Power Purchase Agreement Market Research, 2031

The global power purchase agreement market was valued at $11.6 billion in 2021, and is projected to reach $18.4 billion by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

Power purchase agreement (PPA) often refers to a long-term electricity supply agreement between two parties. The agreement is usually between a power producer and a customer (an electricity consumer or trader). The agreement defines the conditions which include the amount of electricity to be supplied, negotiated prices, accounting of energy, and penalties for non-compliance. Power purchase agreements are highly complex in nature. The terms and conditions in the agreement have been defined in a simple language for mutual understanding of all the parties involved. This is mainly done to prevent confusion or any kind of arrangement-related complications. Certain elements are common across all PPAs such as different considerations would apply for mid-range or peaking thermal plants or plants using different generation technology (e.g. wind or solar) for power production. The agreement can be easily tailored to the specific application which increases power purchase agreement market share in the energy industry..

Electricity is an essential element for the socio-economic development of a country. Electricity is crucial for every end user, be it a residential, corportate, a school, industry, or a hospital. All of them having different energy needs. Power purchase agreements can be seen to bridge the gap between the demand for electricity and availability of electricity. The goal of the agreement is to shield consumers from market price increases, ensure a steady supply of energy, and ultimately lower the investment costs involved in operating or planning.

PPA is between the public and private sector parties which underpin a power sector public-private partnerships (PPP). The agreement is typically between a public sector purchaser "offtaker" (often a state-owned electricity utility, in jurisdictions where the power sector is largely state operated) and a privately-owned power producer. A PPA allows the customer to receive stable and often low-cost electricity with no upfront cost, while also enabling the owner of the system to take advantage of tax credits and receive income from the sale of electricity. Power purchase agreements usually last between 10 and 25 years.

The customer enters into a PPA with a third-party developer to buy electricity produced by solar panels, wind turbines, combined heat and power (CHP) machinery, or other energy producing methods on the roof of a facility or in the nearby area. The developer typically provides initial project coordination services such as bridge financing, design, and permitting with little-to-no cost to the customer. The electric output generated by the energy system is then purchased by the customer at a rate which is generally lower than the utility’s retail rate which resulting in generating immediate cost savings. The utility serving the customer provides an interconnection from the energy system to the power grid, and will continue service if the PPA does not produce enough power to meet the customer’s electrical needs. When the PPA produces excess power, energy can be sold to the utility, typically at the retail electricity rate.

PPAs are a beneficial type of contract which aids in financing or acts as a stabilizing element in the delivery of long-term power. PPAs can be used to reduce market price risks, which is the main factor for power purchase agreement market growth. The power purchase agreements are frequently implemented by large electricity consumers as agreement helps to reduce investment costs associated with planning or operating renewable energy plants. The tracking of production and consumption of power purchase agreement is very important which can be done through the energy procurement systems.

Corporates are indulged in efficiently offsetting and diversifying their own electricity consumption which is accelerating power purchase agreement market trend. Corporates are always searching for profits and power purchase agreement is financial driver. Corporate consider entering into a power purchase agreement to mitigate potential business risks arising out of energy needs and may even help reduce the financial burden by saving on energy bills. For large corporates, managing of energy can prove to be very tedious either due to a lack of expertise or limited resources. In such a scenario, corporate can opt to enter into a power purchase agreement as PPA is next best alternative to investing and managing energy.

As per the global power purchase agreement market analysis, increase in global warming and changes in climatic conditions are projected to lead to faster adoption of PPA in corporate segment in the coming years. The awareness related to the clean energy is increasing in the developing nations which boosts the demand for power purchase agreement during the forecast period. The consumption rate of clean energy is accelerating in developing nations which is contributing toward the increase in power purchase agreement market share. Globally, there is an increase in the adoption rate of power purchase agreement due to various factors such as surge in demand for electricity or power, depletion of fossil fuel resources, and surge in environmental pollution. PPA helps to overcome the concerns which are related to pollution reduction, sustainability, and renewability of resources which is projected to showcase positive impact on power purchase agreement market size in near future.

Power purchase agreement market opportunity will soon arise in emerging countries due to the growth in the number of renewable onsite and offsite power plants. In PPA, all the expenses related to the installation or maintenance of the solar system are owned by the solar company. Consumers pay for the electricity produced by the system directly. The price of electricity which is purchased through PPA will increase at a predetermined rate, usually 2-5% per year, which is generally lower than the rate of increase of your utility. PPA will cost less than the electricity which is purchase from utility.

