Prepaid Card Market Research, 2033

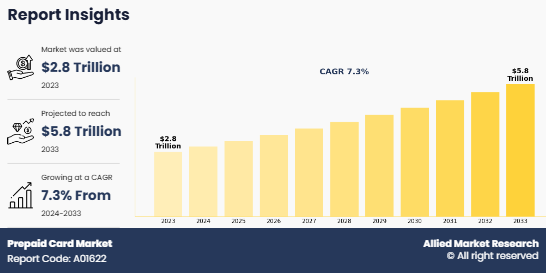

The global prepaid card market size was valued at $2.8 trillion in 2023, and is projected to reach $5.8 trillion by 2033, growing at a CAGR of 7.3% from 2024 to 2033. The prepaid card market is growing due to increasing consumer demand for cashless transactions and the rise of e-commerce. Technological advancements and government initiatives promoting financial inclusion are further driving market expansion.

Key Takeaways

By offering type, the gift cards segment held the largest share in the prepaid card market for 2023.

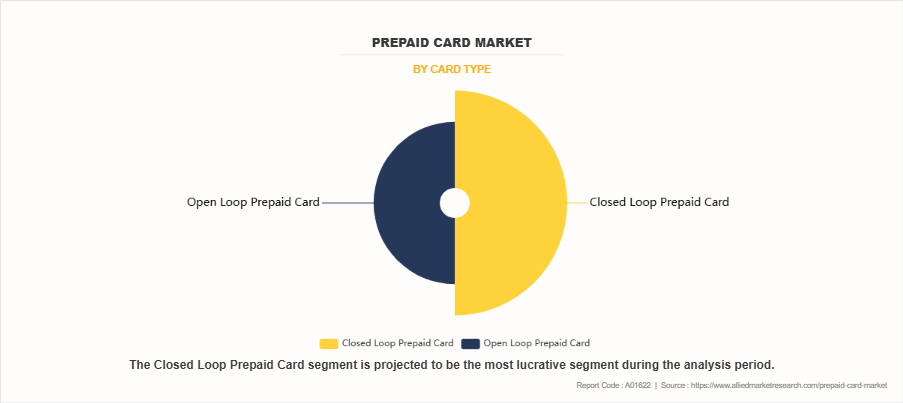

By card type, the closed loop prepaid card segment held the largest share in the prepaid card market for 2023.

By end users, the individuals segment held the largest share in the prepaid card market for 2023.

By end user industry, the retail segment held the largest share in the prepaid card market for 2023

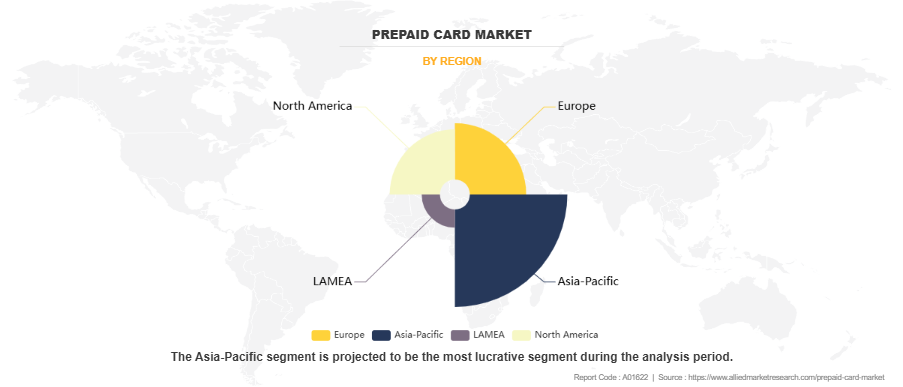

Region-wise, Asia-Pacific held largest market share in 2023. However, LAMEA is expected to witness the highest CAGR during the prepaid card market forecast period.

The prepaid card market is driven by growth in adoption of digital payments, increase in e-commerce transactions, and demand for financial inclusion solutions. The shift toward cashless transactions and the convenience of mobile wallet integration are expected to drive the prepaid card market growth. Moreover, the rise of government initiatives and corporate prepaid programs, such as for employee benefits or government subsidies, further fuels the demand for prepaid cards. As digital payment solutions become more widely accepted, the market is expected to expand as consumers seek safer and more efficient alternatives to traditional forms of payment.

Segment Review

The prepaid card market outlook is segmented on the basis of offering type, card type, end user, end user industry, and region. By offering type, it is classified into gift cards, government benefit/disbursement card, incentive/payroll card, general purpose reloadable card and others. By card type, the market is bifurcated into closed loop prepaid card and open loop prepaid card. By end user, the market is analyzed across individuals, corporates/businesses, and government/public sector. By end user industry, it is classified into retail, healthcare, travel & hospitality and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of card type, the global prepaid card market was dominated by the closed loop prepaid card segment in 2023 and is expected to maintain its dominance in the upcoming years, owing its ability to offer enhanced control, lower transaction fees, and brand loyalty incentives. Closed loop prepaid card is widely used by retailers and specific businesses, which is driving the segment growth. However, the open loop prepaid card segment is expected to register the highest CAGR during the forecast period. This is attributed to its broader acceptance across multiple retailers, convenience for consumers, and the flexibility to be used across various platforms such as online shopping websites, retail stores, ATMs, and mobile payment systems.

