Power Transistors Market Research, 2032

The Global Power Transistors Market was valued at $13.7 billion in 2022 and is projected to reach $23.3 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Power transistors stand as a cornerstone of contemporary technology. In the aerospace and defense industry, they are vital for functions like radar systems, communication equipment, and power distribution within aircraft and spacecraft. In the medical field, high-power transistors or power transistors find applications in devices like MRI machines, X-ray generators, and power supplies for medical instruments. Further, power transistors play a pivotal role in the power electronics sector, enabling the efficient conversion and regulation of electrical energy for applications ranging from uninterruptible power supplies (UPS) to electric propulsion systems for trains and electric vehicles. Their significance also extends to the realms of industrial automation and telecommunications, where they contribute to the reliable operation of equipment and communication networks.

A power transistor is a semiconductor component engineered to manage high levels of electrical power within electronic circuits. Its function involves both amplification and switching of electrical signals, rendering it essential in scenarios where controlling elevated currents or voltages is imperative. Power transistors are available in diverse types, including Bipolar Junction Transistors (BJTs) and Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs). These devices serve a wide array of applications across various industries.

The end users of power transistors include a broad spectrum of electronics enthusiasts, ranging from hobbyists and do-it-yourself aficionados to professional engineers and manufacturers. In the realm of consumer electronics, power transistors find application in audio amplifiers, voltage regulators, and power supplies, ensuring the efficient and dependable operation of devices such as televisions, sound systems, and smartphones. Within the automotive sector, they hold a crucial role in managing motors, lighting systems, and other power-demanding components, thereby enhancing the overall efficiency and safety of vehicles. Furthermore, power transistors are indispensable in renewable energy systems like solar inverters and wind turbine generators, as well as in industrial automation for tasks like motor control and power management.

Segment Overview

The power transistors market is segmented into type and application.

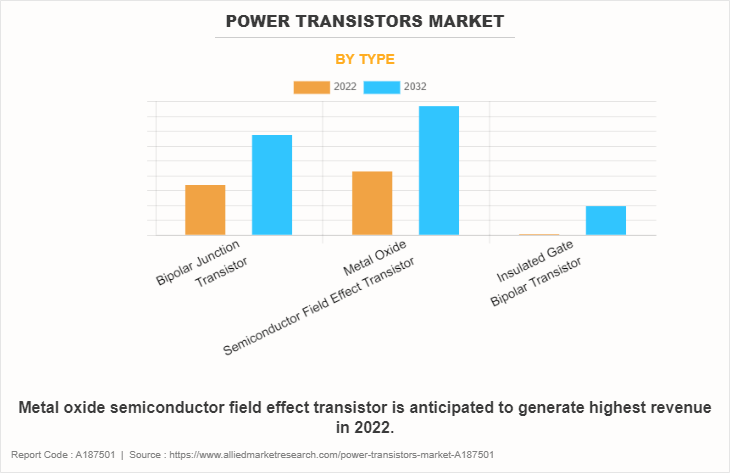

On the basis of type, the market is divided into bipolar junction transistors, metal oxide semiconductor field effect transistors, and insulated gate bipolar transistors. In 2022, the metal oxide semiconductor field effect transistor segment dominated the market, and insulated gate bipolar transistor is expected to grow at a significant CAGR from 2023 to 2032.

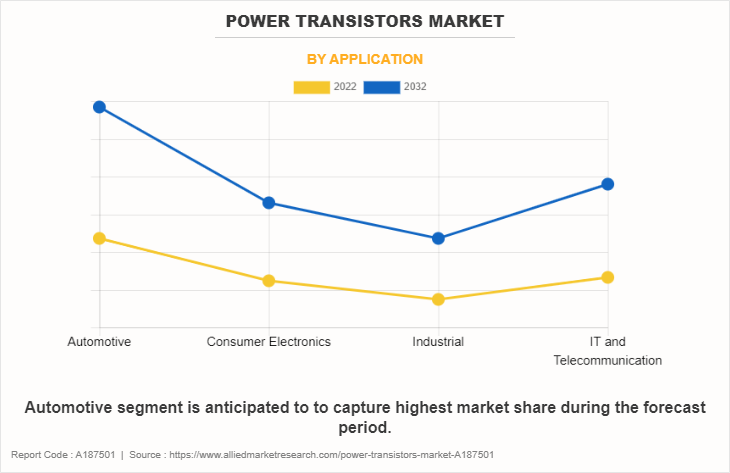

On the basis of application, the market is categorized into automotive, consumer electronics, industrial, IT, and telecommunication. The automotive segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

Based on region, the power transistor market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global power transistor market players that have been provided in the report include Fuji Electric Co., Ltd., Infineon Technologies AG, Microchip Technology, NXP Semiconductors, Renesas Electronics, ROHM Semiconductor, STMicroelectronics, Toshiba Corporation, Vishay Intertechnology, and WOLFSPEED, INC. The key strategies adopted by the major players of the power transistor market are product launch, new product development, joint venture, and business expansion.

