Polymer Emulsions Market Research, 2032

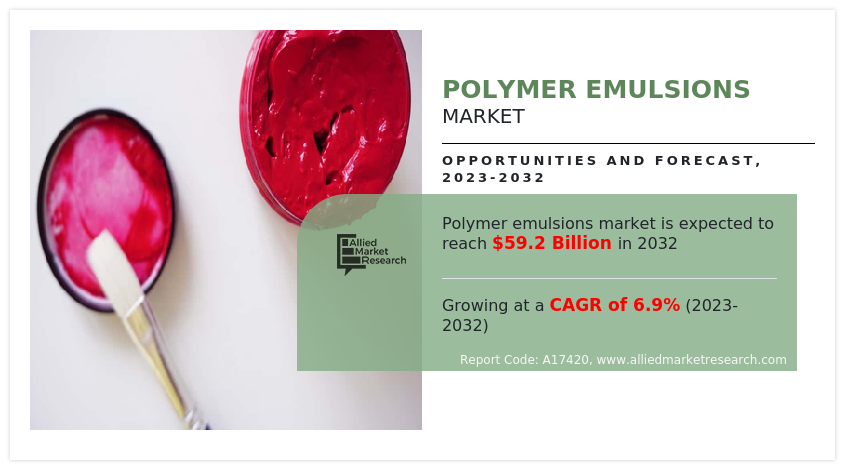

The global polymer emulsions market was valued at $30.9 billion in 2022 and is projected to reach $59.2 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032. The polymer emulsions market is driven by the rising use of polymer emulsions in paints and coatings, where they offer durability, water resistance, and eco-friendliness. This demand is amplified by growth in construction and infrastructure projects, which require high-quality coatings for protection and aesthetics. As industries prioritize sustainable, low-VOC solutions, polymer emulsions become increasingly popular, ensuring strong market growth in tandem with global construction expansion.

Key Report Highlighters:

1. The report depicts detailed insights into the polymer emulsion industry trends and new growth opportunities.

2. The report provides a complete analysis of the market status across key regions and more than 15 countries across the globe in terms of value ($ Million) and volume (Tons).

3. The report identifies the polymer emulsion market growth segments and emerging application areas.4. The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

Polymer emulsion refers to a type of polymer dispersion in which polymer particles are suspended in a liquid medium, typically water. Emulsions are colloidal systems composed of two immiscible phases, such as water and oil, stabilized by a surfactant or an emulsifying agent. In polymer emulsions, the dispersed phase consists of polymer particles typically in the nanometer to micrometer range. These particles are formed by the emulsification process, which involves the dispersion of the polymer in water using mechanical agitation, shear forces, or chemical emulsifiers.

The emulsion polymer is a colloidal fluid containing many polymer particles. These polymer particles should have a specific size and dimension between 0.1 and 1 micron. This phenomenon is observed in water. The process of emulsion polymerization emulsifies hydrophobic monomers with a water emulsifier. The reaction is the one that begins, regardless of whether a water-soluble or oil-soluble initiator is used. Potassium persulfate and azobisisobutyronitrile are two initiators. These initiators exist in various forms. Initiation is the free-radical polymerization that results in a latex-containing aqueous solution. The primary benefit of polymer emulsion is the rigidity of molecular weight. The molecular weight and polymerization rates are quite elevated. The rate of the trade-off between polymerization rate and molecular weight is constant.

Emulsion polymers are used in manufacturing paints and coatings for improving the quality of the color, heat sensitivity, and self-repairing abilities. Manufacturers use emulsion polymers on a large scale to add value to their products owing to the demand for high-quality paints. High demand from the paint & coating industry has been driving the demand for emulsion polymers for the past couple of years.

Increased demand from the coating and adhesives industry.

