Polyurethane Sealant Market Research, 2032

The global polyurethane sealant market was valued at $3 billion in 2022, and is projected to reach $4.6 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032.

Introduction

Polyurethane sealant is a type of adhesive and sealing material made from polyurethane polymers, known for its strong bonding properties, flexibility, and durability. It is commonly used in construction, automotive, and industrial applications to seal joints, fill gaps, and provide a waterproof and weather-resistant barrier. Polyurethane sealants adhere well to a variety of surfaces, including concrete, metal, wood, and plastic, and can accommodate movement without cracking or losing adhesion. Their high resistance to environmental elements such as moisture, UV rays, and temperature fluctuations makes them ideal for both indoor and outdoor use.

Report Key Highlighters:

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The polyurethane sealant market is fragmented in nature among prominent companies such Arkema, Henkel AG And Co. KGaA, Sika AG, BASF SE, 3M, Soudal Group, ASTRAL ADHESIVES, HB Fuller Co, The Dow Chemicals Company, and Pidilite Industries Limited.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global polyurethane sealant industry such as undergoing R&D activities, regulatory guidelines, and technological advancements, development of eco-friendly polyurethane sealants, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,000 polyurethane sealants-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global polyurethane sealants market.

Polyurethane sealant is a type of versatile and durable adhesive material commonly used for sealing joints and gaps in various applications. It is formulated from polyurethane, a polymer composed of organic units joined by urethane links. Polyurethane sealants exhibit a range of properties that make them suitable for diverse sealing and bonding applications.

The construction industry is a major driver of the polyurethane sealants market owing to the fact that polyurethane sealants are widely used in construction for sealing joints, gaps, and cracks in buildings, bridges, highways, and other infrastructure projects. Furthermore, rapid urbanization and population growth contribute to increased construction activities, driving the demand for polyurethane sealants. As urban areas expand, there is a need for sealing and bonding materials in both residential and commercial construction.

Moreover, the automotive industry is a significant consumer of polyurethane sealants. Polyurethane sealants are used for bonding and sealing applications in vehicle assembly. With the growth of the automotive sector, the demand for polyurethane sealants has increased.

However, polyurethane sealants are relatively more expensive compared to other sealant options. The initial cost of polyurethane sealants is a restraining factor, especially in cost-sensitive applications or industries. These factors directly influence the price of organic chemicals and make them costlier. Moreover, the prices of raw materials used in the production of polyurethane sealants, such as polyols and isocyanates, can be volatile. Fluctuations in raw material prices affect the overall cost of manufacturing polyurethane sealants.

On the contrary, government initiatives and increased investment in infrastructure projects, such as roads, bridges, and public facilities, provide opportunities for the use of polyurethane sealants in sealing joints, expansion joints, and other critical areas.

