Premium Finance Market Research, 2032

The global premium finance market was valued at $47.8 billion in 2022, and is projected to reach $139.7 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

Premium financing provides individuals and businesses with the funds required to cover the cost of insurance premiums. By using this strategy, policyholders can avoid large upfront payments, manage cash flow more effectively, and potentially access tax benefits and asset protection strategies. The primary purpose of premium financing is to help policyholders manage their cash flow by spreading out the cost of insurance premiums over a longer period. This can be particularly beneficial for individuals and businesses with high-value insurance policies, such as life insurance or commercial insurance, where premiums can be expensive.

One of the key drivers of the premium finance market is the increase in demand for insurance. Furthermore, an increase in premium rates of insurance drives the growth of the premium finance market. Higher premium rates can place a significant financial burden on policyholders, especially businesses, and individuals with large insurance needs. This creates a demand for premium financing as it allows policyholders to spread the cost of their insurance premiums over time, making it more manageable and ensuring they remain adequately covered. In addition, technological advancements in financial services have been a key driver in the growth of the market.

However, the risk of default in premium payment, and the complex and time-consuming loan application process hamper the premium finance market size. On the contrary, the adoption of AI in insurance platforms is expected to provide lucrative growth opportunities to the premium finance market in the upcoming years. AI-powered insurance platforms can quickly analyze vast amounts of data to figure out how much someone should pay for insurance. Furthermore, artificial intelligence (AI) can also make the insurance process more efficient.

The report focuses on growth prospects, restraints, and trends of the premium finance market forecast. The study provides porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the premium finance market outlook.

Segment Review

The premium finance market is segmented into type, interest rate, provider, and region. On the basis of type, the market is differentiated into life insurance and non-life insurance. On the basis of interest rate, it is categorized into fixed interest rate and floating interest rate. On the basis of provider, the market is divided into banks, NBFCs, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

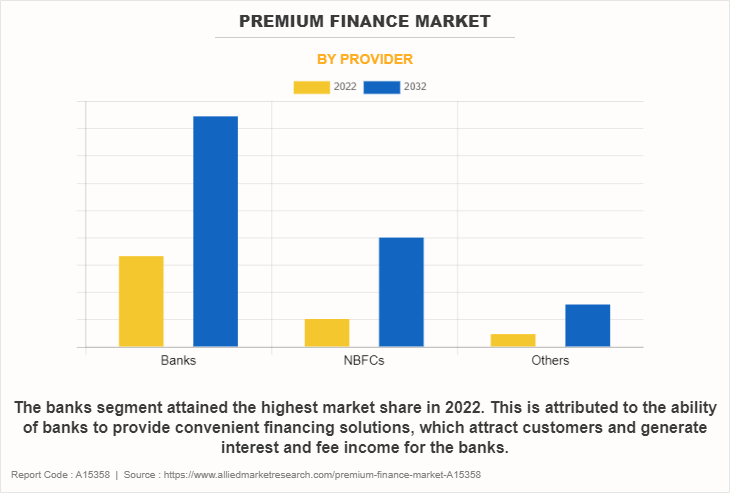

By provider, the banks segment acquired a major premium finance market share in 2022. The growth of the banks segment is propelled by their financial strength and expertise. Banks have the financial resources to offer competitive loan terms, making it attractive for individuals and businesses to choose them as their financing source. However, the NBFCs segment is expected to be the fastest-growing segment during the forecast period, owing to their flexibility and ability to cater to a wide range of borrowers. NBFCs often have more lenient lending criteria compared to traditional banks, making it easier for individuals and businesses to secure premium financing.

