Polywoven Bags Market Research, 2033

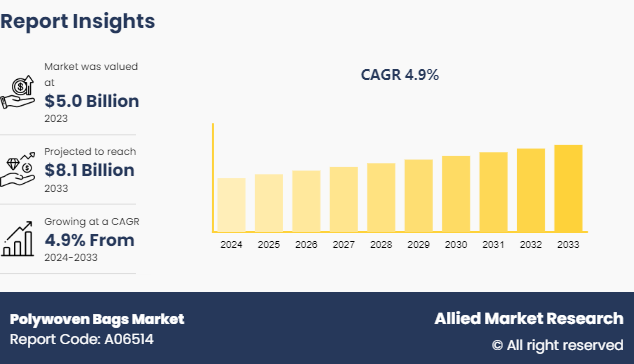

The global polywoven bags market size was valued at $5.0 billion in 2023, and is projected to reach $8.1 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Market Introduction and Definition

Polywoven bags, formerly referred to as woven polypropylene (PP) bags, are strong and long-lasting packaging solutions created by weaving polypropylene strips into the fabric before cutting and stitching them into bags. These bags are frequently used for packing agricultural goods, chemicals, building materials, and consumer items due to their robustness, lightweight nature, and resilience against wear and tear.

The growing need for environmentally conscious and reusable packaging solutions is driving manufacturers to develop the creation of environmentally friendly polywoven bags. In addition, the rise of the construction and agricultural sectors, particularly in developing countries, is driving the need for these bags because of their low cost and durability. Furthermore, the advent of e-commerce has increased the need for safe and dependable packaging, thus boosting the market.

Key market dynamics

The growing need for low-cost, long-lasting packaging solutions in industries such as construction, agriculture, chemicals, and retail are propelling the market for polywoven bags. Polywoven bags are popular in these industries because of their high tensile strength, tear resistance, and capacity to protect products from moisture and pollutants, making them excellent for carrying bulk items such as cereals, fertilizers, sand, and construction materials. In addition, the growth of the digital commerce and logistics industries is increasing the demand for dependable and strong packaging that can withstand the strains of shipping and handling.

The changing price of raw materials, notably polypropylene generated from petroleum, is impeding polywoven bags market demand. Crude oil price volatility can cause firms to incur unanticipated costs, affecting their earnings and pricing strategies. Furthermore, environmental worries about plastic contamination provide a substantial constraint. While polywoven bags tend to be more durable and recyclable than single-use plastics, their manufacturing and disposal can still harm the environment if not properly handled. The absence of adequate facilities for recycling in many areas exacerbates the problem, reducing polywoven bags' efficacy as an environmentally friendly alternative.

As global awareness of environmental concerns grows, there is a greater need for eco-friendly packaging options. Polywoven bags, which are both recyclable and recyclable, are ideally positioned to satisfy this need, especially with continuous developments in compostable and biodegradable polywoven materials, which increase their environmental appeal. Furthermore, the emergence of online shopping and e-commerce creates significant opportunity for polywoven bags market growth. Polywoven bags' strong and resilient nature makes them perfect for e-commerce shipping and transit needs, which require packaging that can endure handling and environmental stresses.

