Prepreg Market Research, 2031

The global prepreg market was valued at $6.3 billion in 2021, and is projected to reach $16.1 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

Report key highlighters

- Quantitative information mentioned in the global prepreg market includes the market numbers in terms of value (USD Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2022-31), and growth analysis.

- The analysis in the report is provided on the basis of fiber type, resin type, manufacturing process, and applications. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Axiom Materials, Inc., Gurit, Hexcel Corporation, Isola Group, Mitsubishi Chemical Corporation, SGL Carbon, Solvay, Sunrez Corporation, hold a large proportion of the prepreg market.

- This report makes it easier for existing market players and new entrants to the prepreg business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

A prepreg refers to a reinforcing fabric that has been pre-impregnated with a resin system. Prepregs are used in high-performance applications where weight and mechanical properties have more importance over cost. Both thermoset and thermoplastic prepregs are lightweight and high-strength composite laminates.

With the growth of the automotive industry, the demand for prepregs is on the rise, which is primarily driving the market growth. For instance, Ford Motor Co is using prepregs and other materials to produce rear suspension knuckle. Furthermore, since the past few years, companies have been increasingly shifting from e-glass to carbon fiber composite materials for lightweight and fuel-efficient vehicles. Automobiles are secluded to highly specialized applications utilizing processes with small volume outputs. Owing to advanced R&D in carbon fiber manufacturing companies, carbon composite materials are incorporated into more diverse structures in an automobile.

Furthermore, one of the major opportunities for the prepreg industry is rise in demand for carbon fiber-reinforced plastic (CFRP). A carbon prepreg is a carbon fiber that has been impregnated with resin. Therefore, it is a preferred material to produce CFRP. CFRP finds application in beams, columns, slabs, and walls. It is extensively used in retrofitting and repairing structurally deficient infrastructures, such as buildings, tunnels, parking structures, and bridges. Thus, with the increase in use of carbon fiber reinforced plastic, the demand for carbon prepregs has witnessed a positive trend.

On the negative side, several technical challenges faced during the manufacturing of prepregs hamper the growth of the market. One of the biggest challenges in the production of prepregs is maintaining the fiber orientations in the product. It is due to the fact that prepregs are often cut to suit the requirements and are laid out by hand.

