Polypropylene and Polypropylene Composites Market Overview:

The global polypropylene and polypropylene composites market for injection molding was valued at $41,944 million in 2017 and is projected to reach $84,419 million by 2025, growing at a CAGR of 8.3% from 2018 to 2025.

Polypropylene is one of the commonly used plastics as well as a fiber. As fiber, polypropylene is used in the manufacturing of artificial turf for sports and leisure activities. It is a thermoplastic, which is made by combining propylene monomer, and is used in numerous applications, such as packaging, reusable containers, laboratory equipment, textiles, and auto components. Attributes such as low cost, electrical insulating properties, heat resistance, easy–to-mold nature, chemical resistance, and convenient end-use applications have led to the widespread usage of injection molded polypropylene. Injection molded polypropylene & polypropylene composites can attain complex and intricate shapes, minimizing wastage of the material, and are used in the various industries. Hence, injection molded plastics are used in the manufacturing of automotive components, interior wrapping, and numerous assembly parts, which fuel their adoption, thereby driving the growth of the polypropylene market.

The major driving factor that is responsible for the growth of the injection molded polypropylene and polypropylene composites market is upsurge in demand for polypropylene and polypropylene composites from various industries. Furthermore, low labor cost, advantage of mass production, and better waste management in the injection molding process have fueled the market growth. However, high initial tooling cost of the injection molding and availability of other substitutes providing stiff competition to polypropylene hinder the market growth. On the contrary, robotics used in injection molding process is expected to make future opportunities for the market growth.

Several developments in the PP market have been witnessed in recent years. One of the developments is used of natural fiber reinforced polypropylene (PP) composites. Natural fibers are low-cost, recyclable, and eco-friendly materials and due to eco-friendly and bio-degradability characteristics, they are considered as strong entrants to replace the conventional glass and carbon fibers. The chemical, mechanical, and physical properties of natural fibers have different properties based on the cellulosic content of the fibers.

The Global PP and PP composites market for injection molding report segments the market based on product, fiber type, application, and geography. Based on product, the market is segmented into polypropylene (PP) and polypropylene composites. On the basis of fiber type, it is divided into glass fiber, carbon fiber, and others. By application, it is fragmented into Packaging, Building & Construction, Automotive, Electrical & Electronics and others. Geographically, the global PP and PP composites market for injection molding is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global PP and PP composites market for injection molding include Borealis AG, Sumitomo Chemicals, Exxon Mobil Corporation, Sinopec Ltd, SABIC, Formosa Plastics Corporation, Lyondell Basell Industries N.V., DuPont, INEOS, and Braskem. In order to stay competitive in the market, these key players are adopting different strategies such as merger & acquisition, product launch, partnership and strategic alliance. In an instance, Mitsui Chemicals is collaborating with Taiwan’s Formosa Plastics to commercialize carbon fiber-reinforced polypropylene unidirectional (UD) sheet and tape under the Tafnex brand. Formosa supplies special sizing agent carbon fiber to Mitsui Chemicals for processing into the UD sheet and tape products.

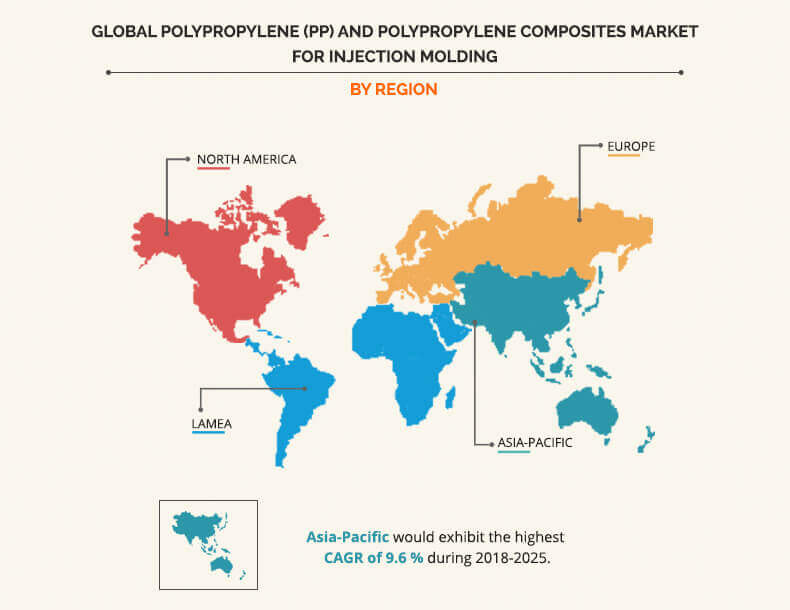

Polypropylene and polypropylene composites market for injection molding, by geography