By region, Asia-Pacific dominated the prepaid card market share in 2023. This was attributed to its rapidly growing digital payment ecosystem, increasing smartphone penetration, and the rising adoption of cashless transactions. In addition, the expanding e-commerce sector, coupled with favorable government initiatives supporting digital financial services, have driven the demand for prepaid cards in Asia-Pacific. However, LAMEA is expected to exhibit the highest CAGR during the forecast period. This is attributed to the increasing financial inclusion initiatives, growing smartphone usage, and a rising preference for digital payment methods in emerging economies. In addition, improvements in internet infrastructure, a surge in e-commerce, and government efforts to promote cashless transactions are expected to drive the prepaid card market's growth in the LAMEA region.

Competition Analysis

The report analyzes the profiles of key players operating in the prepaid card market such as JPMorgan Chase And Co., American Express Company, Mastercard, Green Dot Corporation., Travelex Foreign Coin Services Limited, Visa Inc., Mango Financial, Inc., PayPal Holdings, Inc., Netspend Visa, Kaiku Finance LLC, Bank of America Corporation., HRB Digital LLC., Discover Bank, Western Union Holdings, Inc., CaixaBank, S.A., RBL Bank Ltd., PNC Financial Services Group, Inc, The City Bank Limited, Blackhawk Network Holdings, Inc. and The Points Guy, LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the prepaid card market.

Recent Product Launch in the Prepaid Card Industry

In March 2024, Visa partnered with Western Union. The agreement encompasses card issuance, Western Union’s integration with Visa Direct, and value-added services delivery including risk products. Western Union customers will also be able to receive Visa prepaid cards in select markets offering an innovative solution that bridges the physical and digital world.

In November 2024, The Blackhawk Network launched Visa- and Mastercard-branded e-gift cards that can be used in-store and online. The launch builds on consumers’ growing preferences for QR-code and tapto- pay technology.

In May 2023, Visa and Arab Financial Services (AFS) launched prepaid cards for businesses in Bahrain and Oman. According to AFS and Visa, their collaboration will open the path for digitizing merchant settlements using prepaid cards. The agreement also strengthens AFS's merchant base in both countries' digital credentials.

In November 2022, Visa expanded its prepaid card services through pilot payment innovations including instantly issued prepaid cards with animated card art and support facial biometric payments. The digital card will have animated card art and the official mascot La'eeb, illustrating a future in which consumers may add more customization and even digital animation to their Visa cards.

Top Impacting Factors

Driver

Rise in Demand for Prepaid Cards in Remittances

Rise in demand for prepaid cards in remittances significantly drives the prepaid card market, by offering convenience, security, and speed for cross-border transactions. With an increasing global workforce and migration trends, remittances have become a a vital source of income for families in developing countries. In addition, prepaid cards provide an ideal solution, especially for people without access to traditional banking systems. For instance, workers abroad load funds onto a prepaid card and easily send them back to their families, who can access the money instantly without the need for a bank account. This method is particularly popular in countries such as the Philippines and India, where many depend on remittance flows for household expenses, is expected to drive the market growth.

In addition, prepaid payment cards have become essential for promoting financial inclusion and enhancing remittance services in both emerging and developed markets. These cards allow cardholders to transfer funds conveniently to family members abroad, catering to those who may not have regular bank accounts. Users can choose between two structures for international transfers: dual card and subaccount holding. In the dual card structure, the account holder receives two cards, enabling one to be sent abroad for family members to access funds directly from the sender’s account. Furthermore, the prepaid cards is ideal for secure transactions, as recipients can use them both online and at physical locations, making it easy to access funds without a bank account. This solution is especially beneficial in areas with limited banking services, allowing a broader population to participate in the financial system. With their accessibility, affordability, and ease of use, prepaid cards offer an attractive alternative to traditional money transfer methods, driving increased demand for the prepaid card market.

Restraints

Security Issues and Privacy Concerns

Security issues and privacy concerns hinder the growth of the prepaid card market owing to rise in doubts among consumers and businesses about the safety of using prepaid cards. Prepaid cards are often at risk of data breaches, fraud, and unauthorized access, which results in financial losses and weakens consumer trust. This distrust limits the market growth as users hesitate to adopt prepaid cards due to potential threats to their financial information and personal data. In addition, concerns over weak data protection standards and limited control over personal data can restrict the willingness of government agencies and businesses to approve prepaid cards. For instance, the U.S. government implemented strict regulations, such as the Customer Due Diligence (CDD) rule under the Bank Secrecy Act, to mitigate risks associated with prepaid cards. Thus, the cost and complexity of complying with such regulations related to security issues and privacy concerns can limit market growth.

