Polyurea Coatings Market Research, 2032

The global polyurea coatings market was valued at $0.7 billion in 2022, and is projected to reach $1.2 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

Report Key Highlighters:

The polyurea coatings market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The polyurea coatings market is highly fragmented, with several players including BASF SE, Huntsman International LLC, Pearl Polyurethane, Polycoat Products, PPG Industries, Inc., Sika AG, SPI Performance Coatings, SWD urethane Co., Ltd., Teknos Group, and The Sherwin-Williams Company.

Polyurea coatings are a class of protective coating material that are produced when amines and isocyanates are combined. This chemical process produces a flexible and long-lasting elastomeric coating with various uses. These coatings exhibit distinct properties such as high tensile strength, flexibility, resilience to chemicals and environmental conditions, fast cure times, and superior abrasion resistance. These coatings are widely used in various industries, including construction, transportation, oil & gas, and automotive applications, for waterproofing, corrosion protection, industrial flooring, and other protective coating needs.

The surge in the infrastructural developments is poised to drive significant expansion in the polyurea coating market size.

Rise in urbanization, population expansion, and a focus on economic competitiveness have contributed to the global surge in infrastructure development, driving public and private sectors to invest in updating and enlarging energy, transportation, and communication networks. Infrastructure developments are considered crucial for promoting economic expansion and improving general living standards. According to the World Bank Group, the entire amount of investment commitments, which was $36.4 billion across 44 nations, decreased by 7% when compared to the same period in 2022. However, the total count of projects increased from 121 to 161. This increase illustrates a move toward a wider range of infrastructure projects globally. The demand for polyurea coating has increased, mostly due to parallel expansion in infrastructure development.

Presently, polyurea coatings are the material of choice to protect these essential infrastructure components due to their exceptional toughness, chemical resistance, and rapid cure time. For instance, ISOMAT, a Greek multinational group that is engaged in the production of building chemicals, provides a range of polyurea membranes, both 100% pure and hybrid, that are used for industrial, residential, and infrastructure projects, wastewater treatment facilities, and water tanks.

Moreover, traditional coating materials might not be able to provide infrastructure enough resistance to various problems it experiences. Polyurea coatings are suitable to prevent corrosion, abrasion, and chemical exposure on surfaces, extend the life of structures, and reduce the need for frequent maintenance. In addition to reduce infrastructure's overall life cycle costs, its durability helps many development projects achieve their sustainability objectives.

Moreover, these coatings' rapid curing time enable quicker project completion, lessen downtime, and facilitate effective construction progression. Thus, the construction process is more efficient overall when polyurea coatings can be applied and cured rapidly leading to increase in polyurea coating market share.

Furthermore, proactive maintenance techniques have grown more popular as people become more aware of the financial consequences of infrastructure degradation. Polyurea coatings are essential for preventative maintenance as they offer a strong protective layer that prolongs the life of infrastructure components. This leads to a significant reduction in the frequency of repairs and replacements for owners and operators of infrastructure. Thus, infrastructure development boosts the growth of the polyurea coating industry during the forecast period.

The lucrative use of polyurea coatings in medical facilities is poised to be a significant driver for the expansion of the polyurea coating industry.

Increase in demand for polyurea coatings in medical facilities drives the growth of the market. These coatings meet the specific challenges presented by medical facilities and are essential to maintain a sterile and clean atmosphere. Polyurea coatings act as a barrier that is impermeable, seamless, and resistant to liquids, chemicals, and microbiological development. These coatings offer a highly hygienic and easily cleanable surface in critical areas such as operating rooms and laboratories, where leaks and contamination pose potential hazards. Many manufacturers are offering their products that are employed in medical facilities. For instance, Taiwan PU Corporation provides 85-90A Polyurea Coating System, that are used in hospitals, equipment rooms, and sanatorium floors. It offers exceptional waterproofing qualities, durability, and resistance to abrasion. It generally requires 20 seconds for it to cure.

