Polyimide Foam Market Research, 2032

The global polyimide foam market was valued at $282.0 million in 2023, and is projected to reach $419.9 million by 2032, growing at a CAGR of 4.5% from 2024 to 2032.

Market Introduction and Definition

Polyimide foam is a specialized and advanced polymer-based material characterized by its unique cellular structure. It is produced through the polymerization of polyamic acid, resulting in a three-dimensional network of interconnected cells. This distinctive foam possesses exceptional thermal and acoustic insulation properties, making it a valuable material in various industries. The closed-cell structure of polyimide foam enhances its insulation capabilities by minimizing heat transfer through convection. Polyimide foam is known for its ability to withstand high temperatures, exhibit low thermal conductivity, and maintain a lightweight structure. The combination of high-temperature resistance, low density, effective insulation, and chemical resistance positions polyimide foam as a valuable solution for advanced thermal and acoustic management. Polyimide foams find application in diverse industries such as automotive, aerospace, construction, electric, and electronics.

In the aerospace industry, polyimide foam finds extensive use in thermal insulation for spacecraft, aircraft, and satellites. Its lightweight nature helps reduce overall vehicle weight, contributing to fuel efficiency and payload capacity. Additionally, its ability to withstand extreme temperatures and harsh radiation environments makes it indispensable for protecting sensitive electronic components and ensuring the longevity of mission-critical equipment.

Key Takeaways:

The Polyimide foam industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2024-2032) .

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global polyimide foam market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the polyimide foam market size.

The polyimide foam market share is highly fragmented, with several players including Evonik Industries, UFP Technologies, Inc., DuPont, Polymer Technologies, Inc, Soundown, I.S.T, Boyd, Flexcon Company, Inc, The Claremont Sales Corporation, and Pyrotek. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the polyimide foam market growth.

Market Segmentation

The polyimide foam market is segmented into type, application, and region. By type, the market is bifurcated into rigid foam and flexible foam. As per application, the market is categorized into aerospace, marine, renewable energy, medical, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

The polyimide foam market growth is driven by the rising demand for thermal insulation in the construction sector. Polyimide foam has emerged as a key player in addressing the construction industry's need for effective insulation materials that enhance energy efficiency and contribute to sustainable building practices. In construction applications, polyimide foam's thermal insulation properties play a pivotal role in creating energy-efficient structures. Polyimide foam, with its excellent thermal insulation capabilities, serves as a solution to reduce heat transfer and maintain optimal indoor temperatures, contributing to energy savings and reduced environmental impact. This material is utilized in various construction applications, including building envelopes, roofs, walls, and flooring systems. As of January 2023, the U.S. construction industry's revenue was valued at around $2.8 trillion, with a 12.8% increase from January 2022. The industry's revenue has risen at an annualized rate of 2.7% from 2016 to 2021. According to the United States Department of Energy, heating and cooling account for about 50% of total energy consumption in a typical home. Foam insulation provides lowering energy bills by reducing air leaks and thereby decreasing the heat transfer between indoor and outdoor environments. Thus, the increase in demand for heating and cooling projected to grow polyamide foam market.

However, the polyimide foam market faces a significant restraint in the form of intense competition from alternative insulation materials, hindering its growth trajectory. As industries and consumers seek effective thermal and acoustic insulation solutions, various competing materials present alternative options that may challenge the market share and adoption of polyimide foam. Traditional insulation materials like fiberglass and mineral wool represent a primary obstacle and source of competition for polyimide foam in the insulation market. In addition, the rise of newer and innovative insulation materials further intensifies the competitive landscape. Materials like aerogels, reflective foils, and expanded polystyrene (EPS) foam offer unique features and benefits, catering to specific requirements in different applications. Thus, the competition from alternative insulation materials hinders the growth of polyimide foam market.