Region Analysis

Country-wise, the U.S. acquired a prime share in the power transistor market in the North American region and Canada is expected to grow at a significant CAGR during the forecast period.

In Europe, the rest of Europe dominated the power transistors market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, France and Germany is expected to emerge as the fastest-growing country in Europe's power transistor market with a CAGR of 6.2% and 5.4%, respectively.

In Asia-Pacific, China is expected to emerge as a significant market for the power transistors market industry, owing to a significant rise in investment by prime players due to an increase in growth of manufacturing and a rise in demand for automotive parts such as ADAS systems, installing IoT devices and others.

In the LAMEA region, the Middle East held a significant power transistors market size in 2022. The LAMEA power transistor market has witnessed an improvement, owing to the growth in the inclination of prime vendors toward utilizing the power transistor across this region in various applications such as healthcare, automotive, and others. Moreover, the Middle East region is expected to grow at a high CAGR of 4.6% from 2023 to 2032.

Top Impacting Factors

The power transistor market analysis is expected to expand significantly during the forecast period owing to increased dependence on electrical equipment and machinery and an increase in emphasis on power saving. In addition, during the forecast period, the power transistor market is anticipated to benefit from an increase in the transition toward electric vehicles (EVs). On the contrary, the complex fabrication process associated with power transistors restrains the power transistor market growth during the forecast period.

Historical Data & Information

The global power transistors market outlook is highly competitive, owing to the strong presence of existing vendors. Vendors of the power transistor market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in the power transistors market forecast is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Fuji Electric Co., Ltd., Infineon Technologies AG, Microchip Technology, NXP Semiconductors, Renesas Electronics, ROHM Semiconductor, STMicroelectronics, Toshiba Corporation, Vishay Intertechnology, and WOLFSPEED, INC. The key strategies adopted by the major players of the power transistors market growth are product launch, new product development, joint venture, and business expansion.

- In January 2023, Vishay Intertechnology, Inc. launched 30 V symmetric dual n-channel power MOSFETs that combine high and low side TrenchFET Gen V MOSFETs in a single 3.3 mm by 3.3 mm PowerPAIR 3x3FS package. The dual MOSFETs released can be used in place of two discrete devices in the PowerPAK 1212 package — saving 50 % board space — while offering a 63 % smaller footprint than dual MOSFETs in the PowerPAIR 6x5F.

- In September 2023, Infineon Technologies launched optimos 40V, 25V, and 30 V MOSFET. The OptiMOS 6 40V and OptiMOS 5 25V and 30V power MOSFETs further optimize the proven OptiMOS technology for high-performance designs.

- In April 2023, STMicroelectronics revealed a flexible isolated-buck IC for protected power conversion and gate driving in IGBTs, SiC, and GaN transistors. The STMicroelectronics L6983i 10W isolated buck (iso-buck) converter ensures high efficiency and a compact footprint, with advantages including low quiescent current and 3.5V-38V input-voltage range.

- In September 2023, STMicroelectronics launched STPOWER IH2 series IGBTs with an increased breakdown-voltage capability of 1350V and a maximum operating temperature of 175°C. The higher ratings ensure a greater design margin, robust performance, and extended reliability under all operating conditions. The STPOWER IH2 series IGBTs also permit increased power-conversion efficiency. Favorable parameters include low saturation voltage, Vce(sat), which ensures low dissipation when the device is turned on.

- In January 2022, Vishay Intertechnology, Inc. launched n-channel TrenchFET MOSFETs that increase power density, efficiency, and board-level reliability in telecom and industrial applications. To achieve these design goals, the 60 V SiJH600E and 80 V SiJH800E combine ultra-low on-resistance with high-temperature operation to +175 °C and high continuous drain current handling.

- In February 2022, Vishay Intertechnology, Inc. introduced its fourth generation of 600 V E Series power MOSFETs. It provides high efficiency for telecom, server, and data center power supply applications, the Vishay Siliconix n-channel SiHK045N60E slashes on-resistance by 27 % compared with previous-generation 600V E-Series MOSFETs.

