Power Cable Market Outlook – 2031

The global power cable market was valued at $148.6 billion in 2021 and is projected to reach $277.8 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031. According to Himanshu Jangra, Lead Analyst, Semiconductor and Electronics, at Allied Market Research, the power cable market is expected to showcase remarkable growth during the forecast period of 2022-2031. The report thoroughly examines the market size, power cable market trends, key market players, sales analysis, major driving factors, and key investment pockets. The report on the power cable industry provides an overview of the market as well as market definition and scope. The ongoing technological advancements and surge in demand for submarine power cables have an impact on market growth. Furthermore, the report provides a quantitative and qualitative analysis of the power cable market, as well as a breakdown of the pain points, value chain analysis, and key regulations.

A power cable is an electrical cable made up of one or more electrical conductors and is typically sheathed to keep it all together. The assembly is utilized for electrical power transfer. Power cables can be run overhead, buried in the ground, installed as permanent wiring inside buildings, or left exposed. NM-B (nonmetallic sheathed building cable) power cords are designed to be run within buildings and are bundled inside the thermoplastic sheathing.

The power cable industry is expanding as a result of the increasing trend toward the production of renewable energy globally. Power cord demand is also boosted by an increase in the construction of new power grid infrastructure. For instance, the low availability of power grid infrastructure to transfer electricity is causing several developing countries to experience a surge in demand for power cords; hence, governments in these countries are focusing on building safe power grid infrastructure.

In addition, the industry is witnessing growth due to the increased use of smart grids. The complexity of planning the deployment of power lines and the amount of time it takes for regulatory approvals are, however, expected to restrict market expansion during the forecast period. On the contrary, an upsurge in demand for power all over the world creates lucrative opportunities for the power cable market.

Segment Overview

The power cable industry is segmented into Distribution Type, Voltage Rating, and End Use.

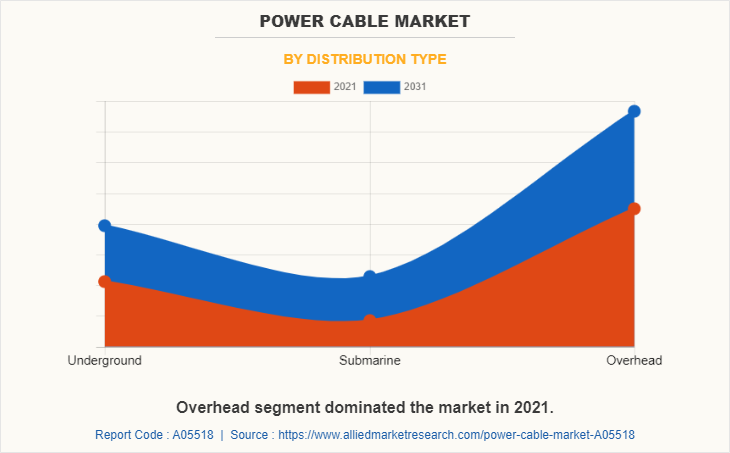

Based on distribution type, the power cable industry is divided into underground, submarine, and overhead. In 2021, the submarine segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

