POS Security Market Overview

The global pos security market was valued at $4 billion in 2021, and is projected to reach $10.3 billion by 2031, growing at a CAGR of 10.2% from 2022 to 2031. Growing digital and mobile payment adoption, especially among youth in developing nations, along with rising e-commerce fraud and regulatory compliance needs, are contributing to the growth of the market.

Market Dynamics & Insights

- The pos security industry in Asia-Pacific held a significant share of 36% in 2021.

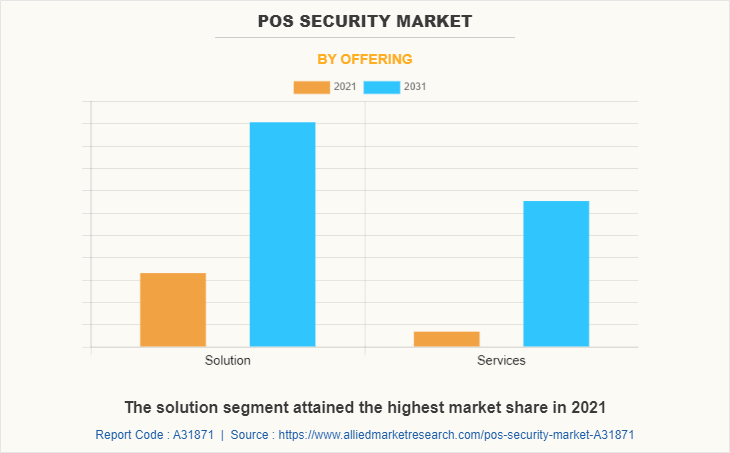

- By offering, the solution segment is one of the dominating segment in the market, accounting for the revenue share of 66% in 2021.

- By deployment mode, the on-premises segment dominated the industry in 2021 and accounted for the largest revenue share of 62%.

- By enterprise size, the large enterprise segment dominated the market, accounting for 63% in 2021.

Market Size & Future Outlook

- 2021 Market Size: $4 Billion

- 2031 Projected Market Size: $10.3 Billion

- CAGR (2022-2031): 10.2%

- Asia-Pacific: dominated the market in 2021

- LAMEA: Fastest growing market

What is Meant by POS Security

Point-of-sale security (POS security) creates safe environments for customers to make purchases and complete transactions. POS security measures are crucial to prevent unauthorized users from accessing electronic payment systems and reduce the risk of credit card information theft or fraud. POS hacks represent a major opportunity for cyber criminals. POS applications contain a huge amount of customer data, including credit card information and personally identifiable information (PII) that could be used to steal money or commit wider identity fraud. In addition, by hacking one application, malicious actors can potentially gain access to millions of credit or debit card details that they can either use fraudulently or sell to other hackers or third parties.

Hackers can also exploit retailers’ compromised POS applications, which can give them access to vast amounts of customer data, as well as additional applications and systems the retailer operates. Therefore, organizations must use point-of-sale systems security to protect their applications, prevent unauthorized access, defend against mobile malware, and prevent hackers from attacking their back-end systems.

The demand for PoS security is increasing as increased adoption of digital payment modes. Rise in demand for adoption of digital payment modes among the consumers and growing craze of mobile payment and online payment among the youth of developing nations is driving the growth of the market. In addition, compliance with regulations and rise in fraudulent activities in E-commerce are driving the growth of the market. However, PoS security deployment issues and lack of awareness among employees for the use of PoS systems have emerged as key industry problems. On the contrary, increasing use of payment applications across different industry verticals will further give major opportunity for the PoS security market growth.

The report focuses on growth prospects, restraints, and trends of the PoS security market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the PoS security market size.

POS Security Market Segment Review

The PoS security market is segmented on the basis of offering, deployment mode, enterprise size and industry vertical. By offering, it is segmented into solution and services. Based on deployment mode, it is bifurcated into on-premise and cloud. Based on enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. On the basis of industry vertical, it is segmented into retail, hospitality, entertainment, healthcare, transportation, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on offering, the solution segment attained the highest growth in 2021. This is attributed to the fact that PoS security solution is used by banks and fintech providers to deliver protection for several banking methods such as hosted PoS pages, pay-by-link, buy buttons, shopping carts, mobile wallets and billing, which drives the growth of the market in this segment. Furthermore, the services segment is forecasted to grow at a significant growth rate during the forecast period.

