Poultry Diagnostics Market Research, 2033

The global poultry diagnostics market size was valued at $0.8 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 10.4% from 2024 to 2033. The poultry diagnostics market is driven by increase in demand for poultry products, rise in awareness of animal health, and need for disease prevention and control. Advances in diagnostic technologies enhance the accuracy and speed of disease detection, promoting early intervention. In addition, regulatory requirements for food safety and biosecurity measures further boost the market growth. The expansion of poultry farming practices and the growing emphasis on sustainable livestock management contribute to the overall demand for effective solutions in the poultry diagnostics industry.

Market Introduction and Definition

Poultry diagnostics involves the use of various techniques and tools to detect diseases in birds, ensuring their health and productivity. This field utilizes methods such as molecular diagnostics, serology, and microbiology to identify pathogens such as bacteria, viruses, and parasites. Accurate diagnostics are crucial for preventing outbreaks, optimizing flock management, and maintaining food safety. As poultry farming continues to grow, effective diagnostics play a vital role in enhancing animal welfare, improving production efficiency, and meeting regulatory standards in the poultry industry.

Key Takeaways

- The poultry diagnostics market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major poultry diagnostics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to poultry diagnostics market opportunity analysis key factors driving the growth of the market are increase in demand for poultry products, disease outbreaks, technological advancements, and rise in awareness of animal health. As the global population continues to grow, the need for high-quality protein sources increases, with poultry being a preferred choice due to its affordability, nutritional value, and versatility in various cuisines. According to the U.S. Department of Agriculture, in the U.S., the total poultry sector sales in 2022 were $76.9 billion, with increase of 67% from 2021. This rising consumption has heightened the focus on poultry health and productivity, leading to a greater emphasis on disease prevention and management. Effective diagnostics play a crucial role in ensuring flock health, as they enable early detection and control of infectious diseases that can impact production efficiency and food safety. Thus, rise in consumption of poultry is expected to drive the poultry diagnostics market growth.

Disease outbreaks have emerged as a significant driver for the poultry diagnostics market, primarily due to their profound impact on poultry health, productivity, and economic viability. Outbreaks, such as avian influenza and Newcastle disease, not only lead to substantial mortality rates among affected flocks but also prompt stringent biosecurity measures and trade restrictions. According to a 2024 article by the National Library of Medicine, Newcastle disease infected around 5.50 million chickens in African region from 2005–2022. These outbreaks necessitate rapid and accurate diagnostic solutions to identify pathogens and manage disease spread effectively. As poultry producers and veterinarians increasingly prioritize disease prevention and control, the demand for advanced diagnostic tools has surged, thus driving the poultry diagnostics market growth.

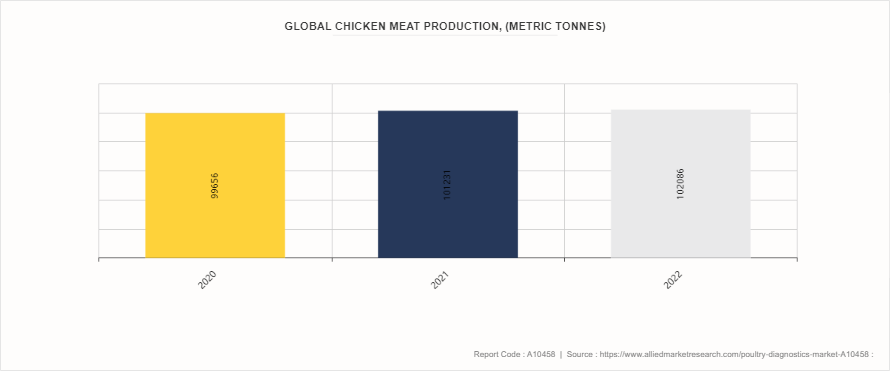

Global Chicken Meat Production

According to poultry diagnostics market forecast increase in global chicken meat production significantly impacts the poultry diagnostics market by driving demand for advanced diagnostic tools and technologies. As poultry farming scales up to meet the rising consumer demand for chicken meat, the need for effective disease management and biosecurity becomes critical. Higher production levels often correlate with intensified farming practices, which can lead to increased disease prevalence among poultry flocks. Consequently, poultry farmers are more inclined to invest in diagnostic solutions that allow for early detection and management of diseases, thereby safeguarding their livestock and ensuring food safety.

Moreover, the expansion of chicken meat production contributes to heightened awareness of poultry health, leading to an increased emphasis on disease prevention and control. This awareness fosters demand for diagnostic services, including molecular diagnostics, serology tests, and other laboratory services that enable quick and accurate disease identification. Thus, the growing chicken meat production is expected to drive the growth of poultry diagnostics market size

Market Segmentation

The poultry diagnostics market is segmented on the basis of product, technology, disease, end user, and region. By product, the market is classified into in instruments, consumables and kits. By technology, the market is divided into ELISA, PCR, immunofluorescent assay, hemagglutination assay, and others. By disease, the market is divided into avian salmonellosis, avian influenza, Newcastle disease, mycoplasma, infectious bursal disease, and others. By end user, the market is divided into veterinary hospitals & clinic, veterinary diagnostics laboratories, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the poultry diagnostics market share in 2023. The region boasts a well-established poultry industry characterized by advanced farming practices and high demand for poultry products. This has led to significant investments in veterinary diagnostics and health management solutions, ensuring the early detection and prevention of diseases. Additionally, regulatory standards in North America mandate regular health monitoring and testing of poultry, further driving the demand for diagnostic products.