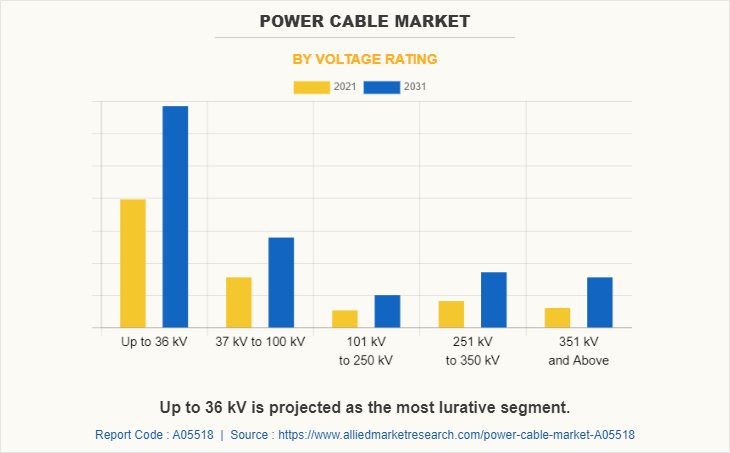

By voltage rating, the power cable market opportunity is segmented into Up to 36 kV, 37 kV to 100 kV, 101 kV to 250 kV, 251 kV to 350 kV, and 351 kV and above. The up to 36 kV segment dominated the market in 2021, in terms of revenue, and is expected to dominate the market during the forecast period.

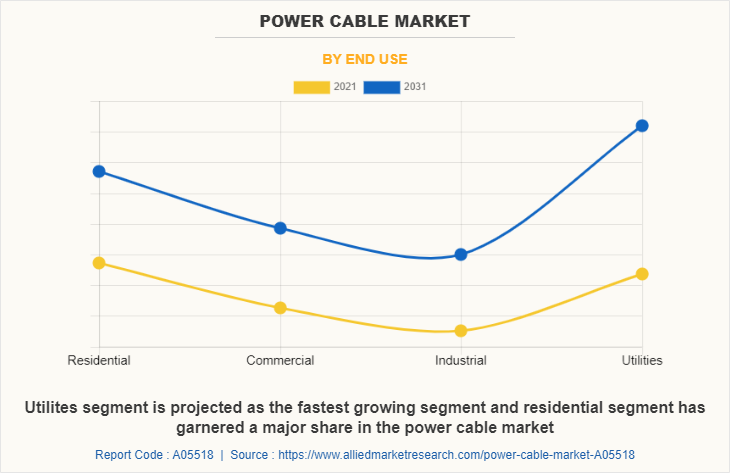

According to the end user, the power cable market forecast is segmented into residential, commercial, industrial, and utilities. The residential segment accounted for a major share of the power cable market in 2021.

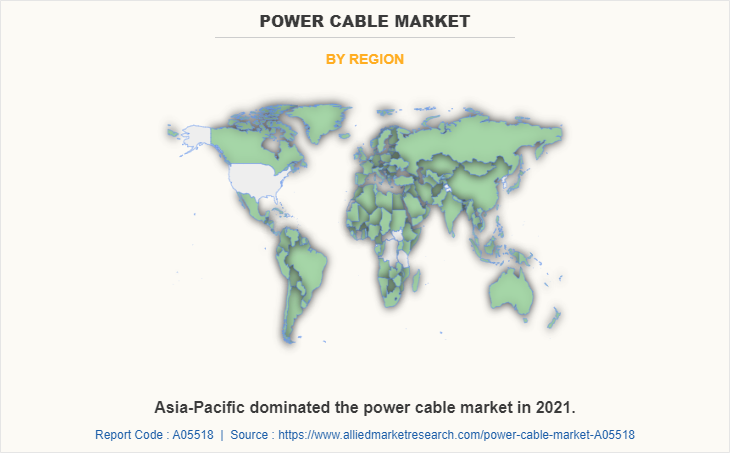

By region, the power cable market trends are analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is studied across into U.S., Mexico, and Canada, whereas Europe is into the UK, Spain, Germany, France, and the rest of Europe. The countries covered under Asia-Pacific are China, India, Japan, South Korea, and the rest of Asia-Pacific, while LAMEA includes Latin America, the Middle East, and Africa. In addition, the report covers the country-wise cross-sectional analysis of the technology and connectors segments.

Key Segment

By Distribution Type Analysis

By distribution type, the market is segmented into underground, submarine, and overhead power cables. The submarine segment is expected to dominate the power cable industry during the forecast period. Underground cables have reduced transmission losses and a lower likelihood of accidents, and they contribute to safety and pleasing aesthetics. Submarine cables are mostly utilized for high-power transmission between nations and states.