Advancements in insulation technologies represent a significant and promising opportunity for the polyimide market. As industries and applications evolve, there is a growing need for insulation materials that can meet increasingly stringent performance requirements. Polyimide, with its exceptional thermal and acoustic insulation properties, is well-positioned to capitalize on the expanding landscape of insulation technologies. In aerospace, electronics, and automotive industries, the need for materials that can withstand extreme heat without compromising performance is driving the demand for advanced insulation solutions. Thus, the advancements in polyimide formulations can further enhance its thermal insulation capabilities, opening new opportunities in industries where temperature control is critical.

Regional Market Outlook

Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In the North America region, the market is influenced by factors such as robust industrial base, technological advancements, and a focus on innovative thermal insulation solutions. Industries such as aerospace, automotive, and manufacturing contribute significantly to the demand for polyimide foam in this region.

In the Asia-Pacific region, the usage of polyamide foam is witnessing rapid growth driven by expanding industrialization and urbanization. In countries like China and India, the automotive industry is a key consumer of polyamide foam, employing it for various applications such as seat cushions, headrests, and door panels. Moreover, the construction sector in the Asia-Pacific region presents significant opportunities for polyamide foam manufacturers, as the demand for high-performance insulation materials continues to rise alongside infrastructure development projects. Additionally, the electronics industry in countries such as South Korea and Japan relies on polyamide foam for its superior cushioning properties, safeguarding electronic devices during shipping and storage.

Key Regulation Guidelines

Polyimide foam is subject to specific regulations governing its composition and physical properties. ASTM C1594-11r17 establishes standards for polyimide rigid cellular thermal insulation, categorizing the foam into types based on closed cell content and grades according to density. It further classifies insulation into classes based on upper temperature limits. The standard covers various physical property requirements such as thermal conductivity, density, compressive strength, water vapor transmission, and more.

ASTM C1594-11 (2017) - This ASTM standard establishes the composition and physical property requirements for polyimide rigid cellular thermal insulation foams. It categorizes the foams into three types (I, II, and III) based on closed cell content, and four grades (1-4) based on density. Type II foams are further divided into two classes (1 and 2) based on upper temperature limits

Regulations such as the Buy American Act require the use of domestic materials, including polyimide foams, in government procurement, supporting the polyimide foam industry.

Competitive Analysis

Key market players in the polyimide foam market include Evonik Industries, UFP Technologies, Inc., DuPont, Polymer Technologies, Inc, Soundown, I.S.T, Boyd, Flexcon Company, Inc, The Claremont Sales Corporation, Rogers Corporation and Pyrotek.

Emerging Automotive and Aerospace Industries

The growing demand for polyimide foam in the automotive and aerospace industries are significant drivers propelling the robust growth of the polyimide foam market. The unique properties of polyimide foam make it a preferred material in these sectors, contributing to advancements in design, performance, and overall efficiency. In the automotive industry, the lightweight nature of polyimide foam allows manufacturers to achieve significant weight reductions in various automotive components without compromising structural integrity. The polyimide foam is utilized in automotive interiors for its acoustic damping properties, enhancing the overall comfort and driving experience. In the aerospace industry, polyimide foam, with its lightweight structure and insulation properties, finds applications in aircraft interiors, components, and insulation systems. The growth of polyimide foam in these industries is further fueled by innovations and research.

