Poultry Vitamin Market Research, 2032

The global Poultry Vitamin Market Size was valued at $1.4 billion in 2022, and is projected to reach $2.8 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032. Vitamins are organic substances that are indispensable to the normal metabolic processes of animal organisms. They are essential in maintaining performance and health. They play an important role when added to poultry feed as well as other livestock feed as it results in better productivity, higher feed conversion, and improved animal welfare. It boosts immunity and improves metabolic disorders and challenges, such as ascites-related mortality in chickens and for strengthening immunity aiding protein absorption. These benefits are augmenting the demand for vitamins feed additives, resulting in increased sales and eventually driving the global market.

For the growth and development of farm animals, increase in the demand for and consumption of livestock-based products such dairy and dairy-based products, meat, and eggs is anticipated to boost the use of feed additives. The FAO reports that by 2025, the world's meat production is expected to increase by 16%. Due to its great demand, low production costs, and low product pricing in both, developed and emerging nations, poultry meat is the main factor driving the expansion of global meat production.

According to statistics provided by the FAO, the output of chicken meat reached 120.5 million tons in 2017, compared to 118.7 million tons for swine, 70.8 million kilograms for cattle, and 14.9 million tons for ovine. There is a growing trend for animal-sourced protein in the form of meat, eggs, or milk because of the expanding understanding of the dynamics of food nutrients, particularly protein, on total physical and mental growth and development.

Due to the overuse or improper usage, antibiotic use decreased after the EU imposed its prohibition in several nations globally, particularly in China, India, and the U.S. Companies were obliged to discontinue using antibiotics in poultry vitamines because of restrictions on the use of antibiotics as a growth booster in feed in many countries. This poses a significant obstacle for producers of poultry vitamines based on antibiotics.

In 2017, the combined demand from emerging economies in the Asia-Pacific and Latin America regions represented 47% of global consumption. According to the FAO report, "World Agriculture: Towards 2015/2030," the population of developing nations in the Asia Pacific region, including India, China, Indonesia, Vietnam, and Thailand, is predicted to consume meat at a rate of 2.4% annually until 2030. To improve the meat weight and quality of the animals, the demand for premium feed concentrates and vitamines have boosted. To fulfil the rising demand for poultry vitamines, major players in the vitamin industry saw an opportunity to start vitamin production facilities in these areas. Similar to this, Brazil had the greatest population of cattle in South America in 2017 with a headcount of 330 million, and the FAO anticipates that it will continue to increase far faster than the average for the region. A high demand for poultry vitamin is anticipated due to increased consumer awareness of nutrient-dense foods and the need for meat products of export quality.

Segmental Overview

The poultry vitamin market is segmented into vitamin type, Product type, nature and region. Based on vitamin type, the market is segmented into retinol, calciferol, tocopherol, phylloquinone and others. Based on poultry type, the market is segmented into chicken, ducks, turkey, and others. Based on nature the market is segmented into organic and conventional. Region wise, the market is further segmented into North America, Europe, Asia-Pacific and LAMEA.

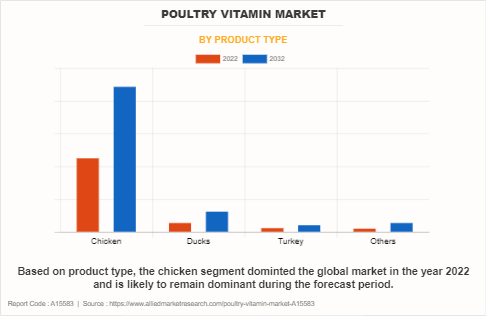

By Product Type

Based on product type the market is divided into Chicken, Ducks, Turkey, and Others. The chicken segment dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. The chicken poultry vitamin market is witnessing notable trends. Growing consumer awareness about the nutritional benefits of poultry products has fueled demand for specialized vitamins to enhance chicken health and productivity. With a rising focus on sustainable and organic farming practices, there's a surge in demand for natural and non-GMO vitamin supplements. Additionally, the global push towards reducing the use of antibiotics in poultry farming has led to an increased emphasis on vitamins as an alternative for maintaining bird health.

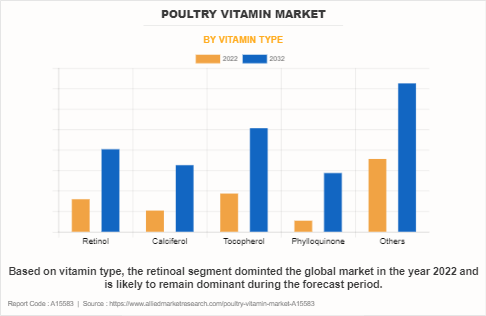

By Vitamin Type

Based on vitamin type, the market is classified into Retinol, Calciferol, Tocopherol, Phylloquinone and Others. The others segment dominated the global market in the year 2022 and is likely to remain dominant during the Poultry Vitamin Market Forecastperiod. Increased consumer awareness of the nutritional value of poultry products has fueled Poultry Vitamin Market Demand for specialized vitamin formulations. Companies are focusing on developing innovative vitamin supplements tailored to address specific health concerns in poultry, promoting overall well-being and disease resistance. Additionally, sustainable and organic alternatives are gaining traction, reflecting a growing preference for eco-friendly solutions in poultry farming. Moreover, advancements in research and development are driving the introduction of cutting-edge vitamin technologies to optimize poultry health, emphasizing the industry's commitment to continuous improvement and meeting evolving consumer expectations.

