Poly Ether Amine Market Research, 2030

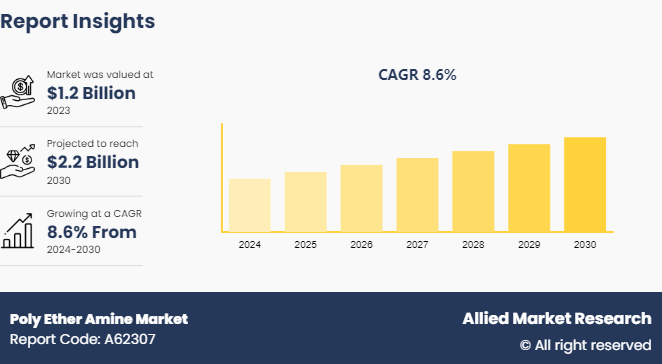

The global poly ether amine market was valued at $1.2 billion in 2023, and is projected to reach $2.2 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030.

Market Introduction and Definition

Polyether amines are a class of organic compounds characterized by multiple ether groups (-O-) separated by alkylene chains (-CH2-) . They find extensive applications in various industries, including adhesives, coatings, sealants, and fuel additives. These compounds exhibit several notable properties, such as high reactivity, excellent adhesion, flexibility, and thermal stability. Polyether amines possess remarkable chemical resistance, making them suitable for harsh environments.

In addition, their low viscosity and ability to cure at room temperature make them ideal for formulations requiring fast processing times. The global polyether amine market continues to grow steadily due to increase in demand from end-user industries such as automotive, construction, and aerospace. Factors such as urbanization, infrastructure development, and technological advancements are expected to further drive market growth in the coming years, fostering innovation and expansion in polyether amine applications.

Key Takeaways

- The poly ether amine market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2030.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand from composite applications is set to drive significant growth in the poly ether amine market. Poly ether amine is a vital ingredient in composite materials production, known for its excellent mechanical properties, flexibility, and thermal stability. These attributes make it indispensable in industries such as automotive, aerospace, and construction, where lightweight and high-strength materials are crucial. In the automotive sector, the push towards fuel efficiency and electric vehicles has amplified the need for lightweight composites to reduce overall vehicle weight. Similarly, in aerospace, the demand for materials that can withstand extreme conditions while being light enough to enhance fuel efficiency is on the rise. Moreover, the construction industry benefits from poly ether amine-based composites due to their durability and resistance to environmental stressors, contributing to longer-lasting infrastructure.

The global shift towards renewable energy, particularly in wind energy, also fuels demand, as poly ether amine is essential in manufacturing durable wind turbine blades. Most composites are employed in the automobile sector. According to OICA, global vehicle manufacturing is expected to exceed 85 million units in 2022, representing a 6% increase over the previous year. Most composites are employed in the automobile sector. According to OICA, global vehicle manufacturing will exceed 85 million units in 2022, representing a 6% increase over the previous year. In addition, U.S. car output increased by 10% in 2022 compared to the previous year. The output of motor vehicles increased by 10% in Canada, Mexico, and the United States, to 12, 28, 735 units, 35, 09, 072 units, and 1, 00, 60, 339 units, respectively. Colombia experienced the largest year-over-year rise in production in the South American area, with 51, 455 units produced, a 26% increase. Moreover, manufacturing in Argentina increased dramatically by 24% to 5, 36, 893 units.

Fluctuating raw material prices pose a significant challenge to the growth of the Poly Ether Amine Market. The production of poly ether amines relies on key raw materials such as ethylene oxide and propylene oxide, whose prices are highly volatile. This volatility is influenced by several factors including crude oil price fluctuations, supply chain disruptions, and geopolitical tensions. For instance, crude oil prices can be affected by changes in global economic conditions, OPEC policies, and political instability in oil-producing regions. Such unpredictability in raw material costs directly impacts the manufacturing expenses for poly ether amine producers.

Higher raw material prices lead to increased production costs, which manufacturers may struggle to pass on to consumers without affecting demand. This can squeeze profit margins and deter investment in production capacity expansion or technological innovation. Additionally, supply chain disruptions, such as those caused by natural disasters or logistical challenges, can lead to sudden spikes in raw material prices and supply shortages. Consequently, manufacturers must navigate these uncertainties, which can hinder long-term strategic planning and market growth. Therefore, the volatility in raw material prices remains a critical restraint, impeding the steady growth of the Poly Ether Amine Market.