Opportunity

Expanding Financial Access for Unbanked and Underbanked Populations

Expanding financial access to unbanked and underbanked populations represents a significant growth opportunity for the prepaid card market. In many regions, millions of people either lack access to traditional banking services or have only limited access, restricting their ability to participate in the digital economy. Prepaid cards bridge this gap by providing an accessible financial tool that requires no credit history or bank account, allowing individuals to perform essential functions such as online shopping, bill payments, and receiving direct deposits. The U.S., a large portion of the unbanked population includes individuals with low incomes or unstable employment, who may struggle to maintain minimum balances required by banks. For instance, in 2021, 4.5% U.S. households remained unbanked, which emphasizes the ongoing demand for accessible financial alternatives such as prepaid cards. This trend is amplified by government initiatives aimed at financial inclusion, such as distributing government benefits through prepaid cards, which has driven their adoption among low-income populations.

Prepaid cards allow unbanked consumers to avoid such restrictions, offering a flexible, fee-based alternative that grants them greater financial freedom. Similarly, in developing countries, prepaid cards serve as a gateway for those without banks nearby, giving them access to essential financial services. In India, for instance, prepaid card programs have become instrumental in expanding financial inclusion, particularly among rural populations who previously lacked reliable banking access. The increasing adoption of mobile wallets and digital payment platforms further enhances the utility of prepaid cards and thus, further supports the market growth. By linking prepaid cards with mobile apps, users can more easily track their expenses and make payments, even if they lack a stable income or banking history. Thus, the demand from underserved populations who can now access financial services without the traditional barriers of bank-based models provides a lucrative opportunity to the prepaid card industry.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the prepaid card market analysis from 2023 to 2033 to identify the prevailing prepaid card market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the prepaid card market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global prepaid card market trends, key players, market segments, application areas, and market growth strategies.

Prepaid Card Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.8 trillion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 424 |

| By Offering Type |

|

| By Card Type |

|

| By End Users |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Mango Financial, Inc., Visa Inc., BlackHawk Network Holdings, Inc., RBL Bank Ltd., Green Dot Corporation, The Points Guy, LLC, American Express Company, Travelex Foreign Coin Services Limited, HRB Digital LLC., Kaiku Finance LLC, Western Union Holdings, Inc., City Bank PLC, NetSpend Corporation, Bank of America Corporation, The PNC Financial Services Group, Inc., DFS Services LLC, Mastercard, PayPal Holdings, Inc., CAIXABANK, S.A., J.P. Morgan Chase And Co. |

Analyst Review

The prepaid card market is experiencing significant growth, driven by increasing consumer demand for flexible payment solutions and the rise of digital transactions. The convenient alternative to traditional bank accounts, prepaid cards offer a secure and easily accessible method of payment, particularly appealing to unbanked or underbanked populations. In addition, the widespread adoption of e-commerce, mobile payments, and digital wallets accelerated the demand for prepaid cards, which can be used for online shopping, bill payments, and peer-to-peer transfers. This is expected to drive the market growth.

Furthermore, technological advancements in mobile payment integration and contactless technology are further propelling the market growth. Prepaid cards now offer enhanced features such as instant load capabilities, rewards programs, and integration with mobile wallets, which is allowing consumers to access funds quickly and securely. These innovations are particularly attractive to millennials and Gen Z, who prefer digital-first payment solutions that offer speed, convenience, and security. The rise of fintech startups and partnerships between banks and technology providers presents opportunities for insurers and financial institutions to capitalize on the expanding market for prepaid cards.

Moreover, government policies and regulations, such as those aimed at promoting financial inclusion and supporting digital payments, are also driving market growth. In many regions, governments are encouraging the use of prepaid cards to distribute welfare benefits, subsidies, and payments, further boosting adoption rates. However, challenges remain, particularly in relation to fraud prevention and regulatory compliance as ensuring secure transactions and protecting consumers' financial data are critical concerns for the industry. Despite these challenges, the prepaid card market is expected to continue expanding, with a growing number of consumers and businesses adopting these versatile payment solutions.

The Prepaid card Market is estimated to grow at a CAGR of 7.3% from 2024 to 2033.

The Prepaid card Market is projected to reach $5.8 trillion by 2033.

The Prepaid card Market is expected to witness notable growth as cards provide an alternative to traditional bank accounts, enabling users to purchase online, in-store, and internationally without needing cash.

The key players profiled in the report include JPMorgan Chase And Co., American Express Company, Mastercard, Green Dot Corporation., Travelex Foreign Coin Services Limited, Visa Inc., Mango Financial, Inc., PayPal Holdings, Inc., Netspend Visa, Kaiku Finance LLC, Bank of America Corporation., HRB Digital LLC., Discover Bank, Western Union Holdings, Inc., CaixaBank, S.A., RBL Bank Ltd., PNC Financial Services Group, Inc., The City Bank Limited, Blackhawk Network Holdings, Inc., and The Points Guy, LLC.

The key growth strategies of Prepaid card Market players include expanding their product portfolios, mergers and acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...