Power Semiconductor Market Research, 2032

The power semiconductor market was valued at $48.9 billion in 2022 and is projected to reach $79.9 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032.

A power semiconductor is a semiconductor device used as a switch or rectifier in power electronics. This device is also called a power device and when used in an integrated circuit it is called power IC. Power semiconductors control motors and lighting systems and convert electric power. They handle high voltages and large currents with less leakage, voltage drop, and other power losses. The current and voltage in power semiconductors start in the order of kilos and mega. The primary use of power semiconductors is for switching and converting purposes in power control systems. Power semiconductors are electronic components crafted from semiconductor materials such as silicon (Si) or silicon carbide (SiC). These materials exhibit distinctive electrical characteristics that enable them to regulate the movement of electrical current under various circumstances. Power semiconductors are usually grouped into three main types: diodes, transistors, gan semiconductors, and thyristors.

The power semiconductor market size is expected to witness notable growth during the forecast period, owing to an increase in the use of solar photovoltaic panels to generate electricity. Moreover, the surge in demand for power electronics modules across various industry verticals majorly drives the market. Furthermore, Growing demand for wireless communication and consumer electronics is projected to shape the future of the power semiconductor market.

However, Intricacy in the production network and planning cycle of SiC semiconductor innovation of power semiconductor are acting as some of the prime factors that restrain the power semiconductor market growth. Further, the rise in the government's HVDC and smart grid initiatives is projected to provide lucrative opportunities to expand the market during the forecast period.

![]()

The power semiconductor market overview is segmented into Product, Component, Application, and Region.

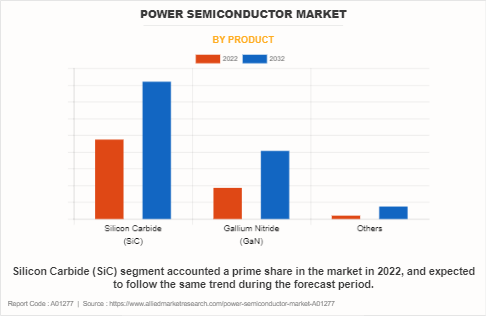

On the basis of product, the market is segmented into silicon carbide (SiC), gallium nitride (GaN), and others. In 2022, the silicon carbide (SiC) segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the Gallium Nitride (GaN) segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2023-2032.

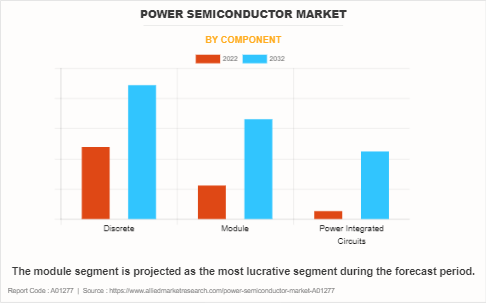

Based on components, the market is segregated into discrete, module, and power-integrated circuits. The Discrete segment acquired a major share of the market and is expected to follow the same trend during the forecast period. However, the Power Integrated Circuits segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2023-2032.

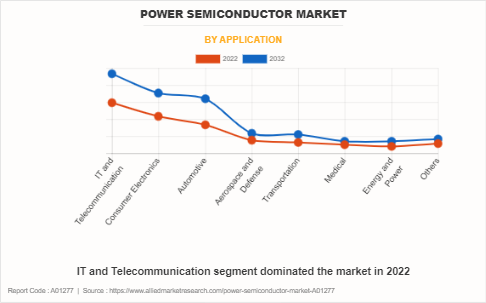

By application, the market is classified into IT & telecom, consumer electronics, automotive, aerospace & defense, transportation, medical, energy and power, and others. The IT and Telecommunication segment dominated the market in 2022 in terms of revenue and is expected to dominate the market during the forecast period. However, the automotive segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2023-2032.