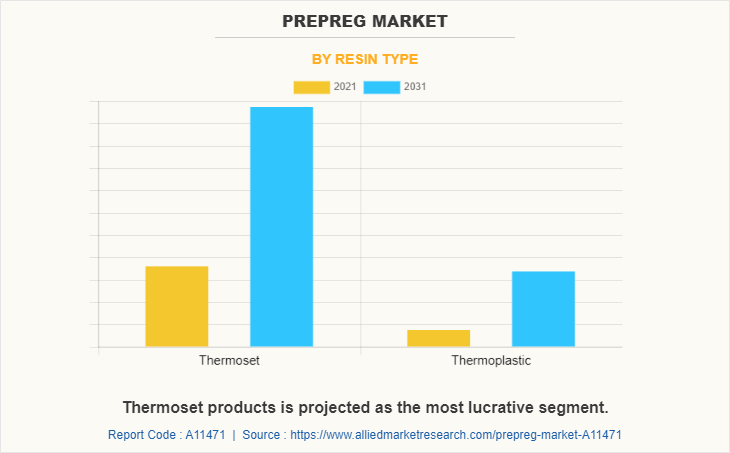

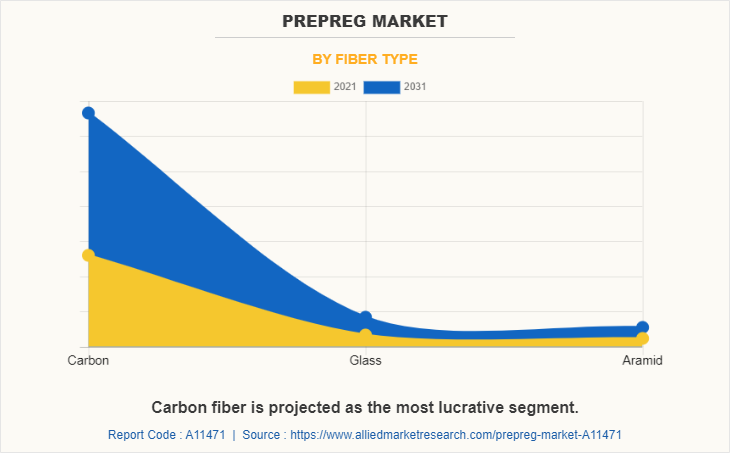

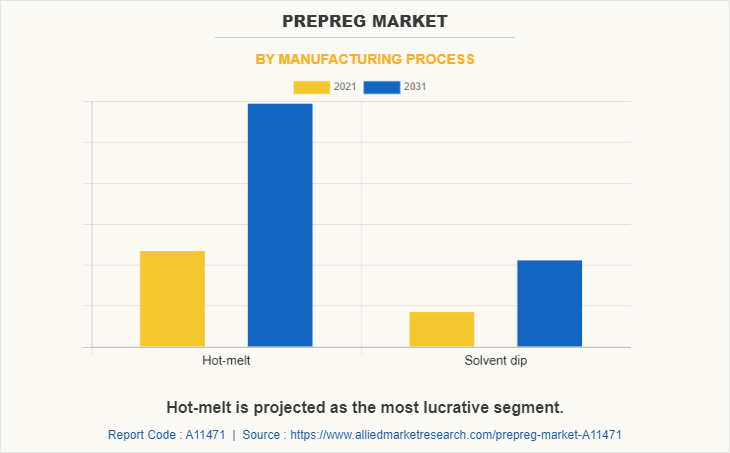

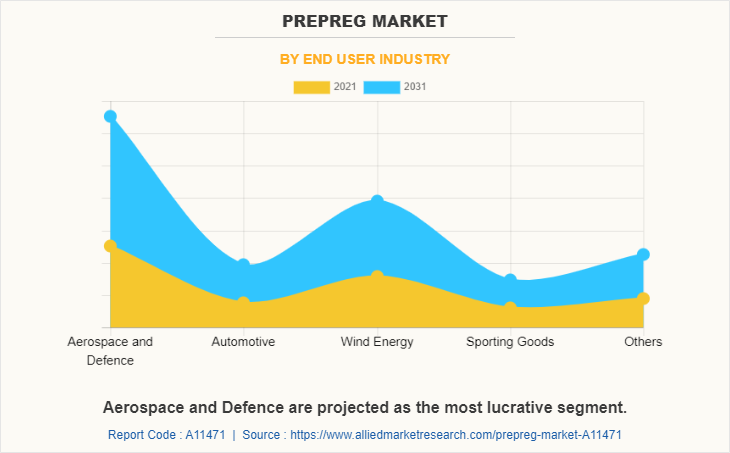

The prepreg market is segmented on the basis of fiber type, resin type, manufacturing process, applications, and region. Depending on fiber type, the market is classified into carbon, glass, and aramid. On the basis of resin type, the market is divided into thermoset and thermoplastic. Depending on the manufacturing process, the prepreg market is segregated into hot-melt and solvent dip. Depending on the application, the market is categorized into aerospace & defense, automotive, wind energy, sporting goods, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global prepreg market are Axiom Materials, Inc., Gurit, Hexcel Corporation, Isola Group, Mitsubishi Chemical Corporation, SGL Carbon, Solvay, Sunrez Corporation, Teijin Carbon Europe GmbH, Toray Composite Materials America, Inc.

By resin type, thermoset resins accounted for a major market share in 2021. The drivers for the use of thermoset prepreg include its high strength and stiffness, chemical resistance, design flexibility, fire retardancy, reduced production time and costs, and durability and weatherability. These factors have led to increased adoption of thermoset prepreg in various industries over the years.

On the basis of fiber type, carbon fiber accounted for a major market share in 2021. The drivers for the use of carbon fiber prepreg include its high strength-to-weight ratio, durability and fatigue resistance, design flexibility, corrosion and thermal resistance, and reduced production time and costs. These factors have led to increased adoption of carbon fiber prepreg in various industries over the years.

On the basis of manufacturing process, the holt-melt process accounted for a major market share in 2021. The use of hot-melt prepreg include reduced production time, improved bonding, reduced waste, design flexibility, environmental friendliness, and improved mechanical properties. These factors have led to increased adoption of hot-melt prepreg in various industries over the years.

On the basis of end user industry, the aerospace & defense dominated the global prepreg market in 2021. Prepreg materials are widely used in the aerospace and defense industries due to their high strength-to-weight ratio, durability, and resistance to high temperatures and harsh environments.