By Voltage Rating Analysis

By voltage rating, the power cable market share is segmented into up to 36 kV, 37 kV to 100 kV, 101 kV to 250 kV, 251 kV to 350 kV, and 351 kV and above. In recent years, the residential sector has expanded significantly because of rapid urbanization and population expansion. As a result, the sector's demand for power has increased, and new residential dwellings are now being built. In the upcoming years, sectors such as industrial, commercial, and others will also experience a significant increase due to the adoption of renewable energy, the building of new power plants, and the transition to smart grids. In addition, the development of offshore wind farms is expected to encourage the use of power cables with large power transmission capacities during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major market players that have been provided in the report include ABB Ltd., Belden Incorporated, Encore Wire Corporation, Finolex Cables, KEI Industries Limited, LAPP North America, Nexans, NKT A/S, Prysmian Group, and TPC Wire & Cable Corp. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

Country Analysis

Country-wise, the U.S. acquired a prime share in the North American power cable market size and is expected to grow at a significant CAGR during the forecast period of 2022-2031. The U.S. holds a dominant position in the North American power cable market, owing to the rise in the deployment of smart grid infrastructure to fulfill the electricity demand.

Country-wise, the UK acquired a major share in Europe's power cable market in 2021, owing to the presence of prime players paired with the availability of advanced manufacturing facilities to develop sustainable power cables.

Country-wise, in the Asia-Pacific region, China dominated the power cable market for power cables owing to the continuous availability of cheap raw materials used to manufacture power cables.

Top Impacting Factors

Significant factors that impact the growth of power cables include the rise in the trend of renewable energy generation drives the growth of the power cable industry. In addition, an increase in the deployment of new power grid infrastructure boosts the growth in demand for power cables. For instance, the surge in the number of developing countries is experiencing limited availability of power grid infrastructure to transfer electricity; hence, governments in such countries are concentrating on establishing safe power grid infrastructure.

Furthermore, the rise in the implementation of smart grids boosts the growth of the market. However, the complexity in deployment planning of power cables, along with the delays in authorization from the government, is projected to hamper the growth of the market during the forecast period. On the contrary, an upsurge in demand for power creates lucrative growth opportunities for the power cable market.

Historical Data & Information

The power cable market outlook is highly competitive, owing to the strong presence of existing vendors. Vendors of the power cable industry with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/Strategies

ABB Ltd., Brugg Cables, Nexans, NKT A/S, and Prysmian Group are the top five companies holding a prime share in the power cable market. Top market players have adopted various strategies, such as acquisition, contract, collaboration, expansion, partnership, product launch, product development, and others, to expand their foothold in the power cable industry.

In November 2019, Nexans acquired a two-year agreement from MHI Vestas for Windlink cable kits. The contract holds for onshore wind turbines and covers Vestas' installation around China, Europe, the U.S., and Brazil. The provided kits include medium voltage and low voltage cable kits from hubs close to Vestas' operation.

In January 2020, Nexans awarded a contract from SSE Renewables, a leading developer and operator of wind farms, to supply 800km of underground cables and 150 km of copper earth cables for the Viking Wind Farm in Scotland.

In October 2020, ABB and Tan Thang Cement collaborated to integrate ABB Ability solutions such as ABB Ability System 800xA DCS, ABB Ability Knowledge Manager, and ABB Ability Expert Optimizer at Tan Thang’s new cement plant in Nghe An province, Vietnam. These digital solutions enable a reliable electrical supply and optimize operational efficiency.

In June 2021, Prysmian Group, the world leader in the energy and telecom cable systems industry, announced the finalization of the contract with SOO Green HVDC Link for the supply and installation of high-voltage direct current cable systems. The 2,100-megawatt interregional project, which is regarded as the first piece of a national clean energy grid, will interconnect the two biggest energy markets in the U.S. and provide plentiful, inexpensive renewable energy to major population centers from Chicago to the mid-Atlantic region.