The shift towards sustainable coatings presents a significant opportunity for the growth of the Poly Ether Amine market. As environmental regulations become stricter and consumer awareness about eco-friendly products increases, the demand for sustainable coatings is rising. Poly Ether Amines, known for their low volatile organic compound (VOC) emissions and high performance, are becoming a preferred choice in the development of environmentally friendly coatings. These amines enhance the durability, chemical resistance, and adhesion properties of coatings, making them ideal for use in various applications such as construction, automotive, and marine industries.

The construction sector is experiencing a boom in green building initiatives, which further drives the need for sustainable materials. Additionally, advancements in Poly Ether Amine formulations are enabling the production of coatings that meet high-performance standards while adhering to environmental norms. This shift not only aligns with global sustainability goals but also opens new avenues for innovation and market expansion for Poly Ether Amine manufacturers. As industries continue to prioritize sustainability, the Poly Ether Amine market is poised to benefit from increased adoption of eco-friendly coatings, contributing to its growth and development.

Market Segmentation

The poly ether amine market is segmented into type, application, and region. By type, the market is classified as monoamine, diamine, triamine, and others. By application, the market is divided into polyurea, adhesives and sealants, composites, epoxy coatings, fuel additives and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

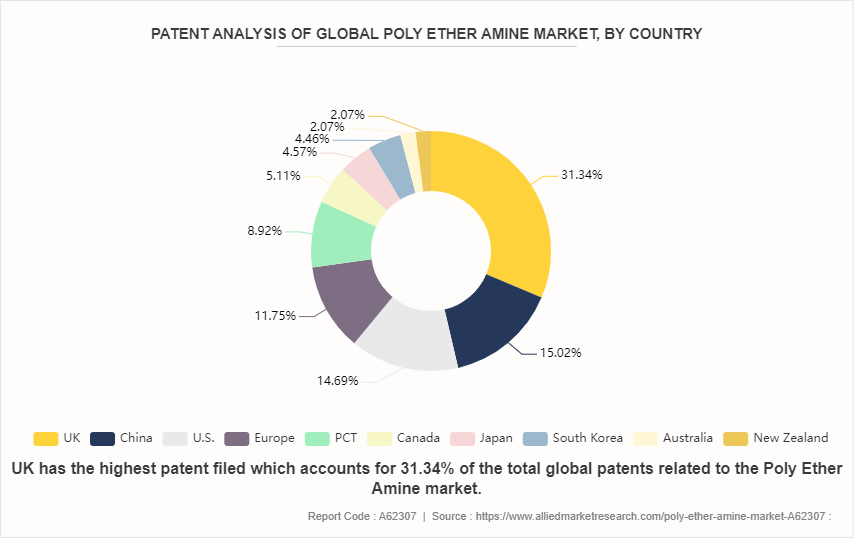

Patent Analysis of Global Poly Ether Amine Market, by Country

The patent landscape for the Poly Ether Amine (PEA) market reveals a dominant presence of the UK, accounting for 31.34% of patents, followed by China at 15.02% and the U.S. at 14.69%. Europe and PCT collectively contribute significantly at 20.67%. Notably, countries like Canada, Japan, and the South Korea also demonstrate notable patent activity in this sector. The distribution suggests a global interest and investment in PEA-related innovation, potentially indicating diverse applications and competitive dynamics within the market. This analysis underscores the importance of monitoring patent trends to discern emerging technologies and market trends.

Competitive Landscape

The major players operating in the poly ether amine market include BASF SE, Huntsman International LLC., CLARIANT, Yantai Dasteck Chemicals Co., Ltd., Yangzhou Chenhua New Materials Co., Ltd., Qingdao IRO Surfactant Co., Ltd., 3N Composites, Actylis, Merck KGaA, Wuxi Acryl Technology Co. Ltd.

Recent Key Strategies and Developments

- In June 2022, BASF announced the ongoing expansion of production capacity at the Geismar site in North America, to be on-stream by mid-2023. This expansion focused on key specialty amines and enabled the production of more polyether amines marketed under the Baxxodur brand.

- In March 2022, Brenntag and BASF SE collaborated, with Brenntag being the company's sole distributor in North America for Polyether amines and the Baxxodur line.

