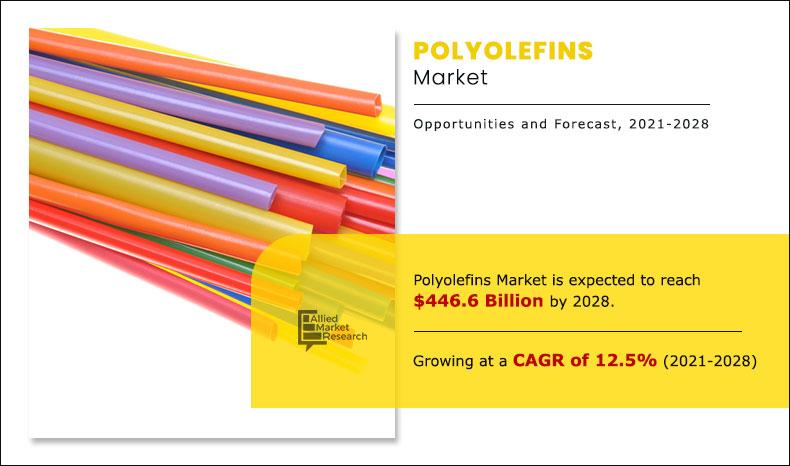

The polyolefins market was valued at $133.9 billion in 2020, and is projected to reach $446.6 billion by 2028, growing at a CAGR of 12.5% from 2021 to 2028. The growing demand for flexible and rigid packaging solutions, driven by industries like food, beverages, and consumer goods, significantly boosts the polyolefins market. In addition, polyolefins are increasingly used in healthcare and medical applications due to their excellent chemical resistance, sterilization compatibility, and non-toxicity. These factors, combined with their versatility and cost-effectiveness, support the expanding market for polyolefin-based products across various sectors.

Polyolefin is a family of polypropylene and polyethylene thermoplastics. It is manufactured majorly from natural gas and oil by polymerization process of ethylene and propylene, respectively. It is produced from olefins/hydrocarbons/monomers, and exhibits high processability, superior chemical stability, and prolonged durability. It is the most widely used thermoplastic polymer enabling in a range of applications such as packaging, consumer goods, and fibers & textiles.

The growing demand for flexible and rigid packaging solutions is a key driver of the polyolefins market. Polyolefins, including polyethylene and polypropylene, are widely used in packaging due to their lightweight, durability, and cost-effectiveness. The rise in e-commerce, food and beverage consumption, and consumer goods has fueled the need for versatile packaging materials. Flexible packaging offers convenience and extended shelf life, while rigid packaging ensures product protection and stability. In addition, increasing awareness of sustainable packaging has led to innovations in recyclable polyolefin materials, further driving market growth. These factors collectively position polyolefins as indispensable in the evolving packaging industry.

Environmental concerns and recycling challenges significantly restrain the growth of the polyolefins market. Polyolefins, primarily derived from fossil fuels, contribute to plastic pollution due to their non-biodegradable nature. The recycling of polyolefin products is complex and inefficient, leading to high waste accumulation. Governments and consumers are increasingly prioritizing sustainable alternatives, pressuring manufacturers to adopt eco-friendly materials. These environmental challenges, coupled with limited recycling infrastructure, hinder market expansion and drive the demand for more sustainable and recyclable options.

Technological innovations in polyolefin production, such as advanced catalysts, process optimization, and automation, present a significant opportunity for the polyolefins market. These advancements enhance efficiency, reduce production costs, and enable the creation of high-performance polyolefin materials with improved properties, such as greater strength, flexibility, and sustainability. Additionally, innovations in recycling technologies, such as chemical recycling, allow for the production of eco-friendly, circular economy-driven polyolefins, meeting growing demand for sustainable solutions in various industries like packaging, automotive, and construction.

The global polyolefins market is segmented on the basis of type, application, and region. On the basis of type, the polyolefins market is categorized into polyethylene (PE), polypropylene (PP), and polystyrene. Depending on application, it is segregated into film & sheet, injection molding, blow molding, profile extrusion, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Polyolefins market share is analyzed across all significant regions and countries.

The polyolefins market analysis covers in-depth information of the major industry participants. Some of the major players in the market include Exxonmobil Corporation, SABIC, Total SE, Repsol, Ineos Group AG, Reliance Industries, LyondellBasell Industries N.V., Sinopec Group, Ducor Petrochemical, and Formosa Plastics Corporation.