In medical facilities, where downtime is frequently minimized to ensure ongoing operations, the rapid cure time of polyurea coatings is helpful. Medical facilities may swiftly resume regular activities with polyurea coatings as they may be applied and cured quicker than conventional flooring systems, which may need longer times. This effectiveness is essential to preserve the functionality of medical facilities, reduce disturbances, and ensure that patient care remains uninterrupted during renovations or maintenance.

Furthermore, high-traffic areas in medical institutions are suitable for polyurea coatings due to their resilience to abrasion and longevity. Polyurea coatings offer a durable surface that withstands wear and tear in locations that experience regular foot and equipment traffic, such as corridors, waiting rooms, and common areas. The impact and scratch resistance of the coatings is beneficial in locations where heavy medical equipment, including wheelchairs and rolling carts, may be used frequently. Floor coating and surface last longer and require less replacements due to its resilience, therefore saving money.

Polyurea coating market analysis shows that some polyurea formulations’ antibacterial properties provide a further line of defense against the spread of infections. In healthcare settings, where infection control is a major issue, this is particularly important. The general cleanliness and security of medical facilities may be improved by polyurea coatings with antimicrobial compounds, which prevent the growth of bacteria, viruses, and fungi on treated surfaces. These coatings offer aesthetic customization choices in addition to their protective qualities.

Medical facilities may create environments that are both aesthetically pleasing and practical as the coatings are available in a variety of colors and textures. This is crucial in places like waiting rooms and patient rooms, where a pleasant and tidy atmosphere may enhance the health of both patients and visitors. Thus, rise in the usage of polyurea coatings in medical facilities is expected to boost the polyurea coating market growth.

However, fluctuating cost of raw materials, that affects both producers and consumers, acts as the key deterrent factor of the global market. Polyurea coatings consist of essential constituents, such as amines and isocyanates, obtained from petrochemical feedstocks. These raw materials' costs are influenced by several external factors, including shifts in the demand for petrochemicals globally, disruptions in the supply chain, and geopolitical developments. The fluctuation in raw material costs is worsened by these uncertainties, making it difficult for producers to predict production costs and for end users to budget for projects that utilize polyurea coatings.

The dynamics of petrochemical supply and demand across the globe are major factors that further affect the price of raw materials for polyurea coating technologies. Crude oil and natural gas derivatives are important petrochemical feedstocks as they are used to produce isocyanates, which are an essential part of polyurea formulations. The price of these essential raw materials might vary rapidly and unpredictably due to fluctuations in oil prices, international conflicts, or interruptions in the supply chain for petrol and oil. The level of volatility in the polyurea coating market forecast presents producers with difficulties to maintain cost stability, which affects their capacity to provide clients with fixed prices.

Furthermore, the complicated chemical reactions and manufacturing processes involved in the synthesis of isocyanates and amines contribute to the overall complexity of the polyurea coating production process. The manufacturing chain is susceptible to disruptions due to its complexity, which may include unexpected events like accidents, natural disasters, or geopolitical tensions.

Polyurea coatings have a wide range of uses in oil & gas, automotive, construction, and other industries, which makes them ideal across the globe. Variations in the price of raw materials may have varying effects on each of these industries. In the construction industry, for instance, where polyurea coatings are used for waterproofing and protection, unexpected increases in the cost of raw materials might influence project budgets and cause construction schedule delays.

Similarly, in the automotive industry, where polyurea coatings are applied to protect against corrosion and to improve aesthetics, variations in cost may affect manufacturers' total manufacturing costs, which can then have an impact on final product prices. Thus, fluctuations in the raw material prices restrain the polyurea coating market growth.

Contrarily, technological advancements in polyurea coating are expected to offer potential growth opportunities for the market. Protective coatings have seen a shift due to technological developments in polyurea coatings, which offer improved sustainability, application efficiency, and performance. The introduction of hybrid polyurea formulations, which combine the benefits of polyurea with those of other polymers like epoxy or polyurethane, is one of the noteworthy developments. These hybrid coatings frequently have enhanced adhesion, flexibility, and UV resistance, meeting particular application needs and extending polyurea's usefulness across a range of sectors.