In November 2021, Prysmian Group, the world leader in the energy and telecom cable systems industry, was awarded a contract by Terna Rete Italia S.p.A. for the new submarine cable connection between the island of Elba and the Italian mainland (Piombino). An HVAC 132 kV three-core power cable with XLPE insulation and single-wire armoring is being designed, supplied, installed, and then put into service between the power plants in Piombino and Elba Island along a 34-kilometer undersea route and a 3-kilometer land route as part of this project.

In January 2022, a Limited Notice to Proceed (LNTP) was signed by Prysmian Group, the global market leader in energy and telecom cable systems, for the provision of power cables as part of a significant HVDC undersea cable project in the Middle East, estimated to cost $245.247 million. Four HVDC 320 kV single-core cables with XLPE insulation are being designed, supplied, assembled, and tested as part of the project to connect the Al Mirfa onshore converter station to Al Ghallan, an artificial offshore island in the Arabian Gulf off the coast of Abu Dhabi in the United Arab Emirates.

In July 2022, the Champlain Hudson Power Express 400 kV high-voltage direct current transmission line in the U.S. is now being designed, manufactured, and installed by NKT under a contract that was recently signed with its project partner, CHPE LLC. The contract is crucial for NKT because it allows it to use its vast expertise and experience in DC technology to support the transition to renewable energy in North America and expand its market position

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power cable market from 2021 to 2031 to identify the prevailing power cable market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights buyers' and suppliers' potency to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the power cable market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of regional and global power cable market trends, key players, market segments, application areas, and market growth strategies.

Power Cable Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 277.8 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 270 |

| By Distribution Type |

|

| By Voltage Rating |

|

| By End Use |

|

| By Region |

|

| Key Market Players | LAPP North America, TPC Wire & Cable Corp, Polycab India Ltd, Prysmian Group (General Cable), Belden Incorporated, FINOLEX CABLES LIMITED, KEI Industries Ltd., NKT A/S, Encore Wire Corporation, Brugg Cables, Nexans S.A., ABB Ltd, Riyadh Cables Group Company |

Analyst Review

The power cable market is projected to depict prominent growth during the forecast period, owing to various factors, such as a rise in the trend of renewable energy generation and an increase in the deployment of new power grid infrastructure. Moreover, the surge in the implementation of smart grids boosts the growth of the market during the forecast period. However, the complexity in deployment planning of power cables along with the delays in authorization from governments is projected to hamper the growth of the market during the forecast period. On the contrary, an upsurge in demand for power all over the world creates lucrative growth opportunities for market growth.

Vendors operating in the market are offering advanced power cables due to the competition. Also, the rise in investment trends among the various countries for the development and transmission of green energy fuels the growth of the market. For instance, in June 2021, Prysmian Group, the world leader in the energy and telecom cable systems industry, announced the finalization of the contract with SOO Green HVDC Link for the supply and installation of high-voltage direct current cable systems. The 2,100-megawatt interregional project, which is regarded as the first piece of a national clean energy grid, will interconnect the two biggest energy markets in the U.S. and provide plentiful, inexpensive renewable energy to major population centers from Chicago to the mid-Atlantic region.

Various leading manufacturers such as ABB Ltd., Belden Incorporated, Encore Wire Corporation, Finolex Cables, KEI Industries Limited, LAPP North America, Nexans, NKT A/S, Prysmian Group and TPC Wire & Cable Corp occupy a prominent revenue share in the power cable market.

Asia-Pacific is the largest regional market for Power Cables.

The residential segment is leading the power cable market in 2021.

The power cable market was valued at $148.58 billion in 2021, and is projected to reach $277.80 billion by 2031, registering a CAGR of 6.4% from 2022 to 2031

An increase in the deployment of new power grid infrastructure boosts the growth in demand for power cables and is expected to drive market growth.

BB Ltd, Brugg Cables, Nexans, NKT A/S, and Prysmian Group are the top five companies holding a prime share in the Power cable market

Loading Table Of Content...