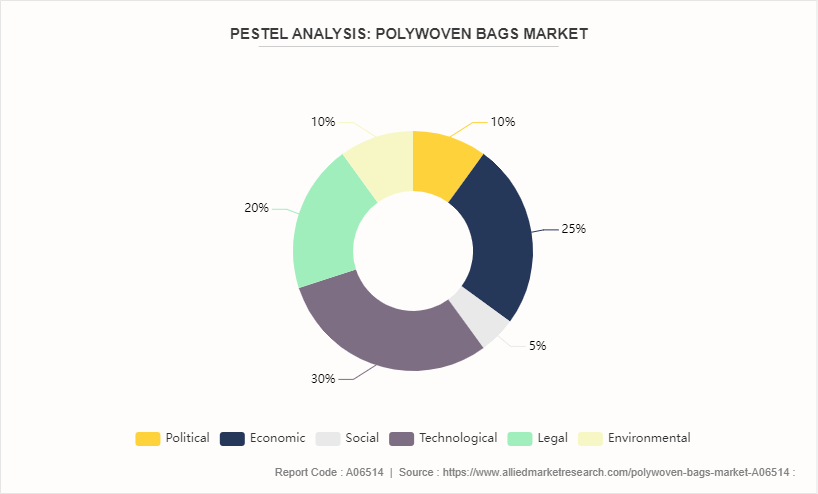

PESTLE Analysis of Global Polywoven Bags Market

Political:

Governments globally are increasingly regulating plastic usage and waste management. For instance, the European Union's ban on single-use plastics and the Indian government's initiatives to reduce plastic waste significantly impact the polywoven bags market

Economic:

Economic uncertainties in some regions, such as fluctuations in crude oil prices, affect the cost of polypropylene, the primary raw material, influencing pricing strategies and profit margins.

Social:

In Europe and North America, consumers and businesses increasingly prioritize eco-friendly and recyclable products, which benefits the polywoven bags industry.

Technological:

Innovations in biodegradable materials and smart packaging solutions, such as RFID tags for inventory management, enhance the industry's offerings, catering to diverse market needs.

Legal:

The U.S. Environmental Protection Agency (EPA) and the European Union's regulations on recycling and plastic usage compel manufacturers to adhere to stringent guidelines, promoting the development and use of sustainable materials and practices in the polywoven bags industry.

Environmental:

The industry's shift towards eco-friendly materials is partly due to global initiatives to reduce plastic waste and promote recycling. In countries such as Germany, stringent environmental regulations encourage the adoption of recyclable and reusable polywoven bags, aligning with broader efforts to mitigate environmental impacts.

Market Segmentation

The polywoven bags market is segmented into product type, end user, distribution channel, and region. On the basis of product type, the market is divided into valve bags, gusseted bags, block bottom bags, pinch bottom bags, and open mouth bags. As per end-user, the market is segregated into agriculture, food industry, construction, retail, and chemicals. On the basis of distribution channel, the market is bifurcated into B2B and B2C. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

China and India are the leading contributors to?market expansion in Asia-Pacific, owing to their thriving agricultural industries and rapid industrialization. China's powerful manufacturing infrastructure and India's massive agricultural base fuel significant demand for polywoven bags used to package grains, fertilizers, and industrial items. The Indian government's measures to increase agricultural output and strengthen supply chain infrastructure fuel this need. Vietnam and Indonesia are both experiencing expansion as a result of increased rice exports and other products that need long-term packaging solutions.

In Europe, rigorous environmental rules and a significant emphasis on sustainability are influencing industry trends. Countries such as Germany and France are seeing a transition towards environmentally friendly polywoven bags, aided by legislation that encourages recycling and minimizes plastic waste. The European Union's Circular Economy Action Plan is a major motivator, encouraging industries to embrace sustainable practices and develop biodegradable materials.

North America has consistent demand, with the U.S.?leading the market. The agriculture industry, particularly in areas such as California and Iowa, is driving expansion here. Polywoven bags are widely utilized for crop storage and transportation. Furthermore, the advent of e-commerce is increasing the demand for dependable packaging solutions throughout the country during the polywoven bags market forecast period.

In Africa, the market is developing, particularly in Nigeria and Kenya, where farming operations are critical to the economy. Polywoven bags are being adopted in these locations due to the necessity for efficient and cost-effective packaging alternatives for agricultural goods and building materials.

Competitive Landscape

The major players operating in the market for gaining polywoven bags market share include H Polesy & Co Pty Ltd, LC Packaging, Mondi Group, Anita Plastics Inc., Knack Packaging, AEP Industries Inc., Interplast Group, Hanoi Plastic Bag JSC, Da Nang Plastic Joint Stock Company, and Bischof & Klein GmbH & Co.

