Pre-Owned Construction Equipment Market Research, 2031

The global pre-owned construction equipment market size was valued at $165,162.2 million in 2021, and is projected to reach $484,310.7 million by 2031, registering a CAGR of 11.2% from 2022 to 2031.

The secondhand construction equipment used for carrying out excavation, earthmoving, transportation and lifting activities at construction sites is considered to be as a pre-owned construction equipment. This equipment is more cost effective and provides better value to the cost.

The growth of the pre-owned construction equipment market is driven by increased construction and mining activity in developing countries such as Latin America and Africa. The U.S. government has invested heavily in building roads, railroad tracks, airports, and other infrastructure that require the use of excavators, loaders, and other heavy equipment. For example, in March 2021, the U.S. President announced a $2 trillion infrastructure plan that includes transportation, broadband, power grids, residential and commercial buildings that will create immense opportunities for market.

In addition, additional costs for equipment maintenance, excessive operating costs, and high wages for skilled workers can be saved by using pre-owned equipment for the required period, which will greatly contribute to the growth of the global market. In addition, equipment purchases and high initial investments in economic bottlenecks can be avoided by choosing pre-owned equipment, thereby driving pre-owned construction equipment market growth.

The lack of a skilled workforce is a major restraining factor for the global pre-owned construction equipment market. In addition, saturation of construction and mining in developed countries is another factor impeding market growth.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. This led to decline in manufacturing of various equipment used for pre-owned construction equipment as well as their demand in the market, thereby restraining the growth of the pre-owned construction equipment industry. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of pre-owned construction equipment companies at their full-scale capacities, that helped the pre-owned construction equipment market share to recover by end of 2021.