Region-wise, North America dominated the market in 2022, owing to the growing awareness of premium finance options and the increase in cost of insurance premiums. These factors have been significant drivers for the premium finance market growth in North America. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the rise in affluence and economic growth in many Asian countries that drive the demand for insurance. Furthermore, the increase in awareness of financial solutions such as premium finance is contributing to the growth of premium finance market in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major players in the premium finance market include IPFS Corporation, JPMorgan Chase & Co., Lincoln National Corporation, AFCO Credit Corporation, Agile Premium Finance, ARI Financial Group, US Premium Finance, Byline Bank, Capital for Life, and Valley National Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the premium finance industry.

Recent Partnerships in the Premium Finance Market

In June 2023, Pavo Insurance Solutions formed a strategic partnership with Agile Premium Finance which aims to transform the premium financing landscape by delivering innovative solutions to the insurance industry.

In May 2023, Pavo, an innovative firm poised to transform the insurance industry formed a partnership with Finsure Consulting to consult on the development of next-generation insurance software. Pavo's has developed innovative software to deliver the first premium finance marketplace, making insurance more accessible and affordable. This pioneering technology, integrated directly into policy platforms, heralds a new era of transparency and competitiveness within the insurance market.

In March 2022, AFCO, the leading provider of insurance premium finance and payment options, and Vertafore, the leader in modern insurance technology, formed a partnership to equip independent insurance agencies with the capability to provide their insureds with invoicing, payment, and premium financing through Vertafore’s InsurLink client experience platform. AFCO integrates its industry-leading payment portal, PayMyPremiums, with InsurLink, enabling agencies to offer even more 24/7 information and services to meet the needs and expectations of modern consumers.

Recent Acquisitions in the Premium Finance Market

In September 2022, Truist Insurance Holdings, Inc., a subsidiary of Truist Financial Corporation and the sixth-largest insurance brokerage in the U.S., acquired BankDirect Capital Finance, a nationwide premium finance company, from Texas Capital Bancshares, Inc.

In August 2022, National Partners PFco, a wholly owned subsidiary of WebBank, acquired Security Premium Finance Company, LLC, a privately held premium finance company that provides insurance premium financing services for commercial and consumer clients to purchase property and casualty insurance products in Florida. The acquisition provides National Partners with diversification, geographic market opportunities, and a competitive advantage in the industry.

Market Landscape and Trends

In July 2021, according to the Forbes newsletter, a decades-long period of falling interest rates created a challenging environment for most life insurance companies to meet the expectations of their longtime policyholders. Insurers who find they cannot achieve the projected targeted investment returns on these policy blocks are forced to reduce dividend rates, impairing policy performance. For instance, in the whole life marketplace, affected policyholders have experienced a decline in dividend rates from a peak of as high as 11.5% in 1989 to as low as 4.25% in 2021. For many policyholders, this creates tough choices: pay more to sustain their policy benefits as planned, keep paying planned premiums and reduce the death benefit or, in some situations, allow the policy to lapse.

In a number of these situations, financing premiums can improve a policy’s performance by reducing or eliminating the policyholder’s annual out-of-pocket expense, increasing the death benefit and/or cash value or accomplishing both.

Top Impacting Factors

Increase in Demand for Insurance

The increased demand for insurance is a significant factor driving the growth of the premium finance market. As more individuals and businesses recognize the importance of insurance coverage to mitigate risks, the need for accessible and affordable premium payment options becomes paramount. Not everyone can afford to pay large insurance premiums upfront. This increased the demand for premium financing life insurance and is primarily rising for financial security and protection against unforeseen events. As a result, premium financing companies have expanded their services to cater to this demand. For instance, in June 2023, Pavo Insurance Solutions formed a strategic partnership with Agile Premium Finance which aims to transform the premium financing landscape by delivering innovative solutions to the insurance industry. Therefore, such factors drive the growth of the premium finance market.