The coating industry is one of the major consumers of polymer emulsions. Water-based coatings have become more popular with stricter regulations on VOC emissions. Polymer emulsions serve as binders in water-based paints and coatings, providing excellent film-forming properties, adhesion, and durability. Moreover, the construction industry utilizes polymer emulsions for applications such as cement modification, waterproofing, and surface treatments, contributing to the increased demand.

In addition, the adhesive industry has seen a significant rise in the adoption of polymer emulsions. Water-based adhesives formulated with polymer emulsions offer numerous advantages such as low odor, improved safety, and reduced flammability compared to solvent-based adhesives. They find applications in various sectors including packaging, woodworking, paper bonding, and textiles.

Adhesives play a key role in the consumer goods industry, which includes packaging, footwear, and household furnishings. The increase in disposable incomes has boosted the demand for these items, which in turn, has increased the demand for adhesives. The increase in consumption of adhesives in the automotive industry has propelled the consumption of emulsion polymers in recent years.

The demand for polymer emulsion has been steadily increasing in various industries due to its unique properties, environmental benefits, and versatility in applications. This rising demand is attributed to the increasing focus on environmental regulations and sustainability has led to a shift towards water-based systems in industries that traditionally relied on solvent-based formulations. Polymer emulsions, being water-based, offer a greener alternative with reduced volatile organic compound (VOC) emissions, and minimized environmental impact. As a result, industries such as coatings, adhesives, and textiles have witnessed a surge in demand for polymer emulsions.

The expansion of the market for emulsion polymers is anticipated to be hampered by fluctuations in the cost of raw materials, which are expected to have a direct effect on their costs. In addition, the gap between raw material demand and availability is anticipated to increase over the next couple of years, as their consumption in other end-user sectors rises.

Butadiene is derived from naphtha, ethane, propane, and C4 hydrocarbons using steam cracking. One key factor influencing the price of raw materials is the availability and cost of monomers or polymer building blocks. Monomers such as acrylic esters, vinyl acetate, styrene, and butadiene are commonly used in the production of polymer emulsions. Any changes in the availability or cost of these monomers are anticipated to affect the overall cost of production. Factors such as disruptions in the supply chain, changes in production capacity, or fluctuations in crude oil prices (as some monomers are derived from petroleum) are expected to contribute to price volatility.

Another traditional method for creating butadiene is the dehydrogenation of butane and butylene. The ever-increasing competition among the major market participants has always pushed producers to compete and improve the quality of their products. The significant demand for low-VOC goods ensured that the usage of renewable materials is always in demand. This creates lucrative opportunity for the polymer emulsions market.