Segment Overview

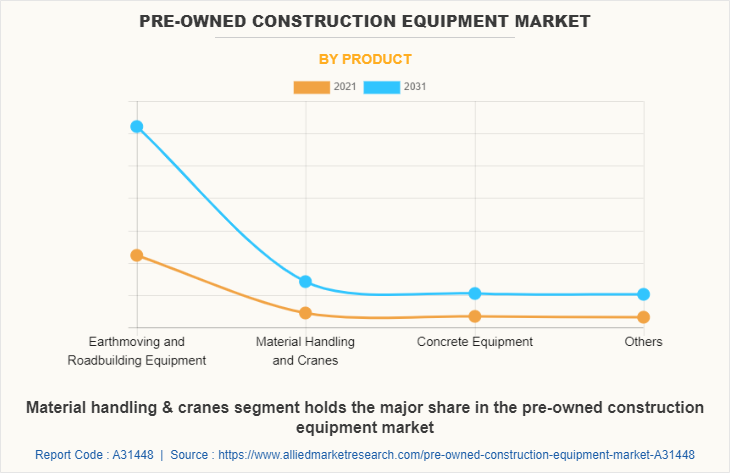

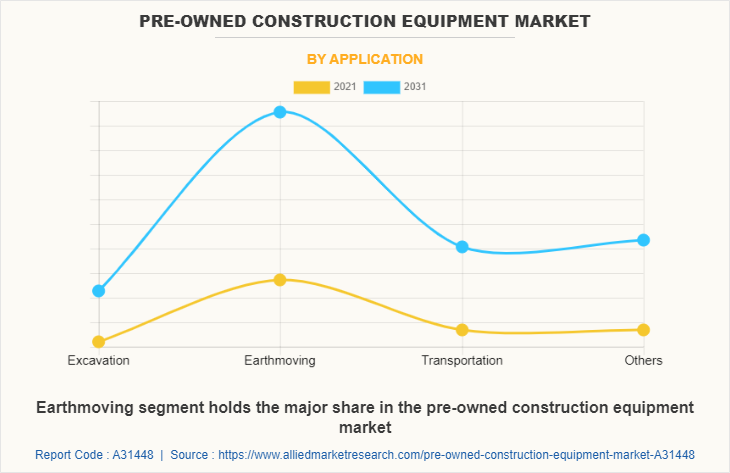

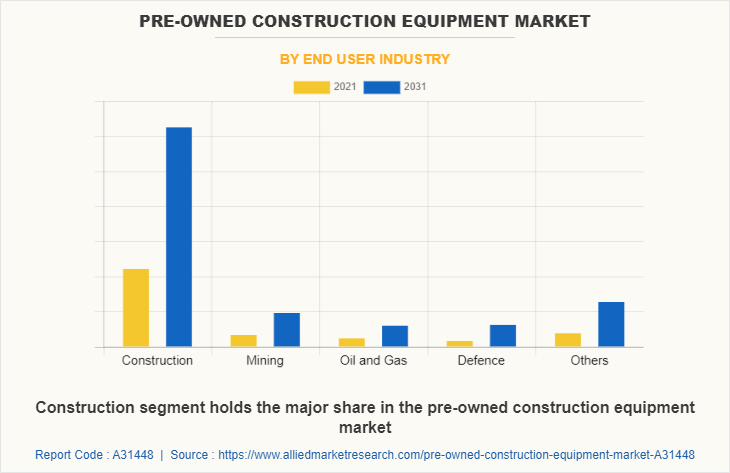

The pre-owned construction equipment market is segmented into product, application, end user industry, and region. By product, the market is categorized into earthmoving & roadbuilding equipment, material handling & cranes, concrete equipment and others. On the basis of application, the market is fragmented into excavation, earthmoving, transportation and others. The end user industry segment is fragmented into construction, mining, oil & gas, defense and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of product, in 2021 the earthmoving & roadbuilding equipment segment dominated the pre-owned construction equipment market, in terms of revenue, and others segment is expected to witness growth at the highest CAGR during the forecast period. As per application, in 2021, the others segment led the market, and is expected to exhibit highest CAGR in the near future. By end user industry, the construction segment led the market in 2021, in terms of revenue and the defense segment is anticipated to register highest CAGR during the forecast period. Region wise, Asia-Pacific garnered the highest revenue in 2021; however, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The key players profiled in the pre-owned construction equipment market report include, AIS Construction Equipment Service Corporation, Caterpillar, Inc., CEUK T/A Construction Equipment UK, Equippo AG, Hitachi, Ltd. (Hitachi Construction Machinery), Hooray Machinery Co., Ltd., Kobelco Construction Machinery Co., Ltd., Komatsu Used Equipment Corp., Machine Hub Asia, Machinery Auctioneers, Ritchie Bros. Auctioneers Incorporated, RÜKO GmbH , Sandhills Global, Shriram Automall India Limited, Terex Corporation, Truck1 and Volve CE Used Equipment. Major companies in the market have adopted product launch, partnership, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pre-owned construction equipment market analysis from 2021 to 2031 to identify the prevailing pre-owned construction equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders maket profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pre-owned construction equipment market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pre-owned construction equipment market trends, key players, market segments, application areas, and market growth strategies.

Pre-Owned Construction Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 484.3 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Product |

|

| By Application |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Hooray Machinery Co.,Ltd, Shriram Automall India Limited, Sandhills Global, Terex Corporation, Caterpillar, Inc., Truck1, Volve CE Used Equipment, CEUK T/A Construction Equipment UK, AIS Construction Equipment Service Corporation, Komatsu Used Equipment Corp., Machinery Auctioneers, RÜKO GmbH, Hitachi, Ltd. (Hitachi Construction Machinery), Equippo AG, Kobelco Construction Machinery Co., Ltd., Infra Bazaar, Machine Hub Asia |

Analyst Review

Various construction equipment companies are acquiring other companies and increasing their presence in different locations. This helps in strengthening their business. Material handling, excavation and lifting are activities carried out at construction sites. Pre-owned construction equipment is commonly utilized to aid heavy activities on mining sites at lower cost. Expansion of the pre-owned construction equipment industry is fueled by increase in building and mining operations in emerging economies of Latin America and Africa. For instance, U.S. president Trump announced a $2 trillion infrastructure plan in March 2021, which covers roads, telecommunications, electric grid, and residential & commercial buildings. These elements create immense opportunities for the market.

Furthermore, significant initial expenditure necessary to purchase equipment, as well as financial restraints, may be avoided by pre-owned equipment, which boost the market growth. The market growth is hampered by lack of trained workers and saturation in the building and mining industries in developed countries. Construction work was halted, owing to the COVID-19 lockdown, which had an indirect impact on the pre-owned construction equipment market. Furthermore, manufacturers are producing modern equipment that are both cost-effective and long-lasting and the integration of IoT is expected to aid in overcoming scarcity of trained personnel and improving operators with end-user safety. During the forecast period, these aspects are expected to provide lucrative opportunities for the market.

The global pre-owned construction equipment market was valued at $165,162.2 million in 2021, and is projected to reach $484,310.7 million by 2031, registering a CAGR of 11.2% from 2022 to 2031.

The forecast period considered for the global pre-owned construction equipment market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global pre-owned construction equipment market report can be obtained on demand from the website.

The base year considered in the global pre-owned construction equipment market report is 2021.

The top companies holding the market share in the global pre-owned construction equipment market report AB Volvo (Volvo CE Used Equipment), AIS Construction Equipment Service Corporation, Caterpillar, Inc., CEUK T/A Construction Equipment UK, Equippo AG, Hitachi, Ltd. (Hitachi Construction Machinery), Hooray Machinery Co.,Ltd, Kobe Steel, Ltd. (Kobelco Construction Machinery Co., Ltd.), Komatsu (Komatsu Used Equipment Corp.), Machine Hub Asia, Machinery Auctioneers, Ritchie Bros. Auctioneers Incorporated, RÜKO GmbH, Sandhills Global, Inc., Shriram Automall India Limited, Terex Corporation and Truck1.

The top seventeen market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By application, the earthmoving segment is the highest share holder of pre-owned construction equipment market.

Loading Table Of Content...