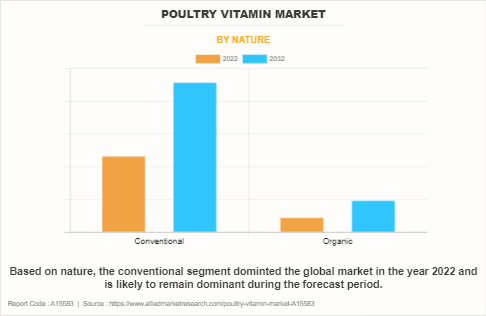

By Nature

Based on nature the market is classified into conventional and organic. The conventional segment dominated the global market in the year 2022 and is likely to remain dominant during the forecast period. Conventional poultry vitamin segment holds the maximumPoultry Vitamin Market Share due to the various benefits offered by convention farming to the farmers, such as ease, convenience, and safety of crops in farming. Conventional farming offers huge availability of raw material at low cost. Conventionally produced soybean, used for manufacturing poultry vitamin, ensures the good amount of yield to farmers and generates significant revenue for the farmers. Therefore, manufacturers get huge quantity of raw material for producing poultry vitamin at cheaper costs. These aforementioned factors are expected to propel the growth of the conventional poultry vitamin segment during the forecast period.

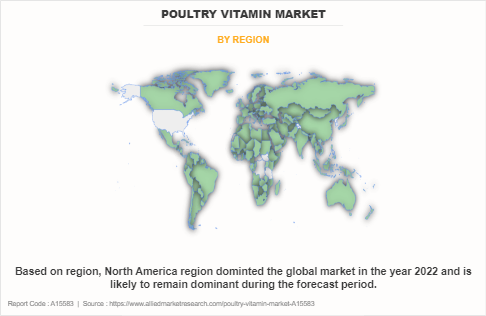

By Region

North America led in terms of market share in 2022 and is expected to retain its dominance during the forecast period. According to the International Health, Racquet & Sports Club Association (IHRSA), due to the growth of the U.S. health and fitness industry the consumption of animal protein is likely to increase and is expected to grow at a faster rate during the forecast period. This is attributed to rise in number of the U.S. consumers adopting a healthy lifestyle or indulging in activities that promote active and healthy lifestyle. Presently, about 20% of the U.S. adults have fitness club memberships, and the number is expected to increase in future. This is further expected to boost the demand for better poultry vitamin in the process.

The report focuses on the poultry vitamin market growth prospects, restraints, and opportunities of the global poultry vitamin market. The study provides Porter’s five forces analysis to understand the impact of various factors such as competitive intensity of competitors, bargaining power of suppliers, threat7 of substitutes, threat of new entrants, and bargaining power of buyers of the Poultry vitamin market.

Competition Analysis

Key Players included in the Poultry Vitamin Market Analysis are Bluestar Adisseo Company, BASF SE, Kemin Industries, Inc., Zinpro Corporation, SHV Holdings N.V., Koninklijke DSM N.V., Cargill, Incorporated, QualiTech, LLC, Anpario plc, and Balchem Corporation.

Recent Developments in Poultry Vitamin Market

Acquisition in Market

- June 2022, Koninklijke DSM N.V., acquire Prodap, which is a Brazilian animal nutrition and technology company in order to strengthen and further develop its busiess.

- June 2021, SHV Holdings N.V., announced to acquire Nutrimin, which is a leading producer of animal feed mixtures to expand its portfolio.

- July 2021, SHV Holdings N.V., acquired Bigsal, which is a Brazilian animal nutrition company in order to expand its presence in northern Brazil.

- September 2020, Bluestar Adisseo Company announced to acquire Framelco Group, which is a Dutch feed additive company to expand its offerings.

- June 2022, Koninklijke DSM N.V., acquire Prodap, which is a Brazilian animal nutrition and technology company in order to strengthen and further develop its busiess.

- June 2021, SHV Holdings N.V., announced to acquire Nutrimin, which is a leading producer of animal feed mixtures to expand its portfolio.

- July 2021, SHV Holdings N.V., acquired Bigsal, which is a Brazilian animal nutrition company in order to expand its presence in northern Brazil.

- September 2020, Bluestar Adisseo Company announced to acquire Framelco Group, which is a Dutch feed additive company to expand its offerings.

- June 2022, Koninklijke DSM N.V., acquire Prodap, which is a Brazilian animal nutrition and technology company in order to strengthen and further develop its busiess.

- June 2021, SHV Holdings N.V., announced to acquire Nutrimin, which is a leading producer of animal feed mixtures to expand its portfolio.

- July 2021, SHV Holdings N.V., acquired Bigsal, which is a Brazilian animal nutrition company in order to expand its presence in northern Brazil.