- In February 2021, Huntsman International LLC acquired Gabriel Performance Products (Gabriel) , a North American producer of epoxy curing agents and specialized additives for the coatings, adhesives, sealants, and composite end industries, from Audax Private Equity.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. Polyether amine is a key additive in adhesives for bonding components of wind turbine blades and in composite materials used in their construction. Its demand, particularly in Asia-Pacific, is expected to surge due to the growing adoption of wind energy solutions. This trend is projected to drive market growth significantly during the forecast period. Polyether amide’s versatile properties make it indispensable in enhancing the strength and durability of adhesives and composites, crucial for the efficient operation of wind turbines. As the renewable energy sector expands, so does the need for reliable materials like polyether amine, positioning the Asia-Pacific market for substantial expansion.

- According to projections made by the Ministry of Housing and Urban-Rural Development, China's construction sector will continue to account for 6% of the country's GDP until 2025. The Chinese government published a five-year plan in January 2022 with the goal of making the construction industry more quality-driven and sustainable considering the projections that had been provided. China intends to build more prefabricated structures to lessen waste and pollution from construction sites. In addition, the building sector will be implementing more contemporary methods, which will raise the need for products like polyether amine.

- In addition, the Indian government has been actively encouraging the building of dwellings to house roughly 1.3 billion people. Over the next six to seven years, the whole country is expected to see housing investments totaling over $1.3 trillion. Moreover, there are expected to be 60 million new houses built in the nation, which will significantly expand the demand for polyether amines.

- In addition, the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan reports that in 2022, about 859.5 thousand new home starts were made in Japan, a 0.4% rise from the year before.

Industry Trends:

- The rise in demand for wind energy boosts the polyether amines market growth. Polyether amines are essential in manufacturing wind turbine blades due to their durability and performance-enhancing properties. As global efforts to adopt renewable energy sources intensify, the need for high-quality polyether amines continues to grow.

- The International Renewable Energy Agency (IRENA) estimates that 508.45 GW of wind energy were generated in Asia in 2023, a 97.32% increase over 2019 levels. China took the lead in wind energy generation in 2023 with 441.89 GW, followed by India with 44.74 GW. Due to the anticipated completion of numerous wind projects in the next few years, the number is anticipated to increase dramatically between 2024 and 2029.

- According to the Global Wind Energy Council (GWEC) , the global wind industry installed a record 117 GW of new capacity in 2023, making it the best year ever for new wind energy.

- The allocation of Contract for Difference (CFDs) to 95 new renewable energy initiatives was announced by the UK government in September 2023, guaranteeing 3.7 GW of sustainable energy capacity. Onshore wind, solar, and tidal energy technologies are among these projects. Moreover, by 2030, the UK-based Octopus Energy intends to invest $ 20 billion worldwide in offshore wind. The investment, according to the firm, which is a subsidiary of Octopus Energy Group, is expected to produce 12 gigatons (GW) of renewable electricity annually, or enough to power 10 million homes.

- In addition, the U.S. Department of Energy's Wind Energy Technologies Office (WETO) stated in April 2024 that it is projected to invest $48 million in offshore wind, with a focus on improving offshore wind platform research and development. Between 2024 and 2029, it is anticipated that these kinds of projects are anticipated to accelerate the global production of wind energy.

Key Sources Referred

- Ministry of Housing and Urban-Rural Development

- Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan

- International Renewable Energy Agency (IRENA)

- Global Wind Energy Council (GWEC)

- U.S. Department of Energy's Wind Energy Technologies Office (WETO)

- bp Statistical Review of World Energy 2022

- OICA

- World Paint & Coating Industry Association

- Japan Electronics and Information Technology Industries Association (JEITA)

- Chinese Association of Automotive Manufacturers

- Invest India

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the poly ether amine market analysis from 2024 to 2030 to identify the prevailing poly ether amine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the poly ether amine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global poly ether amine market trends, key players, market segments, application areas, and market growth strategies.

Poly Ether Amine Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 2.2 Billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2024 - 2030 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Yantai Dasteck Chemicals Co., Ltd., 3N Composites, Huntsman International LLC., Actylis, Clariant AG, Yangzhou Chenhua New Materials Co., Ltd;, Merck KGaA, Wuxi Acryl Technology Co. Ltd, BASF SE, Qingdao IRO Surfactant Co., Ltd. |

Loading Table Of Content...