By region, North America dominated the global prepreg market in 2021. The market is driven by various factors, including the growing demand for lightweight materials in various end-use industries, such as aerospace and defense, automotive, wind energy, and sporting goods. The aerospace and defense industry is one of the largest consumers of prepreg materials in North America. The increasing demand for lightweight and high-strength materials for aircraft and defense applications is driving the growth of the North American prepreg market.

Key players in Prepreg Market

Owing to its superior mechanical qualities, fiber-reinforced plastic (FRP) parts, particularly those constructed from pre-impregnated fibers (prepregs), are utilized in lightweight goods to improve product attributes. Owing to high production costs, which may account for up to 72% of total part prices, prepregs' application areas are confined, for example, to the aeronautics sector, where they predominate.

In addition to the trend of sustainability and lightweight goods, producers of prepreg components, like all other manufacturers, are heavily impacted by the so-called turbulent environment. This means that customer behavior and market behavior have become less predictable. Moreover, the individualization tendency contributes to the increased delivery time and delivery reliability needs.

Companies implement an enhanced production control approach that addresses specifically the manufacturing of prepreg parts to favor more prepreg applications by lowering manufacturing costs and to address the cited trends that put high pressure on the manufacturing of prepreg parts not only in terms of costs. This method is based on factoring the short lifetime of prepreg materials into control choices and considering intermediate cold storage.

Key Strategic Developments:

- In 2021, Hexcel Corporation announced the expansion of its Prepreg manufacturing capacity at its Salt Lake City facility to meet the growing demand for advanced composite materials in the aerospace and defense industries.

- In 2021, Teijin Limited launched a new Prepreg material, Twaron PVB Prepreg, which offers excellent impact resistance and fire resistance for use in aerospace and other industrial applications.

- In 2020, Gurit Holding AG acquired JSB Group, a leading provider of composite materials and manufacturing services, to strengthen its position in the global Prepreg market and expand its product offerings.

- In 2020, Toray Industries, Inc. announced the development of a new Prepreg material that offers excellent impact resistance and processability for use in automotive and other industrial applications.

- In 2020, SGL Carbon SE launched a new range of Prepreg materials that offer high strength and stiffness, along with improved processing characteristics, for use in aerospace and other high-performance applications.

- In 2020, Axiom Materials, Inc. launched a new range of Prepreg materials, Axiom Pristine, that offer high strength and stiffness, along with improved surface finish and compatibility with a wide range of resin systems.

- In 2020, Park Electrochemical Corp. launched a new range of Prepreg materials, Nelcote® E-767, that offer high strength and durability for use in aerospace and other high-performance applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the prepreg market analysis from 2021 to 2031 to identify the prevailing prepreg market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the prepreg market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global prepreg market trends, key players, market segments, application areas, and market growth strategies.

Prepreg Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 16.1 billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 500 |

| By Resin Type |

|

| By Fiber Type |

|

| By Manufacturing Process |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Toray Composite Materials America, Inc., Mitsubishi Chemical Corporation, Axiom Materials, Inc., Isola Group, Solvay, Gurit, Sunrez Corporation, Teijin Carbon Europe GmbH, Hexcel Corporation, SGL Carbon |

Analyst Review

According to the opinions of various CXOs of leading companies, the market is expected to witness robust growth on account of increase in use of prepreg materials in the aerospace and automotive industries. Surge in demand for light and durable materials with increased efficiency in the manufacturing of aerospace components has driven the prepreg industry in the past few years. Furthermore, the rise in use of lightweight blades in wind turbines to improve fuel efficiency is another key driver of the prepreg industry. The prepreg fibers with superior strength and lightweight are vital for the aircraft manufacturing industry. Replacing traditional materials with lightweight composites is an effective path toward meeting the aim of producing lightweight aircraft to increase fuel efficiency, decrease emissions, and reduce material usage, which translate into a growing adoption of prepreg materials.

There is a growing trend in the prepreg market towards the use of sustainable materials that are eco-friendly and have a low carbon footprint. This is driven by increasing environmental concerns and regulations.

aerospace & defense, automotive, wind energy, sporting goods application are the potential customers of prepreg market industry.

North America region will provide more business opportunities for prepreg market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Axiom Materials, Inc., Gurit, Hexcel Corporation, Isola Group, Mitsubishi Chemical Corporation, SGL Carbon, Solvay, Sunrez Corporation, Teijin Carbon Europe GmbH, Toray Composite Materials America, Inc. are the top players in prepreg market.

Loading Table Of Content...

Loading Research Methodology...