- September 2020, Bluestar Adisseo Company announced to acquire Framelco Group, which is a Dutch feed additive company to expand its offerings.

- June 2022, Koninklijke DSM N.V., acquire Prodap, which is a Brazilian animal nutrition and technology company in order to strengthen and further develop its busiess.

- June 2021, SHV Holdings N.V., announced to acquire Nutrimin, which is a leading producer of animal feed mixtures to expand its portfolio.

- July 2021, SHV Holdings N.V., acquired Bigsal, which is a Brazilian animal nutrition company in order to expand its presence in northern Brazil.

- September 2020, Bluestar Adisseo Company announced to acquire Framelco Group, which is a Dutch feed additive company to expand its offerings.

Expansion in Market

- July 2022, BASF SE announced to expand its world-scale vitamin A formulation capacities at its Verbund site in Ludwigshafen in order to strengthen its market position in vitamin A.

- October 2021, Koninklijke DSM N.V., opened its new analytical center of excellence in Tulln, lower Austria in order to conduct analyses of the nutritional content of animal feed, premixes and eggs.

- February 2023, Koninklijke DSM N.V., restarted its animal grade Vitamin A production in Sisseln, Switzerland in order to expand its business.

- May 2022, Kemin Industries, Inc., opened new offices and a distribution center in Mexico in order to enhance its Mexico and Central America operations.

- October 2023, Zinpro Corporation opened its new manufacturing facility in Marialva, Brazil in order to expand its operations.

- October 2021, Koninklijke DSM N.V., opened its new analytical center of excellence in Tulln, lower Austria in order to conduct analyses of the nutritional content of animal feed, premixes and eggs.

- February 2023, Koninklijke DSM N.V., restarted its animal grade Vitamin A production in Sisseln, Switzerland in order to expand its business.

- May 2022, Kemin Industries, Inc., opened new offices and a distribution center in Mexico in order to enhance its Mexico and Central America operations.

- October 2023, Zinpro Corporation opened its new manufacturing facility in Marialva, Brazil in order to expand its operations.

- October 2021, Koninklijke DSM N.V., opened its new analytical center of excellence in Tulln, lower Austria in order to conduct analyses of the nutritional content of animal feed, premixes and eggs.

- February 2023, Koninklijke DSM N.V., restarted its animal grade Vitamin A production in Sisseln, Switzerland in order to expand its business.

- May 2022, Kemin Industries, Inc., opened new offices and a distribution center in Mexico in order to enhance its Mexico and Central America operations.

- October 2023, Zinpro Corporation opened its new manufacturing facility in Marialva, Brazil in order to expand its operations.

Product Launch in Market

- October 2021, Cargill, Incorporated through its brand Nutrena, launched Naturewise poultry feed with essential oils and vitamin D3 for healthy flocks and maximized egg production.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the poultry vitamin market analysis from 2022 to 2032 to identify the prevailing poultry vitamin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the poultry vitamin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global poultry vitamin market trends, key players, market segments, application areas, and market growth strategies.

Poultry Vitamin Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.8 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Product Type |

|

| By Nature |

|

| By Vitamin Type |

|

| By Region |

|

| Key Market Players | Anpario plc, Zinpro Corporation, BASF SE, Bluestar Adisseo Company, QualiTech, LLC, SHV Holdings N.V., Balchem Corporation, Cargill, Incorporated, Kemin Industries, Inc. , Koninklijke DSM N.V. |

Analyst Review

The increasing adoption of sustainable and environment-friendly poultry farming among growers results in new and innovative product search. In addition, the increasing demand for organic products with visibility for nutritional content is expected to support the demand for poultry vitamin. Furthermore, increasing egg and meat consumption is contributing to the market growth.

As disposable income of the consumers increases, meat consumption tends to increase. High expenditure elasticity in poultry indicates its dominance in the diet, both in the developed and the developing countries. There is generally a positive relationship between per capita consumption of poultry products and per capita incomes. This positive relationship supports the general economic theory, which suggests that as incomes increase, particularly in developing countries, people are predicted to increase their consumption of high income-elastic food.

Technology change in the poultry industry, led by advances in breeding that improved poultry size, fecundity, growth rate, and uniformity, has enabled farmers to increase output per unit of feed, produce more birds per year, improve animal disease control, and decrease mortality. These factors enhance the market for poultry vitamin.

The global Poultry Vitamin Market Size was valued at $1.4 billion in 2022, and is projected to reach $2.8 billion by 2032

The global Poultry Vitamin market is projected to grow at a compound annual growth rate of 7.6% from 2023 to 2032 $2.8 billion by 2032

Key Players included in the Poultry Vitamin Market Analysis are Bluestar Adisseo Company, BASF SE, Kemin Industries, Inc., Zinpro Corporation, SHV Holdings N.V., Koninklijke DSM N.V., Cargill, Incorporated, QualiTech, LLC, Anpario plc, and Balchem Corporation.

North America led in terms of market share in 2022 and is expected to retain its dominance during the forecast period.

Increase in meat production and consumption, Standardization of meat products due to disease outbreaks

Loading Table Of Content...

Loading Research Methodology...