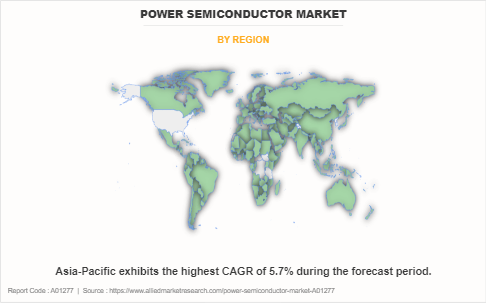

Region-wise, the power semiconductor market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, Specifically the U.S., remains a significant participant in the power semiconductor market. Major organizations and government institutions in the North America region have significantly put resources into action to develop enhanced portable devices which is driving the growth of the Power semiconductor industry in North America.

Competitive Analysis

Competitive analysis and profiles of the major power semiconductor market players that have been provided in the report include Infineon Technologies AG, Texas Instruments Inc., STMicroelectronics N.V., NXP Semiconductors N.V., ON Semiconductor Corporation, Mitsubishi Electric Corporation., Renesas Electronics Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., Hitachi, Ltd.

Country Analysis

North America-wise, the U.S. acquired a prime share in the market in the North American region and is expected to grow at a high CAGR of 3.5% during the forecast period of 2023-2032. The U.S. holds a dominant position in the market, owing to the presence of prime players such as ON Semiconductor Corporation, Texas Instruments, and others who are pioneers in the power semiconductor industry, constantly pushing the boundaries of technology to develop more efficient and high-performance devices.

In Europe, Germany dominated the European power semiconductor market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as one of the fastest-growing countries in Europe's Power semiconductor industry with a CAGR of 6.7%, owing to a strong automotive industry, presence of leading power semiconductor manufacturers, and government support.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to its large and growing market, growing popularity of power semiconductors in consumer electronics and ITÂ and Telecommunication, government support, and presence of leading power semiconductor manufacturers. However, India is expected to emerge as a dominant country in the power semiconductor market opportunity in the Asia-Pacific region.

In LAMEA, Latin America is growing the fastest in the market because of its growing economy, increasing disposable income, and rising demand for power semiconductors in applications such as energy power, and transportation. Moreover, the Africa region is expected to grow at a high CAGR of 6.4% from 2023 to 2032, owing to its economic growth, infrastructure investment, and demand for power semiconductors in applications such as it and telecommunication, consumer electronics, automotive, aerospace and defense, medical, energy and power.

Top Impacting Factors

One of the significant factors that impact the growth of the power semiconductor market forecast includes an increase in the use of solar photovoltaic panels to generate electricity. Moreover, a surge in demand for power electronics modules across various industry verticals is expected to drive market growth. However, the intricacy of the production network and planning cycle of SiC semiconductor innovation might hamper the growth of the market. On the contrary, HVDC and smart grid initiatives by the government offer potential growth opportunities for the market.

Historical Data & Information

The market is highly competitive, owing to the strong presence of existing vendors. Vendors of power semiconductor devices with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments

ON Semiconductor Corporation, Infineon Technologies AG, Texas Instruments Inc., STMicroelectronics N.V., and NXP Semiconductors N.V. are the top 5 companies holding a prime share in the market. Top market players have adopted various strategies, such as product launch, partnership, acquisition, Collaboration, innovation, and product development, to expand their foothold in the Power semiconductor market.

In June 2023, Mitsubishi Electric Corporation announced that the company would begin shipping samples of its new NX-type full-SiC (silicon carbide) power semiconductor module for industrial equipment. The module, which reduces internal inductance and incorporates a second-generation SiC chip, is expected to contribute to the realization of more efficient, smaller, and lighter-weight industrial equipment.

In May 2023, Texas Instruments, a leader in high-voltage technology, today debuted a highly integrated, functional safety-compliant, isolated gate driver that enables engineers to design more efficient traction inverters and maximize electric vehicle (EV) driving range. The new UCC5880-Q1 reinforced isolated gate driver offers features that enable EV powertrain engineers to increase power density and reduce system design complexity and cost while achieving their safety and performance goals.

In May 2023, Infineon Technologies AG, the global leader in automotive semiconductors, and Hon Hai Technology Group (Foxconn), the world's largest electronics manufacturing services provider, aimed to establish a long-term partnership in the field of electric vehicles (EV) to jointly develop advanced electromobility with efficient and intelligent features. The Memorandum of Understanding (MoU) focuses on silicon carbide (SiC) development, leveraging Infineon's automotive SiC innovations and Foxconn's know-how in automotive systems.