Based on region, Asia-Pacific attained the highest growth in 2021. This is attributed to Asia-Pacific PoS security market possesses high potential for growth and is analyzed to include mature markets of Japan and Australia, countries with growing population like China, and emerging markets including Hong Kong and South Korea. Moreover, APAC nations are investing more and more in retail PoS initiatives. These factors boost the adoption of PoS security market in this region.

The report analyzes the profiles of key players operating in the PoS security market such as AO Kaspersky Lab, CardConnect, Check Point Software Technologies Ltd., EPoS Now, Fortinet, Inc., Lightspeed, Morphisec Ltd., Sophos Ltd., Upserve, Inc. and Vend. These players have adopted various strategies to increase their market penetration and strengthen their position in the PoS security market share.

Market Landscape and Trends

Security is one of the biggest risks of POS system environments. Hackers are constantly on the lookout for holes in security and potential weaknesses that might allow them to launch attacks on POS applications. An attack typically begins with a hacker gaining access to a target system by exploiting a vulnerability or using social engineering techniques. They will then install POS malware that is specifically designed to steal card details from POS systems and terminals, which spreads through an organization’s POS system memory to scrape and collect data. The hacker then moves data to another location for aggregation before transferring it to an external location that they can access. Furthermore, organizations can defend against these attack vectors by deploying technology that prevents POS malware. This includes whitelisting specific technology to protect against unauthorized practices, using code signing to prevent tampering, and using chip readers so customers do not have to swipe their credit and debit cards and make it more difficult for attackers to replicate card data.

What are the Top Impacting Factors in POS Security Market

Compliance with Regulations

Organizations need to comply with the stipulations of data privacy and protection regulations to manage and protect PoS systems This includes the Payment Card Industry Data Secunty Standard (PCI DSS), which regulates security standards for any organization that handles credit cards PCI DSS is mandated by financial organizations and administered by the PCI Security Standards Council, which is responsible for increasing cardholder data controls to reduce credit card fraud.

Moreover, it is a comprehensive set of standards that requires merchants and service providers that store, process, or transmit customer payment card data to adhere to strict information security controls and processes. In addition, installing a firewall configuration to protect cardholder data, maintaining secure systems & applications and restricting physical access to payment information are some of the important requirements that boost the demand for PoS security software market across the globe. These are the major driving factors for the growth of the market.

Increased Adoption of Digital Payment Modes

Rise in demand for adoption of digital payment modes among the consumers and growing craze of mobile payment and online payment among the youth of developing nations is driving the growth of the market. In addition, COVID-19 pandemic has also brought a drastic change in the work culture in every banking industry, which drives the growth of the market.

Furthermore, features such as higher PoS security, better customer convenience, minimize the processing costs, less risk of theft, high transparency is increasing the usage of digital payments that boosts the demand for PoS security software among banks and financial institution. Moreover, mobile point of sale (mPoS), mobile wallet, contactless payments, and real-time payments are some of the important factors boosting the digitalization in the payment processing industry, which required PoS security software to protect customer’s information from the cyber-attack.

Rise in Fraudulent Activities in E-commerce

E-commerce refers to the online platform for providing products & services to the consumer directly from the business owners. A rapid increased in e-commerce has been witnessed over the past few years, owing to growth in penetration of smartphones, coupled with faster internet connectivity. Consumers are gradually opting for online purchase for a number of goods and services such as apparel & accessories, groceries, health & beauty, computer & electronics, and books, owing to ease of ordering and receiving it at one’s doorstep. This, as a result, promotes demand for PoS security software among e-commerce industry to streamline the fund acceptance service and securing the customers banking information, which drives the growth of the market across the globe.

PoS security Deployment Issues

Enterprises today use an assortment of different security tools. Organizations use multiple endpoint security products, firewalls, or other security solutions from different vendors. These products were installed gradually purchased using different budgets and are operated by different teams/ vendors PoS security's value proposition assumes that organizations replace these existing solutions with a suite of integrated but proprietary products Not all organizations are willing to rip and replace their existing solutions. This could act as a hindrance in the adoption of PoS security solutions.