The energy consumption of corporates is increasing on daily basis around the word. The power purchase agreement comes with the several advantages for the corporates. Investment in power infrastructure is a part corporate strategy for development and growth. Companies are searching for a dependable way to manage energy costs. As per the power purchase agreement market forecast, corporations will sign agreements for renewable and clean energy throughout the anticipated period. Large businesses are now significant producers and consumers of renewable power. Compared to other regions, the consumption of renewable energy in North America stands out. Factors like reliance of corporate on renewable electricity sources and the cost advantage to corporations contribute to power purchase market growth.

The solar segment offers a growth opportunity for power purchase agreement. Solar power PPA holds several benefits which is convincing corporates to shift to clean energy. Establishment of solar power under PPA provides several benefits such as lower prices of materials and installation costs, savings potential, better technology, and reduced pressures on the environment. The small companies in developing nations are not able to afford the cost of commercial solar panels, so can enter in the power purchase agreement for the clean energy consumption. Power purchase agreements are more inclination towards solar segment due the more financial benefits.

Although power purchase agreement is beneficial as agreement provide more opportunities for corporate and merchants to switch to clean energy sources, however there can be some unfavorable aspects as well. In offsite PPA, the third-party owner owns the system thus, third party gets more benefits as compared to owner. The another restrain for market as PPA do not have access to an independent regulator, which raises questions about how to reconcile the needs of public consumers with the interests of private investors. Private investors predict prices and make deals at inflated prices to make more profits, but consumers prefer affordable electricity. The substitute for PPA is also present in the market which is solar lease agreement as the agreement are almost similar in nature.

The need for power purchase agreement has increased due to a boom in the global energy sector. A surge in the investigation of new renewable energy sources has grown over the past five years, aside from the pandemic period. The report further outlines the details about the revenue generated through the sale of power purchase agreement across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the power purchase agreement market include Schneider Electric, RWE, ENGIE, Statkraft AG Group, Enel Spa, Siemens, Ameresco, General Electric, Shell, Renewable Energy Systems Ltd. and Ecohz.

The power purchase agreement market is segmented on the basis of type, application, end use and region.

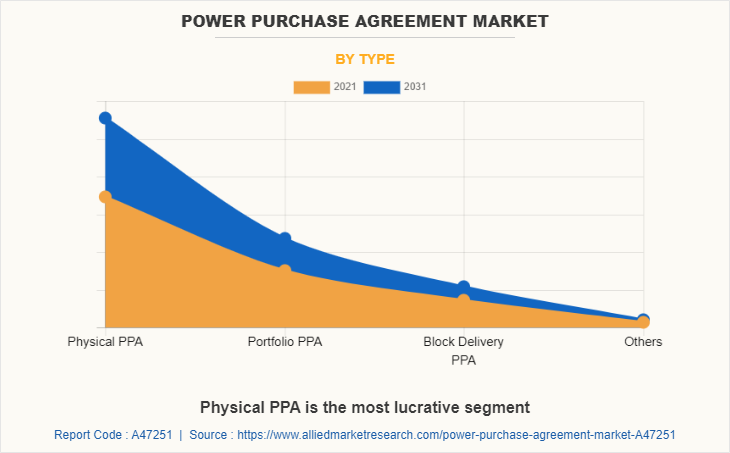

Based on type, the market is classified into physical PPA, portfolio PPA, block delivery PPA and others. The physical PPA segment is further classified on the basis of location into off-site PPA and on-site PPA. The off-site segment is further segmented into sleeved and synthetic. In 2021, the physical PPA dominated the market as in line with the agreement power is directly delivers to the customer at PPA price. Physical PPA bring the advantage of potential electricity cost savings with no up-frost capital costs and long-term electricity cost stability and predictability.

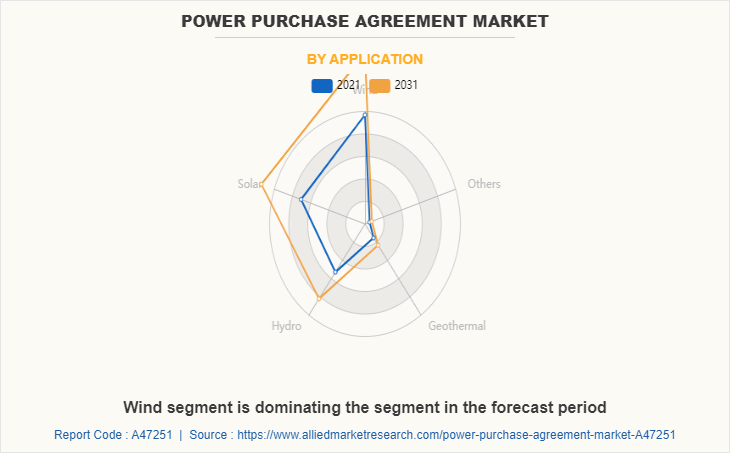

Based on application, the market is classified into wind, solar, hydro, geothermal and others. The wind sector dominated the market in 2021 as globally the production of the power through wind source is maximum. However, the solar segment holds the highest CAGR during the forecast period, as solar comes with the cost advantages and new technology for the storage of power and transmission.