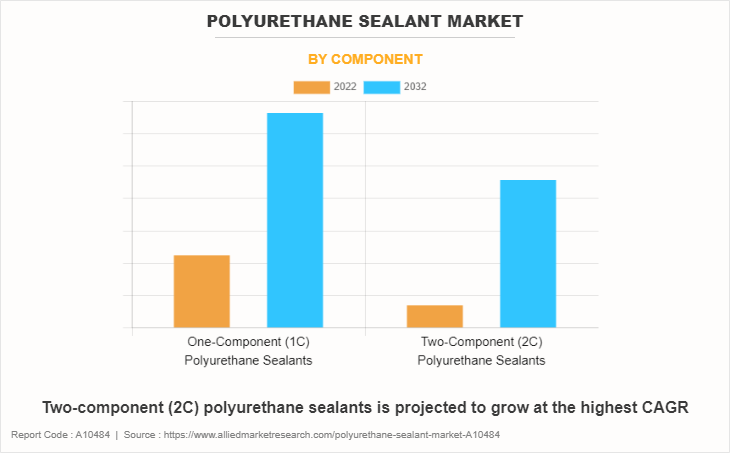

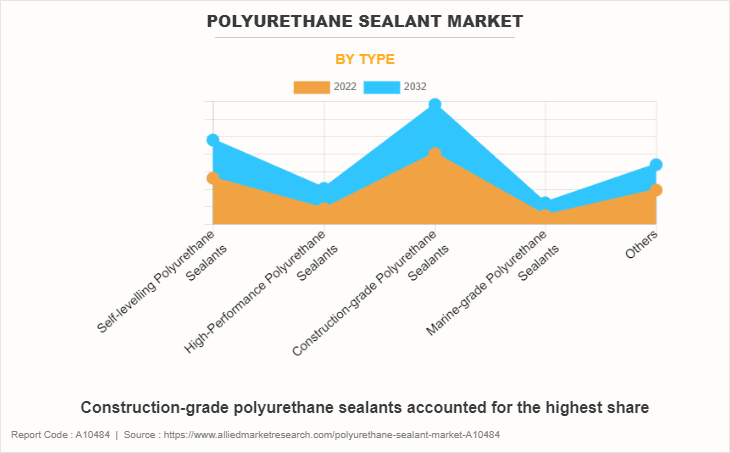

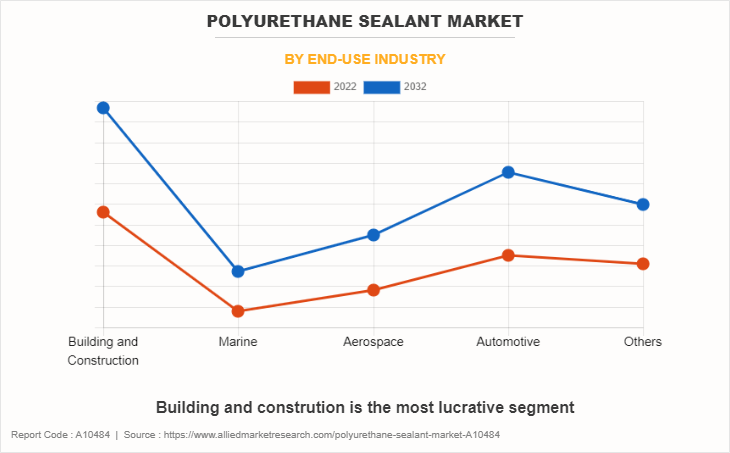

The polyurethane sealants market is segmented on the basis of component, type, end-use industry, and region. On the basis of component, the market is categorized into one component (1C) polyurethane sealants and two-component (2C) polyurethane sealants. On the basis of type, it is divided into self-levelling polyurethane sealants, high-performance polyurethane sealants, construction-grade polyurethane sealants, marine-grade polyurethane sealant, and others. On the basis of end-use industry, the market is categorized into building & construction, marine, aerospace, automotive, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the one component (1C) polyurethane sealants segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.4% during the forecast period. One of the primary reasons for the popularity of one component (1C) polyurethane sealants is their user-friendly nature. They come in pre-mixed formulations, eliminating the need for on-site mixing of components. This simplicity makes them easy to use for both professionals and DIY users. The ready-to-use nature of 1C polyurethane sealants reduces labor and application time.

Contractors and installers appreciate the convenience of a sealant that does not require complex mixing procedures, contributing to overall project efficiency. Moreover, 1C polyurethane sealants are versatile and can be used in a wide variety of applications. They adhere well to various substrates, making them suitable for sealing joints, gaps, and cracks in different materials such as metals, plastics, concrete, and wood. These factors altogether may surge the demand for one component (1C) polyurethane sealant; thus, fueling the polyurethane sealant market growth.

By type, the construction grade polyurethane sealants segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.6% during the forecast period. Construction-grade polyurethane sealants are formulated to provide durable seals in construction joints, expansion joints, and other structural applications. As construction activities increase globally, the demand for reliable sealing solutions in building and infrastructure projects has grown. In addition, construction sites often experience structural movements, expansions, and contractions.

Construction-grade polyurethane sealants are designed to accommodate these movements, ensuring that seals remain intact and effective over time. Furthermore, these sealants adhere well to a variety of substrates commonly found in construction, including concrete, masonry, metal, and wood. Their versatility allows for use in different construction scenarios, providing a consistent and reliable seal. These factors may augment the demand for construction-grade polyurethane sealants; thus, leading the polyurethane sealant market to witness a significant growth.

By end-use industry, the building and construction segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.8% during forecast period. Polyurethane sealants are highly versatile and can be formulated to meet a wide range of construction needs. Their adaptability makes them suitable for various applications, from joint sealing to bonding to different substrates. Furthermore, polyurethane sealants offer excellent flexibility, allowing them to accommodate movement and expansion in building materials. This flexibility is crucial in applications such as sealing joints and cracks, where structural movement is common.

