Power Generation Equipment Market Research, 2032

The global power generation equipment market size was valued at $110.4 billion in 2022, and is projected to reach $173.1 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

Report Key Highlighters:

The global power generation equipment market has been analyzed in terms of value ($Million). The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

The global power generation equipment market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

The power generation equipment market is fragmented in nature with few players such as ABB, Bharat Heavy Electricals Limited (BHEL), Caterpillar, Cummins Inc., General Electric, MITSUBISHI HEAVY INDUSTRIES, LTD., Schneider Electric, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, and Wärtsilä.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the power generation equipment industry.

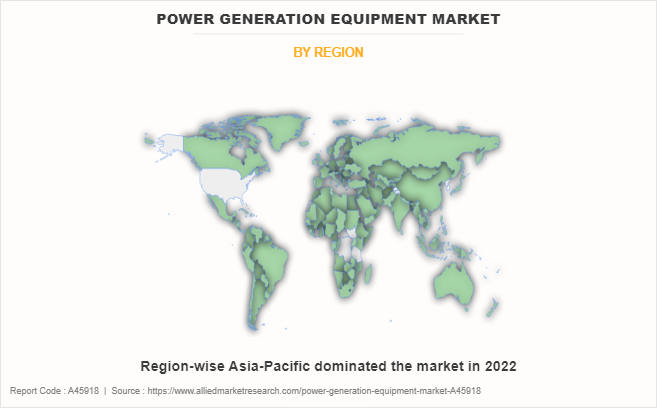

Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global power generation equipment market.

Power generation equipment refers to machinery and devices designed to convert various forms of energy into electrical power. These equipment are essential components of power plants and facilities responsible for generating electricity for residential, commercial, industrial, and other applications. The primary goal of power generation equipment is to harness energy from diverse sources such as fossil fuels, renewable resources, or nuclear reactions, and convert it into a usable and distributable form of electrical power for consumption. Power generation equipment includes generators, turbines, engines, and associated systems that play a crucial role in meeting the demand for electricity in different sectors of society.

Rise in adaptation for decentralized power system has driven the demand for power generation equipment. Decentralized systems offer a more resilient energy infrastructure by distributing power generation across multiple points, reducing vulnerabilities to single points of failure. This is important in regions that are prone to natural disasters or facing challenges in maintaining stable centralized grids. In addition, there is a notable shift in the energy landscape due to increase in emphasis on decentralized or distributed power generation systems. This trend is fueled by various factors such as increase in adoption of renewable energy sources, advancements in technology, and a desire for more resilient and sustainable energy infrastructure. All these factors drive the demand for power generation equipment market during the forecast period.

However, power generation equipment that depends on traditional fossil fuels faces regulatory pressure to adopt cleaner technologies such as renewable energy sources, which are more capital-intensive and require substantial infrastructure changes. This transition poses a financial challenge for companies in the power generation sector and slows down the market growth. In addition, global regulatory frameworks are more complex and demanding. Governments are implementing strict emission standards and environmental regulations to ensure that power generation activities align with sustainability goals. Compliance with these regulations involves significant investments in technology upgrades, emissions control systems, and adherence to stringent operational guidelines. All these factors hamper the power generation equipment market growth.

The electrification of transportation, especially the adoption of electric vehicles (EVs), creates additional opportunities for power generation equipment. The increased demand for charging infrastructure and the need for robust power grids to support the fleet of electric vehicles contribute to the overall expansion of the power generation equipment market. In addition, electrification initiatives include a wide range of projects, from rural electrification to the establishment of smart grids in urban areas. As a result, the demand for diverse power generation equipment such as generators, transformers, and distribution infrastructure are witnessing a substantial growth. All these factors are anticipated to offer new growth opportunities in the power generation equipment market forecast.