In Asia-Pacific region, rapid market expansion is anticipated due to the rapid expansion of the poultry industry in countries like China, India, and Indonesia. Increasing consumer demand for poultry products, driven by population growth and rising disposable incomes, is prompting poultry producers to adopt modern farming techniques, including advanced diagnostics for disease management. Furthermore, the growing awareness of biosecurity measures and disease outbreaks in poultry farms is leading to an increased focus on diagnostic solutions.

- According to the Department Of Animal Husbandry, Government of Maharashtra, there is tremendous growth in poultry sector during last 3-4 decades.

- According to a 2022 article by the U.S. Department of Agriculture, broiler sales increased by 60%, turkey sales increased by 21%, and egg sales increased by 122%.

- According to a 2024 article by European Food Safety Authority, in 2021/2022, the highly pathogenic avian influenza epidemic was the largest observed so far in the Europe in terms of number of poultry outbreaks.

- According to a study published by the Infection, Genetics, and Evolution Journal in November 2022, different levels of avian influenza seroprevalence were reported in different backyards, commercial poultry, and wild birds in Bangladesh. The prevalence of household chicken across Bangladesh was 13.8%, 15.0% in layer poultry, and 12.5% in broiler chickens

Industry Trends

- According to a 2023 article by the U.S. Department of Agriculture, the U.S. poultry products hold leading positions in both international and the U.S. meat commodity markets.

- According to a 2024 article by National Library of Medicine, Coccidiosis is recognized as the parasitic disease with the highest economic impact on the poultry production industry. The financial impact of coccidiosis is considerable, estimated to be between $2.4 billion to $3 billion annually.

- According to a 2024 article by the World Organization for Animal Health (WOAH) , the total number of Newcastle disease outbreaks reported to the WOAH by these 26 countries from 2005 to 2022 was 15, 970, with 5, 503, 385 cases that led to 3, 475, 377 domestic chicken deaths during this period.

- In March 2023, Zoetis received a grant of $15.3 million from the Bill & Melinda Gates Foundation to improve livestock health and productivity of dairy, beef, poultry, and fish farmers in seven additional Sub-Saharan African nations.

Competitive Landscape

The poultry diagnostics market report summarizes top key players overview as IDEXX Laboratories, Inc., Zoetis Services LLC, Antech Diagnostics, Inc., Embark Veterinary, Inc., Agrolabo S.p.A., Thermo Fisher Scientific Inc., Innovative Diagnostics SAS, and FUJIFILM Corporation, Vimian, and Innovative Diagnostics. Other players in the poultry diagnostics market are MEGACOR Diagnostik GmbH, and Bionote Inc.

Recent Key Strategies and Developments

- In January 2024, Alveo Technologies, Inc. announced its collaboration with industry experts and poultry sector leaders to introduce an efficient, precise, in-situ multiplex panel designed to detect all relevant strains of avian influenza. The initial focus will be Group A, H5, H7, and H9. Alveo has formed partnerships with Pharmsure International Ltd., Royal GD, and x-OvO to aid in the co-development and distribution of the tests.

- In March 2024, Harch Tech Group, a company based in the Netherlands that specializes in poultry diagnostics, acquired NYtor, to improve the health of their male chicks by utilizing advanced PCR technology tests.

- In April 2023, GD analyzed and revealed a dynamic range of infectious bronchitis virus (IBV) lineages. The investigation provided a high resolution on several factors that are responsible for the infection caused in the chicken.

- In October 2022, IDvet offered ID Screen Influenza H5 indirect ELISA kit, the only diagnostic tool for monitoring and differentiating infected and vaccinated animals.

- In June 2022, IDEXX LABORATORIES, INC., in collaboration with Anand Animal Health Pvt. Ltd., conducted a seminar, “Effective Control of Poultry Diseases using IDEXX ELISA System”, in North India.

- In July 2022, BIONOTE collaborated with PSIvet, one of the largest veterinary buying cooperatives in the U.S. The collaboration aimed to make the availability of the Vcheck V200 analyzer and tests more affordable for PSIvet’s veterinary practitioners.

- In August 2021, INDICAL BIOSCIENCE GmbH acquired Check-Points, a Dutch R&D-focused company. The acquisition aimed to expand the company’s poultry diagnostics product portfolio and direct-to-producer offering

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the poultry diagnostics market analysis from 2024 to 2033 to identify the prevailing poultry diagnostics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the poultry diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global poultry diagnostics market trends, key players, market segments, application areas, and market growth strategies.

Poultry Diagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 Billion |

| Growth Rate | CAGR of 10.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By Technology |

|

| By Disease |

|

| By End User |

|

| By Region |

|

| Key Market Players | Thermo Fisher Scientific Inc., Antech Diagnostics, Inc, Agrolabo S.p.A, Fujifilm Corporation, Embark Veterinary, Inc., Vimian Group LLC, IDEXX Laboratories, Inc., Innovative Diagnostics, Zoetis Services LLC, Innovative Diagnostics SAS |

The global poultry diagnostics market was valued at $0.8 billion in 2023

The market value of poultry diagnostic market is projected to reach $2.1 billion by 2033

The forecast period for poultry diagnostic market is 2024-2033.

The base year is 2023 in poultry diagnostic market

Major key players that operate in the poultry diagnostic market are IDEXX Laboratories, Inc., Zoetis Services LLC, Antech Diagnostics, Inc., Embark Veterinary, Inc., and Thermo Fisher Scientific Inc

Loading Table Of Content...