Increase in Premium Rates

Increase in premium rates of insurance drives the growth of the premium finance market. Higher premium rates can place a significant financial burden on policyholders, especially businesses, and individuals with large insurance needs. This creates a demand for premium financing as it allows policyholders to spread the cost of their insurance premiums over time, making it more manageable and ensuring they remain adequately covered. This financial flexibility is a key driver for individuals and companies to turn to premium finance providers. Moreover, as premium rates rise, policyholders seek more comprehensive insurance coverage to protect their assets and mitigate potential risks. Premium financing enables them to access larger policies without having to pay the full premium upfront.

Technological Advancements

Technological advancements have been a key driver in the growth of the premium finance market. The integration of technology into financial services has streamlined and simplified the premium financing process. With user-friendly online platforms and mobile apps, individuals and businesses can easily access and apply for premium financing solutions. This convenience has made it more attractive for consumers, leading to increased adoption of premium finance options and the expansion of the market. Furthermore, technology has enhanced the efficiency of underwriting and risk assessment in premium finance. For instance, in October 2023, Input 1, LLC, a multi-national provider of insurance products and services announced that Partners Premium Finance Corporation has selected the Premium Billing System (PBS) as its servicing platform for their newly created premium finance company. Therefore, such factors contribute to the growth of the premium finance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the premium finance market analysis from 2022 to 2032 to identify the prevailing premium finance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the premium finance market segmentation assists to determine the prevailing premium finance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as premium finance market trends, key players, market segments, application areas, and market growth strategies.

Premium Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 139.7 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 235 |

| By Type |

|

| By Interest Rate |

|

| By Provider |

|

| By Region |

|

| Key Market Players | ARI Financial Group, AFCO Credit Corporation, Agile Premium Finance, US Premium Finance, Capital for Life, Lincoln National Corporation, JPMorgan Chase & Co., Valley National Bancorp, Byline Bank, IPFS Corporation |

Analyst Review

Premium finance loans are often provided by a third-party finance entity known as a premium financing company. However, insurance companies and insurance brokerages occasionally provide premium financing services through premium finance platforms.

Key players in the premium finance market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in March 2022, AFCO, the leading provider of insurance premium finance and payment options, and Vertafore, the leader in modern insurance technology, formed a partnership to equip independent insurance agencies with the capability to provide their insureds with invoicing, payment, and premium financing through Vertafore’s InsurLink client experience platform. AFCO integrates its industry-leading payment portal, PayMyPremiums, with InsurLink, enabling agencies to offer even more 24/7 information and services to meet the needs and expectations of modern consumers. Therefore, such strategies adopted by key players propel the growth of the premium finance market.

The COVID-19 pandemic significantly accelerated the premium finance market, leading to the increased importance of insurance coverage among insurers during a global health crisis. Furthermore, the premium finance market witnessed a surge in the adoption of premium finance, with an increased focus on digital solutions and enhanced customer experiences. Moreover, the pandemic accelerated the adoption of digital technology and remote work, influencing consumer behavior. This digital transformation prompted premium finance companies to enhance their online presence and develop user-friendly platforms for clients to access and manage their payment plans.

The key players in the premium finance market include IPFS Corporation, JPMorgan Chase & Co., Lincoln National Corporation, AFCO Credit Corporation, Agile Premium Finance, ARI Financial Group, US Premium Finance, Byline Bank, Capital for Life, and Valley National Bank. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with an increase in awareness & demand for premium finance across the globe.

The premium finance market is segmented into type, interest rate, provider, and region. On the basis of type, the market is differentiated into life insurance and non-life insurance. Depending on the interest rate, it is categorized into fixed interest rate and floating interest rate. By provider, the market is divided into banks, NBFCs, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Premium Finance.

The premium finance market was valued at $47,835.94 million in 2022 and is projected to reach $139,740.66 million by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

The major players in the premium finance market include IPFS Corporation, JPMorgan Chase & Co., Lincoln National Corporation, AFCO Credit Corporation, Agile Premium Finance, ARI Financial Group, US Premium Finance, Byline Bank, Capital for Life, and Valley National Bank.

Loading Table Of Content...

Loading Research Methodology...