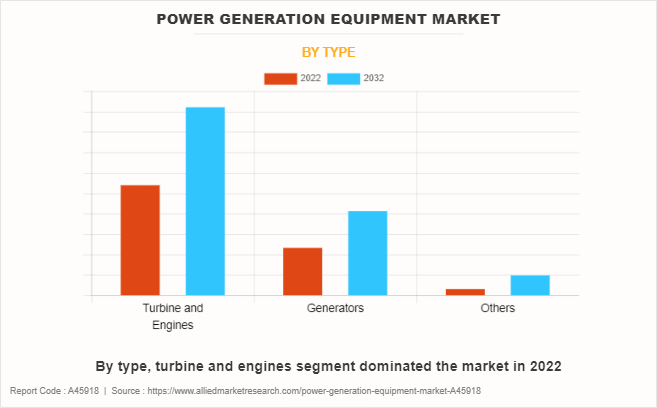

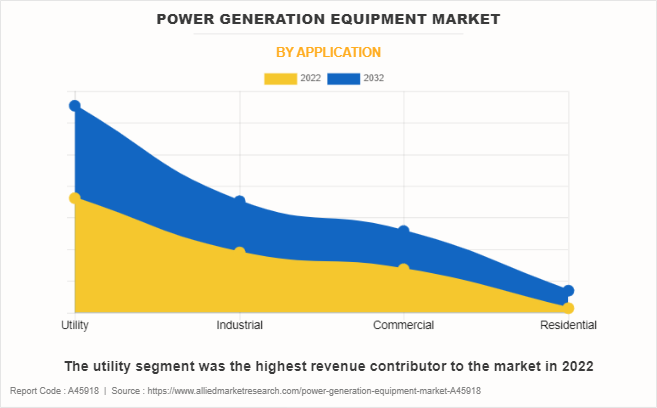

The power generation equipment market is segmented on the basis of type, application, and region. On the basis of type, the market is divided into turbine and engines, generators, and others. On the basis of application, the market is segmented into utility, industrial, commercial, and residential. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Turbine and engines segment accounted for less than three-fifths of global power generation equipment market share in 2022 and is expected to maintain its dominance during the forecast period. The decentralization and digitization of power generation infrastructure drives the adoption of turbines and engines in distributed energy systems. Distributed generation such as combined heat and power (CHP) plants, microgrids, and cogeneration facilities, relies on turbines and engines for onsite power generation, heating, and cooling. These distributed energy systems offer benefits such as increased energy efficiency, grid resilience, and energy independence which drives the demand for turbines and engines in various industrial, commercial, and residential applications.

The utility segment accounted for more than two-fifths of global power generation equipment market share in 2022 and is expected to maintain its dominance during the forecast period. The transition towards cleaner and more sustainable energy sources drives the investments in utility-scale power generation equipment. Governments and global utilities are adopting renewable energy sources such as solar, wind, hydroelectric, and biomass to reduce carbon emissions and mitigate climate change. This shift towards renewable energy necessitates the deployment of utility-scale power generation equipment tailored for these sources such as solar panels, wind turbines, hydroelectric dams, and biomass power plants.

Asia-Pacific accounted for less than half of the global power generation equipment market share in 2022 and is expected to maintain its dominance during the forecast period. Technological advancements and innovations in power generation equipment play a pivotal role in market expansion. The Asia-Pacific region is witnessing rapid advancements in power generation technologies, including advanced gas turbines, combined cycle power plants, ultra-supercritical coal-fired power plants, and energy storage systems. These innovations are aimed at enhancing energy efficiency, reducing emissions, and ensuring grid stability, thereby catering to the evolving energy landscape of the region.

Key players in the power generation equipment market include ABB, Bharat Heavy Electricals Limited (BHEL), Caterpillar, Cummins Inc., General Electric, MITSUBISHI HEAVY INDUSTRIES, LTD., Schneider Electric, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, and Wärtsilä.

Apart from these major players, there are other key players in the power generation equipment market. These include Alstom, Andritz AG, Babcock & Wilcox Enterprises, Doosan Heavy Industries & Construction, Emerson Electric Co., Harbin Electric Company Limited, Honeywell International Inc., Kawasaki Heavy Industries, MAN Energy Solutions, Rolls-Royce Holdings plc, Shanghai Electric Group Company, Sumitomo Heavy Industries, and Voith Group.

Historical trends of power generation equipment:

- In the late 19th and early 20th centuries, the industrial production of power generation equipment gained momentum. Companies such as General Electric and Siemens pioneered manufacturing processes, introducing innovations in steam turbines and generators. These early developments marked the foundation of the power generation industry, providing reliable sources of electricity for various applications.