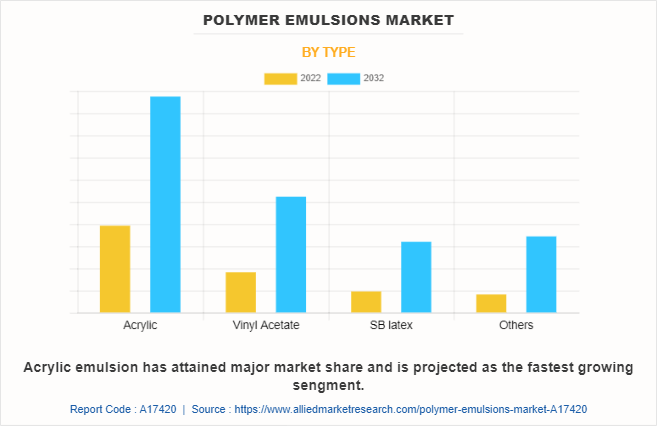

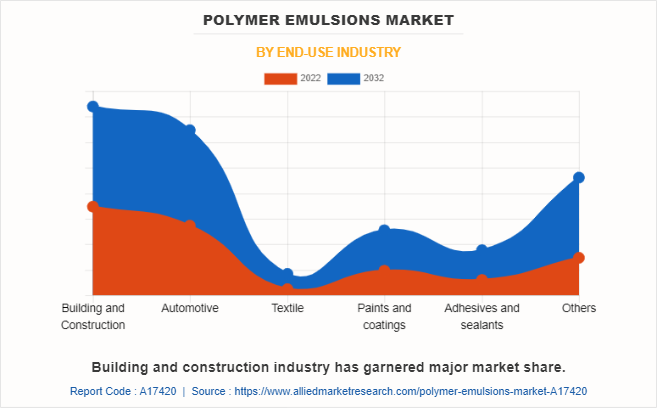

The global polymer emulsions market is segmented into type, end-use industry, and region. On the basis of type, the market is classified into acrylic, vinyl acetate polymer emulsion, SB latex, and others. On the basis of end-use industry, it is categorized into building & construction, automotive, textile, paints & coatings, adhesives & sealants, and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global polymer emulsions market include Arkema Group, Asahi Kasei Corporation, BASF SE, Celanese Corporation, Clariant, DIC Corporation, Dow, Gellner Industrial LLC, Halltech Inc., Interpolymer Co. Ltd., Momentive, Resil Chemicals Pvt. Ltd., Synthomer PLC, The Lubrizol Corporation, and Wacker Chemie AG. Other players operating in the market are Akzo Nobel, N.V., Mallard Creek Polymers, and Trinseo.

The acrylic emulsion segment has garnered one-third of the market share. Acrylic polymer emulsion has several applications in coatings, adhesives, textiles, construction, and other sectors when they are dispersed in water with the help of emulsifiers. Acrylics and other water-based acrylic polymer products are important tools for the graphic arts and industrial coating industries. Acrylic resins offer a huge advantage when used as an ingredient in paint. They are commonly the main ingredient in latex paint. The growth in construction activities, particularly in developing regions, has led to an increased demand for acrylic polymer emulsion. Its excellent adhesion, durability, and weather resistance make it suitable for protecting and enhancing the performance of building materials.

The building and construction industry has garnered more than one-fourth of the market share. Polymer emulsion in the building and construction industry enhances the performance of cement repair mortars, tile mortars, membranes, caulks, drywall spackle, and concrete cures and seals. Polymer emulsion offers many uses in building and construction, in building a home or a commercial property such as a new school. A few key applications are waterproofing, structural adhesives, tracks and tennis courts, and road construction. Synthetic latex-based cement products are used in various applications such as asphalt modification, concrete repair systems, exterior masonry systems, grouts and mortars, flooring, and bridge-deck structures.

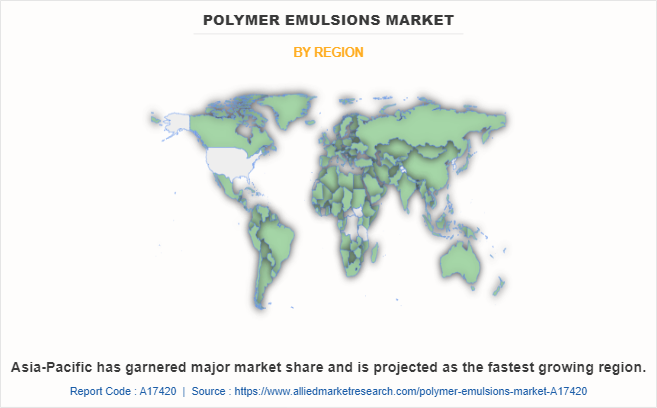

Asia-Pacific has garnered more than one-third of the market share and is projected as the fastest-growing region. The Asia-Pacific region experiences rapid industrialization and urbanization, leading to increased construction activities and infrastructure development. Polymer emulsion-based coatings, adhesives, and sealants are extensively used in these projects for their versatility, durability, and performance. The demand for polymer emulsion in the construction sector, including paints, waterproofing coatings, and flooring adhesives, has seen substantial growth.