In May 2023, Vitesco Technologies and Onsemi announced a decade-long-term supply agreement worth $1.9 billion (€1.75 billion) for silicon carbide (SiC) products to enable Vitesco Technologies’ ramp in electrification technologies.

In May 2023, Infineon Technologies AG announced the business expansion for a new plant in Dresden together with political leaders from Brussels, Berlin, and Saxony. EU Commission President Ursula von der Leyen, German Federal Chancellor Olaf Scholz, Saxony's Prime Minister Michael Kretschmer, and Dresden's Mayor Dirk Hilbert symbolically launched construction work together with Infineon CEO Jochen Hanebeck. With an investment volume of five billion euros, the new plant is the largest single investment in Infineon's history.

In March 2023, Mitsubishi Electric Corporation announced that the company will double a previously announced investment plan to approximately 260 billion yen in the five-year period to March 2026 mainly for constructing a new wafer plant to increase the production of silicon carbide (SiC) power semiconductors.

In June 2023, Airbus, a global pioneer in the aerospace industry, and STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, announced a collaboration to cooperate on power electronics. It involves R&D to support more efficient and lighter power electronics, essential for future hybrid-powered aircraft and full-electric urban air vehicles.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power semiconductor market analysis from 2022 to 2032 to identify the prevailing power semiconductor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the power semiconductor market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as power semiconductor market trends, key players, market segments, application areas, and market growth strategies.

Power Semiconductor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 79.9 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Product |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Toshiba Corporation., Infineon Technologies AG, Hitachi, Ltd, ON Semiconductor Corporation, Fuji Electric Co Ltd., Texas Instruments Inc., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Renesas Electronics, STMicroelectronics N.V. |

Analyst Review

As per the experiences of CXOs of driving organizations, the ongoing business situation has been seeing an expansion sought after for power gadgets, especially in the created areas like the U.S., Europe, and China. Businesses in this sector have been introducing a variety of new products, such as SiC MOSFETs and Schottky barrier diodes due to their increasing application in photovoltaic inverters, industrial motor drives, and electro-mobility. Sic power devices have been experiencing rapid expansion in tandem with the rising popularity of electric vehicles and photovoltaic inverters. Organizations, like Infineon Advancements and Cree, Inc., have been shaping vital associations for the supply of silicon wafers. High wafer costs and design issues are major barriers to the expansion of SiC power devices by major players in the power semiconductors market. As a result, businesses have started designing power devices on 6-inch wafers and larger ones.

In contrast, GaN has gradually emerged as a sustainable semiconductor material for upcoming power electronic converters, due to its advantageous properties, such as a wide band gap and the potential to form heterostructures. Even though GaN power gadgets are in their underlying stage, they have previously outperformed their silicon partners. GaN is mostly used in high-speed and optical electronic devices, but power electronics applications have been gaining popularity in recent years. According to reports, the revenue of high-voltage transistors with a voltage of more than 600V rises at a rapid rate. In the previous ten years, the execution of GaN power gadgets has in practically no time moved along. The key players profiled in the report include Infineon Technologies AG, Texas Instruments Inc., STMicroelectronics N.V., NXP Semiconductors N.V., ON Semiconductor Corporation, Mitsubishi Electric Corporation., Renesas Electronics Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., and Hitachi, Ltd.

Asia-Pacific accounted a major share the market

IT & telecom segments dominate the market in the year 2022.

The rise in the installation of solar photovoltaic panels for electricity generation, driven by the increasing demand for eco-friendly technologies and government incentives, is fueling the adoption of power semiconductors

The power semiconductor market was valued at $48,870.0 million in 2022.

ON Semiconductor Corporation, Infineon Technologies, Texas Instruments Inc., Fuji Electric Co., Ltd., and Mitsubishi Electric are the top companies to hold the market share in Power Semiconductor.

Loading Table Of Content...

Loading Research Methodology...