Furthermore, to comply with environmental requirements and address health concerns regarding harmful emissions during application and curing, researchers have concentrated on developing low-VOC and solvent-free polyurea coatings. These developments meet the growing need for ecologically friendly solutions while also advancing a more sustainable coating alternative.

Developments in application technology have been crucial to the polyurea coatings industry. The best curing and coating performance is ensured by state-of-the-art plural-component spray equipment with accurate mixing ratios and enhanced temperature control. This technology makes it easier to apply polyurea coatings in a range of conditions, including those with high humidity and harsh temperatures. In addition, the application procedure has been improved by automated spray systems, increasing efficiency, and decreasing error margin. The quality and consistency of polyurea coatings are further enhanced by the advent of smart application equipment with real-time monitoring capabilities, giving users more control over the coating process.

Polyurea coating market trends have improved in performance in many ways due to the addition of nano-additives. Coatings with enhanced hardness, scratch resistance, and barrier qualities are all produced by manipulating material properties at the nanoscale through the use of nanotechnology. Polyurea coatings strengthened by nanotechnology exhibit exceptional robustness and longevity, making them ideal for rigorous uses in industries like industrial maintenance, aerospace, and transportation.

Moreover, an innovative breakthrough in the industry is the development of self-healing polyurea coatings. Without assistance from outside sources, these coatings are capable of self-repairing small abrasions or scratches. Under specific circumstances, the coating's self-healing mechanism involves the reformation of chemical bonds, which restores the integrity of the coating. This development is especially useful for coatings used in automotive and architectural applications, where it is essential to preserve the coating's protective properties and aesthetic appeal over time. Thus, advancements in technology are expected to offer lucrative growth opportunity for the polyurea coating market.