Other players in polywoven bags market include Inova Pvt. Ltd., Daman Polyfabs, Pratap Group, Sah Polymers Limited, and others.

Industry Trends:

Pratap Group invested in W&H's newest technology, Convertex CL-170, in May 2023, taking into account the company's manufacturing capacity and dedication to differentiated solutions for long-term sustainability.

Sah Polymers Limited, an Udaipur-based firm, launched?its initial public offering (IPO) on December 30, 2022. The company's primary operations are the production and sale of high-density polyethylene (HDPE) flexible intermediary bulk containers (FIBC) bags/polypropylene (PP) bags, woven sacks, woven polymer-based goods, and HDPE/PP woven textiles. The company provides customized bulk packaging choices to B2B producers in a variety of sectors, including textiles and others.

The European Union (EU) took action to combat plastic pollution by enacting rules. Single-use plastic will be forbidden from being sold in EU Member States' marketplaces beginning in July 2021. Furthermore, European countries are moving towards the implementation of broad plastic packaging fees.

Recent Key Strategies and Developments

In May 2023, Nova Chemicals, a polyethylene supplier, collaborated with biaxial film producers all over the world to create BOPE-HD (biaxially oriented high-density polyethylene) film on industrial tenter frame lines. BOPE-HD is a 100% recyclable alternative to typical, non-recyclable mixed materials films for lightweight packaging.

In July 2023, easy2cool developed and produced a paperfloc Eco-liner bag in collaboration with Mondi that uses trimmed recycled paper to provide insulation for chilled items. This collaboration was formed to replace excessive plastic insulating packaging used in e-commerce.

In June 2022, Mondi group's stand-up reaction pouch recyclable won the Swiss Packaging Awards, highlighting packaging innovation and originality.

In April 2022, LC Packaging and M B Nieuwenhuijse teamed with Plastic Bank to assist in turning the tide on ocean plastic, ensuring a sustainable future for future generations.

Key Sources Referred

Plastics Industry Association (PLASTICS)

American Chemistry Council (ACC)

European Plastics Converters (EuPC)

European Association of Plastics Recycling & Recovery Organizations (EPRO)

British Plastics Federation (BPF)

Indian Plastics Institute (IPI)

All India Plastics Manufacturers' Association (AIPMA)

China Plastics Processing Industry Association (CPPIA)

Japan Plastics Industry Federation (JPIF)

Australian Packaging Covenant Organization (APCO)

Canadian Plastics Industry Association (CPIA)

Association of Plastics Recyclers (APR)

World Packaging Organization (WPO)

International Organization for Standardization (ISO)

Society of Plastics Engineers (SPE)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the polywoven bags market segments, current trends, estimations, and dynamics of the polywoven bags market analysis from 2023 to 2033 to identify the prevailing polywoven bags market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the polywoven bags market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global polywoven bags market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global polywoven bags market trends, key players, market segments, application areas, and market growth strategies.

Polywoven Bags Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.1 Billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 235 |

| By Product Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | LC Packaging, Da Nang Plastic Joint Stock Company, AEP Industries Inc., Mondi Group, Hanoi Plastic Bag JSC, Anita Plastics Inc., Interplast Group, H Polesy & Co Pty Ltd, Knack Packaging, Bischof & Klein GmbH & Co |

The global polywoven bags market was valued at $5.0 billion in 2023, and is projected to reach $8.1 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The polywoven bags market registered a CAGR of 4.9% from 2024 to 2033.

The forecast period in the polywoven bags market report is from 2024 to 2033.

The top companies that hold the market share in the polywoven bags market include H Polesy & Co Pty Ltd, LC Packaging, Mondi Group, Anita Plastics Inc., Knack Packaging, AEP Industries Inc,and others.

The polywoven bags market report has 3 segments. The segments are fproduct type, end user, and distribution channel.

Loading Table Of Content...