO) a 500 million liters per day (MLD) wastewater treatment facility in Worli, Mumbai, to serve a population of about 2.5 million people.

Key Sources Referred

- The International Trade Administration

- Union Budget 2022

- World Bank

- Invest India

- 14th Five-Year Plan (FYP)

- The Council on Energy, Environment, and Water (CEEW)

- Ministry of Jal Shakti of the Government of India

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the poly aluminium chloride (PAC) market analysis from 2024 to 2033 to identify the prevailing poly aluminium chloride (PAC) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the poly aluminium chloride (PAC) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global poly aluminium chloride (PAC) market trends, key players, market segments, application areas, and market growth strategies.

Poly Aluminium Chloride (PAC) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.6 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Form |

|

| By End-Use Industry |

|

| By Region |

|

Loading Table Of Content...