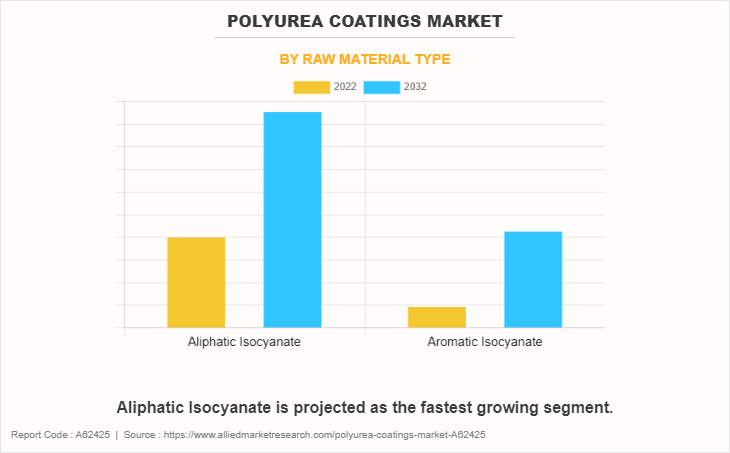

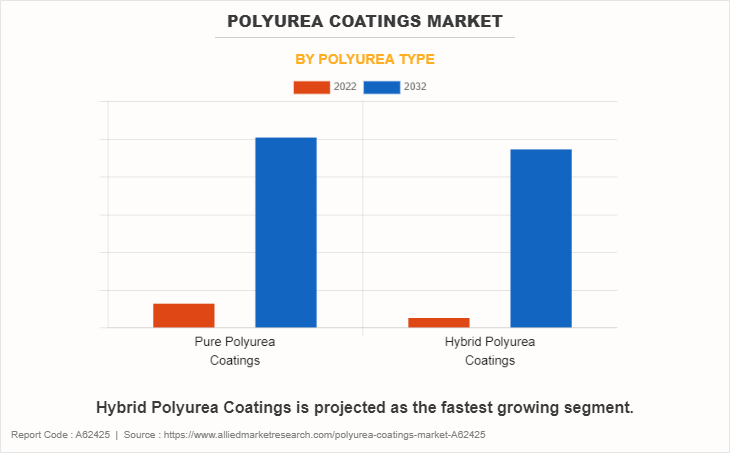

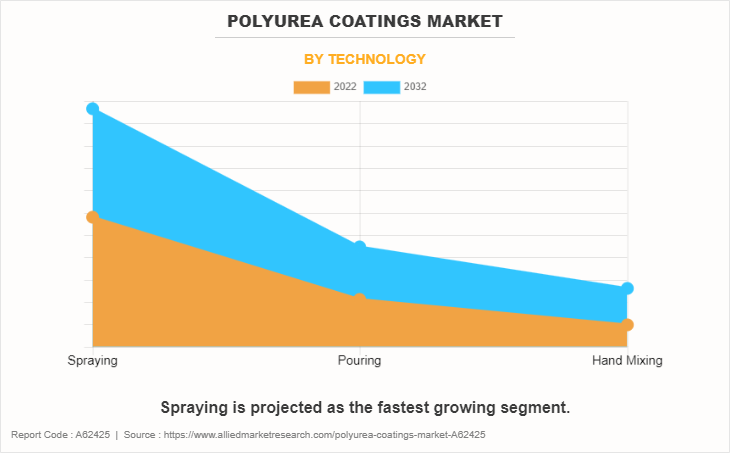

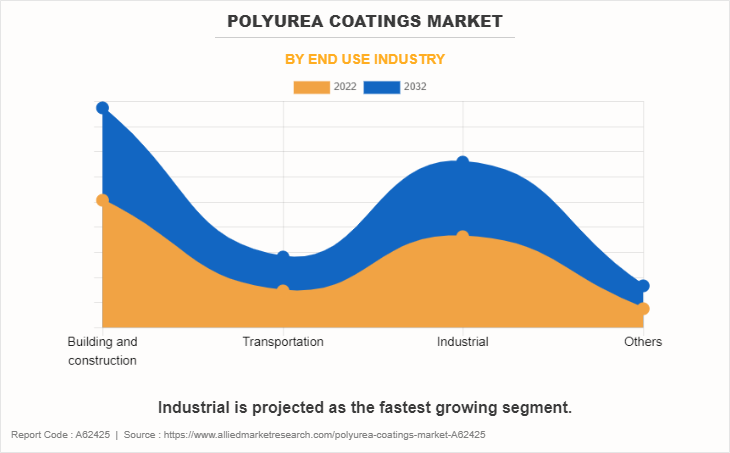

The polyurea coating market is segmented into raw material type, polyurea type, technology, end-use industry, and region. By raw material type, the market is bifurcated into aliphatic isocyanate and aromatic isocyanate. On the basis of polyurea type, it is categorized into pure polyurea coatings and hybrid polyurea coatings. Depending on technology, the market is divided into spraying, pouring, and hand mixing. By end-use industry, it is categorized into building and construction, transportation, industrial, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The Aliphatic isocyanate segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 5.0%. This can be attributed to aliphatic isocyanate having exceptional UV stability, weather resistance, and color retention properties. These characteristics make it ideal for outdoor applications, providing long-lasting protection against environmental factors, that is crucial for industries such as construction, automotive, and infrastructure.

The pure polyurea coatings segment accounted for the largest share in 2022 owing to its versatility, rapid curing, and seamless application. Its ability to form a durable, elastic, and chemical-resistant protective layer across various surfaces makes it a preferred choice for industries like construction, manufacturing, and automotive.

The hybrid polyurea coatings segment is expected to register the highest CAGR of 4.9% due to their unique combination of polyurea and polyurethane properties. This results in enhanced flexibility, abrasion resistance, and prolonged durability, making them increasingly favored for diverse applications, including industrial and commercial coatings.

The spraying segment accounted for the largest share in 2022 and is expected to register the highest CAGR. This can be attributed to spraying technology having its efficiency and versatility. It allows for quick and uniform application over various surfaces, facilitating seamless protection. The ease of spraying enables large-scale projects, making it the preferred choice in industries such as construction, infrastructure, and manufacturing for its cost-effective and time-saving benefits.

