Polyacrylic Acid Market Outlook - 2032

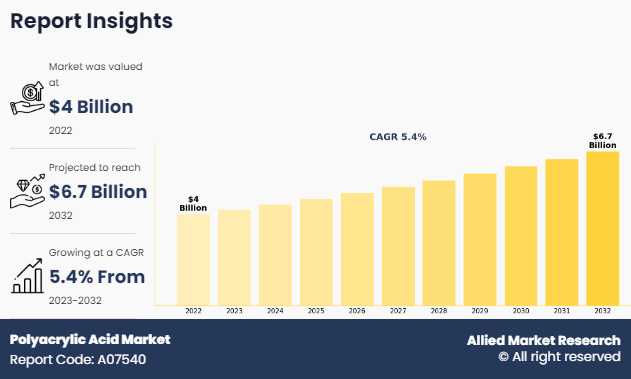

The global polyacrylic acid market size was valued at $4.0 billion in 2022, and is projected to reach $6.7 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. The polyacrylic acid market has experienced growth due to several factors such as surge in demand for water treatment & personal care products, and rapid expansion in the paints & coatings industry. However, competition from alternative polymers and price volatility of raw materials hinder market growth to some extent. Moreover, the rise in exploration of onshore oil and gas offers remunerative opportunities for expanding the polyacrylic acid market.

Introduction

Polyacrylic acid is a polymer derived from acrylic acid, a simple monomer. It is characterized by a repeating structure of acrylic acid units linked together to form a chain. It is a versatile material used in various industries, including adhesives, sealants, detergents, cleaning products, superabsorbent polymers, personal care products, coatings, paints, agriculture, oil & gas industry, and medical & pharmaceutical applications.

Key Takeaways

- The polyacrylic acid market is highly fragmented, with several players including Acuro Organics Limited, Evonik Industries AG, Sumitomo Seika Chemicals, Dow, Maxwell Additives Pvt, Ltd, Nippon Shokubai Co. Ltd, Ashland Inc., Lubrizol Corporation, BASF SE, and Arkema.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers more than 20 countries in terms of value and volume during the forecast period 2022-2032 is covered in the polyacrylic acid market report.

Market Dynamics

The increase in concerns about water scarcity and pollution across the globe has led to a surge in demand for effective water treatment solutions, which have positive impact on the polyacrylic acid market. Polyacrylic acid is widely used in water treatment processes as a dispersant, scale inhibitor, and flocculating agent. Its ability to improve water quality by preventing scale formation and facilitating the removal of impurities makes it indispensable in this industry. As governments and industries worldwide invest in water infrastructure and adopt stricter environmental regulations, the demand for PAA in water treatment applications is expected to drive polyacrylic acid market growth.

However, PAA faces competition from other polymers with similar functionalities, such as polyacrylamide (PAM), polyvinyl alcohol (PVA), and polycarboxylates. These alternative polymers offer similar or even superior performance characteristics for certain applications, making them viable substitutes for PAA. However, PAA forms stable complexes with metal ions, readily dissolves in water, and it has a wide range of applications beyond water treatment. Market players need to innovate continuously to differentiate PAA-based products and maintain their competitiveness.

The rise in exploration of onshore oil and gas presents a significant opportunity for the polyacrylic acid (PAA) market. PAA is utilized in various applications within the oil and gas industry, including drilling muds, hydraulic fracturing fluids, and scale inhibition in pipelines. PAA's properties as a dispersant, scale inhibitor, and rheology modifier make it essential for optimizing drilling and production operations, thereby driving its market growth.