In addition, polyurethane sealants adhere well to a variety of substrates, including concrete, metal, wood, plastics, and masonry. This versatility makes them suitable for different construction scenarios and materials. These factors altogether may surge the demand for polyurethane sealants for building and construction applications.

The Asia-Pacific polyurethane sealant market size is projected to grow at the highest CAGR of 5.1% during the forecast period and accounted for 44.9% of the polyurethane sealant market share in 2022. The construction industry in Asia-Pacific has been a major consumer of polyurethane sealants. Rapid urbanization, population growth, and infrastructure development projects have led to a continuous demand for sealants in various construction applications.

Furthermore, large-scale infrastructure projects, including the construction of highways, bridges, airports, and other public facilities, have driven the demand for polyurethane sealants. These sealants are crucial for sealing joints, gaps, and providing durability in infrastructure components.

The global polyurethane sealant market profiles leading players that include Arkema, Henkel AG And Co. KGaA, Sika AG, BASF SE, 3M, Soudal Group, ASTRAL ADHESIVES, HB Fuller Co, The Dow Chemicals Company, and Pidilite Industries Limited. The global polyurethane sealant market report provides in-depth competitive analysis as well as profiles of these major players.

Key Developments

In November 2023, Henkel launched its first bio-based polyurethane (PUR) adhesives specifically designed for load-bearing timber construction. The new Loctite engineered wood adhesives, HB S ECO and CR 821 ECO, offer a sustainable alternative by reducing CO₂-equivalent emissions by over 60% compared to traditional fossil-based adhesives.

In March 2023, Bostik, a leading global adhesive specialist, expanded its research and development capabilities by inaugurating a new technology lab in Shanghai. This facility serves as an extension of Bostik’s Asia Technology Center (ATC), strengthening the company’s innovation and development efforts in the Asia-Pacific region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyurethane sealant market analysis from 2022 to 2032 to identify the prevailing polyurethane sealant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polyurethane sealant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polyurethane sealant market trends, key players, market segments, application areas, and market growth strategies.

Polyurethane Sealant Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.6 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 570 |

| By End-Use Industry |

|

| By Component |

|

| By Type |

|

| By Region |

|

| Key Market Players | Arkema, 3M, Sika AG, Soudal Group, Pidilite Industries Limited, ASTRAL ADHESIVES, Henkel AG & Co. KGaA, HB Fuller Co, The Dow Chemicals Company, BASF SE |

Analyst Review

CXOs assess the current market dynamics, including growth rates, emerging trends, and potential areas for expansion. Understanding the growth potential of the polyurethane sealant market helps in strategic planning and resource allocation.

CXOs closely monitor the competitive landscape, assessing the market share of their company and competitors. Understanding the strengths and weaknesses of competitors helps in formulating effective strategies to maintain or improve market position.

Moreover, innovation in product formulations and development are crucial in a competitive market. CXOs prioritize R&D to introduce new formulations, improve product performance, and address evolving customer needs.

In addition, maintaining strong relationships with key customers and understanding their evolving requirements is essential. CXOs emphasize customer satisfaction, feedback mechanisms, and customized solutions to meet specific industry demands.

Furthermore, assessing and adopting new technologies is crucial for staying competitive. CXOs consider advancements in manufacturing processes, application technologies, and digital platforms to enhance operational efficiency and customer engagement.

CXOs are likely to prioritize sustainability initiatives, responding to the increasing demand for environmentally friendly products. This involves developing eco-friendly formulations, reducing carbon footprints, and adopting sustainable business practices.

Rising demand from construction sector, stringent environment regulations, and expansion in the automotive sector are the upcoming trends of polyurethane sealant Market in the world.

Building and construction is the leading application of polyurethane sealant market.

Asia-Pacific is the largest regional market for polyurethane sealant.

The polyurethane sealant market was valued for $3.0 billion in 2022 and is estimated to reach $4.6 billion by 2032, exhibiting a CAGR of 4.6% from 2023 to 2032.

Arkema, Henkel AG And Co. KGaA, Sika AG, BASF SE, 3M, Soudal Group, ASTRAL ADHESIVES, HB Fuller Co, The Dow Chemicals Company, and Pidilite Industries Limited are the top companies to hold the market share in polyurethane sealant.

Loading Table Of Content...

Loading Research Methodology...