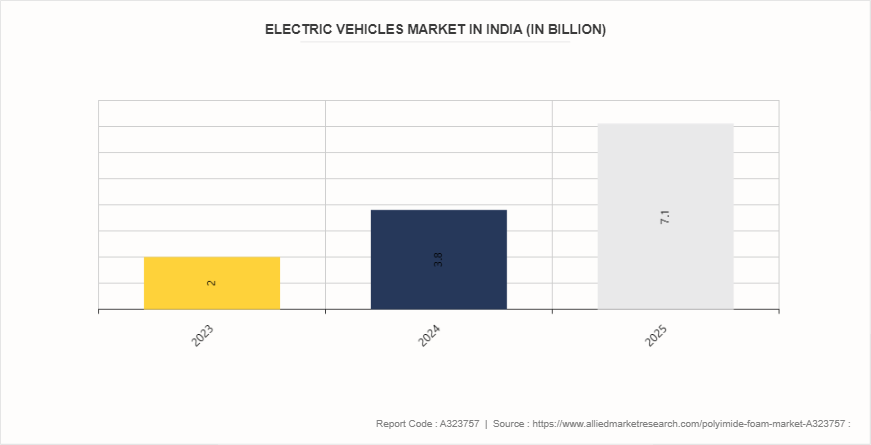

According to Invest India, India's automotive industry is worth around %222 billion, while the EV market in India is valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global research and development spending. All these factors drive the growth of the polyimide foam market.

Key Industry Trends

According to the Boeing Commercial Market Outlook 2022-2041, by 2031, airplanes will grow their commercial fleet with an annual rate of 2.6% and reach 35, 400 airplanes in service, and by 2041 this number will reach 47, 080, representing an annual rate of 2.8% over the 2019-2041 period. Aircraft components, such as engines, avionics systems, and cargo compartments, generate significant amounts of heat during operation. Polyimide foam's exceptional thermal stability allows it to withstand high temperatures without degrading or losing its insulating properties

According to the General Aviation Manufacturers Association (GAMA) , for the first time in decades, industry deliveries topped 4, 000 units in 2023. Furthermore, in 2023, airplane billings increased to $500 million. Such advancements are expected to increase market demand across multiple applications in the aerospace industry.

According to OICA, China has the largest automotive production base in the world, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year. Polyimide foam is growing in popularity in automotive engineering is thermal insulation. Modern vehicles, especially electric and hybrid models, generate significant heat from various sources such as engines, exhaust systems, and battery packs.

In June 2023, Carpenter Co. acquired Recticel N.V.’s engineered foams division in June 2023 for 454.1 million euro, or more than $492 million, making it the largest vertically integrated manufacturer of foams and specialty polymer products globally. The deal encompasses Foam Partner and Otto Bock operations, extending Carpenter's reach to Northern Europe, Asia, Africa, and North America.

Historic Trends in Polyimide Foam Market

In the 1970s, researchers initiated the development of polyimide foams by exploring novel polymer formulations aimed at creating lightweight and thermally stable materials suitable for high-temperature applications. This era marked the beginning of systematic efforts to engineer polymers with properties that could withstand extreme temperatures while maintaining structural integrity and performance.

In the 1980s, significant progress was made in the synthesis and characterization of various polyimide foam formulations. Researchers in both academic and industrial settings intensified their efforts to optimize the foam structure, aiming to achieve desired properties such as high-temperature stability, mechanical strength, and low thermal conductivity.

In the 2000s, significant advancements in manufacturing processes and material science led to notable improvements in polyimide foam properties and performance. Researchers and engineers capitalized on these advancements to explore new applications for polyimide foam, particularly in the aerospace and automotive industries, where lightweight structural components were in high demand.

The 2010s witnessed further refinements in polyimide foam technology, with a focus on enhancing thermal stability, flame resistance, and mechanical properties. As demand for lightweight, high-temperature materials increased across industries, polyimide foam gained popularity as a versatile solution.

Key Sources Referred

- National Aeronautics and Space Administration

- U.S. Department of Energy

- Polyurethane Foam Association

- American Chemistry Council, Inc

- HigherGov

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyimide foam market analysis from 2024 to 2032 to identify the prevailing polyimide foam market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the polyimide foam market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global polyimide foam market trends, key players, market segments, application areas, and market growth strategies.

Polyimide Foam Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 419.9 Million |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | UFP Technologies, Inc., Polymer Technologies, Inc., Evonik Industries, The Claremont Sales Corporation, Soundown, I.S.T, Flexcon Company, Inc, DuPont, Pyrotek Inc., Boyd, Rogers Corporation |

Loading Table Of Content...