The Asia-Pacific polypropylene and polypropylene composites market size for injection molding is expected to witness rapid growth rate during the forecast period, to increase in application of polypropylene in various industries such as plastic industry, automobile, consumer goods & electronics, construction, packaging, and other industries. Moreover, government policies supporting the use of injection molded polypropylene & polypropylene composites fuel the growth of the market in Asia-Pacific.

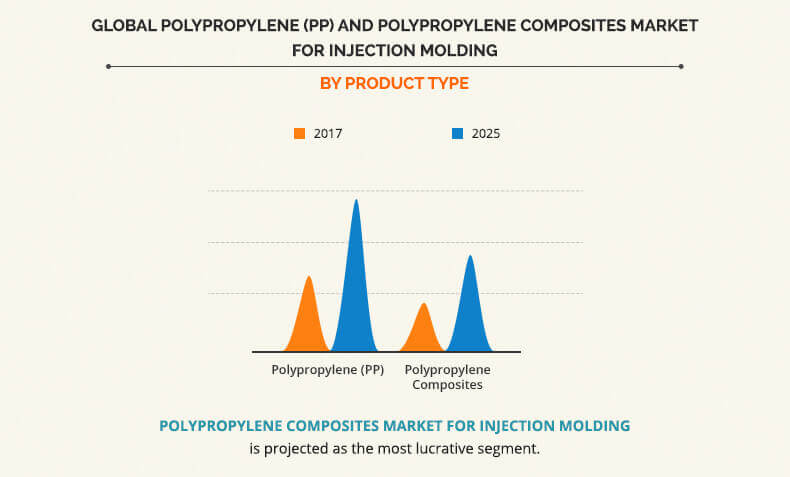

Global polypropylene and polypropylene composites market for injection molding, by product

The polypropylene composites segment is projected to be the most lucrative segment, owing to their versatility, low cost, and high impact resistance. Furthermore, lightweight, high tensile strength, and recyclable nature of polypropylene composites have encouraged automobile manufactures to use polypropylene composites in the exterior and interior parts of the automobile, thereby improving fuel efficiency and minimizing emission.

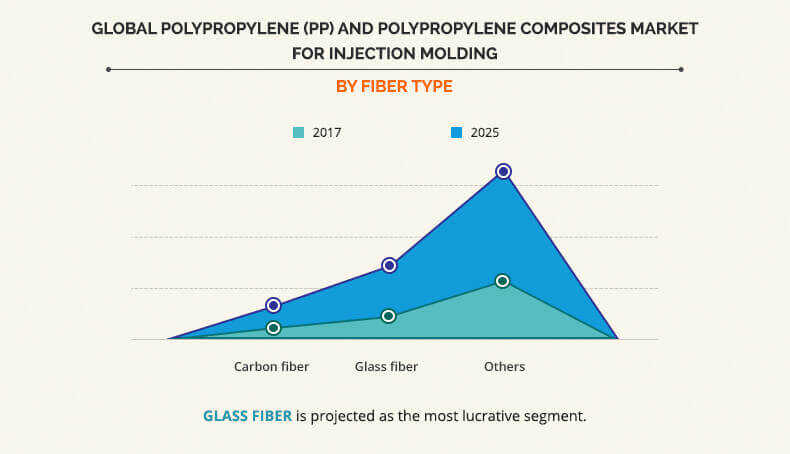

Global polypropylene and polypropylene composites market for injection molding, by fiber type

In Fiber type, the glass fiber polypropylene composites segment is estimated to be grow at highest CAGR during the forecast period, due to good thermal insulation and thermal conductivity.