Segments Overview

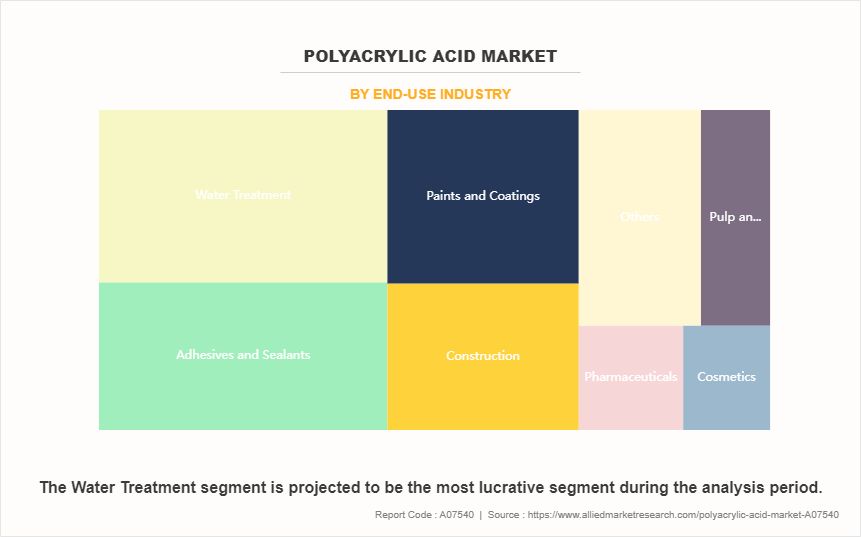

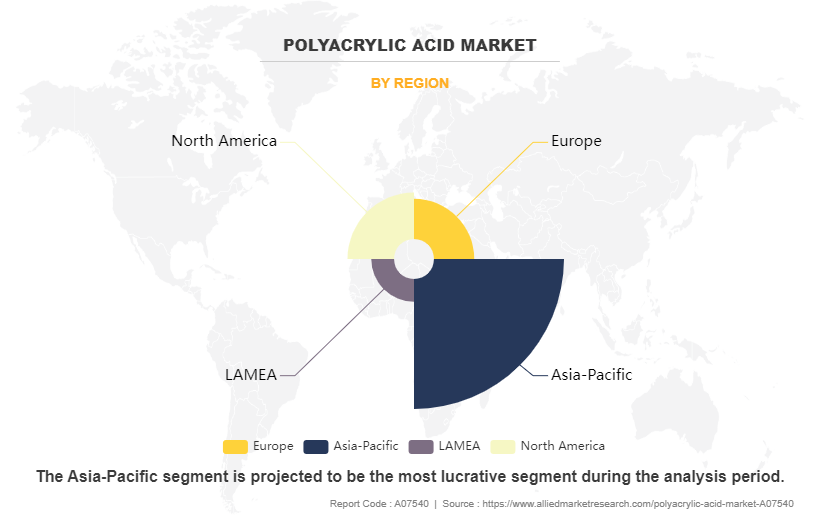

The polyacrylic acid market is segmented into type, application, end-use industry, and region. On the basis of type, the market is bifurcated into synthetic and bio-based. Depending on application, it is segregated into thickeners, dispersants, scale inhibitors, emulsifiers, binders, and others (conditioners and clarifying agents). By end-use industry, it is fragmented into construction, paints & coatings, pulp & paper, adhesives & sealants, water treatment, pharmaceuticals, cosmetics, and others (textile and consumer goods). On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