The building and construction segment accounted for the largest share in 2022 due to the coatings' exceptional protective properties. Polyurea coatings provide durability, chemical resistance, and waterproofing, making them vital for applications like roofing, flooring, and infrastructure. The construction industry relies on polyurea coatings for long-lasting and reliable protection against environmental factors.

The industrial segment is expected to register the highest CAGR of 5.1% due to rising demand for robust protective solutions. Polyurea coatings offer superior resistance to chemicals, abrasion, and corrosion, making them crucial for industrial applications, including pipelines, tanks, and machinery, driving their increased adoption and growth in this sector.

Asia-Pacific garnered the largest share in 2022 due to rapid industrialization, infrastructure development, and increased construction activities. The region's burgeoning automotive, manufacturing, and building sectors drive demand for protective coatings. Growing awareness of polyurea's benefits, coupled with economic growth, positions Asia-Pacific as a key market contributor.

The major players operating in the global polyurea coating market are BASF SE, Huntsman International LLC, Pearl Polyurethane, Polycoat Products, PPG Industries, Inc., Sika AG, SPI Performance Coatings, SWD urethane Co., Ltd., Teknos Group, and The Sherwin-Williams Company.

Other players include ArmorThane, ISOMAT, MARVEL COATINGS, Nukote Coating Systems, Rhino Linings Corporation, Rust-Oleum, Specialty Products Inc., Taiwan PU Corporation, The Euclid Chemical Company, and VIP Coatings Intl GmbH & Co.KG.

Strategic Developments Undertaken By Key Players

In April 2023, Pearl Polyurethane launched the polyurea-based DuraPearl elastomer system. The new DuraPearl product is one of the most robust solutions on the market as it can be customized for harsh climates across the globe. This product launch will boost the growth of the polyurea coating market.

In December 2021, Teknos Group introduced TEKNOPUR 400, a two-component elastomeric coating that is an affordable solution for waterproofing and producing long-lasting concrete and roofing surfaces. It was developed using modified polyurea technology. TEKNOPUR 400-800 exhibits strong mechanical qualities and is able to withstand severe abrasion, offering it a long-lasting surface with superior wear resistance. It works particularly well for making sturdy concrete and roofing surfaces, but it may also be applied to wood, geotextile, and foam substrates. This product launch will increase the demand for the polyurea coating market.

In January 2021, PPG Industries, Inc. acquired VersaFlex, a manufacturer of epoxy, polyurea, and polyurethane coatings for industrial applications, transportation infrastructure, water and wastewater infrastructure, and flooring. PPG's current product portfolio will be enhanced and complemented by VersaFlex's appealing industry mix, robust growth outlook, distinctive product offering, extensive experience, and manufacturing capabilities in polyurea and flooring coatings.

In October 2020, PPG Industries, Inc. launched the SANISHIELD 3000/5000 two-part polyurea coatings system for walls and ceilings in industrial settings, including food and beverage facilities, where easy maintenance and fast installation are essential. The PPG SaniShield coating technique improves surface integrity and longevity by filling small breaches in the substrate material, offering an alternative to fiberglass and stainless steel wall and ceiling systems. It provides outstanding gloss retention on a clean, white surface. This product launch will boost the demand for polyurea coatings, leading to market growth.

Public Policies

Environmental Protection Agency (EPA) Regulations: The EPA oversees various rules pertaining to coatings, one of which is emissions of volatile organic compounds (VOCs). Manufacturers of polyurea coatings must comply with VOC restrictions to minimize air pollution and other environmental consequences. State-level environmental agencies might also have specific requirements.

European Union REACH Regulation: The Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) legislation in the European Union provides a thorough framework that controls the use and manufacturing of chemicals, including those that are used in coatings. To protect human health and the environment, polyurea coatings and their constituent parts must adhere to REACH regulations.

Occupational Safety and Health Administration (OSHA): Workplace safety regulations are set by OSHA in the U.S. OSHA implements rules that protect workers from exposure to these potentially dangerous compounds, as isocyanates are frequently used in polyurea coatings. OSHA rules must be followed by manufacturers and applicators to guarantee a secure workplace.