The Asia-Pacific region has a strong presence in the textile and nonwoven industries. Polymer emulsions are extensively used in textile coatings, printing, and finishes, providing functionalities such as water resistance, durability, and color fastness. In the nonwoven sector, polymer emulsion binders are used for fabric stabilization and reinforcement, including applications in hygiene products, filtration media, and medical textiles. The growth in textile and nonwoven sectors of this region contributes to the demand for polymer emulsion.

Technology Trend Analysis

Low-VOC and eco-friendly innovations in polymer emulsions focus on creating sustainable formulations to meet strict environmental regulations. By reducing harmful emissions, these formulations align with global goals for greener products. Such advancements enhance indoor air quality, promote health safety, and cater to the rising consumer demand for environmentally responsible coatings in industries such as construction, automotive, and packaging.

The polymer emulsions market is embracing bio-based raw materials to reduce carbon emissions and meet the growing demand for sustainable products. Derived from renewable sources like plant oils or starch, these materials offer an eco-friendly alternative to petroleum-based counterparts, aligning with global environmental goals and customer preferences for greener solutions across various industries, including coatings and adhesives.

Nanoparticles in polymer emulsions enhance durability by creating stronger molecular structures, making materials more wear-resistant. They improve water repellence through hydrophobic surface formation and increase thermal stability by reducing sensitivity to heat. These improvements make polymer emulsions more effective and versatile across various industrial applications.

The integration of IoT and AI in emulsion manufacturing enables real-time monitoring and process optimization. IoT sensors collect data on parameters like temperature, viscosity, and mixing speed, while AI analyzes this data to ensure precision and efficiency. This technology reduces waste, enhances product quality, and improves operational efficiency, meeting the growing demand for cost-effective and sustainable manufacturing solutions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polymer emulsions market analysis from 2022 to 2032 to identify the prevailing polymer emulsions market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the polymer emulsions market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global polymer emulsions market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

According to the CXOs of leading companies, the growth of global residential and commercial construction has had a considerable impact on the demand for polymer emulsion used in the production of architectural paints and coatings. Asia-Pacific has experienced a proliferation of large-scale residential and commercial construction projects due to apparent economic potential of the region and rise in housing demand. Government efforts to encourage non-oil industries in the Middle East have promoted investments in areas such as tourism, hospitality, and healthcare, which has raised demand for and expenditures on commercial infrastructure. Moreover, the number of residential construction and renovation projects has expanded dramatically in North America.

Polymer Emulsions Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.2 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 267 |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Resil Chemicals Pvt. Ltd, The Lubrizol Corporation, Halltech Inc., Wacker Chemie AG, BASF SE, CLARIANT, dic corporation, Momentive, Celanese Corporation, Gellner Industrial LLC, Synthomer PLC, Interpolymer, Arkema, Dow Inc., Asahi Kasei Corporation |

Analyst Review

According to the CXOs of leading companies, the growth of global residential and commercial construction has had a considerable impact on the demand for polymer emulsion used in the production of architectural paints and coatings. Asia-Pacific has experienced a proliferation of large-scale residential and commercial construction projects due to apparent economic potential of the region and rise in housing demand. Government efforts to encourage non-oil industries in the Middle East have promoted investments in areas such as tourism, hospitality, and healthcare, which has raised demand for and expenditures on commercial infrastructure. Moreover, the number of residential construction and renovation projects has expanded dramatically in North America.

Increasing demand for bio-based polymer emulsion is the upcoming trend in the Polymer Emulsions Market.

Building and construction is the leading industry of the Polymer Emulsions Market.

Asia-Pacific is the largest regional market for Polymer Emulsions.

The Polymer Emulsions Market was valued at $30.9 billion in 2022 and is estimated to reach $59.2 billion by 2032, exhibiting a CAGR of 6.9% from 2023 to 2032.

Arkema Group, Asahi Kasei Corporation, BASF SE, Celanese Corporation, Clariant, DIC Corporation, and Dow are the top companies to hold the market share in Polymer Emulsions

Loading Table Of Content...

Loading Research Methodology...