- In May 2022, STMicroelectronics launched MDmesh MOSFETs, with increased power density and efficiency. STMicroelectronics’ STPOWER MDmesh M9 and DM9 N-channel super-junction multi-drain silicon power MOSFETs are ideal for switched-mode power supplies (SMPS) in applications from data-center servers and 5G infrastructure to flat-panel televisions.

- In August 2022, Renesas Electronics Corporation announced the development of Si-IGBTs (Silicon Insulated Gate Bipolar Transistors) which offered a small footprint while providing low power losses.

- In December 2022, ROHM developed a compact, high-efficiency 20V Nch MOSFET, RA1C030LD, optimized for switching in small, thin devices, including smartphones and wearables such as wireless earbuds and other hearable equipment.

- In February 2021, ROHM launched a 24-model lineup of 24V input, -40V/-60V withstand voltage P-channel MOSFETs available in both single and dual configurations ideal for industrial and consumer applications such as factory automation, robotics, and air conditioning systems.

- In April 2021, Vishay Intertechnology launched the AEC-Q101 qualified p-channel -80 V TrenchFET MOSFET. With the lowest on-resistance of any -80 V p-channel device, the new Vishay Siliconix SQJA81EP increases power density and efficiency in automotive applications.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power transistors market analysis from 2022 to 2032 to identify the prevailing power transistors market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities for the power transistors industry.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network for the power transistors industry.

- An in-depth analysis of the power transistors market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global power transistors market trends, key players, market segments, application areas, and market growth strategies.

Power Transistors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 233 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ROHM Semiconductor, Renesas Electronics, Vishay Intertechnology Inc., Wolfspeed, Inc., NXP semiconductors, STMicroelectronics, Infineon Technologies AG, Microchip Technology Inc., Toshiba Corporation., Fuji Electric Co., Ltd. |

Analyst Review

According to the perspectives of CXOs of a leading power transistor market company, there is a strong expectation for significant growth in the market in the coming years. These industry leaders believe that several factors will drive this growth and create ample opportunities for companies operating in the power transistor in semiconductor sector.

Power transistors play a crucial role in driving various applications and end-user industries by effectively managing and controlling high-power electrical circuits. Their capability to amplify and switch electrical signals is fundamental across a diverse range of sectors. For instance, in consumer electronics, power transistors ensure the efficient and dependable operation of devices like televisions, audio systems, and smartphones. In addition, in the automotive applications, power electronics are indispensable for regulating and overseeing motors, lighting systems, and other power-intensive components, contributing to the efficiency and safety of vehicles. Furthermore, power transistors are essential for efficiently converting and managing electrical energy, within renewable energy systems such as solar inverters and wind turbine generators. Power transistors significance also extends to industrial automation, where they enable precise control of motors and power distribution. The versatility and necessity of power transistors make them a foundational element of modern technology.

The market outlook for power transistors in the automotive sector is promising. There is a projected surge in demand for power transistors with an increasing focus on electric and hybrid vehicles. Power transistors are pivotal in governing the electric motors that drive these vehicles, as well as managing various electrical systems. The shift toward electrification necessitates advanced power electronics for efficient energy conversion and management, leading to a substantial market for power transistors. Moreover, the automotive industry is progressively integrating advanced driver assistance systems (ADAS) and electric power steering, both of which rely on power transistors for precise control and operation. This indicates a sustained and robust demand for power transistors in the automotive sector in the foreseeable future.

Furthermore, progressions in power transistor technology are fueling innovation and broadening their applications within the automotive industry. The development of wide-bandgap semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) is augmenting the efficiency and performance of power transistors. These materials have the capacity to handle higher voltages and temperatures, resulting in more compact and efficient power electronics. The adoption of these advanced power transistors is set to increase as automakers endeavor to achieve greater energy efficiency and extended range in electric vehicles. In addition, the integration of power transistors with sophisticated control systems and artificial intelligence in autonomous vehicles further emphasizes their pivotal role in shaping the future of automotive technology.

The power transistor market analysis is expected to expand significantly during the forecast period owing to increased dependence on electrical equipment and machinery and increase in emphasis on power saving.

Automotive segment is the leading application of power transistors market during the forecast period.

Asia-Pacific is the largest regional market for Power Transistors.

The global power transistors market was valued at $13,660.0 million in 2022.

Fuji Electric Co., Ltd., Infineon Technologies AG, Microchip Technology, NXP Semiconductors, Renesas Electronics, ROHM Semiconductor, STMicroelectronics, Toshiba Corporation, Vishay Intertechnology, and WOLFSPEED, INC

Loading Table Of Content...

Loading Research Methodology...