National Emission Standards for Hazardous Air Pollutants (NESHAP): The NESHAP program of the U.S. EPA controls harmful air pollutants from industries, including coating application. Producers of polyurea coatings might have to adhere to NESHAP's emission guidelines to reduce their negative effects on the environment.

Product Labeling and Consumer Safety Standards: Certain areas have laws governing product labelling that educate workers and consumers on the contents and the risks of coatings. Adherence to these guidelines guarantees openness and security.

Waste Disposal Regulations: Waste produced during the production and application of polyurea coatings is often regulated for proper disposal. Guidelines may include disposing of waste products properly and following disposal procedures to reduce the influence on the environment.

Impact of Russia–Ukraine War On The Polyurea Coating Market:

Conflicts and tensions on the geopolitical front might harm the raw material supply chain that is essential to industry. The sourcing of essential components or feedstocks from conflict-affected countries for polyurea coatings may result in lack of supply and higher raw material costs. This could therefore affect the polyurea coatings' total cost of manufacture and price.

The global economy may become unstable because of geopolitical conflicts, which could impact consumer purchasing and investment confidence. The demand for infrastructure and building projects—two important markets for the uses of polyurea coatings—may decline because of companies becoming more cautious about growing or investing.

The conflict may cause delays in logistics and shipping, which would make it more difficult to supply polyurea coatings and related goods to end customers on time. Shipment delays and other disruptions in the supply chain may impact project timetables and construction dates, which can affect coating demand.

The need for polyurea coatings is strongly associated with various industries, including but not limited to construction, automotive, and oil & gas. Geopolitical tensions may cause any slowdown or interruption in these industries, which could then spread out to affect the demand for coatings.

Currency exchange rate variations brought on by geopolitical events may affect the price of imported raw materials and, consequently, the competitiveness of polyurea coatings on the international market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyurea coatings market analysis from 2022 to 2032 to identify the prevailing polyurea coatings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polyurea coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polyurea coatings market trends, key players, market segments, application areas, and market growth strategies.

Polyurea Coatings Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Raw Material Type |

|

| By Polyurea Type |

|

| By Technology |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | BASF SE, The Sherwin-Williams Company, Pearl Polyurethane, SPI Performance Coatings, SWD urethane Co., Ltd., Teknos Group, Sika AG, Huntsman International LLC, PPG Industries, Inc., Polycoat Products Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the wide usage of polyurea coatings in various end-use industries such as construction, automotive, transportation, and oil & gas drives the market growth. Moreover, infrastructure development boosts the growth of the polyurea coating market. This is attributed to the fact that polyurea coating has exceptional durability, quick cure periods, and superior chemical resistance. These coatings are renowned for their seamless, flexible, and waterproof nature.

However, competition from alternative coating solutions such as epoxy coating and acrylic coating limits the adoption of polyurea coatings. The fluctuating cost of raw materials further restrains the market growth.

The CXOs further added that technological advancements in the manufacturing of polyurea coatings and surge in use of environmentally friendly products offer lucrative opportunities for growth. Moreover, the industry is characterized by a high number of new entrants that seek to tap lucrative opportunities in the global market while existing players enter strategic collaborations to increase capacities and expand their reach into emerging markets. The acquisition, collaboration, and expansion activities in the industry have increased significantly over the past decade. Companies constantly seek to establish long-term contract agreements with trusted partners for sustainable business operations globally.

The global polyurea coatings market was valued at $0.7 billion in 2022, and is projected to reach $1.2 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

Technological advancements and rise in popularity of environmentally friendly products are the upcoming trends of polyurea coatings market in the world.

Polyurea coatings are widely used in various end-use industries including building and construction, transportation, aerospace, and others.

Asia-Pacific is the largest regional market for polyurea coatings market.

The major players operating in the global polyurea coating market are BASF SE, Huntsman International LLC, Pearl Polyurethane, Polycoat Products, PPG Industries, Inc., Sika AG, SPI Performance Coatings, SWD urethane Co., Ltd., Teknos Group, and The Sherwin-Williams Company.

Loading Table Of Content...

Loading Research Methodology...