Other players in the value chain of the polyolefins market include Borealis AG, Arkema S.A., Braskem S.A, Abu Dhabi Polymers Company Ltd. (Borouge), Sasol Ltd., Tosoh Corporation, and Polyone Corporation.

The key players adopt numerous strategies such as product launch, business expansion, acquisition, partnership, collaboration, joint venture, and agreement to stay competitive in the polyolefins market.

For instance, Saudi Basic Industries Corporation (SABIC), one of the largest petrochemicals manufacturers, launched a new anti-abrasive polyolefins compound pipe grade, a new polyolefin compound pipe grade, named SABIC P1600A. It is used for slurry transportation for mining industries. This new product offers anti-abrasion advantages over conventional materials such as steel and ceramic. The product launch has reinforced product portfolio of the company.

In addition, Repsol, an energy company headquartered in Spain, developed three new grades of metallocene polyethylene at its plant in Tarragona, Spain for the automotive sector that reduces vehicle weight and hence reduce energy consumption. This product launch helped the company to strengthen its foothold in the global polyolefins market.

Polyolefins Market, By Type

By type, the polyethylene segment garnered 65.6% share in terms of revenue in 2020, and is expected to grow at a CAGR of 11.6% during the forecast period. This is attributed to its high demand in numerous applications such as extrusion packaging applications, extrusion nonpackaging, injection molding, and blow molding.

By Type

Polypropylene is projected as the most lucrative segment.

Polyolefins Market, By Application

By application, the film & sheet segment garnered 31.0% share in 2020 in terms of volume. This is attributed to rise in utilization of films in construction, automobile, solar energy, and food & nonfood packaging.

By Application

Film & Sheet is projected as the most lucrative segment.

Polyolefins Market, By Region

Region wise, Asia-Pacific is expected to grow at a CAGR of 13.6%, in terms of revenue during the forecast period. This is attributed to the presence of emerging economies such as India, China, Japan, and South Korea. These emerging economies have rapidly growing consumer base such as packaging, automotive, and construction. China is one of the major contributors to the market, owing to a huge consumer base and presence of key players in the polyolefins market.

By Region

Asia-Pacific holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key benefits for stakeholders

- The report outlines the current trends and future scenario of the polyolefins market from 2021 to 2028 to understand the prevailing opportunities and potential investment pockets.

- The polyolefins market size is provided in terms of volume and revenue.

- The report provides an in-depth analysis of the market along with the current and future polyolefins market trends.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The study provides a comprehensive analysis of the factors that drive and restrain the polyolefins market growth.

Analyst Review

Numerous industries are facing changes in customer spending due to the outbreak of the COVID-19, which is hindering the polyolefins market growth. For instance, the automotive sector witnessed decline in sales in 2020, which, in turn, decreased the demand for polyolefins. On the contrary, significant increase was witnessed in consumer packaging demand in 2020. This is attributed to rise in home deliveries of products due to the implementation of lockdown in many countries, which, in turn, boost the consumption of polyolefins for the purpose of packaging. In addition, increase in penetration of the e-commerce platforms notably contributes toward the growth of the market.

Key Market Segments

By Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene

By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- UAE

- South Africa

- Rest of LAMEA

Polyolefins Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | SINOPEC GROUP, INEOS GROUP AG, LYONDELLBASELL INDUSTRIES N.V., SABIC, EXXONMOBIL CORPORATION, TOTAL SE, REPSOL, RELIANCE INDUSTRIES, DUCOR PETROCHEMICAL, FORMOSA PLASTICS CORPORATION |

Analyst Review

Numerous industries are facing changes in customer spending due to the outbreak of the COVID-19, which is hindering the polyolefins market growth. For instance, the automotive sector witnessed decline in sales in 2020, which, in turn, decreased the demand for polyolefins. On the contrary, significant increase was witnessed in consumer packaging demand in 2020. This is attributed to rise in home deliveries of products due to the implementation of lockdown in many countries, which, in turn, boost the consumption of polyolefins for the purpose of packaging. In addition, increase in penetration of the e-commerce platforms notably contributes toward the growth of the market.

Rising renewable energy sector is one of the major factors boosting the market growth.

The polyolefins market was valued at $133.9 billion in 2020, and is projected to reach $446.6 billion by 2028, growing at a CAGR of 12.5% from 2021 to 2028.What are the most

Food packaging industry and medical industry is expected to increase the demand for polyolefins market

The increasing use of polypropylene in medical sector is one of the main drivers for the polyolefins market

Films and sheets are the application anticipated to drive the adoption of polyolefins

The decreased automotive production owing to outbreak of COVID-19 hindered the polyolefins market

Loading Table Of Content...