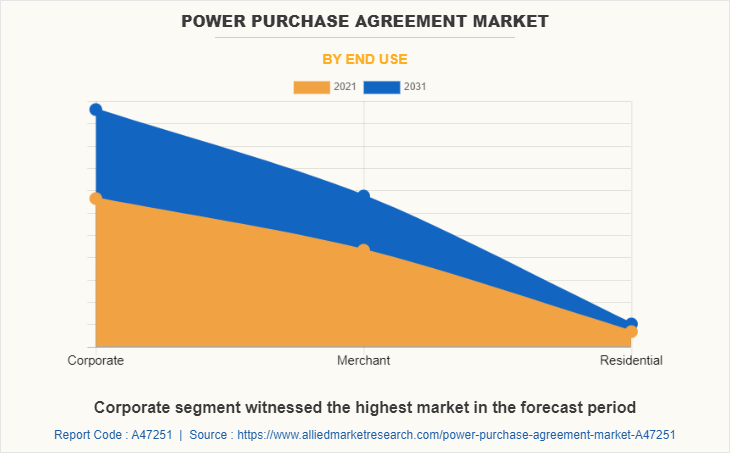

Based on end use, the market is classified into corporate, merchant and residential. The corporate sector dominated the market in 2021 due to consumption of the power is increasing and to lower the expenditure on power companies are entering into PPA. Government is also providing the cost and tax benefits for corporate to enter in PPA.

By region, the market is studied across North America, Europe, Asia-Pacific and LAMEA. In 2021, Europe dominated the market owing to increased production of power through renewable sources. In Spain and Sweden, the large companies have already entered into the PPA and several power producers are into the expansion of the power production plant. North America holds the highest CAGR of 5.3% in the forecasted period. U.S. also started power purchase agreement policy which has made the country an interesting prospect regarding power purchase agreement projects

The booming world economy has caused exponential population growth and high energy demand which is becoming very difficult to satisfy. Some of the non-renewable sources are depleting which are used for the production of power. The commercial sector is shifting towards the renewable energy sources for power production on higher rate. Several companies are investing the doing the business expansion and agreement which boosting the power purchase agreement market.

Key Strategies

- In November 2022, RWE has decided to accelerate expansion of its green portfolio and enhances security of supply during energy crisis. In 2022, Green portfolio expanded by 1.3 gigawatts and further 9.4 gigawatts in growth through buildouts and acquisitions

- In August 2022, Siemens Gamesa has signed a new agreement with ACEN CORPORATION to Develop 70 MW Wind Farm in Philippines. The development will help the company to fulfil the increasing demand of the renewable energy in the country

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power purchase agreement market analysis from 2021 to 2031 to identify the prevailing power purchase agreement market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power purchase agreement market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power purchase agreement market trends, key players, market segments, application areas, and market growth strategies.

Power Purchase Agreement Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.4 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 447 |

| By Application |

|

| By End Use |

|

| By Type |

|

| By Region |

|

| Key Market Players | statkraft, RWE AG, RES Group, Ameresco Inc., Schneider Electric, Shell Plc., Engie, Siemens AG, General Electric, Enel S.p.A., ecohz |

Analyst Review

The CXOs of major corporations claim that the spread of COVID-19 caused a considerable and quick reduction in global economic activity. Pandemic had a detrimental effect on the market. Other pandemic consequences include decreased client spending, negative net income and revenue, operations interruptions. The demand for energy products and services has decreased. Manufacturers of solar energy equipment are anticipated to enhance their manufacturing capacity and mergers to broaden their customer base and global presence. Other sources, such as hydro and wind energy also play an important role in the growth of power purchase agreement market. Government support and increase in research and development in the solar energy solution is projected to help drive growth of the global power purchase agreement market in near future. Long term contract for the power supply to the corporates, help to lower the income risk to producer and help in expanding the production of power through renewable sources.

Inclination towards the renewable energy consumption in corporates is the upcoming Trends of Power Purchase Agreement Market in the World

Solar application is growing with the highest CAGR in Application segment of Power Purchase Agreement Market

Europe is the largest region however, North America hold the highest CAGR in the coming years

Electric, RWE, ENGIE, Statkraft AG Group, Enel Spa, Siemens, Ameresco are top Companies to Hold the Market Share in Power Purchase Agreement Market

The global power purchase agreement market was valued at $11.6 billion in 2021, and is projected to reach $18.4 billion by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

Loading Table Of Content...