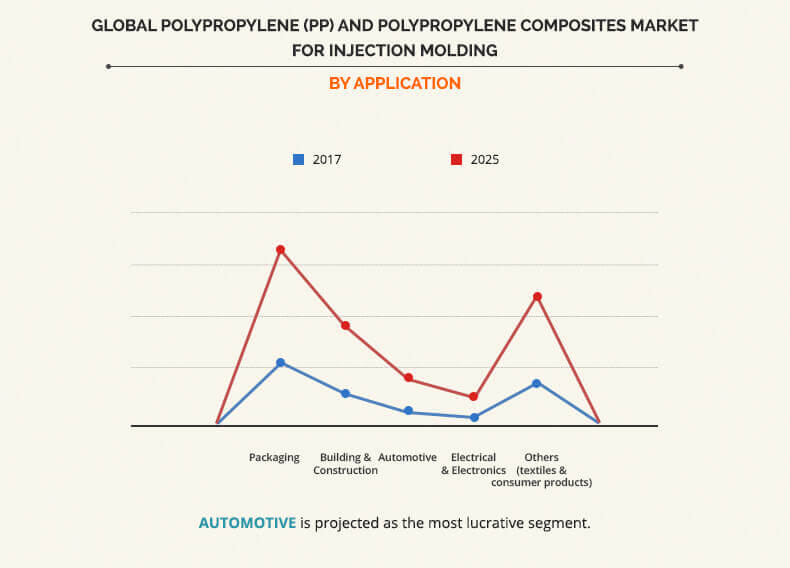

Global polypropylene and polypropylene composites market for injection molding, by application

The automotive application is estimated to be grow at highest CAGR during the forecast period, due to increasing use of Polypropylene composites in automotive application because of high strength to weight ratio, superior corrosion resistance, fatigue resistance, and fire resistance properties of the carbon fiber polypropylene composites.

Key Benefits for Polypropylene and Polypropylene Composites Market:

- Porters Five Force's analysis helps to analyze the potential of buyers and suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current trends and future scenario of the polypropylene and polypropylene composites market analysis for injection molding from 2017 to 2025 to understand the prevailing opportunities and potential investment pockets.

- Major countries in each region have been mapped according to their individual revenue contribution to the global as well as regional polypropylene and polypropylene composites market trends.

- An in-depth analysis of the current research & developments is provided along with the key dynamic factors that are responsible for polypropylene and polypropylene composites market growth.

- The key drivers, restrains, and opportunities and their detailed impact in the polypropylene and polypropylene composites market analysis have been elucidated in the study.

- The profiles of key players along with their key strategic developments in the polypropylene and polypropylene composites market share have been enlisted in the report.

Polypropylene and Polypropylene Composites Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By FIBER TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | DowDuPont Inc, Saudi Basic Industries Corporation, LyondellBasell Industries Holdings B.V., China Petroleum & Chemical Corporation (Sinopec Limited), Formosa Plastics Corporation, Borealis AG, Braskem S.A, Exxon Mobil Corporation, Sumitomo Chemical Company, Limited, INEOS Group Holdings S.A |

Analyst Review

Polypropylene is a thermoplastic material, which is used in numerous applications, such as packaging, reusable containers, laboratory equipment, textiles, and auto components. Attributes such as low cost, electrical insulating properties, heat resistance, easy to mold nature, chemical resistance, and convenient end-use application have led to the widespread usage of polypropylene in plastic injection molding processes. Polypropylene fits into the mold, and is highly responsive to injection pressure and speed. Low cost of the material has made it one of the most ideal raw materials for plastic injection molding products. It is widely used in food & beverages containers, owing to their high chemical resistance and translucent nature. Furthermore, polypropylene is widely utilized in several end-use applications such as flexible packaging, rigid packaging, automotive, and consumer products.

Polypropylene composites are made by reinforcing the polypropylene polymer with fibers such as glass fiber, carbon fiber, and others. This reinforcement helps the polypropylene to attain physical properties such as high tensile strength, lighter weight, superior resistance to heat, and others. The automotive and aerospace & defense industry has been one of the major consumers of the polypropylene composites, followed by the automotive industry.

Loading Table Of Content...