Moreover, concerns regarding theft & security have created a lack of trust toward online payment processing among the individuals. In addition, availability of 3D secure authentication, address verification service, and incorporation of payment card industry (PCI) standard during the transaction are some of the major security issues in the minds of consumers, causing lack of trust about online payments among the public.

Lack of Awareness Among Employees for the use of PoS Systems

It is important to make sure that PoS systems are only in the hands of trusted employees that are approved to use them. It is not critical to train every employee on the use of PoS systems if they are not using it. It is essential to limit the use of PoS systems to only those who have permission and are trustworthy. There are more issues when using a mobile PoS device: If it is mobile, employees may make the mistake of taking the devices home. This could create issues related to the protection of sensitive data stored on the devices: Hence, security data is always at stake at such devices. It has become imperative for end user organization to invest in training employees to use the PoS security systems.

Increasing use of Payment Applications Across Different Industry Verticals

The acceleration of metropolitan cities across the globe have required different industry verticals to develop their online payment application, which is expected to provide lucrative opportunity for the PoS security software market during forecast period. Furthermore, every business is operating a digital platform, which resulted in increase in the online payment traffic. Thus, to handle the audience and have safe and secure transaction the demand for PoS security software increased, which provides lucrative opportunity to boost the growth of market during the upcoming years across the globe. Moreover, governments, regulatory bodies, and other authorities across several countries are expected to boost and expand the PoS security industry. Therefore, these factors will provide major lucrative opportunities in the growth of the PoS security market forecast.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the PoS security market analysis from 2021 to 2031 to identify the prevailing PoS security market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the PoS security market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global PoS security market trends, key players, market segments, application areas, and market growth strategies.

POS Security Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.3 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 241 |

| By Offering |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Epos Now, Vend, Lightspeed, CardConnect, Upserve, Inc., Fortinet, Inc., AO Kaspersky Lab, Sophos Ltd., Morphisec Ltd., Check Point Software Technologies Ltd. |

Analyst Review

POS security is the security for a point-of-sale (POS) payment system – that is, the system that businesses use to accept, process, and record payment transactions between the business and the customer. Moreover, point-of-sale describes the appliances and software that process transactions: everything from tap-and-go credit card readers to old-fashioned cash registers, as well as the POS software that operates behind the scenes. In addition, POS systems have predominantly moved online and to cloud systems, allowing customers to pay via no-contact solutions. This type of connectivity is helpful for the customer, but can give rise to new attack vectors.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on January 2022, Adyen, the global payments platform announced the launch of mobile Android point of sale (POS) terminals in the UK, and the U.S. The devices represent a fundamental change in the role of the payment terminal, functioning as an all-in-one solution, eliminating the need for separate cash registers, barcode scanners, and customer facing displays. Additionally, the terminals come with an app management system, allowing merchants to upload and manage the apps they use every day, for inventory management, loyalty programs, returns and more. The launch of these multi-purpose terminals will not only reduce the cost of their hardware, but also help businesses drastically improve in-person customer experiences.

Some of the key players profiled in the report include AO Kaspersky Lab, CardConnect, Check Point Software Technologies Ltd., EPoS Now, Fortinet, Inc., Lightspeed, Morphisec Ltd., Sophos Ltd., Upserve, Inc. and Vend. These players have adopted various strategies to increase their market penetration and strengthen their position in the PoS security market.

The global PoS security market was valued at $3,989.44 million in 2021, and is projected to reach $10,287.71 million by 2031, growing at a CAGR of 10.2% from 2022 to 2031.The global PoS security market was valued at $3,989.44 million in 2021, and is projected to hit $10,287.71 million by 2031, growing at a CAGR of 10.2% from 2022 to 2031.

The demand for PoS security is increasing as increased adoption of digital payment modes. Rise in demand for adoption of digital payment modes among the consumers and growing craze of mobile payment and online payment among the youth of developing nations is driving the growth of the market.

Asia-Pacific is the largest regional market for POS Security Market

AO Kaspersky Lab, CardConnect, Check Point Software Technologies Ltd., EPoS Now, Fortinet, Inc., Lightspeed, Morphisec Ltd., Sophos Ltd., Upserve, Inc. and Vend

Loading Table Of Content...