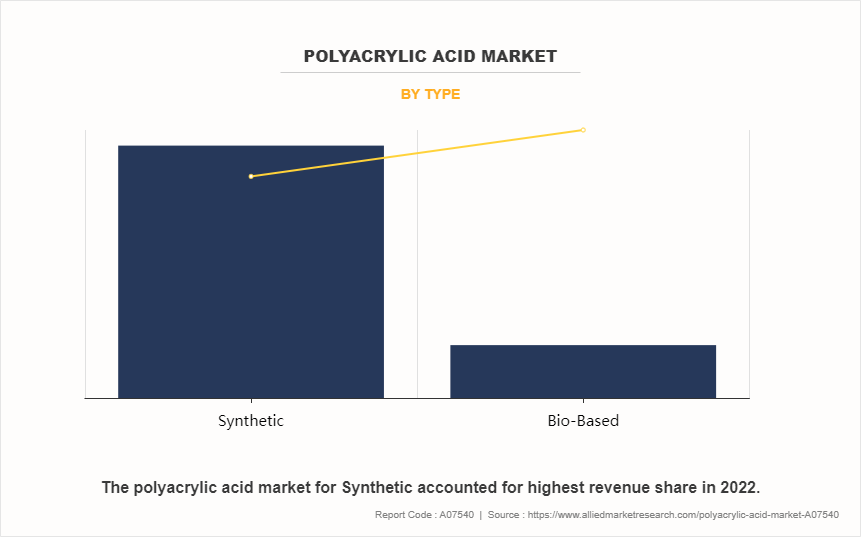

Polyacrylic Acid Market By Type

The synthetic segment dominated the Polyacrylic acid market, accounting for more than four-fifths of revenue in 2022. Geriatric population growth, childbirths, water quality concerns, and technology improvements in emerging countries all contribute to development. The market is promising; however, the bio-based segment is expected to develop at a CAGR of 5.9% from 2023 to 2032. The desire for sustainable products, as well as the circular economy, provide prospects for market growth.

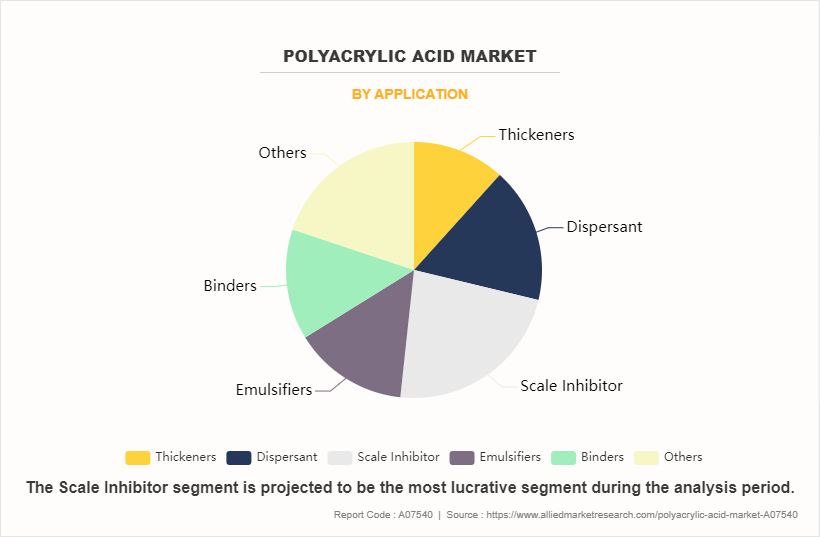

Polyacrylic Acid Market By Application

The scale inhibitor segment dominates the Polyacrylic acid market, accounting for nearly one-fourth of revenue in 2022. Industrialization, environmental regulations, and technological advancements drive growth in this sector. Infrastructure development projects and awareness about scale deposition increase the demand for polyacrylic acid. The thickeners segment is projected to grow at a 6.2% CAGR from 2023 to 2032, driven by the growing demand for cosmetics and personal care products. The global cosmetics and personal care industry, valued at $518.6 billion, presents significant opportunities due to its eco-friendly nature and thriving e-commerce landscape.

Polyacrylic Acid Market By End Use Industry

The water treatment segment, accounting for nearly one-fourth of the Polyacrylic acid market revenue in 2022, is expected to dominate due to increasing water pollution due to industrialization, urbanization, and population growth. Advanced water treatment chemicals like polyacrylic acid are expected to be adopted due to environmental regulations and technological advancements. The cosmetics segment is projected to experience the highest CAGR of 6.80% from 2023 to 2032, driven by rising disposable income, changing lifestyles, and personal grooming awareness. Manufacturers develop customized formulations and collaborate with cosmetic manufacturers while ensuring regulatory compliance.

Rapid industrialization and urbanization globally have led to the development of various infrastructures. The presence of development of infrastructure such as road construction in developed and developing countries propels the demand for PAA as it is widely utilized in cold mix asphalt applications.