- The mid-20th century witnessed significant advancements in power generation equipment technology. Gas turbines and hydroelectric generators became more widespread, contributing to the diversification of power sources. This era marked the expansion of electricity generation for residential, commercial, and industrial use, fostering economic growth and technological progress.

- In the late 20th century, there was a notable shift towards cleaner and more efficient power generation technologies. The development of nuclear power plants and advancements in gas turbine efficiency became prominent. Environmental concerns led to increased emphasis on renewable energy sources, such as wind and solar power that influence the design and implementation of power generation equipment.

- In the 2010s, power generation equipment technology continued to evolve with a focus on digitalization and smart grid solutions. Integration of advanced control systems, predictive maintenance, and renewable energy integration became key trends. The market witnessed innovations in energy storage technologies and grid resilience, reflecting the industry’s commitment to sustainability and reliability.

- The early 2020s marked ongoing innovation in power generation equipment. Manufacturers explored advanced materials, such as advanced alloys and composites, for increased efficiency and durability. Smart grid technologies, decentralized energy systems, and the development of small modular reactors gained attention, reflecting the industry pursuit of resilient, sustainable, and adaptable power generation solutions.

Key potential factors that drive the power generation equipment market demand:

In the global power generation equipment market, increasing number of companies have adopted expansion and product launch to expand the market or develop new products. For instance, in May 2022 General Electric secured first 9HA combined cycle power plant equipment order in Vietnam, to be powered using liquefied natural gas (LNG). This new 9HA.02 combined cycle power plant is expected to improve the reliability and stability of the energy grid to support renewables penetration.

In December 2022, Schneider Electric launched a clean, secure energy portfolio. This enables energy transition and a net-zero future via sustainability, flexibility, reliability, resilience, and efficiency. Also, in June 2021, Siemens Energy built a remote-controlled gas fired power plant to secure Germany power supply. This new gas-fired power plant serves as special grid-related equipment and a modern service center enables purely digital remote operation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power generation equipment market analysis from 2022 to 2032 to identify the prevailing power generation equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power generation equipment market overview and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power generation equipment market trends, key players, market segments, application areas, and market growth strategies.

Power Generation Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 173.1 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ABB, Mitsubishi Heavy Industries, Ltd., Wartsila, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, Schneider Electric, Bharat Heavy Electricals Limited, Caterpillar, Cummins Inc., General Electric |

Analyst Review

According to the opinions of various CXOs of leading companies, the power generation equipment market is expected to grow during the forecast period. Surge in demand for decentralized power generation and rise in industrialization and urbanization have increased the demand for power generation equipment. The expansion of industries related to metal fabrication, manufacturing, and aerospace, coupled with the continuous growth in the automotive sector has heightened the need for diverse power generation equipment. These developments drive the market for generators, turbines, and associated components to meet the demand for electricity.

The market growth is driven by increase in demand for power generation equipment across various industrial sectors such as automotive, manufacturing, construction, and aerospace, where these equipment are crucial for powering operations and supporting economic development. In addition, technological advancements in power generation equipment such as enhanced efficiency, increased capacity, and integration of renewable energy sources, are contributing to the market expansion. Moreover, the demand for high-precision and sustainable power generation, especially in industries such as aerospace and electronics, is identified as a pivotal factor propelling the growth of the power generation equipment market.

The global power generation equipment market was valued at $110.4 billion in 2022, and is projected to reach $173.1 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

Utility is the leading application of Power Generation Equipment Market.

Integration of energy storage solutions integration are the upcoming trends of Power Generation Equipment Market in the world.

Surge in demand for decentralized power generation, and rise in industrialization and urbanization are the leading drivers for the Power Generation Equipment Market

Asia-Pacific is the largest regional market for Power Generation Equipment

Asia-Pacific is the fastest growing region for the Power Generation Equipment Market

Key players in the power generation equipment market include ABB, Bharat Heavy Electricals Limited (BHEL), Caterpillar, Cummins Inc., General Electric, MITSUBISHI HEAVY INDUSTRIES, LTD., Schneider Electric, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, and Wärtsilä.

Loading Table Of Content...

Loading Research Methodology...