Polyacrylic Acid Market By Region

Based on region, the Asia-Pacific segment held the highest market share in 2022, accounting for more than half of the Polyacrylic acid market revenue, and is estimated to dominate during the forecast period. In Asia-Pacific, the demand for PAA is driven by rapid industrialization, urbanization, and an increase in focus on environmental sustainability. Several countries in the region, including China, Japan, South Korea, and India, have significant manufacturing capacity of PAA and consumption of PAA across various industries. In addition, advancements in technology and the development of eco-friendly formulations are expected to further boost the adoption of PAA in Asia-Pacific.

Competitive Analysis

The major players operating in polyacrylic acid market include Acuro Organics Limited, Evonik Industries AG, Sumitomo Seika Chemicals, Dow, Maxwell Additives Pvt, Ltd, Nippon Shokubai Co. Ltd, Ashland Inc., Lubrizol Corporation, BASF SE, and Arkema.

Recent Developments in Polyacrylic Acid Market

In April 2023, Akrema introduced new acrylic solutions that can enable unique synergies across coatings, adhesives, and advanced materials. In addition, it offers a range of sustainable waterborne acrylic solutions for high-capacity anodes, cathode primers, and ceramic-coated separators.

In September 2020, Nippon Shokubai CO. Ltd, and FANCL Corporation jointly developed a novel polymer that prevents fine particles, such as airborne pollen and PM 2.5 from adhering to the skin and hair and has antibacterial/antiviral activity. The novel polymer is also found to have a moisturizing effect on skin and hair, and it is expected to be applied to cosmetics intended to gently protect skin and hair from various external stimulating factors.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyacrylic acid market analysis from 2022 to 2032 to identify the prevailing polyacrylic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polyacrylic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polyacrylic acid market trends, key players, market segments, application areas, and market growth strategies.

Polyacrylic Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.7 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Application |

|

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Evonik Industries AG, Nippon Shokubai Co. Ltd., Maxwell Additives Pvt. Ltd., The Lubrizol Corporation, BASF SE, Sumitomo Seika Chemicals, Dow Inc., Arkema, Ashland Inc., ACURO ORGANICS LIMITED |

Analyst Review

According to the opinions of various CXOs of leading companies, the polyacrylic acid market was dominated by the water treatment segment in 2022.

As per the insights of various industry leaders, the sales of polyacrylic acid are increasing significantly in India, with particular prominence in applications related to water treatment and scale inhibition. In recent years, the rise in industrial activities in developing countries such as China, India, Brazil, and other Asia-Pacific countries have propelled the demand for efficient water treatment solutions, and polyacrylic acid, known for its effectiveness in inhibiting scale formation, has played a pivotal role.

The emphasis on environmental sustainability and implementation of stringent water quality regulations further boosts market growth, as industries seek eco-friendly solutions to address water treatment challenges. Challenges such as fluctuating raw material prices and supply chain disruptions are addressed through strategic initiatives aimed at building resilient supply chains.

The CXOs further added that with increase in awareness of environmental concerns, there is a surge in trend toward adoption of eco-conscious practices in the polyacrylic acid market, aligning products with sustainable materials and waste reduction strategies. Companies have invested in innovative technologies, including smart solutions for real-time tracking and data-driven insights, to enhance the efficiency and effectiveness of polyacrylic acid applications in various industries across the globe.

$6.7 billion is the estimated industry size of polyacrylic acid in 2032.

Increased demand in water treatment, expanded use in personal care products, growth in the agriculture sector, development of biodegradable polymers, technological innovations, and regional market dynamics are the upcoming trends of Polyacrylic Acid Market in the world.

Scale inhibitor is the leading application of Polyacrylic Acid Market in 2023.

Asia-Pacific is the largest regional market for Polyacrylic Acid during the forecast period.

Acuro Organics Limited, Evonik Industries AG, Sumitomo Seika Chemicals, Dow, Maxwell Additives Pvt, Ltd, Nippon Shokubai Co. Ltd, Ashland Inc., Lubrizol Corporation, BASF SE, and Arkema are the top companies to hold the market share in Polyacrylic Acid.

Loading Table Of Content...

Loading Research Methodology...